Overseas Wednesday – International Equities & ETF Portfolios (IPH, WTC, AVH, MCD US, SBUX US, YUM US, CMG US, QSR US)

The ASX200 enjoyed a very strong Tuesday leaving us up 124-points / 1.9% for November with only 3 trading days remaining, not a bad performance considering over the last 10-years the average performance for the penultimate month of the year, when 3 of the “Big 4 Banks” trade ex-dividend is -0.6%. I feel it’s been a particularly strong performance considering the hugely influential banking sector has been heavily under the cosh because of poor results, capital raisings and of course now AUSTRAC.

The main piece of news catching my eye over the last 24-hours was the RBA governor Phillip Lowe saying Australia’s central bank would not resort to Quantitative Easing (QE) until Official Rates hit 0.25%, not as far away as many might think considering the RBA are expected to drop rates from 0.75% to 0.5% in Q1 of 2020. They also suggested if they did implement QE it would be through buying government bonds, as opposed to corporates. In our opinion the RBA has simply volleyed the ball back over the net to the Liberal government whom I’m sure are pondering fiscal stimulus in2020 – our anticipated path moving forward.

Yesterday’s +0.8% rally was again broad based with less than 30% of the index closing down on the day, we continue to believe fund managers are caught underweight equities hence the market and any reasonable weakness is attracting buyers – my “GUT Feel” still says as test of the psychological 7000 area is a strong possibility into Christmas i.e. now only ~3% away.

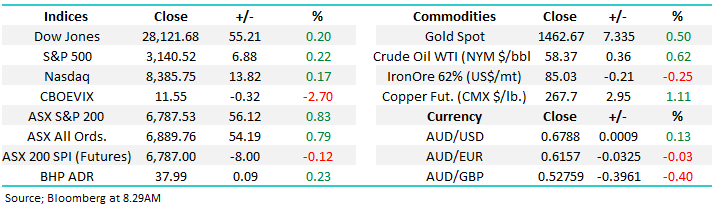

MM remains neutral the ASX200 with a slight bullish bias.

Overnight US stocks edged higher closing at an all-time high for a second consecutive day, although positive comments from Mr Trump that a trade deal was very close failed to ignite the buyers in any meaningful way. Gold stocks enjoyed some buying thanks to a bounce ion the Gold price while Copper hit a 2-week high.

Today we’ve taken a quick look at US food outlet stocks as we look to position our Overseas Equities and Global Macro ETF Portfolio’s into 2020 – overnight we allocated 6% into Alibaba (BABA US) and 5% into Wells Fargo (WFC) in our International portfolio following the alert in our Afternoon Report yesterday. A reminder that all international alerts will appear in the afternoon notes and there will be a notation in the subject links of the report.

ASX200 Chart

Local Bond yields ignore Phillip Lowe

Surprisingly local bonds markets and the $A took comments by Phillip Lowe from the RBA in their stride with neither really moving following his speech overnight. The topic was unconventional policies and he talked about quantitative easing in Australia, concluding that it would only take place if interest rates had been cut to the lowest, they can be.

MM still expects Australian bond yields to make fresh all-time lows implying the RBA will in fact cut again.

Australian 3-year Bond Yields Chart

3 local stocks catching MM’s eye

Before moving onto our international flavour today I have quickly touched on 3 local stocks who have been catching my attention.

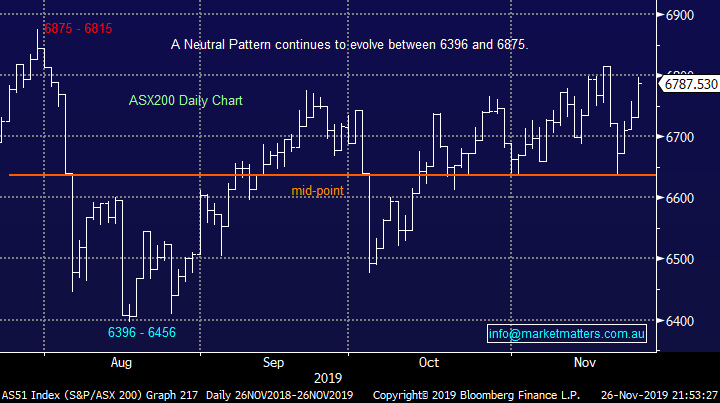

1 IPH Ltd (IPH) $8.76

Intellectual Property (IP) business IPH reported strongly last week and the market has certainly supported the Sydney based business over the last few days – I wonder if investors envisage the company has room for expansion with China increasing pressure on IT theft as they move down a conciliatory path on trade with the US.

MM is bullish IPH looking for ~15% upside.

IPH Ltd (IPH) Chart

2 Wisetech Global Ltd (WTC) $26.60

WTC fell 3% yesterday while the market and IT sector rallied, never a good sign – we remain short-term bearish targeting the low $20 region.

Technically MM is interested in WTC around $22.

Wisetech Global Ltd (WTC) Chart

3 Avita Health (AVH) 61c

In our last Weekend Report the “Trade of the Week” was buying Avita Medical, an Australian $1.3bn company. After yesterday’s +6% rally we have become even keener on this view!

MM is bullish AVH with stops below 56c i.e. 10% risk targeting 25% upside.

Avita Health (AVH) Chart

Reviewing some US Food Distribution Businesses

The restaurant game is a tough gig with over half of new ventures failing in the first year while 70% of the survivors subsequently closed in the next 3-5 years. The world loves American restaurant chains illustrating if you get it right food can be profitable. Getting it right is a broad term however with food being only one component of it. Technology is now a key cog in the wheel while logistics, marketing and distribution channels are all key in determining margins and earnings.

Importantly this is a growth industry with Americans spending more $$ dining out than on groceries in 2019 for the first time ever! The largest 10 businesses in the world are all American and although there’s clearly scale in China their culture is more around quality making the landscape different for new local chain operators but undoubtedly, they will come as Chinese do love some Western influence.

Today we have simply looked at the largest 5 operators in order of market cap.

1 MacDonald’s Corp (MCD US) $US193.72

The most famous of all fast food outlets is Chicago giant McDonalds which is now an incredible $US146bn global phenomenon based around selling burgers. There are now over 38,000 “Golden Arches” on our planet and rising, not bad for a business founded back in 1948 by 2 brothers – with the exception of the tricky Subway franchise this is a business that has rarely put a foot wrong.

Although competition is always increasing their first step advantage and prime locations has the company well positioned moving forward.

MM likes MCD after its 15% correction.

MacDonald’s Corp (MCD US) Chart

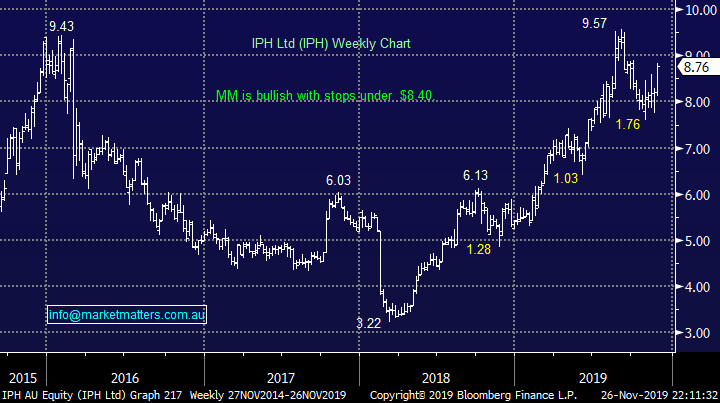

2 Starbucks Corp (SBUX US) $US84.62

Seattle based coffee business SBUX has built itself into an almost $US100bn goliath, this is one of Hamish Douglass’ (Magellan) largest holdings and as we discussed on Friday its tricky one for me because I don’t like their product! I’m not the only one here, the Italians won’t touch the stuff with only one shop in the whole country but there are still 30,000 stores elsewhere on our planet so I’m sure management isn’t too fussed about the fussy Italians and my good self of course!

Technically the stock looks ok after a recent +15% correction and after its latest solid quarter, which showed 7% growth in the US and 6% in China, value appears to have been restored to the coffee business. Technically we could buy here with stops under $US75 for the true believer.

MM remains neutral / bullish SBUX.

Starbucks Corp (SBUX US) Chart

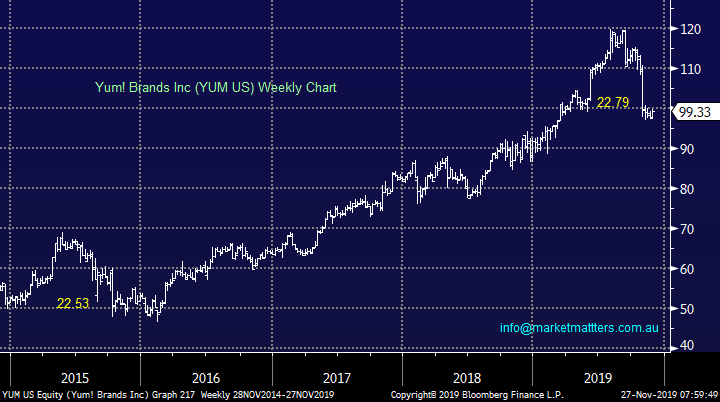

3 Yum! Brands Inc (YUM US) $US99.32

Yum! Is actually the largest fast-food operator in the world in terms of outlets, they operate an amazing 48,000 locations for household names KFC, Pizza Hut and Taco Bell – that’s a logistical job and a half! This is clearly a multi-restaurant business firing on all cylinders, and it continues to expand, including success in China through Yum China.

After its almost 20% correction we believe value has returned to the stock.

MM likes YUM around $US99.

Yum! Brands Inc (YUM US) Chart

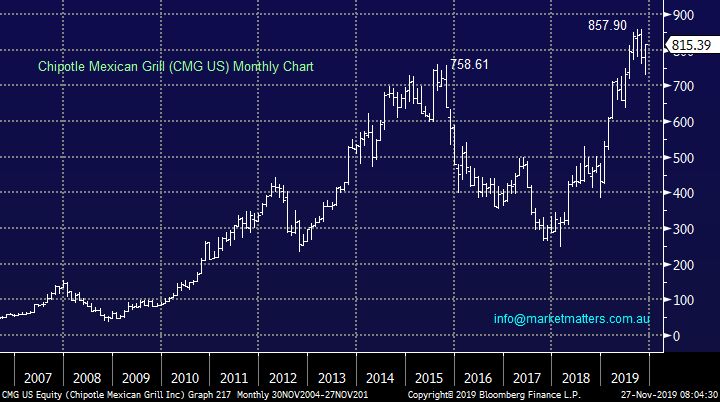

4 Chipotle Mexican Grill (CMG US) $US815.39

CMG is termed the largest “fast-casual dining stock” with 2523 stores earlier this year and expanding rapidly with ~140 stores to open this year alone. This relatively small Mexican chain already has a market cap of over $US22bn as its surged post the GFC.

Technically we believe fresh all-time highs are almost inevitable, but the risk / reward is not compelling at this point in time.

MM is neutral / positive CMG.

Chipotle Mexican Grill (CMG US) Chart

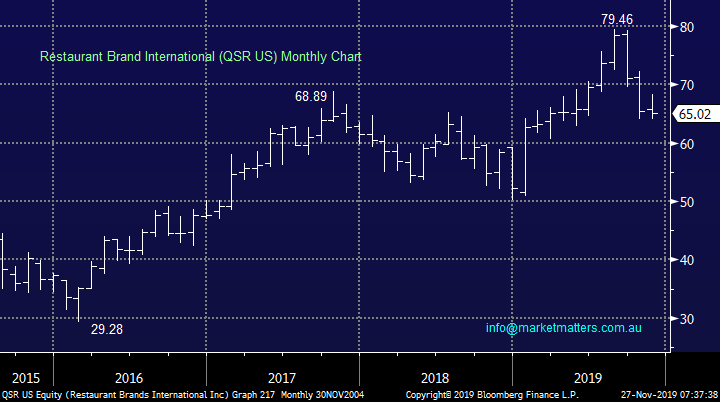

5 Restaurant Brands International (QSR US) $US65.02

Lastly QSR which is best known for its Burger King franchise. The company has over 26,000 stores with around 70% being the Burger King brand. The business is still struggling to match Maccas with their average store turning over only around half of a Macca’s outlet.

MM is neutral / negative QSR.

Restaurant Brands International (QSR US) Chart

Conclusion

Of the 5 largest restaurant chains in the world looked at today MM likes MacDonald’s and Yum! Brands at today’s prices.

We will look at the next 5 lesser known in the Top 10 by size in the sector sometime in the next week.

No changes to our Global Macro ETF Portfolio during the week

Overnight Market Matters Wrap

· US equities continued its strong week ending its session at all-time highs for the second time this week, as trade talks with China continue in a positive tone.

· Crude oil rose on the back of this, currently sitting at US$58/37/bbl. along with aluminium and dr. copper on the upside.

· On the domestic front, the RBA governor Philip Lowe said in a speech to a group of Australian business economists that he would only consider implementing quantitative easing (QE) if the official cash rate dropped to 0.25% (currently 0.75%), but he didn’t expect that point to be reached in the near future.

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.23% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open with little change, around the 6785 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.