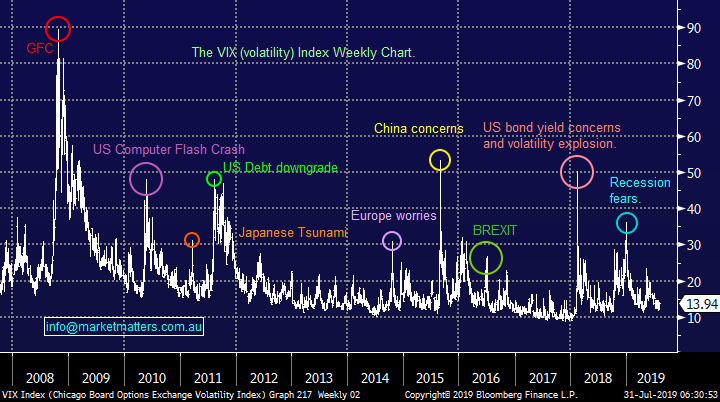

Overseas Wednesday – International Equities & ETF Portfolios (CYB, NCM, VIX, BAC US, EPV US, EUM US, TYU9, TMF US)

The ASX200 enjoyed a solid Tuesday but after making fresh all-time highs profit taking appeared to hit the market with volume steadily increasing, the market finally closed up only 19-points after giving back well over half of its early morning gains. Winners only marginally nudged losers on a day which felt relatively weak even though it did close in the black, the gold stocks remained very strong while the high flying Software & Services index led the declines falling 1.6%, as every stock in the sector closed down on the day.

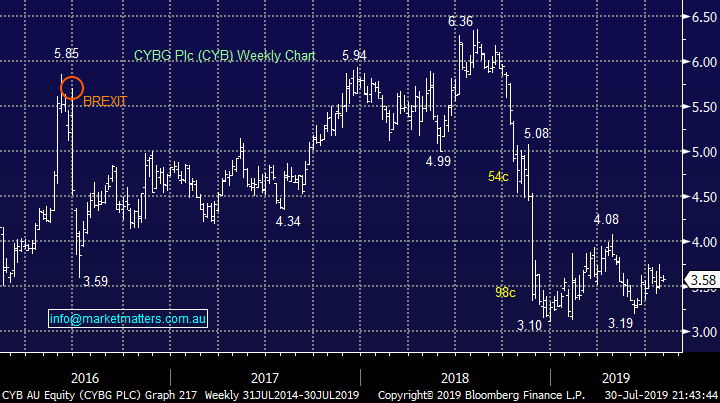

Yesterday had a definite “risk off tone” feel as investors appeared to chase the relative safety of the golds, banks and Telstra (TLS) - Australia’s largest Telco (TLS) hit $4 for the first time in almost a year while Newcrest Mining (NCM) scaled levels not reached since 2012. Interestingly the last week has seen 2 recently very popular stocks unceremoniously thrown into the naughty corner, Iluka (ILU) was dumped 19.2% in just 4-days while Bingo (BIN) has corrected 8.8% over the last 3 days. MM believes the risks are very elevated being long popular / overcrowded/ high performing stocks into reporting season, especially if the are trading on optimistic elevated valuations.

Hence with volatility increasing “under the hood” into Augusts reporting season MM is still comfortable holding relatively high cash levels in our Growth Portfolio. I’m bracing myself fore one very busy month, reporting season and the APEX Foundation Posties ride, here’s a quick YouTube clip of a past event for any subscribers that missed it last time, note there will be no Weekend Report next week: Click Here.

MM remains comfortable to adopt a more defensive stance than over the 1st 6-months of 2019.

Overnight US stocks were again mixed with the Dow closing marginally lower while the tech based NASDAQ fell almost -0.5% as markets await the Fed, also President Trump started to again rattle the US – China trade War can after being quiet for a while, he lamented the worlds 2nd largest economy for continuing to “rip off” the US. The SPI futures are calling the ASX200 to open down around 30-points.

Below I provide a quick update on reporting today, not a lot out although Genworth (GMA) has just released their 1H results, while we have Janus Henderson (JHG) after market. Click the image to listen.

In today’s report we are going to update our thoughts, ideas and plans for our International Equities and ETF Portfolios.

ASX200 Chart

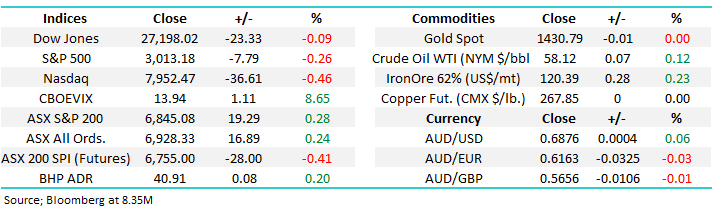

UK based CYBG Plc (CYB) bank has produced another extremely disappointing result overnight leading to the stock tumbling almost 10% in the UK.

The Net Interest Margin (NIM) for CYB was 1.92% in FY17, 1.78% in FY18 and now appears on track to be 1.66% for FY19 and 1.55% for FY20 – an unpleasant trend. These forecasted declines moving forward feel almost conservative with Virgin Money now offering new mortgages at an interest rate ~0.8% below that of CYB, an extremely strange synergy for CYB following its takeover of Virgin Money in mid-2018 i.e. smacking its own margins!

The stock feels totally overvalued at current levels without the attractive yield offered by the local banks to support any share price weakness.

MM will be only interested in CYB below $3, or around 20% lower.

CYBG Plc (CYB) Chart

As Newcrest (NCM) rallied over 3% yesterday making fresh multi-year highs in the process I could almost feel subscribers wondering where we were planning / hoping to lock in some profits – the simple answer is we are not. At this stage MM believes both the stock and sector will go significantly higher, if anything MM is likely to buy the next $2 correction in NCM, or equivalent pullback in another quality Australian gold name.

MM remains extremely bullish the gold / precious metals sector.

Newcrest Mining (NCM) Chart

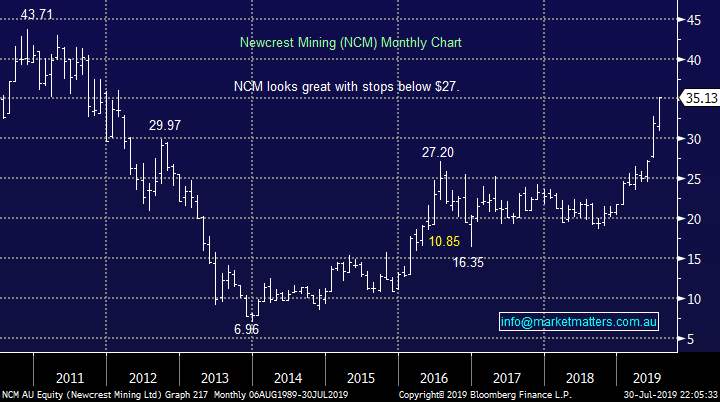

We have written a number of times over recent weeks why equities should be supported into any weakness by their relative value compared to interest rates / bond yields however markets usually are a 2-edged sword and one market indicator is flashing amber to MM:

Short positions in the VIX are near historical highs implying a high degree of risk for a short but very sharp correction moving forward.

When traders are forced to cover short volatility positions they effectively are forced to indirectly sell S&P500 futures which puts amplified pressure on stocks, when the market is heavily positioned one-way these moves can cascade on themselves, similar to Q4 of 2018.

The “Fear Gauge” (VIX) Chart

International Equites Portfolio

The US S&P500 remains basically at its all-time high as we approach tonight’s critical Fed decision on interest rates. Our position has not waivered after being very bullish since Christmas we are nervous around what comes next for US stocks as “full valuations” imply little meaningful upside potential but just as we mentioned previously no sell signals have evolved although a number of warning signals are flashing on amber e.g. when the S&P made its latest all-time high only 8% of stocks made a fresh 52-week high illustrating weak breath and momentum i.e. not bullish broad based buying.

MM believes the risk / reward for US stocks is slowly but surely diminishing.

US S&P500 Index Chart

We like many believe the post GFC bull market for assets including equities is being almost entirely fuelled by the current “free money” environment. This is illustrated perfectly by the disturbing fact that corporate demand (company buybacks) for stock has far exceeded that from all other investors combined in the US according to Goldman Sachs, in other words when companies stop having access to free money to buy their own stock to improve EPS a decent correction feels almost inevitable.

Hence we watch the Junk Bond market extremely closely as it’s a great indication of how easily companies, which don’t use self-generated profits, can raise money to fund buybacks. Currently we are seeing stocks make fresh highs while junk bonds struggle, a warning signal moving forward.

MM remains neutral and cautious both US & international equities at current levels.

US S&P500 Index & Junk Bond ETF Chart

The last week was fairly quiet with our International Portfolio now only holding 5 stocks / positions and 70% in cash after we cut Netflix (NFLX) : https://www.marketmatters.com.au/new-international-portfolio/

We have not hidden our nervous medium-term outlook for global equities hence we are not being as pro-active building this portfolio as we would have been 6-months ago.

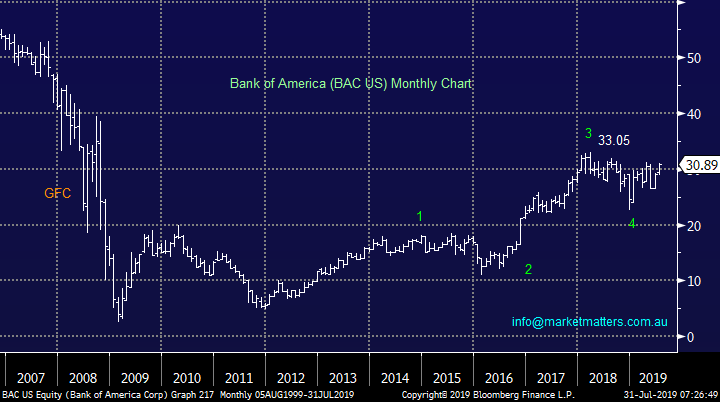

1 Bank of America (BAC) $US30.89.

Bank of America remains a recovery story following tough times during the GFC but its improving steadily even in the current tough low interest rate environment. BAC has been a sector standout and between dividends and stock buybacks the bank plans to return an impressive $37 billion to shareholders over the coming year – a 42% increase. BAC announced that it has been authorized for over $30bn in stock buybacks over the 12-months. This is a whopping 50% increase over last year's $20 billion buyback, a truly huge buyback plan.

MM continues to like the BAC recovery story and its very encouraging to see the stock rally even on days when the index struggles.

MM is bullish BAC initially targeting 15% upside.

Bank of America (BAC US) Chart

MM Global ETF Portfolio

MM is still holding 3 positions in the portfolio, we are long gold, long the $A and short US stocks while still holding 80% in cash: https://www.marketmatters.com.au/new-global-portfolio/

We remain comfortable with these 3 positions and will average the long $A if we see the local currency make fresh multi-year lows around the 67c area. There are 3 additional positions we are considering today, it feels like its time to press the button on at least one of these.

1 Shorting Europe

MM is bearish Europe targeting at least 10% downside for the EuroStoxx 50, the second chart below.

We like the ProShares Ultra Short Developed Europe Index (EPV US) which is listed in the US to play this view - https://www.proshares.com/funds/epv.html

Note: There are no ASX listed ETFs that provide short European exposure.

MM is bullish the EPV US ETF

ProShares Ultra Short (2x) FTSE Developed Europe Index (EPV US) Chart

Euro Stoxx 50 Chart

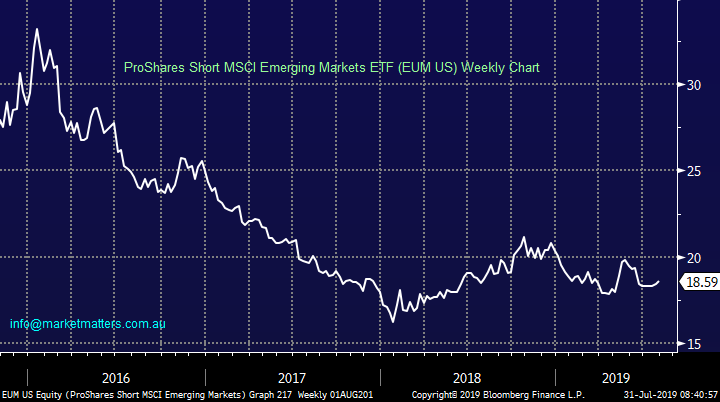

2 Emerging Markets

No change from last week, we are currently short US stocks but only with a deliberate 5% allocation hence allowing us to take a short position in another equities space e.g. the Emerging Markets (EM), or Europe as discussed above.

MM remains bearish the Emerging Markets and are considering taking a position accordingly, our current feeling is the US-China trade war may drag on for much longer than many anticipate which is bad news for the EM.

Our preferred vehicle is the ProShares Emerging Markets Short MSCI ETF (EUM US). Details of this ETF are explained on this link : https://www.proshares.com/funds/eum.html

We are considering buying the EUM US ETF.

ProShares Short MSCI Emerging Markets ETF (EUM US) Chart

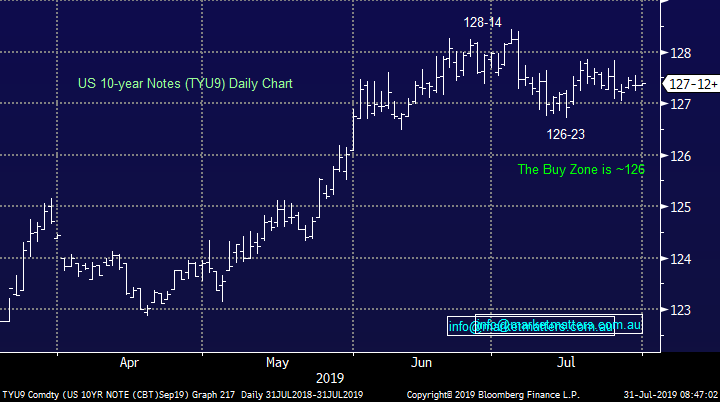

3 US Interest Rates

No major change ahead of the Fed, markets continue to be driven by global bond yields making it logical to be considering these as an investment vehicle for the MM ETF Portfolio, after all we are watching them like a hawk as the Fed steps up to the plate.

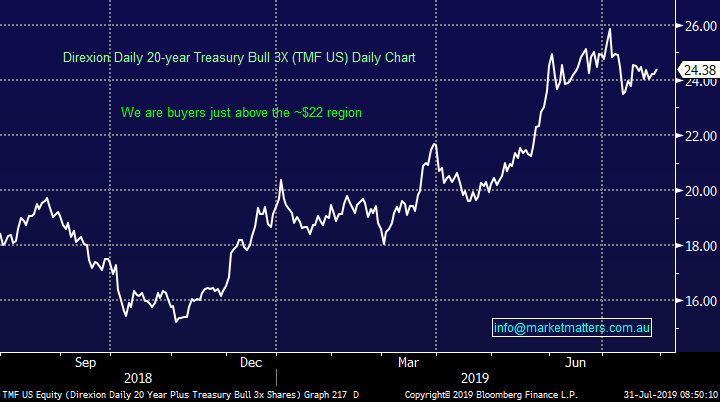

The ETF we initially like to play any views here is the Direxion Daily 20-year Treasury Bill 3x ETF (TMF US) : https://www.direxioninvestments.com/products/direxion-daily-20-year-treasury-bull-3x-etf

The Fed’s announcement on rates this week is likely move the US-10 year notes, potentially creating opportunity for our ETF Portfolio – it’s all about preparation.

MM now likes the underlying US 10-year Notes just above the 126 area & are sellers around the 129 area.

US 10-year Notes (September) Chart

Ideally the TMF will spike down to our buy zone just above the 22 area from where we are targeting a ~15% pop higher.

MM is bullish the TMF around the 22 area.

We are considering leaving buy orders below current levels in the market over the next 24-48 hours.

Direxion Daily 20-year Treasury Bill 3x ETF (TMF US) Chart

Conclusion (s)

MM likes BAC for our International Equities Portfolio.

MM is bullish the ProShares Ultra Short Developed Europe Index (EPV US), the ProShares Emerging Markets Short MSCI ETF (EUM US) and Direxion Daily 20-year Treasury Bill 3x ETF (TMF US) around the 22 area.

*watch for alerts in today’s PM report.

Overnight Market Matters Wrap

· The US closed marginally lower overnight, as President Trump criticised China amid renewed trade negotiations, meanwhile over half of the S&P 500 companies have reported, with 75% surpassing consensus earnings expectations.

· US trade officials arrived in Shanghai with Trump tweeting that “the problem with China, they just don’t come through”. Expectations of a deal are low with the Chinese focussing on direct trade, while US negotiators want to incorporate long term structural issues into the talks.

· All eyes will be on tomorrow’s US Fed rate decision with the major of economists expecting a 0.25% rate cut.

· The September SPI Futures is indicating the ASX 200 to open 17 points lower towards the 6825 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.