Overseas Wednesday – International Equities & ETF Portfolios (JHG US, JPM US, JNJ US, UNH US, DTYS US)

The ASX200 has been exhibiting the characteristics of a washing machine as we see themes like risk on / risk off, buy growth / cyclicals & chase yield / sell yield rotate through the market almost daily, the bottom line is the Australian market is trading in a classic neutral pattern (normal distribution) between 6396 and 6875 with trading activity between these 2 support and resistance areas basically random noise. To put things in perspective the market has been contained within this 479-point band for 12-weeks, since the all-time high in August, without even managing to get within 1% of these 2 extremes.

Yesterday we saw a day for the growth / “yield play” stocks while the cyclicals which MM is still looking to accumulate moving forward struggled all day e.g. BHP Group (BHP) -1.2% and Western Areas (WSA) -1.9%. It’s important to reiterate that MM is looking for Cyclicals to outperform Growth in 2020 but trying to identify the exact point of inflection is guesswork at best hence we intend to slowly tweak our portfolios over the weeks ahead assuming we don’t change our overall opinion – we are always open-minded and hence can and will evolve our macro viewpoint if reasons necessitate.

If its not the US - China trade war BREXIT steps up to fill the temporary void of market uncertainty but since we saw the yield curve invert when investors suddenly focussed on a potential global recession in 2020 any selling has met with stubborn buying which agrees with our opinion that many fund managers are underweight equities and hence looking to buy a pullback - it’s usually scary when too many people are looking for the same opportunity. Overnight we saw a new combination of optimism around BREXIT and solid start to the US reporting season from the likes of JP Morgan, United Health and Johnson & Johnson lay the foundation for a strong day – if US earnings do continue to perform strongly fresh highs for US indices feels inevitable, it’s a fresh influence on stocks that’s been absent for a while.

No change, MM remains comfortable being relatively defensive, at least for a few weeks!

Overnight global stocks were strong following US earnings with the S&P500 closing up 1%, the ASX200 is set to open up 50-ppoints with banks the likely points leader.

This morning we have looked at our thoughts for the International Equity and Global Macro ETF portfolios using 3 of the stocks that reported earnings overnight as a barometer.

ASX200 Chart

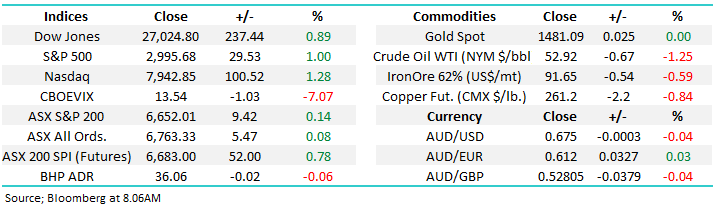

The most eye catching moves yesterday were in the Retail Sector following Nick Scali’s admission that their sales were down 8% YTD, far worse than the already tough anticipated conditions – the stock closed down almost 14% after managing to regain over 35% of the initial knee-jerk early sell-off. Interesting to see Anthony Scali sell 11m shares at $7.00 back in March 2018, bought by one of their Chinese suppliers who then on-sold them to local funds at $6.65 about a month ago. Not sure I would have ponied up to buy a line of stock from a supplier to the company at a discount to what they bought them for - they obviously have more insight than most!

At a sector level, all 7 of the stocks closed down on the day with the average decline a painful -3.2%. Last Friday we looked at the highly correlated Consumer Discretionary Sector with a very clear conclusion: MM is very close to turning bearish the ASX Consumer Discretionary sector.

From a risk / reward perspective we see no reason to be chasing stocks in these 2 sectors.

ASX200 Retail Index Chart

Also worth mentioning this year’s biggest potential IPO, Latitude Financial which has failed to get up even after re-pricing the deal lower. We weren’t fans of the offer and the re-packed lending business has now failed at listing twice in the past two years. Hard to see them coming back to market any time soon.

Where to now for US stocks?

Last night’s strong rally by US stocks following a strong kick-off to reporting season feels like it may have set the tone for equities to challenge and probably break to fresh all-time highs – our “best guess” at this stage is ~2% higher.

MM believes US stocks now poised to test the 3070 area, around 2% higher.

US S&P 500 Index Chart

Base Metals look to be forming a base

Last night with positive news on BREXIT and US company reporting dominating market news relatively little coverage was given to the IMF ‘s very downbeat comment on the global economy:

The International Monetary Fund (IMF) anticipates a global slowdown to its weakest position since the GFC taking Australia’s economic growth forecast down to just 1.7% - a notably more bearish opinion of our economy than the RBA. The comments from Nick Scali who also saw a more than a 10% drop in people walking through its doors implies the RBA remains a touch too confident. Even though we saw optimism in many areas of the market commodities didn’t dance the recovery tune, they will need a bazooka of global fiscal spending in our opinion but we feel this is coming.

MM believes its almost time to go overweight on resources / miners.

Bloomberg Base Metals Index Chart

Bond yields are leading sector rotation

Australian Official interest rates appear headed for 0.5% but if the IMF is to be believed perhaps zero plus a round of fiscal support is more appropriate. Whereas in the US lower rates are expected, bond yields appear to have become range bound – the major US 10-years illustrated below are rotating between 1.5% and 2%. Considering the current relative stance / position of the RBA and Fed the $A holding onto the mid 67c region is encouraging to our contrarian bullish stance.

When we see bond yields rally as they did overnight the classic “yield play” stocks / sectors come under pressure e.g. even with the Dow up more than 200 points, we had US Utilities and Real Estate sectors closing down, while conversely the Financials and IT stocks surged.

MM believes the bear market for bond yields is very mature but new lows will probably be seen in 2019.

We have a contrarian view that the risk / reward favours the cyclical stocks into any pullback below 1.5% for the US 10-year bond yield, MM is looking to invest accordingly – currently we are in no man’s land.

US 10-year bond yields Chart

International Equites Portfolio

We have maintained a patient stance towards increasing our market exposure for the MM International Portfolio, unfortunately not ideal as the market considers another assault on its 2019 highs : https://www.marketmatters.com.au/new-international-portfolio/

We must remain open-minded that the dip lower for a buying opportunity in global stocks wont unfold, we are slightly with the crowd on this one – the latest Bank of America fund manager survey showed an increasing fear of a global recession while the average cash holding rising by over 6%. Importantly investors are heavily skewed for safety in the likes of Consumer Staples while holding their lowest exposure to resources since early 2016 i.e. there is room for the resources to surge if fiscal stimulus can increase demand for the industrial metals.

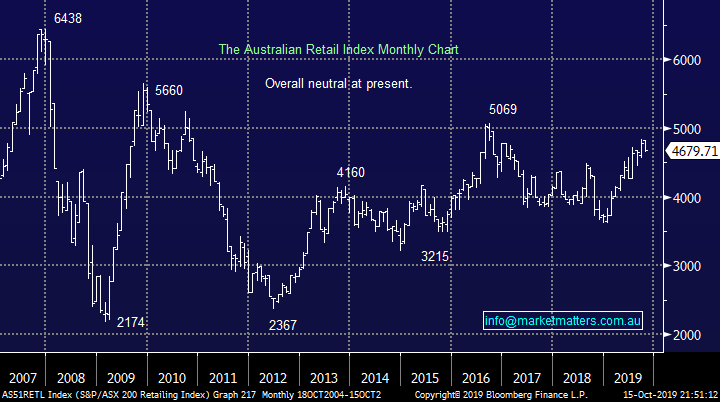

In the bigger picture we have been looking for a buying opportunity in the small cap Russell 2000 targeting an eventual test of 1800, around 20% higher – potentially the correction will now take the form of “sideways chop” as opposed to the spike lower we were hoping for.

US Russell 2000 Index Chart

Today I have looked at 3 stocks who reported overnight and one which is exposed to the unfolding BREXIT dramas.

1 Janus Henderson (JHG US) $US21.95

MM is holding investment manager Janus Henderson (JHG) in our Growth Portfolio but given our bullish view on the position we feel the US stock will fit nicely into our MM International Portfolio – note last night the stock turned over almost $25m in the US making it a very real market in its own right.

The chart below is the US listed JHG which rallied ~2% overnight.

MM is bullish JHG targeting at least 15-20% upside.

Janus Henderson (JHG US) Chart

2 JP Morgan (JPM US) $120.13

Investment bank JPM rallied ~3% following its upbeat earnings report overnight. They were up +4.4% at their best touching an all-time high after they beat expectations, earnings per share (eps) of $2.68 ahead of $2.46 consensus underpinned by their fixed income and investment banking divisions. Interestingly, CEO Jamie Dimon made special mention of a “more challenging interest rate backdrop” however he also talked up the health of the American consumer with strong home loan volumes along with demand for car loans.

While JPM was the best of the banks that were out overnight with results this is not a breakout we would chase, although clearly the stock is in a bullish technical trend while it can hold above $US117.

MM is neutral JPM at current levels.

JP Morgan (JPM US) Chart

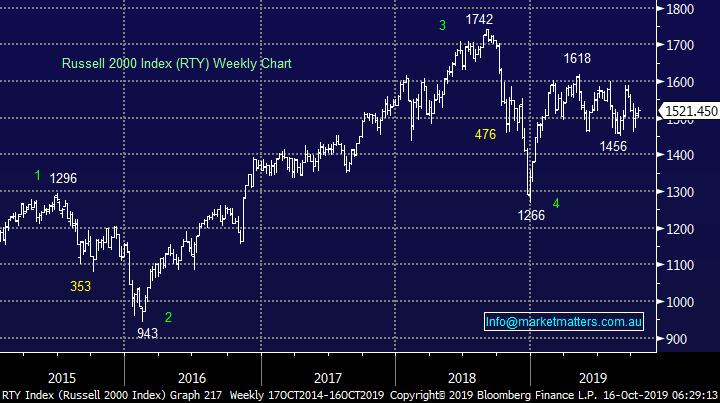

3 Johnson & Johnson (JNJ US) $US132.66

The household name produced some solid earnings overnight taking the stock up ~1.5% but they continue to trade in the middle of the last 2-years trading range – typical of a lot of US stocks at present. We currently see no reason to be involved at this point.

MM is neutral JNJ.

Johnson & Johnson (JNJ US) Chart

4 United Health Group (UNH US) $US238.20

Health business UNH which is a large and diversified provider of health services in the US delivered some excellent 3rd quarter earnings last night sending the stock up over 8% in the process – total revenue was up a very impressive 7% to over $US60bn. We feel the stock still shows value at todays levels trading on a 14% discount to its long term P/E with solid risk / reward at current levels.

MM likes UNH with stops below $US225 -~6% risk.

United Health Group (UNH US) Chart

MM Global Macro ETF Portfolio

MM is skewed the wrong way at present in this portfolio as markets embrace risk. That said, we’re not seeing any meaningful change to the choppy sideways price action in most markets other than clear strong underlying support into any pullbacks. : https://www.marketmatters.com.au/new-global-portfolio/

We remain relatively comfortable with our 4 positions but further tweaks are set to unfold in the weeks ahead:

1 – The closely watched and topical bond market; we feel that US 10-year bonds are in their final leg of declining yields for 2019. MM are keen buyers of a dip to fresh lows in the Bear ETF (DTYS US), ideally around the ~7.50 area which is approaching slowly but surely.

MM is a buyer of the DTYS around 7.50.

Details of this ETF are explained on this link : https://etfdb.com/etf/DTYS/

iPath 10-year Bond Bearish ETF (DTYS US) Chart

2 – Update : our thoughts around BREXIT remain positive hence our comfort in buying JHG for the International Portfolio but the risk / reward is not attractive in the Pound at present – it has already embraced the potential of a positive outcome.

British Pound v $US Chart

3 – If the S&P500 is going to rally towards 3070 it makes sense to try and pick up a few $$ along the way, especially as our Macro ETF Portfolio is skewed to the downside.

The tech based NASDAQ is the likely leader with a target almost 3% above. We are considering a “cheeky” short-term play in a geared NASDAQ ETF but I stress short-term.

Our preferred ETF is the Proshares UltraPro QQQ ETF (~3x leverage) : https://www.etftrends.com/quote/TQQQ/

NASDAQ Index Chart

Conclusion (s)

International Equities: Of the 4 stocks MM looked at today we particularly like Janus Henderson (JHG US) and United Health (UNH US).

Macro ETF: No major changes appear likely in the short-term except a quick foray long the NASDAQ.

**A reminder than any international alerts will be included in the PM Note – with a notation in the subject line**

Overnight Market Matters Wrap

- The US equity markets rallied overnight, with investors focusing on the 3rd quarter corporate earnings which started on a positive note, with better than expected numbers out from 9 of 11 companies that reported. Among those that beat included JP Morgan Chase, Citi, Black Rock, Johnson and Johnson and United Health while only Wells Fargo and Goldman Sachs missed.

- European markets were also generally stronger with Germany and France up over 1% on hopes of a Brexit deal as the end of month deadline looms, while the UK market was little changed.

- On the commodities front, crude oil slid further, now sub US$53.00/bbl. along with gold and copper, while Iron ore just sits around the $92/t. area.

- The December SPI Futures is indicating the ASX 200 to open 58 points higher, towards the 6710 level this morning with Macquarie Group (MQG) expected to outperform the broader market after an overall good performance in the US financial sector.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.