Overseas Wednesday – A look at tonight’s US Fed meeting (RIO, GOOGL US, JHG US, GOLD US, SLV US, ETPMAG)

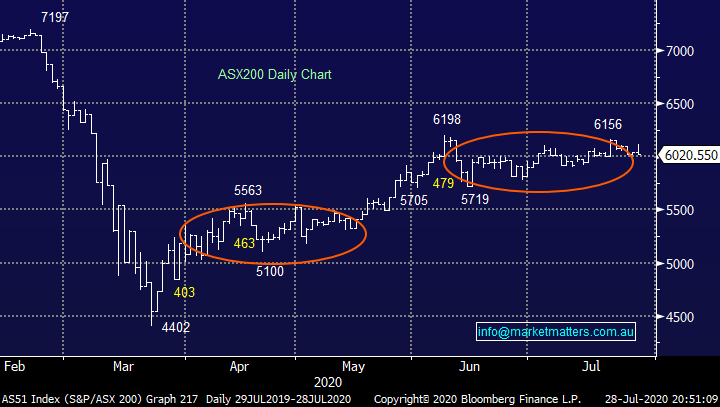

The ASX200 tried and failed yet again to break free of the magnetic 6000 area, it was an interesting Tuesday as we saw an initial surge in asset prices from equities to gold while the $US fell, however just before midday everything went into fairly aggressive reverse with the local market falling -1.5% from its morning high, gold surrendering ~$US50/oz and the greenback regaining early losses, it felt like either the outcome of Wednesday nights ( US Fed meeting) had been leaked or short-term traders were simply squaring off their positions before the announcement – by the time subscribers are reading tomorrows note we will have a pretty good idea.

My “Gut Feel” is either way markets have got a little ahead of themselves and another pullback in stocks probably 5-8% is looming in August this would suggest gold will consolidate its recent impressive gains with a dip under $US1900 feeling likely, this would give risk assets a perfect platform for a traditional rally into Christmas. We are considering increasing cash levels slightly to potentially add some alpha to our portfolios – remember MM has been pretty committed to stocks since the aggressive recovery from March’s low with our Growth Portfolio only holding 4.5% in cash.

Remember one comment from yesterday’s missive – “If / when we get a $US100/oz pullback in gold, which may occur this week, after the FOMC meeting, add to positions”, in just 7-hours last night the precious metal retraced over $US70/oz, we might be buying just when everyone’s saying its all over, time will tell but Fed monthly meetings usually have a significant bearing on financial markets and my feeling is investors are anticipating ongoing stoking of the “free money” fire hence there’s plenty of room for disappointment.

Today’s report is a little shorter than usual because tonight’s FOMC feels like it may move the goalposts for at least a few weeks.

Gold ($US/oz) Chart

Under the hood yesterday we saw over 65% of the index close in the red after such a promising start and could have been much worse if it hadn’t been for the heavyweight resources with BHP, RIO and Fortescue all rallying strongly – they are poised to give back some these gains this morning. However, the market ultimately interprets the FOMC minutes we are likely to remain medium-term bullish equities and especially the resources, but equities are now feeling “toppy / heavy” with another pullback now our preferred scenario in the short term. The ASX has had plenty of opportunity to follow both Europe and the US to fresh post March highs but we failed with Victoria’s COVID-19 crisis probably the largest contributing factor.

The Dow slipped 205-points overnight and the SPI futures are calling the ASX200 to open down around 20-points, smack back onto the 6000 level. MM is fully committed to stocks at this point in time hence as we’ve said previously were effectively in “sell mode” – we are seriously considering actioning this before the Fed meeting which is smelling like a classic “buy the rumour and sell the fact” scenario.

MM remains bullish equities medium-term.

ASX200 Index Chart

Yesterday we saw the heavyweight resources stocks close strongly but well off their intra-day highs with RIO falling over 3% from its morning top. The sector has followed our rhetoric over the last few months as its enjoyed all the ducks aligning on the macro side. We’ve seen a USD sell-off, strong reflation trend with bullish commodities, recovering inflation expectations, strong equities albeit with losing momentum and precious metals enjoying high momentum breakouts I feel this will all correct after the FOMC before resuming the uptrend.

MM is bullish resources, but a pullback feels likely.

RIO Tinto Ltd (RIO) Chart

Reporting

Reporting season is now underway, for a list of company results, CLICK HERE for the Market Matters Reporting Calendar **Please note, data sourced from Bloomberg, not all ASX companies are on this list**.

Today’s results are headlined by 1H20 numbers from Rio Tinto (RIO) with the report out after market today. I will cover when they land:

The market is looking for underlying earnings of $US4.3b and a dividend of $US1.71.

Overseas stocks

Recently we’ve noted the deteriorating momentum and increasing selectivity in the US market, usually a leading indicator for a pullback albeit one to again buy in our opinion. Amongst the technical indicators we monitor divergences are increasing including the NAAIM Position Index which has bounced to 97%, a contrarian high signal which supports our view of a short-term pullback into August – this index represents the average exposure to US Equity markets reported by active investment managers. In other words, like MM the majority of them are long which is a concern. Also, the 10-year low in the CBOE Put/Call ratio implies the US market is no longer hedged to the downside and therefore vulnerable for a negative surprise.

However, the persistent negative position of many investors who don’t believe the market can continue to climb the proverbial wall of worry suggests to MM another pullback will be fairly shallow and ultimately bought.

MM remains bullish US stocks medium-term, but tech in particular does feel “tired”.

US S&P500 Index Chart

MM International Portfolio

The technical picture from Europe is definitely concerning short-term with an ~8% pullback now looking a distinct possibility but the outcome from the Fed meeting could change everything in an instant – investors need to be aware of all possibilities and being married to any one scenario whether on fundamentals or technicals before a huge meeting like the FOMC is fraught with danger.

Currently MM is only holding 6% of our International Portfolio in cash which feels low going into the FOMC hence we have looked at 1 or 2 positions we are considering cutting in tonight’s session before the FOMC announcement. However, as we have said previously, we are bullish medium-term hence any action will be accompanied by a potential buy into a pullback.

MM International Portfolio : https://www.marketmatters.com.au/new-international-portfolio/

The EURO STOXX below looks poised to test the 3100 area, or ~8% lower – subscribers should remember that the ASX is more correlated to European indices as opposed to the US.

EURO STOXX 50 Chart

Alphabet (GOOGL US $US1503

Google was our last purchase into the IT space but its already showing us a nice ~20% profit since mid-April. As subscribers know we feel the technology sector is due for a period of underperformance and probably a decent pullback short-term – hence Google is an ideal candidate to help us de-risk into the FOMC. Obviously by definition we prefer to hold our positions in Apple (AAPL US) and Microsoft (MSFT US) moving into 2021.

MM is considering taking profit on our position in Google.

Alphabet Inc (GOOGL US) Chart

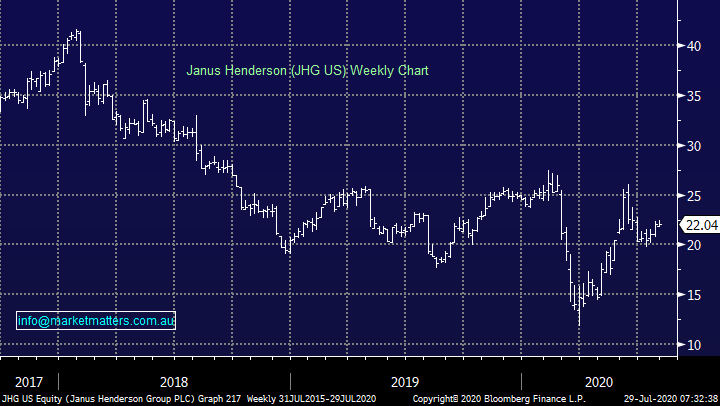

Janus Henderson (JHG US) $US22.04

Investment manager JHG has recovered strongly from its 2020 low but after more than doubling since March its started to struggle and underperform the market switching MM to neutral the stock technically while there are other sectors we prefer fundamentally, hence it’s a prime candidate to help us increase cash levels.

MM is neutral JHG at current levels hence cutting the position makes sense.

Janus Henderson (JHG US) Chart

Barrick Gold (GOLD US) $US29.59

International gold miner Barrick Gold (GOLD US) has a market cap of $US52bn making it more than double the size of our own Newcrest Mining (NCM). Like the sector we like GOLD but after last night’s 1% fall the risk / reward favours buying at lower levels making it the ideal place for funds from previously discussed sales if risk assets do correct after the FOMC.

MM likes Barrick Gold into a pullback.

Barrick Gold (GOLD US) Chart

MM Global Macro ETF Portfolio

No change, MM currently has 24% of our Global Macro Portfolio in cash with the only area that we feel needs a tweak is an increased exposure towards our reflation outlook with silver remaining the ideal candidate.

MM Global Macro Portfolio : https://www.marketmatters.com.au/new-global-portfolio/

We see 2 potential ways to implement this view:

iShares Silver ETF (SLV US) $US19.67

An excellent and simple way to gain exposure to silver as a commodity without risking underlying company performance is the SLV and as a $US10bn ETF it’s certainly got some decent depth, as the chart illustrates below it basically mirrors the silver price. We were too slow last week but we remain very bullish, our ideal entry after the FOMC is under 22, most definitely a possibility in today’s volatile environment.

MM is bullish the SLV ETF.

iShares Silver ETF (SLV US) Chart

Alternatively, the easiest way for local investors to play the theme is through the ASX listed Physical Silver ETF from aptly named ETF Securities. This tracks the Silver price minus the 0.49% pa management fee and is unhedged, so a higher AUD does detract from performance however that’s the case with the ETFs above given they’re listed overseas. The security is underpinned by Silver bars held in a vault and is known as an exchange traded commodity (ETC). It can be bought / sold like a normal share, using the 6-letter code EPTMAG or on some platforms EPTMAG.AXW.

MM is considering buying this for both our domestic Growth and Global ETF portfolios.

Again, we were too pedantic last week but we are keen accumulators below the 32 area.

ETF Securities Silver Bullion ETF (ETPMAG) Chart

Conclusions

MM is looking to tweak both of our International & Global Macro Portfolios as outlined above before / after the important FOMC meeting overnight.

Watch for alerts.

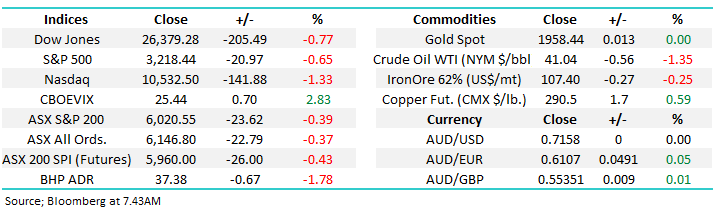

Overnight Market Matters Wrap

· A weak performance in the US overnight, with the 3 key major indices ending the session lower

· Crude oil slid on the back of economic growth concerns, however still hovering above the US$41/bbl. area.

· BHP is expected to underperform the broader market after ending its US session off an equivalent of -1.78% from Australia’s previous close, while RIO will report full year earnings after market today.

· The September SPI Futures is indicating the ASX 200 to open with little change from yesterday’s close, around the 6020 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.