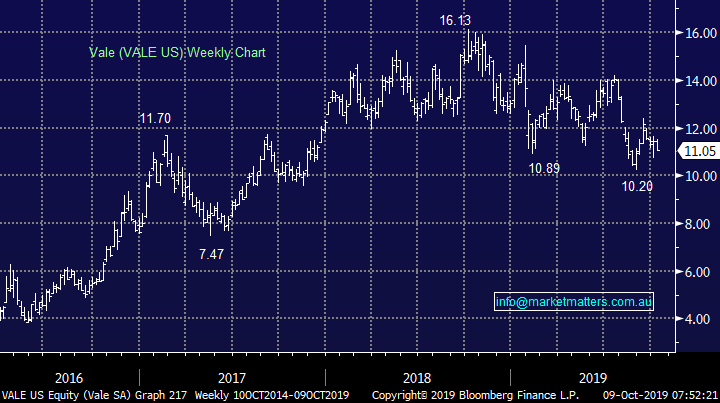

Overseas Wednesday – International Equities & ETF Portfolios (NCM, GLEN LN, VALE US, FCX US, TTD US, DTYS US)

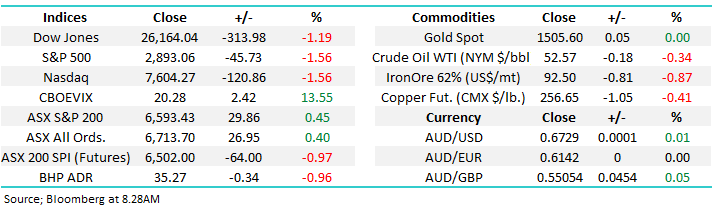

The ASX200 continued its recent bounce yesterday gaining another 30-points as it slowly but surely eats into the sharp losses suffered last Wednesday and Thursday. However even after a solid 3-days of gains the local bourse is down almost 100-points for October to-date, unfortunately to MM it still feels like a matter of time until we see local stocks resume their short-term downtrend with our ideal target still ~4% lower. Tuesday saw the index remain solid under the hood with winners outstripping losers by 2:1 while all 11 sectors managed to close in the green.

This morning we have woken up to see another bout of volatility hit US stocks courtesy of increased tensions with China, this time triggered by the White House looking to limit how much US retirement funds can invest in China – hardly the perfect back drop for the looming trade talks. Equity markets have felt net optimistic looking for an improvement for trade between these 2 global economic superpowers hence any negative outcome is likely to have investors refocusing on a recession leading to selling in stocks.

Just for good measure BREXIT is putting a dampener on Europe as the “deal / no deal” date looms fast, Boris Johnson appears to have the support of the British people but not Angela Merkle et al. I think we’ll all be happy when this political mess is behind us but it’s certainly adding to the mix for MM as we look for a solid buying opportunity in stocks later this month – its early I know but statistically a traditional “Christmas Rally” looks a strong possibility, especially if we slip lower in the next few weeks – hopefully one that starts earlier than last year.

No change, MM remains comfortable being relatively defensive, at least for a few weeks.

Overnight global stocks were smacked on the renewed US – China tensions with the Dow falling over 300-points, the SPI futures are calling the ASX200 to open down 1% wiping away over half of the last 3-days gains.

This morning we have looked at our thoughts for the International Equities and Global Macro ETF portfolios with one eye firmly on our outlook for the global economic picture moving forward.

ASX200 Chart

Where to now for US stocks?

Last night’s aggressive decline by US stocks still hasn’t triggered any fresh sell signals for MM but our preferred scenario remains that the Dow will at least test the 25,000 area, over 4% lower. However we reiterate MM is a buyer of any short-term market spike lower and will look to increase our market exposure / risk across our respective portfolios into any such move.

MM believes US stocks remain poised to correct at least 4% for a buying opportunity.

US Dow Jones Index Chart

Commodities are looking very interesting

The industrial metals led by “Dr Copper” have experienced a tough couple of years but at MM we believe a major buying opportunity is looming fast – MM anticipates buying the likes of OZ Minerals (OZL), Sandfire Resources (SFR) and Western Areas (WSA) in the coming weeks.

MM believes its almost time to load up on resources / miners.

Copper Chart

No change with our bullish outlook for gold and its related stocks, the technical picture is almost too good for the bulls while China’s continued buying combined with global uncertainty offers an ideal fundamental back drop for this traditional safe haven.

MM is bullish gold stocks targeting another 10% upside.

Newcrest Mining Chart

Do bond yields remain the key?

Australia had our rate cut in October with another now expected by markets in the months ahead, this will take the RBA Cash Rate down to an amazing 0.5%. As subscribers know MM expects the next bout of local economic stimulus to be fiscal in nature as the RBA is clearly running out of any wriggle room from a classic monetary perspective as interest rates approach zero.

The US is now looking for a rate cut in 2019 following the weak manufacturing data last week. There is no major change with our outlook on US bond yields with fresh 2019 lows looking likely in the weeks ahead - ideally on a run for the safety of bonds as equities fall.

MM believes the bear market for bond yields is very mature but new lows will be seen in 2019.

We have a contrarian view that the risk / reward favours the cyclical stocks into any pullback below 1.5% for the US 10-year bond yield, MM is looking to invest accordingly.

US 10-year bond yields Chart

International Equites Portfolio

No change again, our MM International Portfolio continues to perform steadily supporting our patient approach to this relatively new offering: https://www.marketmatters.com.au/new-international-portfolio/

MM still hold 72% in cash looking to buy weakness through October, plus we hold 8% in bearish S&P500 ProShares ETF (SH US) and 5% in Barrick Gold (Gold US) both of which will probably be closed / switched if our anticipated pullback scenario unfolds.

MM still believes the risk / reward for US stocks is on the downside into later October, hopefully they have just started to listen.

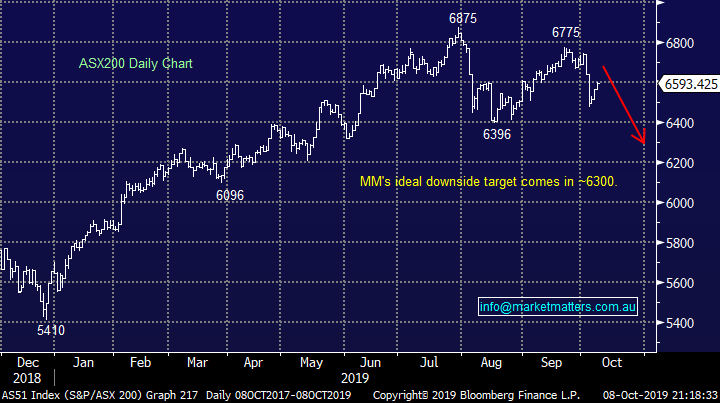

The US small cap Russell 2000 Index continues to underperform which is bearish sentiment indicator i.e. investors are only comfortable in the perceived safety of the large name blue chip stocks – last night alone this index fell -1.7% compared to the Dow only retreating -1.2%. Our target for this small cap index is around 1430, or only another 3% lower. Hence we are comfortable being patient just here but can see ourselves pressing some buy buttons very soon.

A failed spike by the Russell 2000 below 1450 will be a bullish signal to MM.

US Russell 2000 Index Chart

Over recent weeks as our view on markets has remained consistent MM has covered a number of stocks we are considering buying into weakness, today we have done the same but have included 3 large international miners into the mix for the first time as we are looking for a major point of inflection in the likes of Copper i.e. MM is looking to go long miners fairly aggressively.

Importantly subscribers should understand that if / when we get the buying opportunities MM is anticipating we are likely to deploy over 50% of our free cash into the market very rapidly.

1 Glencore Plc (GLEN LN) GBP223.90

Glencore is a major diversified natural resources business with a market cap of GBP 30bn, after our own BHP it’s the 4th largest global producer of copper. I actually went for a job there around 15 years ago as a coal trader – I didn’t get the gig and I’m sure life would have turned out a lot differently if I had! Although the business does have a large exposure to the out of favour coal the huge share price correction is offering some excellent value in our opinion, the business generated over GBP7bn of free cash flow in 2018 making it a nice cash cow in todays low interest rate environment – the consensus yield for GLEN over the next 12-months is over 7%.

MM likes GLEN around GBP215.

Glencore Plc (GLEN LN) Chart

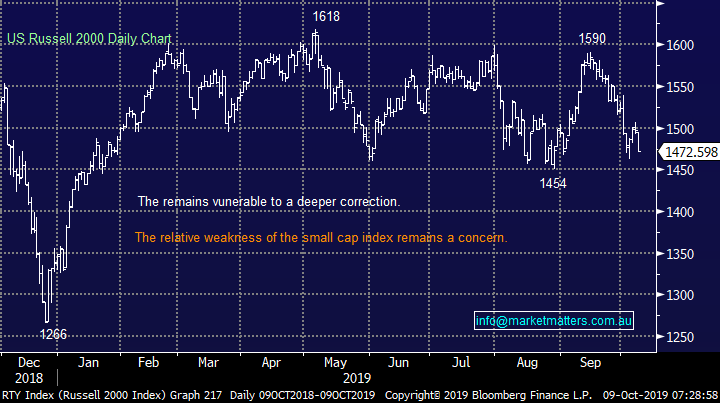

2 Vale (Vale US) $US11.05

Brazilian mining giant Vale is the 10th largest global producer of copper but its unfortunately been in the headlines for the wrong reasons over recent years due to its awful dam disaster in late 2018. However with bad news comes opportunity and we feel that Vale is now starting to represent value especially as its in the interest of the struggling Brazilian government to have the miner operating efficiently and profitably.

MM likes ideally below $US10.50.

Vale (Vale US) Chart

4 Freeport-McMoRan (FCX US) $US8.51

Phoenix based FCX is the world largest copper producer after Chile’s government, their mines are in the likes of Indonesia, US and the Congo. The price of FCX almost perfectly mirrors the copper price which is of no surprise but it is very interesting to MM who are looking for a major bottom in the industrial metal.

MM likes FCX into fresh 2019 lows.

Freeport-McMoRan (FCX US) Chart

4 Trade Desk (TTD US) $190.44

Lastly, not a miner but a stock we have touched on a few times in 2019 TTD – an unusual one for MM but around current levels the risk / reward is looking attractive for this advertising technology company.

MM likes TTD around current levels.

Trade Desk (TTD US) Chart

MM Global Macro ETF Portfolio

No change again, MM increased our portfolio holdings last month by buying into the Silver ETF (SLVP US) plus increasing our ProShares Short S&P500 ETF & $A positions, we now have 69.5% in cash : https://www.marketmatters.com.au/new-global-portfolio/

We remain comfortable with our 4 positions but further tweaks are set to unfold in the weeks ahead:

1 – The very topical bond market; we feel that US 10-year bonds are in their final leg of declining yields for 2019. MM are keen buyers of a dip to fresh lows in the Bear ETF (DTYS US), ideally around the ~7.50 area which is approaching slowly but surely.

MM is a buyer of the DTYS around 7.50.

Details of this ETF are explained on this link : https://etfdb.com/etf/DTYS/

iPath 10-year Bond Bearish ETF (DTYS US) Chart

2 – No change again on our thoughts around BREXIT, MM is watching for any panic spike lower in the Pound as a potential buying opportunity because we believe ultimately things won’t be as bad as many fear in the years ahead i.e. markets hate the unknown!

Details of our preferred British Pound ETF are explained on this link : https://etfdb.com/etf/UGBP/

British Pound Chart

Conclusion (s)

· No change, MM likes sitting on our hands at this stage but we are dusting off the buy button, especially after last night’s falls.

· MM likes the 3 miners looked at today and TTD – watch this space

· We are keen buyers of both the DTYS and pound into weakness.

Overnight Market Matters Wrap

- A wave of negative news across both the US and Euro region created the sea of red to widen with the chances of BREXIT to occur by the due date being highly unlikely and the US-China Trade deal also not looking so great with further blacklists seen on Chinese companies ahead of the meet this week.

- US Fed chairman Powell said they will add to the supply of reserves over time and left open his options regarding rates at the next FOMC meeting, while the head of the IMF said the world is experiencing a synchronised slow down as a result of the trade war - manufacturing and investment has weakened and services and consumption could be next!

- Metals on the LME were mostly lower, while iron ore resumed trading after a week of holidays in China, +1.5%. as expected, gold is higher at $US1505.60/oz. while crude oil is a touch lower.

- The December SPI Futures is indicating the ASX 200 to give back most of the week’s gains and open 64 points lower towards the 6530 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.