Overseas Wednesday – International Equities & Global Macro ETF Portfolios (WSA, MCR, GOOGL US, SBUX US, SVXY US, IEU)

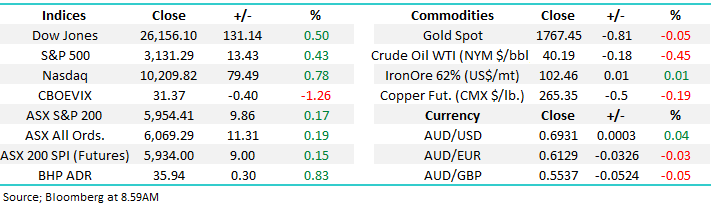

The ASX200 reminded any doubters yesterday that we still live in volatile and uncertain times, at 11am the market was looking good sitting up almost 1% when suddenly we get a newsflash across our screens that on Fox News, White House trade adviser Peter Navarro had said the China / US Trade deal was basically finished, the local market plunged almost 100-points lower in the blink of an eye only for President Trump to come to the markets rescue by assuring everyone all was ok – with President Trump behind in the polls and November looming fast I reckon there may be a few more news stories which ends with him being the knight in shining armour!

By the close the ASX recovered more than half its drop to finish up almost +0.2% with winners marginally edging losers, the resources caught my eye on the upside while the Australian IT Sector continues to come off the boil even as the US tech based NASDAQ rallies impressively, it again made fresh all-time highs overnight. These elevated levels of volatility bring opportunity for the prepared investor and at MM we pride ourselves on “stalking” the vast majority of our investments / divestments, currently we regard ourselves as almost fully invested with our Australian Growth & Income Portfolios only holding 8.5% and 5% respectively in cash hence although we are still bullish MM is eyeing stocks / levels to start reducing risk / market exposure into strength.

However it’s important to maintain context with today’s market and our views, we remain bullish stocks believing central banks will indeed manage to stimulate the global economy out of its COVID-19 caused downturn – the data thus far is supporting a ‘V’ shaped recovery hence the largest risk to investors is to not maintaining a core long position hence any selling / reduction in market exposure needs careful consideration. Simply consider the below 2 thoughts:

1 – Tactically we feel another decent pullback is on the horizon but based on the impressive market breadth and initial relative breakouts of cyclicals versus defensives (reflation trade), we remain strategically bullish and wouldn’t be surprised to see another news driven pullback to be short and sharp as has been the norm since the March low. MM is comfortable selling strength and buying weakness, but our core view is bullish.

2 - The speculative positioning is hugely short the US S&P500, hence from a contrarian standpoint MM continues to see the bull market very much intact and the squeeze / grind higher characteristic should continue, again pullbacks are likely to be short and sharp as we continue the current high volatility theme, a bit like yesterday.

MM remains bullish short & medium-term.

ASX200 Index Chart

Overnight Moody’s reaffirmed our AAA rating citing that Australia was “doing better than other advanced countries” as we’ve said previously on many levels, we are indeed the lucky country. Only 10 countries retained this coveted status illustrating that Scott Morrison et al has done a good job, we only have to look at the global statistics around COVID-19 to understand this point loud and clear. However, before we get too excited, we should point out that other major ratings agencies still have our credit rating on a negative outlook.

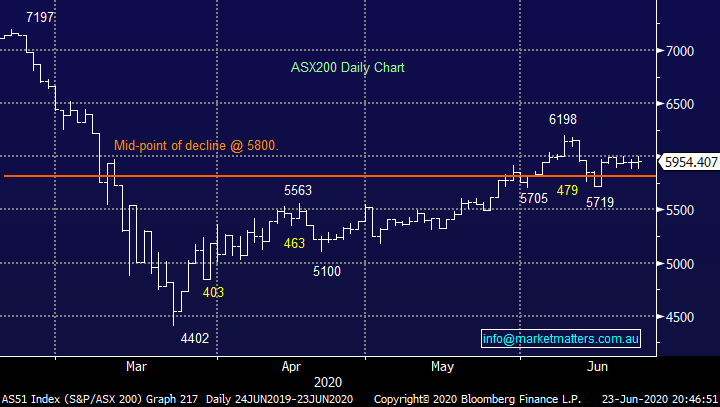

Overall the news was comforting but nothing more, it did help the $A garner a “bid tone” as it again casts its eyes upwards towards the psychological 70c region – remember our initial medium-term target is ~80c, although in the short term ~70c remains a big hurdle and a few attempts before a sustained move above would not surprise.

In our opinion the “Little Aussie Battler” is showing the way ahead for stocks and it remains up medium-term.

ASX200 v Australian Dollar ($A) Chart

Nickel – Part 2

In yesterday’s morning report we touched on our increased appetite for nickel, we should have kept our mouths shut before we got onboard! Western Areas (WSA) shot out of the blocks in the morning surging higher, it finally closed up 16% to be by far the markets best performer on the day. Some positive drilling results at the South Australian Western Gawler Project got the ball rolling but I feel the markets now got the bit between its teeth for the sector – even the papers are picking up on things. The initial drilling results have the project on course for a similar set up as Oz Minerals (OZL) key development project at West Musgrave.

MM is bullish WSA with stops now under $2.50.

Western Areas (WSA) Chart

The other smaller Nickel company that we looked at yesterday was Mincor (MCR) which is capped around $300m, a company with a “mixed” history. MCR is a sort of ‘middle ground’ between the large cap WSA and the small cap / super high-risk PAN. Andrew Forrest owns 14% of MCR while BHP also has reasons to see MCR’s Kambalda Project in WA get off the ground. Importantly, Mincor will produce a nickel sulphide concentrate, and so is exposed to the battery metal thematic.

MM is bullish MCR with stops under 70c.

Basically, MM is bullish nickel stocks looking for the optimum way to “play” the view.

Mincor (MCR) Chart

Overseas stocks

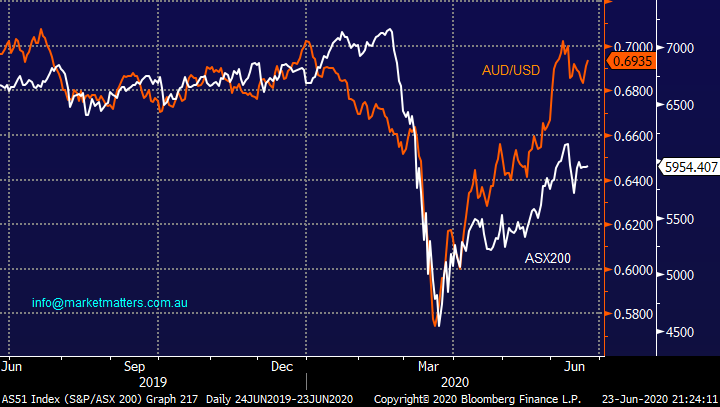

It remains very pertinent in our opinion that the futures market is still registering a massive net short position in the S&P500, strategically a bullish contrarian sign. Importantly these indicators have nothing to do with short-term crazy fluctuations, but the positioning does suggest that any news driven pullbacks will encounter keen buyers. Not surprisingly COVID-19 appears an obvious candidate for such news with the US still struggling, yesterday we saw both California and Arizona register record numbers of new cases, with 1.4m infected people still fighting the virus the 124,000 US death toll looks destined to go much higher.

Our outlook for the broad-based S&P500 is largely unchanged, one of the below 2 scenarios feels likely as the index slowly approaches its February all-time high.

1 – The S&P500 makes fresh recent highs up towards 3250, around 4% higher, where we feel the risk / reward will favour a little (I stress little) profit taking.

2 – The S&P500 is poised for another 7-8% correction where MM will be keen buyers.

Either way today’s action is simple - wait and see as the index continues to chop around between 3000 and 3200.

MM remains bullish the US S&P500 medium-term.

US S&P500 Index Chart

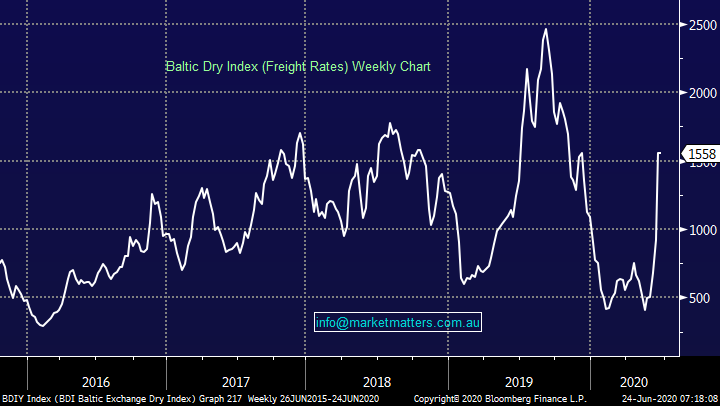

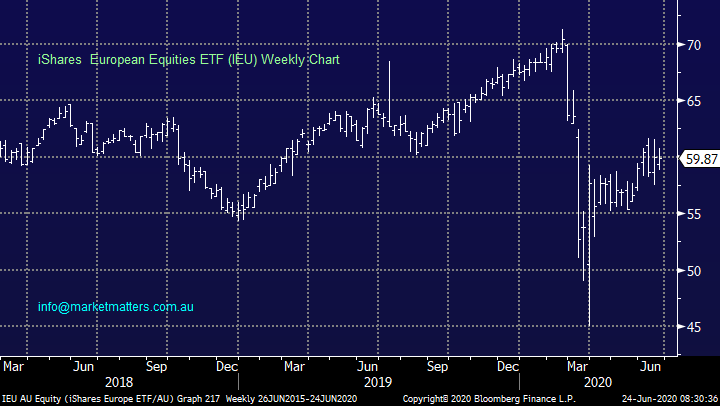

The current strong bounce in the Baltic Dry Index (other shipping indices are also rallying) generates a bullish signal basis macro correlation for both European & our local index. Also, we believe it’s just a matter of time before we see a major breakout in the Chinese Shanghai Composite, which has basically been consolidating since 2019. Hence most importantly any near-term pullbacks into July MM believes are simply buying opportunities due to the strong macro background for equities.

MM believes a breakout to new all-time highs for the S&P500 and cyclical driven markets such as the DAX is just a question of when.

Baltic Dry Index Chart

MM International Portfolio

MM has steadily increased our global market exposure through 2020 with our cash level now sitting at just 10%, with the exception of a couple of banks things are looking good which should be no major surprise considering the last few months strong performance by US equities, particularly technology stocks which take u a large chunk of the portfolio.

At this stage we are fairly comfortable with our portfolio mix with only a couple of stocks under consideration as we look to tweak around our “buy strength and sell strength mantra” – today I have included 1 stock we are considering buying at lower levels and conversely one potential sell higher.

https://www.marketmatters.com.au/new-international-portfolio/

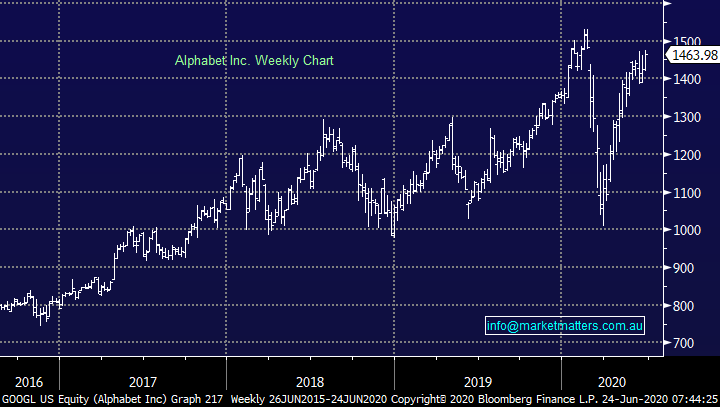

1 Google (GOOGL US) $US1463.98

GOOGLE was bought by MM in mid-April and is currently showing a healthy +16% paper profit but its been a noticeable laggard amongst the FANGS. Interestingly I have noticed Microsoft pushing their own search engine “Microsoft Edge” offering over the last few weeks, perhaps this has been a factor. Either way if we feel the US IT Sector is ready for a pullback we would rather take profit on a laggard as opposed to a high flyer such as Apple (AAPL), Microsoft (MSFT US) or Trade Desk (TTD).

MM is considering taking profit on GOOGL around $US1500.

Google Alphabet (GOOGLE US) Chart

2 Starbucks Corp (SBUX US) $US75.49

On this one we agree with Hamish Douglass from Magellan, before the coronavirus SBUX were opening a store in China every 15-hours, that’s expansion! This is a great company to use as proxy for exposure to the growing Chinese middle class with 40% of its profit growth coming from China.

MM currently likes SBUX around $US70.

Starbucks Corp (SBUX US) Chart

MM Global Macro Portfolio

Our global macro positions are showing a pretty even mix of winners & losers but importantly were only holding one position we are considering closing out in the coming weeks, while we have a couple of additions under consideration including a European market position shown below.

https://www.marketmatters.com.au/new-global-portfolio

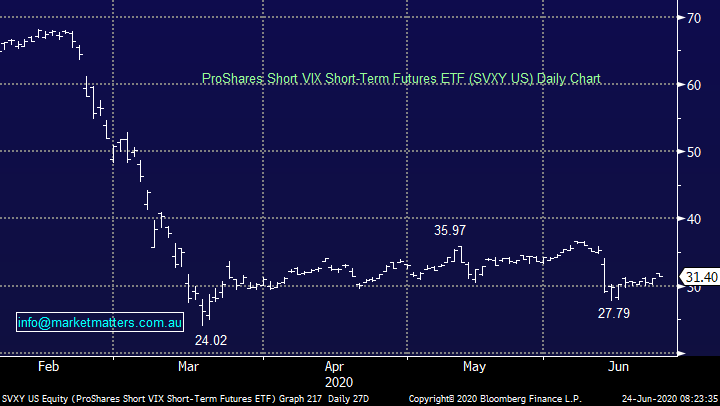

1 ProShares Short VIX ETF (SVXY US) $US31.40

We are only showing a small profit here but if US stocks are getting poised for another correction the likelihood is this VIX ETF will break ~10% lower – even as the NASDAQ has roared to fresh all-time highs investors have remained cautious with regard to the VIX implies technically another correction is close at hand.

MM is considering taking a small profit on SVXY.

ProShares Short VIX ETF (SVXY US) Chart

2 iShares European Equities ETF (IEU) $A59.87

As we touched on earlier we believe it’s just a matter of time until European indices start playing some catch up with the US, to invest accordingly we like the local IEU ETF which has a current market cap around $530m.

MM likes the IEU around the 56 area.

iShares European Equities ETF (IEU) Chart

Conclusions

MM remains bullish the global economy and stocks for at least the next 12-18 months but we reiterate we feel its likely to be a choppy advance with plenty of opportunities for the active investor.

Overnight Market Matters Wrap

- A whippy market continued overnight, with the major indices started at higher levels, only to fade towards the close as investors focussed on the virus

- The tech. heavy Nasdaq 100 continued to outperform, led by Apple after unveiling its new operating systems and using its own microchips for its iPhone.

- Crude oil managed to hover above the US$40/bbl. level, while BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.83% from Australia’s previous close.

- The September SPI Futures is indicating the ASX 200 to open 48 points higher, testing the 6002 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.