Overseas Wednesday – International Equities & ETF Portfolios (BRK/A US, AAPL US, WFC US, KO US, AXP US, OZL, BABA US)

The ASX200 enjoyed a strong Tuesday after the RBA revealed in their minutes they were actually close to cutting interest rates on Melbourne Cup Day, a move that surprised both us and the market. The market’s reaction was straight from the copybook - the $A sold off dipping below the 68c mark, bond yields fell and the ASX200 rallied putting almost 60-points from its low. Gains in stocks were led not surprisingly by the interest rate sensitive names / sectors, especially those offering some yield – makes sense as term deposits could easily be heading for sub 1% yields in 2020.

Commentators are now talking about a Christmas rally as the shops get into the full swing of Santa, never feels right in November to me but the kids are already bugging me to hang lights from every conceivable point on the house plus put Rudolph and his mates on the roof – I’ll have to put a pic in here if their badgering is successful – feels unlikely at the moment.

When we combine falling interest rates with apparently cautious / underweight fund managers the path of least resistance still appears to be on the upside. We wouldn’t be surprised to see the ASX200 test 7000 in 2019, its now less than 3% away and continued yield chasing could potentially do the heavy lifting. However we still believe the market will continue with its choppy sector rotation theme as investors deliberate the big question – is it time to switch from growth to value? In other words are interest rates close to a low.

The Healthcare & IT sectors who also usually benefit from falling bond yields didn’t particularly join the party yesterday while Telstra (TLS) put on a healthy +1.4%, my “Gut Feel” is we are seeing some investor capitulation and it’s the yield course their focusing on from the menu. After all the housing bulls have come out to play, why not those in equities – HSBC are now calling Sydney Housing prices up ~10% and Melbourne ~12%, that’s a lot of Australians feeling better in 2020, except of course those living off term deposits.

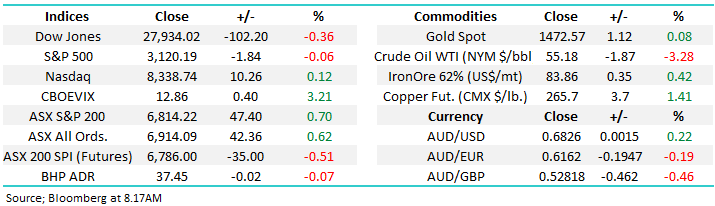

MM remains neutral the ASX200 with a bullish bias - feels correct at present.

Overnight US stocks were mixed with the Dow down -0.36% while the NASDAQ was up +0.12%. The most eye catching was the SPI futures which are calling the ASX200 down ~30-points, with BHP unchanged in the US I wonder if some of yesterday’s short-term buyers have had quick change of heart.

Today we’ve focused our attention on Warren Buffett’s 5 largest holdings, should any be in the MM Overseas Equities Portfolio? Plus our usual look at our International and Macro ETF Portfolio’s.

ASX200 Chart

The RBA pushes bond yields lower

Its no surprise that bond yields fell following the RBA but we feel the subdued nature of their decline supports MM’s view that bond yields are close to a major low. Hence we remain bullish value over growth moving into 2020 but the elastic band feels like it has a little further to stretch on the downside until an aggressive snap back will feel almost inevitable.

MM is looking for a MAJOR low for bond yields.

Australian 3-year Bond Yields Chart

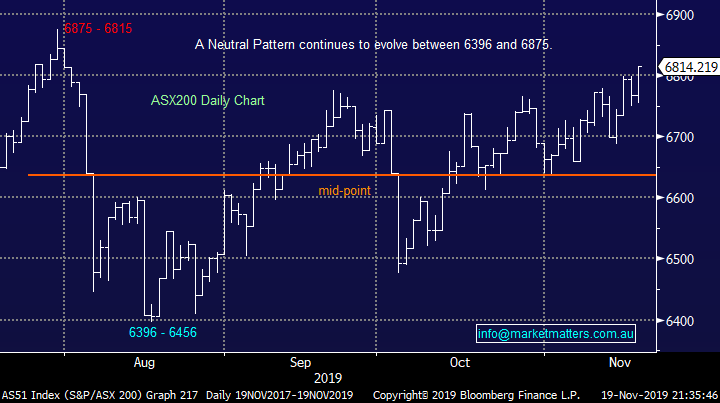

The Australian Dollar ($A) proves resilient

Similar to bond yields the decline by the $A was fairly muted considering the RBA basically flagged the Cash Rate was headed down to 0.5% and by 10pm last night the “Little Aussie Battler” had regained all of its losses and was actually up on the day – a feather in the bullish cap in our opinion i.e. a market that doesn’t fall on “bad news” is a strong market.

Technically MM is bullish the $A into 2020.

The Australian Dollar ($A) Chart

Reviewing Warren Buffett’s 5 largest holdings

We only have to look at Warren Buffett’s investment vehicle Berkshire Hathaway (BRK/A US) over the last 30-years to see why he’s often referred to as the Oracle of Omaha but at this stage he’s actually headed for his worst year since the GFC, I’m sure short-term noise in his opinion - his stock is up ~8% for the year but the S&P500 is up ~23%. One of the major influences of his relatively tough year is his mountain of cash which sits around $US130bn, that’s close to 24% of Berkshires market value providing basically no yield – clearly he’s struggling to find perceived value in today’s market.

Today we’ve conducted the simple exercise of reviewing his 5 largest holdings because with a track record like his it makes sense to have a handle on his investments and rationale.

On November 1st his 5 largest holdings were Apple (AAPL US), Bank of America (BAC US), Wells Fargo (WFC US), Coca-Cola (KO US) and American Express (AXP US). More on these 5 later but his 6th largest holding is in Kraft Heinz (KHC US) which has fallen by over 60% since early 2017 illustrating that nobody’s perfect and another of the reasons he’s endured a relatively tough year

Berkshire Hathaway Class A (BRK/A US) Chart

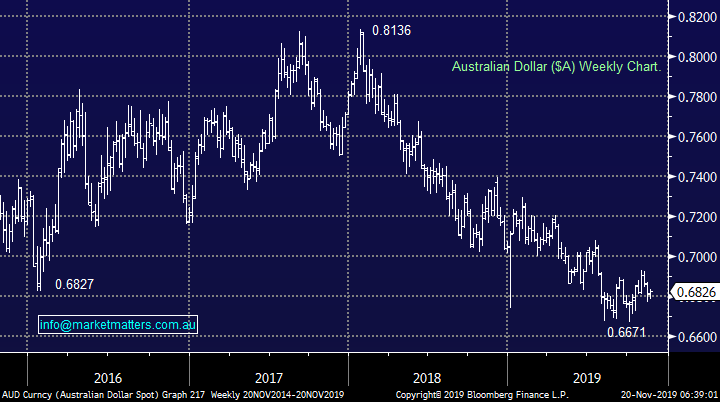

1 Apple Inc (AAPL US) $US266.03

Household name Apple has flourished even after the sad parting of company icon Steve Jobs back in 2011. The stock’s performance in 2019 has been an almost mirror of investors’ confidence with regard to US – China trade and currently the votes clearly a very positive one. The growth for Apple throughout China and Asia is exciting while the 2 economic super powers are on talking terms and although we expect a few bumps in that road its in both countries interest to trade hence trade we believe will ultimately be the winner.

The success of this business is almost mind boggling, last month they announced quarterly revenue of $US64 billion with 60% coming from overseas. This enabled the company to undertake a staggering $US18.5bn in stock buybacks clearly helping the underlying performance of its shares. The company has a greater than $US200bn cash war chest on hand providing it with plenty of resources to evolve the business above and beyond the legendary iPhone.

We hold this position in the International Equities Portfolio with a 6% weighting sitting on a paper profit of ~35%.

We are bullish AAPL both technically and fundamentally and will consider increasing our holding into the next decent pullback

MM remains bullish and long Apple.

Apple Inc (AAPL US) Chart

2 Bank of America (BAC US) $32.95

Bank of America (BAC US) has far from recovered its pre-GFC major losses but it has rallied strongly in 2019. The stocks makes up one of a duo of major positions that Mr Buffett is holding in the US Banking Sector, a view we like which should benefit from an end to declining bond yields – bank margins generally increase as bond yields rally.

BAC reported strongly in October with net income rising 4% to $US7.5bn with 3 of the 4 main banking divisions showing gains in revenue – a solid result in our opinion in relatively tough operating environment for banks. We are initially looking for another 10-15% upside.

Another position we share with Buffett, with a 5% weighting showing a paper profit of ~8%

MM remains bullish and long the Bank of America.

Bank of America (BAC US) Chart

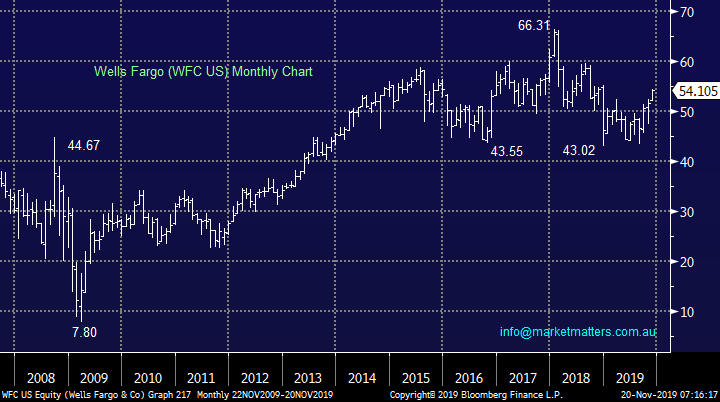

3 Wells Fargo (WFC US) $54.10

His second bank, WFC has been a very bumpy ride for Mr Buffett after scandal rocked the business in 2016 around millions of false accounts being established by employees for incentive payments – sounds like a magnified version of what we’ve seen in Australia. However with problems comes opportunity and we feel WFC may finally be in recovery mode.

Interestingly the bank delivered a slight earnings miss last month with net income of $US4.6bn, down over 20% on the corresponding period in the previous year but importantly the stock has subsequently rallied, a great indicator for a stock that may be in turnaround mode.

MM is bullish WFC targeting fresh post GFC highs.

Wells Fargo (WFC US) Chart

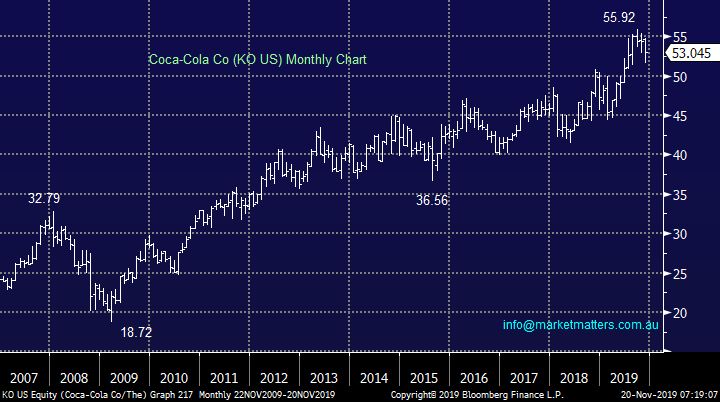

4 Coca-Cola (KO US) $53.04

Another household name in the group is Coca-Cola but this is one that MM is not 100% behind moving into 2020 as the western world becomes more health conscious and the increasing diabetes problems are being targeted on many levels – not an ideal back drop for Coke, although I’m still a loyal customer! The company beat revenue estimates coming in at $US9.5bn for the ¼ last month but earnings were in-line, coke zero / smaller can sizes drove the growth and illustrates the evolving consumer.

Technically the stock looks ok but not one for MM.

MM is neutral Coca-Cola.

Coca-Cola (KO US) Chart

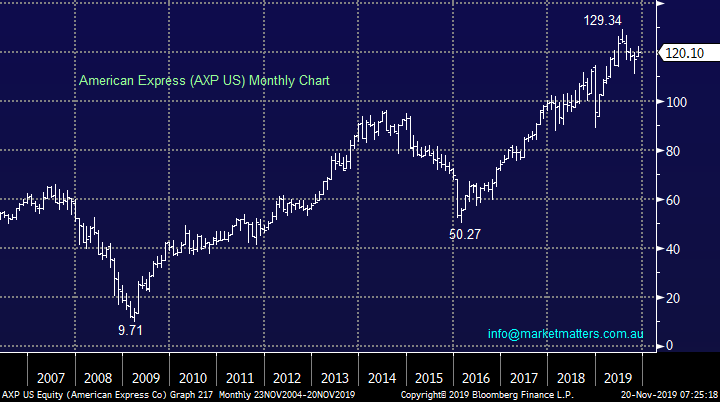

5 American Express (AXP US) $120.10

The third household name in his top 5 is American Express which is well positioned as we move into an ever increasing cashless society but the number of potential competitors is increasing dramatically. The company beat earnings estimates last month with net income rising to $US1.76bn as people spent more on their cards plus net interest income and card fees were all solid.

Technically the stock like Coca-Cola looks ok but again not one for MM as we perceive the competition risks are mounting for AXP.

MM is neutral AXP.

American Express (AXP US) Chart

International Equites Portfolio

Last week there were no changes to our International Portfolio with our cash position remaining at 48% : https://www.marketmatters.com.au/new-international-portfolio/

Of the 5 stocks we looked at today MM likes Apple (AAPL) and Bank of America (BAC) which we already own plus Wells Fargo (WTC) as a recovery story in the banking space we like.

No change with our current thoughts: While there remain 3 specific sectors where we would like to increase our exposure for the MM International Portfolio the possibility of a continued move lower buy bond yields has left us twiddling our thumbs because if this does occur entry levels are likely to be far more attractive i.e. Patience for now but no changes in the plan.

Resources

Our preferred stock to increase our exposure here is local stock OZ Minerals (OZL)

MM is bullish OZL and likes it for our International Portfolio.

OZ Minerals (OZL) Chart

Banks

Our preferred option here has changed to the recovery story WFC which we discussed earlier.

MM likes the risk / reward with WFC.

Emerging Markets

MM continues to like the Emerging Markets moving into 2020, a view strongly supported by our core bearish $US view last week I reiterated “our preferred ways to play this view adding to our Samsung (005930 KS) and Ping An (2318 HK) position plus internet and e-commerce goliath Alibaba (BABA US).” We remain comfortable with this view.

MM likes Alibaba (BABA US).

Alibaba (BABA US) Chart

Conclusion (s)

MM likes the resources, banks and emerging markets into 2020, we expect to significantly increase our exposure to these areas once we are comfortable with the position of bond yields – we are net bearish at present.

We are considering trickling on a few positions at todays levels leaving room to average if the opportunity arises.

MM Global Macro ETF Portfolio

Last week we didn’t change our MM Global Macro Portfolio leaving our cash level at 51.5% as we continue watch bond yields closely. : https://www.marketmatters.com.au/new-global-portfolio/

Again no change: our strongest 2 views are bullish the emerging markets and cyclical banks hence we are simply likely to increase our IEM and BNKS ETF positions, ideally into falling bond yield led weakness but the later has been shrugging of the recent pullback in bond yields.

US 10-year Bond Yield Chart

We still hold our macro view around BREXIT and the UK election i.e. we remain positive hence our comfort in holding Janus Henderson (JHG) in both the Platinum and International Portfolios. Following the recent pullback as an election looms we believe the road of uncertainty is almost over for the UK – good news in our opinion assuming Labor don’t win the election!

Our preferred ETF to invest in the Pound remains the Invesco ETF: https://www.invesco.com/portal/site/us/investors/etfs/product-detail?productId=FXB

British Pound Chart

Conclusion (s)

We are likely to implement these 3 ideas moving forward but until we see some clarification from bond yields “buying the Pound” is the most likely button to be pressed.

Watch the pm reports for alerts.

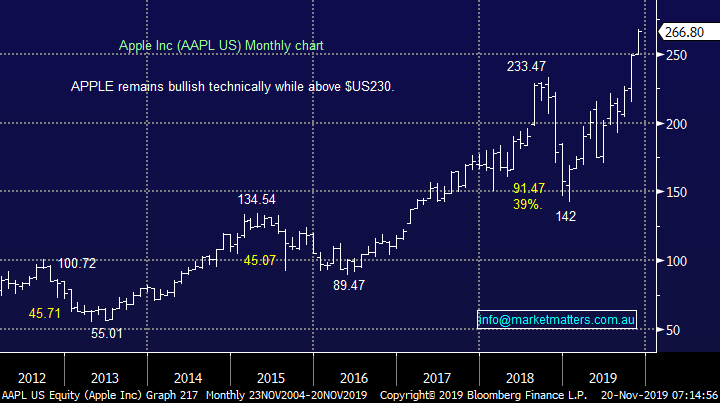

Overnight Market Matters Wrap

- A mixed session in the US saw the both the Dow and broader S&P 500 close in negative territory, while the tech. heavy Nasdaq 100 outperformed slightly as US-China trade deal negotiations are once again making headlines. Washington is suggesting a roll-back of 35-60% on recent tariffs. Beijing wants to roll back all levies implemented in the last six months and then a gradual lifting of older tariffs.

- On the commodities front, copper rallied, while crude oil slid its recent upside momentum to end 3.28% lower on global supply concerns.

- Locally, eyes will be on stock specific names such as Aristocrat (ALL) earnings report and the following AGMs today - Goodman Group (GMG), Independence Group (IGO), Lendlease Group (LLC), Mineral Resources (MIN), News Corp (NWS), Panoramic Resources (PAN), Platinum Asset Management (PTM), Seven Group Holdings (SVW), Shopping Centre Austrasia (SCP), Webjet (WEB).

- The December SPI Futures is indicating the ASX 200 to open 30 points lower this morning, testing the 6785 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.