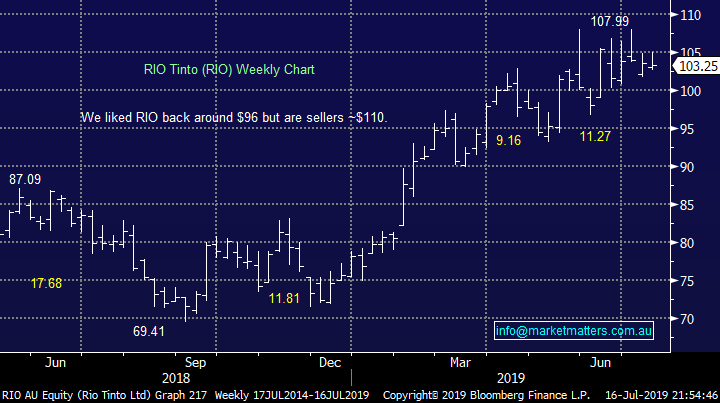

Overseas Wednesday – International Equities & ETF Portfolios (TLS, NHF, DMP, RIO, SH US, MCD US, WMT US, BABA US, EUM US, TMF US)

The ASX200 continued its pullback yesterday in what was a classic quiet end of school holidays trading day, both volumes and interest were low overall. A couple of broker downgrades had a big impact on the quiet day with both standouts unfortunately residing in our Growth Portfolio. Domino’s Pizza (DMP) -4.3% and NIB Holdings (NHF) -3.8%. However the worst performer on the day was Perpetual (PPT) which fell another 6% on the prior days poor FUM update which showed $1.1bn of outflows in the 4th quarter. Overall, a poor day for MM Portfolios. On the sector level things were also quiet although weakness was focused in the Energy, IT and Telco stocks which all fell around 1%.

Some articles I read tried to blame the markets drift lower on the RBA minutes which supposedly dampened expectations of further interest rate but I feel that’s well and truly off the mark considering both the 3-year bond yields and $A also drifted lower. We simply feel equities are tired after their relentless 6-months charge higher, no great surprise with Augusts reporting season only a few weeks away – the volatility will certainly pick up soon on the stock level for those complaining they’re bored!

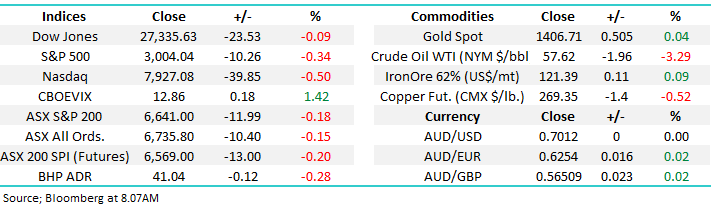

At MM we continue to believe that equities are potentially “looking for a swing high / top” but as illustrated below this usually takes a number of weeks to evolve. Subscribers are likely to receive more alerts / ideas around tweaking our portfolios moving forward, with low beta stocks (shares that have not hugged the ASX200 over recent years), defensives, negative facing ETF’s and of course more cash are all under consideration short-term.

MM remains in “sell mode” looking to adopt a more defensive stance than over the previous 6-months.

Overnight US stocks were quiet on the index level with the S&P500 closing down -0.3% while the SPI futures are calling the ASX200 to open down around 10-points this morning.

In today’s report we are going to look at a few more positions MM are considering for both our new International Equities and ETF Portfolio’s. However firstly I have briefly updated our opinion on 4 stocks catching our eye over the last 48-hours.

ASX200 Chart

1 Telstra (TLS) $3.74.

Telstra (TLS) continues to fall into our buy zone, however with reporting season looming we would only consider a relatively small initial exposure below $3.70, if at all.

MM likes TLS 1-2% lower.

Telstra (TLS) Chart

2 NIB Holdings (NHF) $7.65

Yesterday 2 brokers downgraded NHF on valuations grounds which led to the stock smacked early in the morning over 10% before recovering strongly to close down only -3.8%. The rationale was around valuation however we could argue the same logic applies to most of the market since its 25% rally since December.

We’ve had NHF on our sell radar for a while, after buying in February at $5.60 which made yesterdays open very frustrating but the recovery was equally encouraging and if it can close around $7.65, or higher this week, it will look excellent technically.

MM remains net bullish NHF targeting fresh 2019 highs.

NIB Holdings (NHF) Chart

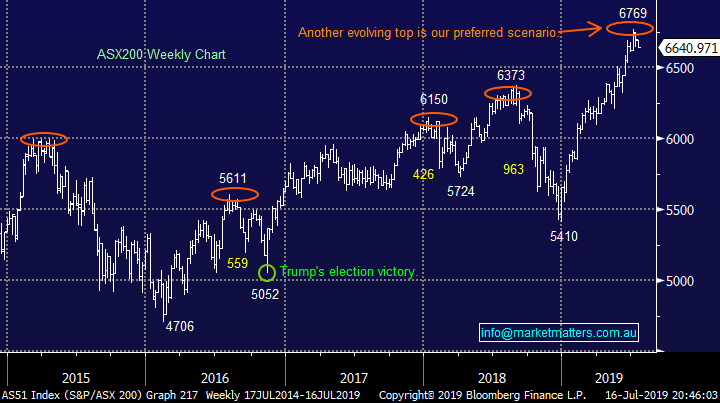

3 Domino’s Pizza (DMP) $38.58.

The drop in DMP looks to have been on the back of a price target downgrade by Morgan’s to $44.89 over concerns the company might miss their FY 2019 guidance – any sniff of this scenario and stocks are being hung out to dry.

DMP was a shorter term technical trade and the stock needs to bounce from around current levels for us to remain positive.

A close below $38.50 would trigger stops on DMP

Domino’s Pizza (DMP) Chart

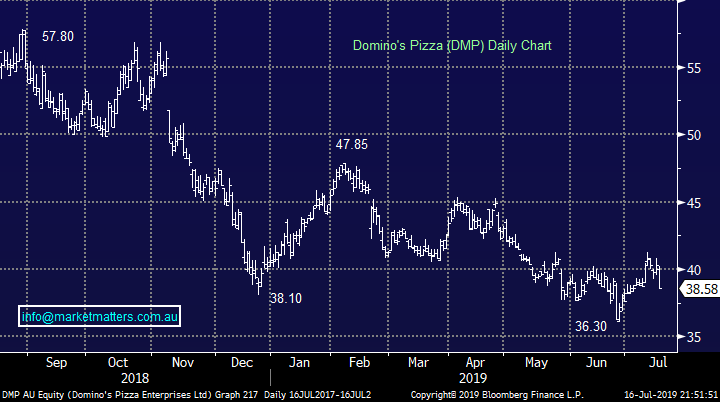

4 RIO Tinto (RIO) $103.25.

RIO significantlyunderperformed other iron ore names yesterday following disappointing cost guidance in their quarterly report. Production was hindered over the quarter by weather issues which has forced Rio to downgrade production guidance twice, however so far in 2019, the booming iron ore price has been more than enough to support the stock over the period.

The short-term momentum now feels poor and we are in no hurry to start buying, our ideal accumulation levels are $96, and then $91.

MM initially likes RIO closer to $96.

RIO Tinto (RIO) Chart

International Portfolio

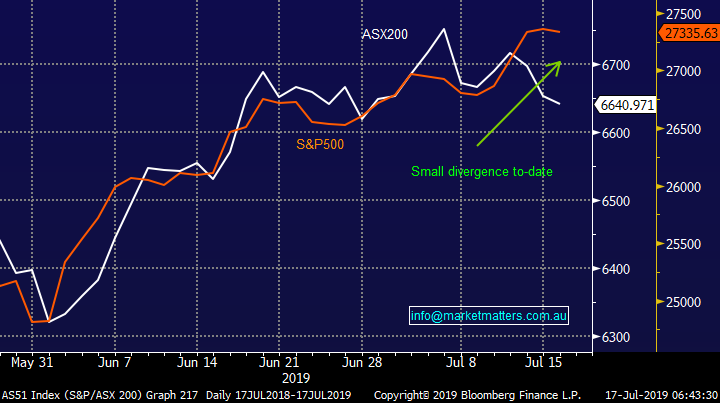

The ASX200 has slipped 129-points over the last few days ignoring US indices which made fresh all-time highs in Monday’s trading session, my “Gut Feel” was we often lead US down turns but obviously this needed clarification – the chart below illustrates the current divergence between our own index and those in the US.

1 - In 2018 when local stocks corrected over 15% the ASX200 peaked over 1-month before US stocks.

2 - In 2011 before local stocks plunged 25% the ASX200 again started falling almost 1-month before US stocks.

3 – In 2015 when Australian stocks corrected over 21% both the ASX200 & S&P500 formed a classic rolling top together but local stocks accelerated lower around 1-month before US stocks.

Obviously this is not a large volume of data but it sends a clear warning signal that we have led all 3 of the post GFC major declines by stocks.

This reinforces our comfort with holding a defensive stance towards stocks – we want to buy when everyone’s scarred, not bullish.

ASX200 & US S&P500 Index Chart

US stocks dominate most investors International Portfolios and they traded at all-time highs yesterday but at MM we are becoming increasingly concerned for a number of reasons with 2 of the recent additions to the list below:

1 - Investor confidence has finally switched to a bullish stance: https://www.aaii.com/sentimentsurvey

2 – High yielding bonds have continued to drift lower even while the S&P500 has pushed to fresh all-time highs, the correlation between these 2 is usually excellent which is illustrated below.

MM remains neutral and cautious both US & international equities at current levels.

US S&P500 Index & Junk Bond ETF Chart

The last week remained fairly quiet with our International Portfolio now holding 5 stocks and 75% in cash, I reiterate there is no hurry to construct this portfolio : https://www.marketmatters.com.au/new-international-portfolio/

We have not hidden our nervous medium-term outlook for global equities which means if we are correct MM is looking for 1 of 2 things as we evolve this portfolio:

1 – The proverbial needle (s) in a haystack i.e. stocks that can rally even if equities experience another decent pullback e.g. our Barrick gold position.

2 – Quality stocks that will outperform in both bullish and bearish markets which can be hedged with a bearish market ETF (s) when appropriate i.e. produce positive returns even in a falling market.

Today we have touched on 4 positions MM is considering moving forward, note these are not fresh additions to our watch list. At MM we have always dismissed the concept of providing “3 new shares to buy” every week because by definition they cannot all be our favourite stocks in today’s environment!

1 ProShares Short S&P500 (SH US)

Following the greater than 28% rally by US stocks from the December low looking extended and the reasons outlined earlier we feel it’s time to add a negative facing ETF to our International Equities Portfolio.

MM is considering adding the SH bearish ETF to the International Equities Portfolio.

ProShares Short S&P500 (SH US) Chart

2 McDonalds (MCD US) $US213.72

No change with this one, McDonalds has been a leading force in fast food for decades, and it's worked hard to update its image while keeping up with changing times e.g. McCafé.

MCD's current valuation, like much of the market, is relatively rich on a historical basis for the fast-food giant. However MCD is a dividend investor favourite in the US yielding ~2.5%, with the company having recently celebrated its 42nd consecutive annual dividend hike – US investors are more easily pleased when it comes to yield! In addition to paying dividends, the business has also made stock buybacks, returning even more capital to its shareholders.

For McDonald's, growth plans are clear, they understand the need to keep up with the pace of innovation in serving customers the way they want to be served, and that involves integrating new technology.

MM is bullish MCD, especially on a relative basis.

McDonalds (MCD US) Chart

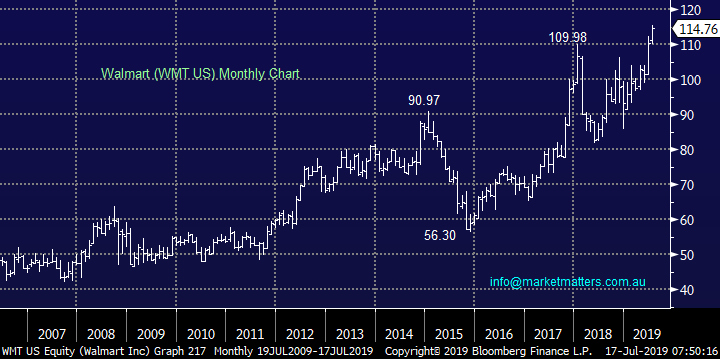

3 Walmart (WMT US) $US114.76

No change again - US Walmart operates discount stores and supercentres, a common destination points for consumers when times get tough.

The business has been kicking some goals of late and in its first-quarter report the company again looked solid with same-store sales growing plus it delivered a nice beat on earnings. However it was e-commerce, with its 37% growth, that caught most investors eye. This growth was driven by online grocery as well as home and fashion products. The rollout of free next-day shipping in major cities this year should help Walmart maintain its robust e-commerce growth rate. It sounds like Amazon mark 2.

MM likes WMT while it holds above $US105

Walmart (WMT US) Chart

4 Alibaba (BABA US) $US174.19

An amazing 2 out of every 5 people in China are not yet on-line although with a population approaching 1.4bn that’s still a large market for online retailer / e-commerce business Alibaba (BABA) but one that’s still got enormous growth potential. The concerns around a US-China trade war, either now or in the future, has certainly put pressure on China facing stocks / indices but with that comes opportunity.

MM likes BABA around current levels.

Alibaba (BABA US) Chart

Conclusion (s)

Of the 3 stocks and one ETF looked at today for the International Equities Portfolio we like all 4 ideas and are considering adding a mixture of them to our portfolio.

*watch for alerts in today’s PM report.

MM ETF Portfolio

MM recently launched our ETF Portfolio and are now holding 3 positions in the portfolio - simply put we are long gold, long the $A and short US stocks while still holding 80% in cash: https://www.marketmatters.com.au/new-global-portfolio/

We continue to believe there are a couple of great “plays” evolving in today’s market but I reiterate major macro views don’t change too often, I have updated the 2 positions we are considering today, again nothing particularly new here:

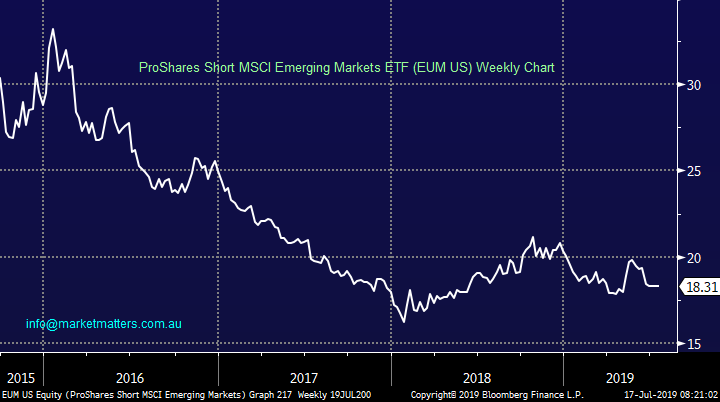

1 Emerging Markets.

We are currently short US stocks but only with a deliberate 5% allocation thus allowing us to either average or take a short position in another equities space e.g. the Emerging Markets which are already in a downtrend.

MM is bearish the Emerging Markets considering taking a position accordingly. Our preferred vehicle is the ProShares Emerging Markets Short MSCI ETF (EUM US). Details of this ETF are explained on this link : https://www.proshares.com/funds/eum.html

ProShares Short MSCI Emerging Markets ETF (EUM) Chart

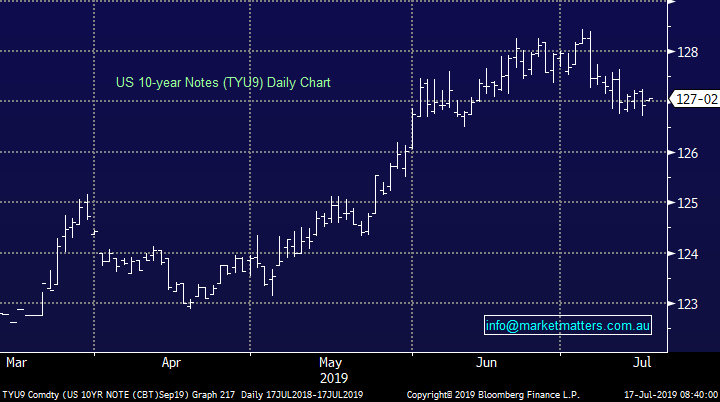

2 US Interest Rates

Markets continue to be driven by global bond yields making it logical to be considering these as an investment vehicle for the MM ETF Portfolio, after all we are watching them like a hawk. We feel rates are currently stabilising / bouncing before a probable another look lower hence this can be “played” by buying bonds into the current correction, because this is a relatively short term outlook a leveraged position is required.

The ETF we initially like to play this view is the Direxion Daily 20-year Treasury Bill 3x ETF (TMF US) : https://www.direxioninvestments.com/products/direxion-daily-20-year-treasury-bull-3x-etf

MM likes the underlying US 10-year Notes ~126.50 (16/32).

US 10-year Notes (September) Chart

The TMF has reached our buy zone as we look for a “pop” higher of 10-15%.

MM is bullish the TMF at current levels.

Direxion Daily 20-year Treasury Bill 3x ETF Chart

Conclusion (s)

MM is bullish both the ProShares Emerging Markets Short MSCI ETF (EUM US) and the ProShares (SH US) ETF which we are considering adding to.

Also The TMF has reached our buy zone as we look for a “pop” higher of 10-15%.

Overnight Market Matters Wrap

· The US equity markets closed with little change overnight, as President Trump threatened more tariffs on another $US325B of Chinese imports while Chinese officials said it was misleading to suggest they needed a trade deal with the US because its economic expansion was slowing.

· US bonds initially fell on some better than expected economic data including retail sales and manufacturing production. Fed Chairman Powell delivered a speech in Paris on monetary policy and largely stuck to his dovish tone. Expectations are still for a rate cut this month.

· Metals on the LME were stronger across the board, with nickel cash the highlight, up ~3%. Crude oil however fell 3.29% after Pompeo said Iran was potentially willing to negotiate.

· BHP is expected to underperform the broader market after ending its US session down an equivalent of -0.28% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open with little change this morning, around the 6640 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.