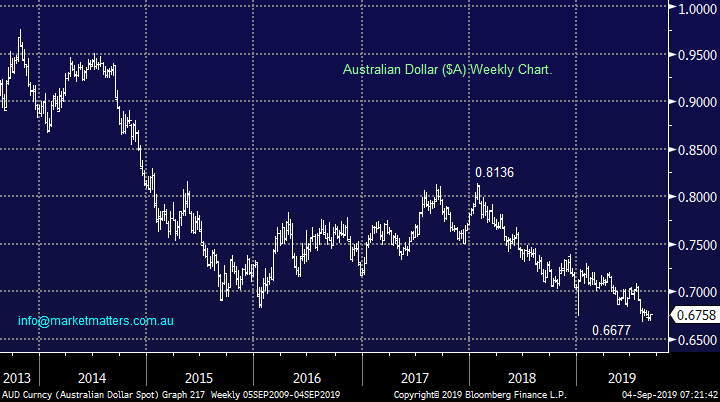

Overseas Wednesday – International Equities & ETF Portfolios (CGC, AAPL US, FB US, BABA US, SLVP US)

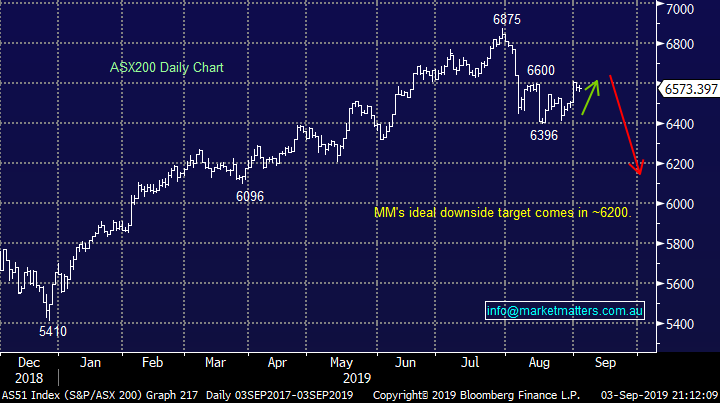

The ASX200 whipsawed around yesterday with little net direction as it appeared to try and second guess how US stocks would trade after the Labor Day long weekend. Even by 9pm AEST the US S&P:500 futures had traded in a significant 37-points / 1.3% range as US – China trade concerns escalate and Boris Johnson muscles BREXIT towards a conclusion, albeit a potentially messy finale. Around the same time as markets commenced trading in Europe on Tuesday the Pound was hammered below GBP1.20, to its lowest level in over 3-years, as Boris Johnson appeared to lose his slim government majority – what a mess, let’s hope that the US and China can ultimately be more efficient.

As the Northern hemisphere faces mounting headwinds for risk assets Australia enjoyed some much needed positive economic data yesterday as the June quarter produced the countries first current account surplus in almost 45-years – when Margaret Thatcher was voted the first female to lead the UK’s Conservative party and Disco was in vogue. The current account surplus reached $5.8bn compared to an anticipated $1.5bn – as we often quote “the economists would have been correct but…...”. Following China’s strong data earlier in the week perhaps the region is holding up better than many fear.

Unfortunately it’s not all good news for stocks because there was nothing in this data, or the RBA’s latest statement, to suggest another rate cut (s) is a forgone conclusion for Australia – markets are still expecting a rate cut on Melbourne Cup Day with a 60% probability priced in for next month, at MM we cannot see any reason for a cut in October. We stick with our thought in the PM Report: the RBA is ready to cut if needed but they might move slower than some think / hope.

Our thoughts are another cut to 0.75% in November could easily be the last change for long time as the RBA looks to avoid any knee jerk reaction, especially as there’s a distinct lag with the impact of rate cuts on the economy e.g. we’ve only just seen the Cash Rate fall from 1.5% to 1% and property prices are steadily improving but policy makers would be keen to avoid further risks of a bubble in this critical area for the domestic economy, and at this stage it’s hard to gauge how far this recovery will go.

MM currently remains comfortable to adopt a more defensive stance than during the first 6-months of 2019.

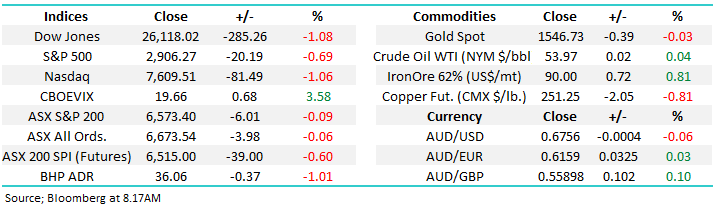

Overnight US stocks closed lower with the Dow down almost 300-points following noticeably weak manufacturing data and ongoing concerns around trade, the SPI futures are calling the ASX200 to open down 40-points. Our “Gut Feeling” is the local market is vulnerable at current levels to a ~6% decline where we would “love to go shopping”.

In today’s report we are going to look at our Platinum, International and ETF Portfolio’s, the Income portfolio will be covered in the income report later today.

ASX200 Chart

As I mentioned earlier, the British Pound tumbled yesterday evening taking its decline since April 2018 to ~16% but by the sessions close it actually closed marginally higher. There’s a significant amount of bad news built into the price of the Pound and a sharp recovery would not surprise us as a BREXIT conclusion finally feels imminent – stocks like CYBG (CYB) and Janus Henderson (JHG) with UK exposure would probably enjoy such a bounce.

British Pound Chart

Yesterday’s economic data and statement by the RBA had little impact on Australian bond yields as they still expect a rate cut in November plus another in 2020, halving the current Cash Rate from 1% to 0.5%.

Our feeling is another sharp sell-off by equities is required to drive the local 3-year bonds below 0.6%, currently our preferred scenario at MM.

Australian 3-year Bond yields Chart

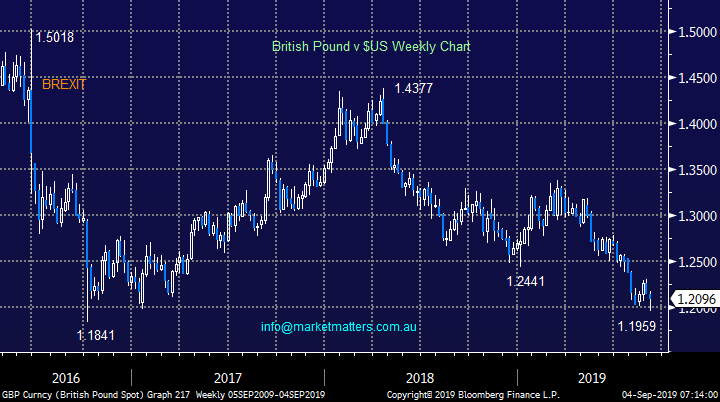

Lastly the Aussie dollar which continues to take most data and economic news in its stride, yesterday’s numbers / statement hardly registered with the “little Aussie battler”. We are still looking for a major low in the $A but a poor period for stocks is often accompanied by a flight to the $US which may give a final spike down in the $A – watch this space.

Australian Dollar Chart

Growth Portfolio

Yesterday MM sold 3 stocks from its MM Growth Portfolio – Adelaide Brighton (ABC), Bank of Queensland (BOQ) and Orocobre (ORE). We now hold a significant 29% cash position. To become significantly more defensive / cashed up we will want an excellent opportunity from a risk / reward perspective or situation where one of our stocks presents a really compelling selling opportunity.

1 Costa Group (CGC) $3.37

MM has discussed reducing our Costa Group (CGC) position but at this stage the stocks looking good and a rally towards $4 would not surprise hence with our cash position already sitting at 29% we will be fussy with this selling.

MM is considering trimming our CGC position down from 6% to 3-4%.

Costa Group (CGC) Chart

2 Defensive to Cyclical

We think the time to rotate from defensive stock to cyclicals may actually be in late 2019 hence we are likely to avoid the Real Estate and Utilities when we increase our market exposure in favour of stocks more exposed to an economic improvement like the Materials sector. However if we are correct and stocks are poised for another decent leg down then the elastic band between the defensives and cyclicals has further to stretch, a panic sell off in cyclicals would be very tempting for MM in the weeks / months ahead.

MM is watching the embattled cyclical stocks for signs of a turnaround.

International Equites Portfolio

The US S&P500 is sitting 4% below its all-time high as geopolitical issues continue to increase day to day volatility, for those with flexibility and a plan exciting times. At MM we still expect further choppy action before another leg to the downside sometime in the weeks ahead, a news induced pop above 2950 would be ideal as it would probably stop out all the “weak shorts” making it easier to decline – remember markets do like to move in the path of most pain. However we continue it’s a matter of when, not if, stocks take another leg to the downside.

MM still believes the risk / reward for US stocks is on the downside for the next few months.

Our preferred scenario is the S&P500 will shortly test the 2750 area in 2019, or another 5% lower.

US S&P500 Index Chart

Hence with MM still holding 75% in cash plus 2 market hedges via 5% a negative exposure to US stocks through a bearish S&P500 ETF (SH US) and 5% in Barrick Gold (GOLD US) our position fits our view leading to an inactive periods for this relatively new portfolio: https://www.marketmatters.com.au/new-international-portfolio/

While we continue to anticipate pressing the “Buy button” around the 2750 area basis the S&P500 what comes next is more a function of the short-term swings of US / global stocks. No change with below:

1 - We are likely to add to our bearish ETF into any short-term strength in the S&P500, ideally up towards the 2950 area.

2 – MM is looking to be fairly aggressive buyers of any 5% spike lower by US stocks / global indices. In line with our cyclical comments above a decent portion of this buying is likely to be focused in Asian facing stocks.

Below are 3 stocks which MM is watching carefully for signs of what comes next and opportunities into any sell-off.

1 Apple (AAPL US) $US205.70

Apple continues to hold the illustrated uptrend line below, a break of this technical support is likely to coincide with a sharp decline towards $US180 where MM will look to increase our position. The Apple watch was the first of the companies products to be hit by tariffs on the weekend with the major iPhone on the hit list for December, if the market starts pricing in this next group of tariffs it’s easy to comprehend AAPL 10% lower.

MM likes AAPL below $US180.

Apple (AAPL US) Chart

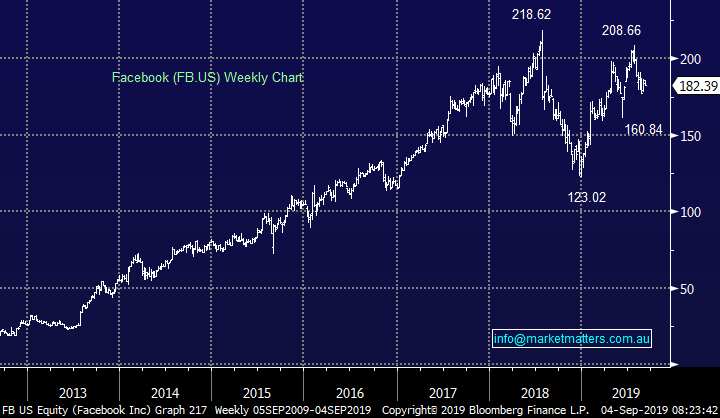

2 Facebook (FB US) $182.39

Facebook has already generated technical sell signals, like most US indices, the failure above $US200 targets a retest of $US160, or 12% lower – this along with the position of Apple implies if we get an aggressive sell off by US stocks this quarter it will be tech led.

MM likes Facebook but more than 10% lower.

Facebook (FB US) Chart

3 Alibaba (BABA US) $172.41

We like Alibaba medium-term, it’s a quality business we want to own with our target at least 20% higher. However its unlikely to be immune to a sharp move lower in US equities hence we remain patient keen buyers.

MM likes BABA into weakness.

Alibaba (BABA US) Chart

MM ETF Portfolio

Sorry but still no change, MM continues to hold 3 positions in the portfolio: we are long gold, long the $A and short US stocks while still holding 80% in cash: https://www.marketmatters.com.au/new-global-portfolio/

We remain comfortable with these 3 positions but tweaks feel close at hand when / if the correct catalysts evolve:

1 – MM plans to average our long $A position following the local currencies fresh multi-year lows below the 67c area level, we are now looking for an optimal technical set-up as we believe the $A “looks for a low”. As mentioned earlier a spike higher by the $US due to weakness in equities might create this opportunity.

2 – We are looking to increase our bearish exposure to US stocks into a move above 2950 for the US S&P500 feels correct i.e. around 26.50 for the ProShares short S&P500 ETF which we currently hold.

3 – Thirdly MM is keen to increase our exposure to precious metals but we now prefer silver as our vehicle of choice to complement our GDX gold ETF following the metals technical breakout, and previous relative underperformance.

Our preferred long vehicle is the iShares MSCI Global Silver Miners ETF (SLVP US). Details of this ETF are explained in this link : https://www.ishares.com/us/products/239656/ishares-msci-global-silver-miners-etf

MM is bullish the silver miners ETF (SLVP US).

iShares MSCI Global Silver Miners ETF (SLVP US) Chart

Conclusion (s)

MM likes sitting on our hands at this stage but we are dusting off the buy button in tune with our targeted pullback by the S&P500 towards / below the 2750 area.

Overnight Market Matters Wrap

· The game of snakes and ladders resumed following a day’s rest in the US with a weaker than expected manufacturing data along with the negative wave in the US-China Trade drama.

· Across in the UK, Prime Minister Boris Johnson faces an early general election, after this morning suffering defeat in the Parliament in his efforts to push through Brexit “deal or no deal” on October 31.

· Investors once again flocked to the ‘safe haven’ assets, with gold gaining to its highest levels in over 6 years, US 10-year bonds higher, while Crude oil sliding back sub US$54/bbl.

· BHP is expected to give back all of this week’s gains and more after ending its US session off an equivalent of -1.01% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 36 points lower, testing the 6535 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.