Overseas Wednesday – International Equities & ETF Portfolios (MFG, COH, CYB, BABA US, 700 HK, 2318 HK, SH US, TYU9, GOVT US)

The ASX200 experienced another choppy session as intra-day sentiment continues to be very unpredictable. At around 11am we were trading unchanged, which felt extremely impressive at the time, but alas nerves increased as the day progressed and finally we closed down 21-points, still a solid result considering the Dow fell almost 400-points on Monday night. The Healthcare sector was weakest on the day with market darling Cochlear (COH) and CSL (CSL) both appearing to be hit by profit taking after hitting all-time highs over the last fortnight and ahead of their earnings reports – CSL out today and COH on Friday. Sentiment was buoyed by positive results from both Challenger (CGF) and Magellan (MFG) although the latter’s $275m capital raise to fuel growth was probably a net negative over the day.

Asia continues to rattle global markets with the Hang Seng falling over 2% as Hong Kong continues to experience domestic unrest while the turmoil in Argentina has ensured that markets remain on their toes, or in a number of cases running for cover. The Hang Seng has corrected over 16% since mid-April and now looks set to break below its 2018 low, the ASX200’s equivalent is 5410 or a massive 17.6% lower – we are not trying to scare investors here just reiterate our mantra to remain open-minded to all potential investment outcomes.

Today looks set to be a major day on the reporting front with the likes of CSL Ltd (CSL), Woodside (WPL), Computershare (CPU), Pact Group (PGH) and Tabcorp (TAH) all facing the music with the last 2 sitting in our Growth Portfolio, fingers crossed! My thoughts on the results so far this morning:

MM remains comfortable to adopt a more defensive stance than over the first 6-months of 2019.

Overnight US stocks staged an impressive recovery with the Dow basically regaining the 400-points it lost in the previous session, as we said previously we are in a choppy news driven market and last night the relief rally was courtesy of Donald Trump who reduced his original China tariff threat, where there’s compromise lies hope. The SPI futures are calling the ASX200 open up almost 50-points, with the IT stocks likely to lead the way after the Nasdaq rallied +2.20% overnight.

In today’s report we are going to update our thoughts, ideas and plans for our International Equities and ETF Portfolios while also considering a few topical situations in the local market.

ASX200 Chart

Growth Portfolio

Three stocks have caught my eye over the last 24 hours, below is a quick summary on my mixed thoughts towards these particular companies:

1 Magellan (MFG) $59.83

Yesterday Magellan (MFG) announced a strong 35% increase in net profit aided by a 28% surge in funds under management (FUM). The international fund manager has taken the logical opportunity to raise $275m at $55.20 to help with its launch of a high conviction fund, strengthen its balance sheet and the development of a fresh retirement product – potentially bad news for Challenger (CGF).

We’ve just had the Magellan team in the office talking about the launch of the new high conviction listed fund which looks interesting. We will pen a note on it shortly and provide investors with access to the IPO.

MM would be interested in MFG below $55.

Magellan (MFG) Chart

2 Cochlear (COH) $203.37

Cochlear (COH) is a classic case of great company whose shares have become very expensive. The last few weeks has seen an 11% pullback, around double that of the ASX200 which in our opinion illustrates its risks above $200.

This is a stock that has already fallen over 20% twice in the last few years and is more than likely to do so again when investors again become concerned with high valuation plays, this is when MM will look to again become a buyer.

MM is neutral to bearish COH above $200.

Cochlear (COH) Chart

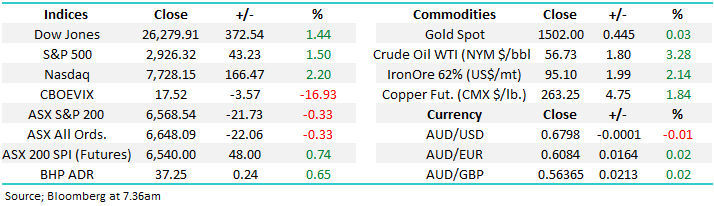

3 CYBG Plc (CYB) $2.57

UK based CYB has now fallen almost 60% over the last 12-months, especially painful when we consider that CBA has rallied ~5% over the same period. This a company in completely the opposite vein to COH, its theoretically cheap trading around half its book value but continues to get cheaper, along with many European banks. Technically it would be easy to find the stock oversold but nothing is lining up on the fundamental side of the ledger to interest us in CYB.

MM is neutral CYB at best.

CYBG Plc (CYB) Chart

International Equites Portfolio

The US S&P500 is currently sitting only 3.4% below its all-time high posted last month, it’s been a very choppy period for both the bulls and bears. The constant flow of news has led to a push / pull sort of market but considering the potential ramifications of a US-China Trade War, an Argentinian debt crisis and the risks of a recession the influence of falling interest rates to support stocks can be clearly seen by all. We still believe it’s time consider lightening exposure into strength while buying aggressive falls.

MM believes the risk / reward for US stocks is on the downside for at least the next 4-6 weeks.

Our preferred scenario is the S&P500 will initially correct another ~6% in an ongoing choppy manner.

US S&P500 Index Chart

MM is still holding 75% in cash plus 2 market hedges via 5% negative exposure to US stocks via an ETF (SH US) and 5% in Barrick Gold (GOLD US) an ideal mix while we are short-term bearish global equities: https://www.marketmatters.com.au/new-international-portfolio/

We continue to anticipate pressing the “Buy button” in an aggressive manner in the next 4-6 weeks but at this stage patience continues to be a virtue paying the proverbial dividend, if anything we are likely to add to our bearish ETF into a decent bounce moving forward. However below are 3 stocks we like into further weakness as quality businesses get dragged down by the negative sentiment, especially towards China and the region in general.

1 Alibaba (BABA US) $US164.03

Following a solid bounce last night the China based e-commerce business remains over 8% below its recent high and almost 16% below its 2019 high. However we feel there remains a strong possibility of further ructions from the region hence our preferred way to play BABA is to accumulate into weakness if / when it occurs below $US140.

MM likes BABA between $US120 and $US140.

Alibaba (BABA US) Chart

2 Tencent (700 HK) $HK334

The story for TenCent is very similar to BABA with our preferred scenario to accumulate into weakness if / when it occurs below $HK275.

MM likes Tencent between $HK250 & HK275.

Tencent (700 HK) Chart

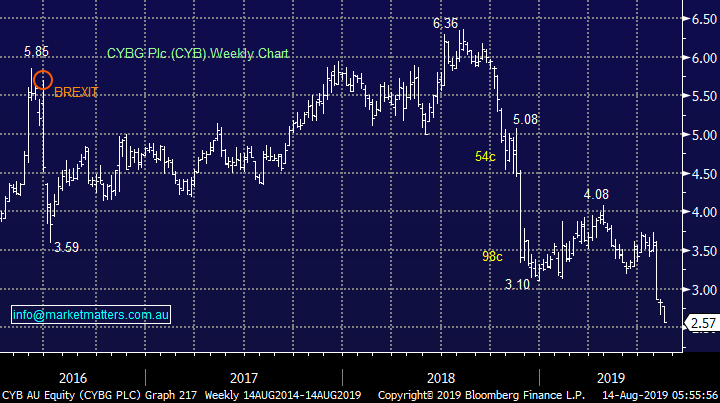

3 Ping An Insurance (2318 HK) HK87.30

MM already holds 4% in this financial services business which has been dragged lower on US – China trade concerns, another 6-8% lower and we are likely to average our position.

MM likes Ping in the low 80‘s.

Ping An Insurance Group (2318 HK) Chart

MM ETF Portfolio

MM is still holding 3 positions in the portfolio, sorry for the boring start here but investing for the sake of it rarely pays dividends: we are long gold, long the $A and short US stocks while still holding 80% in cash: https://www.marketmatters.com.au/new-global-portfolio/

We remain comfortable with these 3 positions but tweaks feel very close at hand:

1 – We plan to average the long $A following the local currencies fresh multi-year lows below the 67c area level, we are now looking for an optimal technical set-up.

2 – We are looking to increase our bearish exposure to US stocks into the current rally, a move from 5% to 7.5% above 2950 for the US S&P500 feels correct i.e. around 26.50 for the ProShares short S&P500 ETF which we currently hold.

ProShares Short S&P500 ETF (SH US) Chart

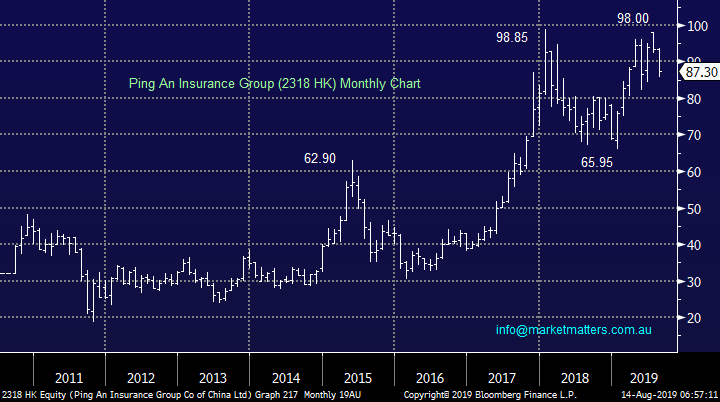

The other market which is still on our radar is the very topical bond market which is generally moving in an opposite direction to stocks as it acts like a safe haven. MM remains bullish bonds but recognises they are in a mature bull market but as we all know these can go on for a long-time.

Our preferred vehicle is the iShares US Treasury ETF (GOVT US). Details of this ETF are explained on this link : https://www.ishares.com/us/products/239468/ishares-us-treasury-bond-etf

We are considering taking exposure to US bonds ~129 basis the 10-year notes.

US Ten-year Notes (TYU9) Chart

US Treasury ETF (GOVT US) Chart

Conclusion (s)

MM remains net bearish global stocks in the weeks ahead and will be looking for opportunities to invest accordingly.

Overnight Market Matters Wrap

· US Equities traded higher following President Trump noting he will delay a 10% tariff on some Chinese products until mid-December. More talks between US and Chinese trade officials are planned in two weeks.

· Metals on the LME closed in the black with copper and nickel ahead ~1.5%. Crude oil surged 3.28%, while gold remains hovering above $US1,500/oz. US 10 year bonds yields rose slightly to 1.7%.

· BHP is expected to outperform the broader market today after ending its US session up an equivalent of 0.65% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 27 points higher this morning, testing the 6600 level with CBA trading ex-dividend today at $2.31/share.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.