Overseas Wednesday – International Equities & ETF Portfolios (TTD US, 700 HK, TBF US)

The ASX200 tried to ignore losses in the US yesterday but it finally succumbed to the selling pressure to finish the day down -0.3%, losers outnumbering winners by 2:1. The resources were the only one of the markets 11 major sectors to close positive courtesy of strong performances from the likes of BHP Group (BHP), RIO Tinto (RIO) and Fortescue Metals (FMG).

As we expected the market appears to have drifted in a relative slumber this week with both volumes and volatility down on last week’s sharp pullback by local stocks. The usual characteristic of a “Santa Rally” is the market rallies on a day when it’s not expected and then continues to advance 20 / 30-points per day even if global indexes wobble – watch this space with Christmas Day arriving in just 2-weeks.

MM is looking for a springboard style, seasonal buying opportunity, in the next few days.

NB– with buying its often best to a be a touch early as opposed to missing the move as few investors like to chase strength. *Watch for alerts

Overnight US stocks drifted lower in choppy session; the SPI futures are calling the ASX200 to open unchanged while BHP was marginally higher on the US ADR’s.

Today we’ve focused on a few overseas major US sectors to see if they are moving as we expect plus importantly are their Australian peers dancing the same jig.

ASX200 Chart

Professional investors appear to be positioning themselves for a volatile end to 2019 as the VIX ticks higher even while stocks tread water. This means investors / traders are buying calls / puts pushing up their prices (i.e. volatility) in an anticipation of a Christmas Rally, or fear of another sharp down leg similar to last week.

MM also expects a decent move for stocks in the next few weeks.

The VIX (Volatility / Fear Gauge) Index Chart

US & Local Bond yields diverge slightly.

Australian bond yields have edged lower over the week, but they remain around the same levels reached in early September. Our preferred scenario is we see another spike lower down towards 0.5% but what’s catching our attention is the sector rotation which appears to bubbling away under the surface i.e. resources are strengthening while yield play / defensive stocks are struggling however its early days and the entrenched relative performance trend has not vaguely been broken at this stage.

MM believes local bond yields are very close or may even have seen a low.

Overall there is no change to our view for 2020 / 2021 hence MM believes the “bond proxies” will underperform moving forward as their decade old tailwind is removed.

Australian 3-year Bond Yields Chart

Conversely US yields have edged higher over the last week as the market votes that Trump won’t get his way with the Fed anytime soon – he would obviously love a few rate cuts into the November Presidential election, another event I’m sure he would claim credit for!!

MM also believes US bond yields are very close or may even have seen a low.

US 10-year bond yield Chart

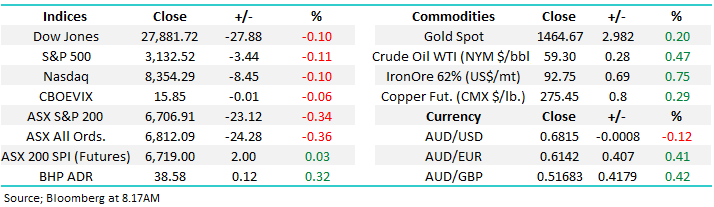

MM still prefers Value over growth into 2020.

When we look at the Value and Growth Indices in the US both look strong, especially after the Value gauge recently broke out to fresh all-time highs. If MM is correct and bond yields are close to an inflection point, then the huge outperformance from the growth end of town is likely to be over i.e. the white and orange lines on the chart below should start to converge.

NB Value stocks include Banks & Resources while Growth includes areas like the IT stocks.

MM prefers Value overgrowth into 2020.

US Value & Growth Indices Chart

Stocks remain interesting.

US stocks have bounced quickly from the Trump “inspired” mini -2.7% dummy spit and we believe it’s now a matter of days until we see the S&P500 scale levels never seen before - not a big call its only 0.6% away! However, this is not a breakout we would buy as another test below 3080 would not surprise before January passes.

The chart below illustrates the usefulness of Candlestick Charts in identifying a low, in all of the major inflection lows since May the springboard higher was characterised by a candle with a noticeable tail i.e. skinny part of the daily bar at the bottom.

MM expects new all-time highs into Christmas for US stocks.

US S&P500 Chart

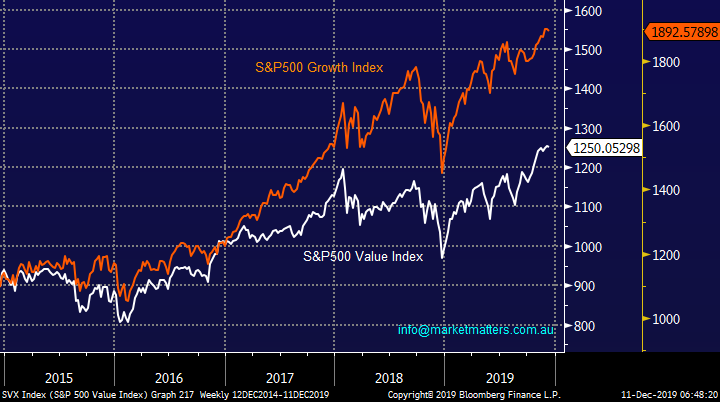

The $US still looks vulnerable

The $US continues to drift lower although the $A has not yet enjoyed the relative move. In the short-term we expect a 2-3% move lower towards the 95 regions with the risks of a much deeper move into 2020 mounting in our opinion.

MM is bearish the $US which is by definition bullish the metals / miners & $A.

The $US Index Chart

A brief review of 3 major US sectors

The sectors we have chosen today deliberately have a major follow through for the Australian market moving into 2020 – assuming we track the US of course!

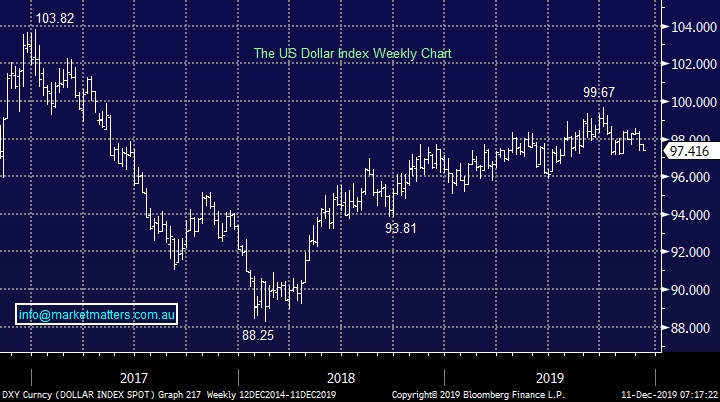

1 US S&P500 Banking Sector

The US Banking Sector continues to follow our roadmap into Christmas with our initial target around +10% higher – hopefully the Australian banks can have a fresh 2020, free of scandal and regulatory interruptions, because they should be mirroring at least some of the gains from their antipodean friends.

MM remains bullish the US Banking Sector.

US S&P500 Banking Sector Chart

2 US S&P500 Utilities Sector

Unlike the US Banking Sector, the rate sensitive Utilities have soared above their pre-GFC highs as declining bond yields offered the sector a cracking tailwind. There are no sell signals at present, but we will be watching carefully if bond yields do turn higher in 2020.

MM is neutral the US Utilities Sector.

US S&P500 Utilities Sector Chart

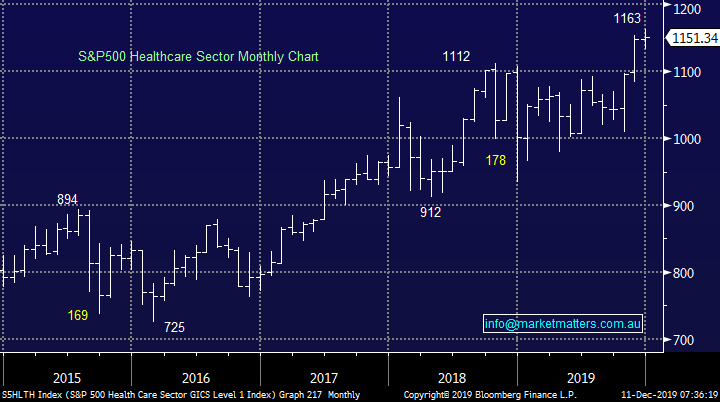

3 US Healthcare Sector

The US Healthcare Sector has made fresh all-time highs this month, but the upside momentum is declining, we are wary of this sector which is positively correlated to falling bond yields – a 15% correction would not surprise.

MM is wary of the US Healthcare Sector.

US Healthcare Sector Chart

The MM International Equites Portfolio

Last week there were again no changes to our International Portfolio with our cash position remaining at 37% plus we have 8% exposure to a negative facing ETF. : https://www.marketmatters.com.au/new-international-portfolio/

There remains a number of stocks / sectors which we are considering for the MM International Portfolio the possibility of a move lower by bond yields has left us twiddling our thumbs but with the seasonally strong Christmas period arriving we are considering a few purchases after remaining patient over the last few weeks.

One specific stock MM has discussed in 2019 is advertising technology company Trade Desk (TTD US), last week it spiked lower on a competitor downgrade only to rally and close well creating a significant candle tail as discussed earlier.

MM is bullish Trade Desk (TTD US).

Trade Desk (TTD US) Chart

On-line goliath Tencent has struggled in 2018 / 19 but we like the way its holding current levels even as shares in the region remain choppy. After spending the last 6-months basically trading sideways a pop higher feels close at hand.

MM is bullish Tencent (700 HK).

Tencent (700 HK) Chart

Conclusion (s)

No change, MM likes the resources, banks and emerging markets into 2020, we expect to significantly increase our exposure to some of these areas if bond yields follow our anticipated path but as the risks slowly increase that bond yields may fail to make fresh all-time lows logic dictates we should accumulate a few stocks while leaving flexibility to act if they do indeed finally move lower.

We specifically like Tencent (700 HK) and Trade Desk (TTD US) at current levels – these 2 are less dependent on bond yields hence we may buy sooner rather than later.

Watch the pm reports for alerts.

The MM Global Macro ETF Portfolio

Last week we didn’t change our MM Global Macro Portfolio leaving our cash level at 51.5% as we continue to watch bond yields closely. : https://www.marketmatters.com.au/new-global-portfolio/

Ideally, we are looking to implement the following changes in the MM Macro ETF Portfolio:

1 – MM is looking to go long the bearish US bond ETF (TBF US) into new lows.

2 – We are looking to cut our silver and gold positions and increase our copper exposure.

3 – We are looking to increase our Emerging Markets ETF (IEM).

The strong likelihood is we will press all the buy and sell buttons in one go but for now patience still feels the better form of valour.

ProShares Short US Bond ETF Chart

Conclusion (s)

We are likely to implement these 3 ideas / plans moving forward, the time to be busy still feels nigh!

Watch the pm reports for alerts.

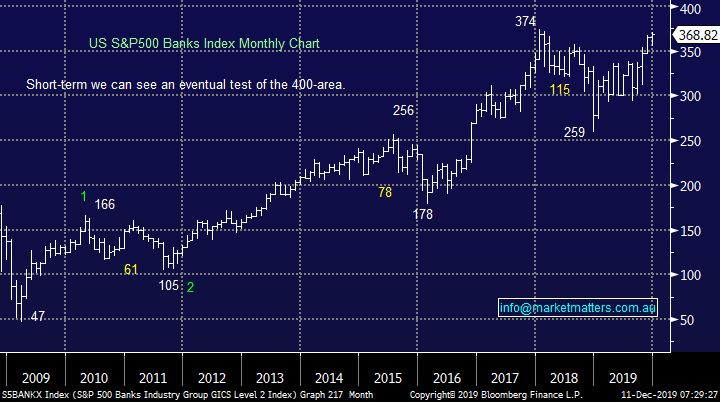

Overnight Market Matters Wrap

- The US equity markets closed with little change overnight as investors sit on the sideline ahead of the interest rate decision tonight as well as the US-China trade deal deadline this weekend, while the UK was much the same ahead of their election tomorrow and the ECB rate decision.

- Crude oil resumed its ascent, currently at US$59.30/bbl. assisting BHP in the US to close up an equivalent of 0.32% from Australia’s previous close.

- The December SPI Futures is indicating the ASX 200 to open 12 points higher, towards the 6720 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.