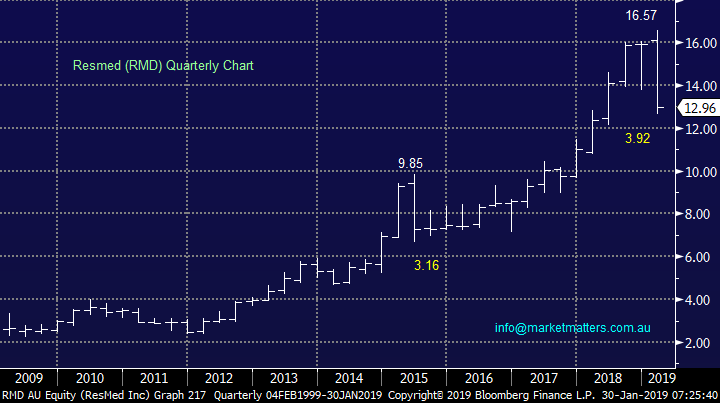

Overseas stocks are matching ours for volatility (RMD, RIO, TLS, NTFX, PYPL, ABBV, BA)

The ASX200 suffered a tough day at the office on Monday as January comes to an end with the market falling 31-points primarily due to weakness in the banking sector – it feels like investors are becoming nervous about the release of the Banking Royal Commission next week e.g. CBA -1.6% and ANZ -2.3%. The volatility on the stock level was again pronounced as reporting season unfolds with almost 10% of the ASX200 moving by ~4%, and much more in a few cases. The first part of today’s report will provide a quick snapshot of our thoughts / plans around the 3 big movers MM holds in our Growth Portfolio.

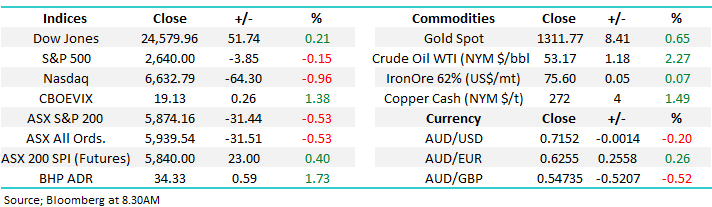

MM remains mildly negative the ASX200 short-term targeting a dip below the psychological 5800 area.

Overseas stocks were mixed with the Dow closing up 52-points while the tech based NASDAQ slipped 1%. The ASX200 is poised to open up around 25-points which would regain most of yesterday’s losses, we assume the futures are expecting some buying in the banks today – in the US BHP closed down 40c in the US while ResMed was marginally higher.

Today we are going to look at 5 of the world’s largest stocks which have moved by over 10% during the last month.

NB Please excuse the number of charts in today’s report but we have covered a lot of ground both locally and overseas.

ASX200 Chart

Three stocks in the MM Growth Portfolio all had large moves yesterday, 2 in our favour (RIO and Telstra) and the one which fell enabling us to buy around our targeted entry – ResMed (RMD). Without tempting fate, we were very happy by all 3 at the close of business yesterday.

1 RIO Tinto (RIO) $83.53

RIO rallied $3.06 / 3.8% to close at its highest level since last June courtesy of strength in the iron space following the tragedy at Vales mine in Brazil.

We have been long RIO since August 2018 targeting the $88-$90 region, although a dividend estimated to be around $2.41 fully franked in early March is likely to have a large impact on the share price in later parts of Q1 2019.

MM is still looking to take profit on RIO between $88 and $90.

RIO Tinto (ASX: RIO) Chart

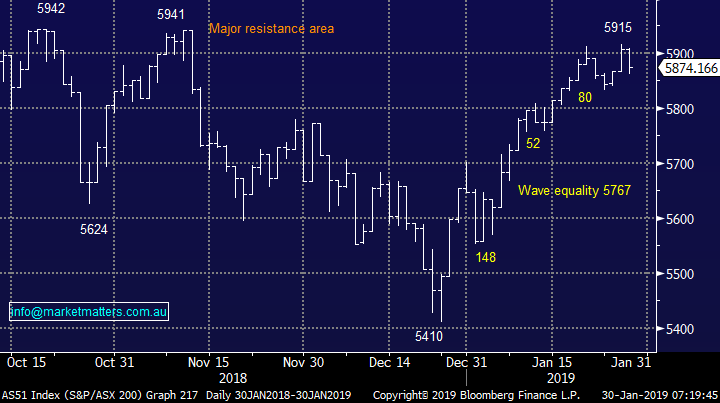

2 Telstra (TLS) $3.19

TLS enjoyed a great day rallying almost 8% on the news that TPG was no longer going to roll out its own mobile network

Similar to RIO we have been long since August, this time we are targeting another ~10% upside although the 7.5c fully franked dividend expected in late February may make our $3.50 target a big ask unless the stock adds to recent strong gains over the next few weeks.

MM is still looking to take profit on TLS around $3.50 but may be tempted to take part profit ahead of mid-Februarys profit numbers.

Telstra (ASX: TLS) Chart

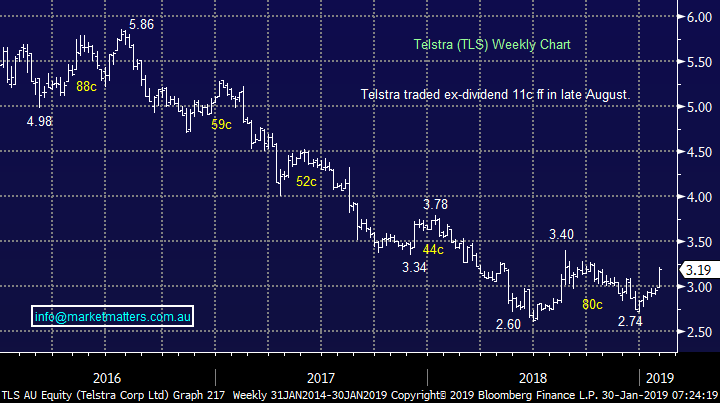

3 ResMed $12.96

RMD has now fallen almost 24% from this month’s all-time high – another great example of the risks of “crowded trades”. RMD’s result was a touch light as discussed in the afternoon report yesterday but when stocks are trading on high valuations the market becomes extremely unforgiving.

MM is comfortable dipping its toe into RMD but similar to its correction in 2015-2016 we will be patient with our recovery expectations.

ResMed (ASX: RMD) Chart

US stocks

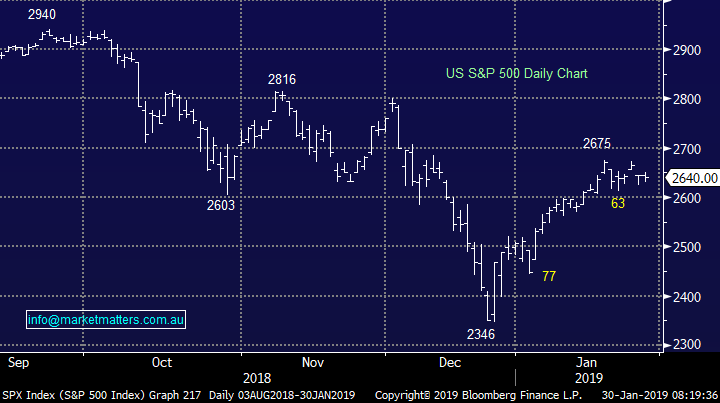

US stocks are trading inline with our expectations at this juncture hence until further notice we won’t be changing our action plan around the underlying indices.

We can see a final spike high towards 2700 but we believe the rally from Decembers 2346 low is very mature and close to a decent correction.

US S&P500 Index Chart

5 global movers over the last month

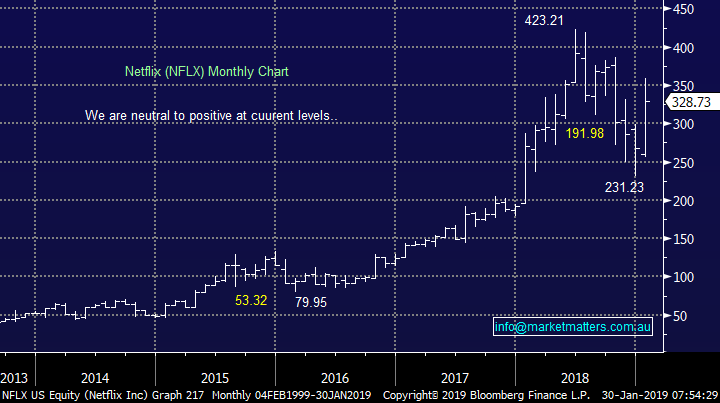

1 Netflix (NFLX) $US328.73

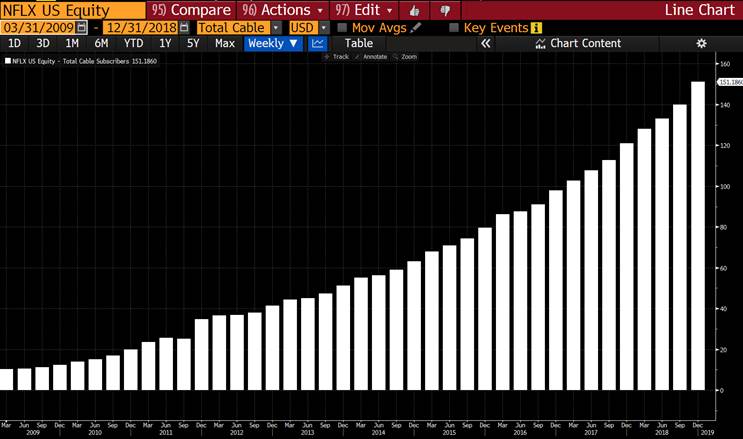

The TV subscription phenomenon NFX has rallied almost 30% over the last month making it a standout performer on the global stage. It’s clearly a sensational success story with the chart below showing growth in subscriber numbers over the past 10 years. In 2009 they had 10.3m subscribers, today they have more than 150m and growing by the day.

With such a substantial user base, the recent decision by the entertainment goliath to turn the dial up on subscription pricing in the US will drive earnings and that in theory should bring down its current P/E of 122x. If they achieve analyst expectations, the stock will be trading on a ‘modest’ 34x times earnings in 2021! Clearly a lot can happen between now and then however the earnings power of a business like this shouldn’t be underestimated.

Technically we are currently neutral to positive Netflix

Netflix (NFLX US)Chart

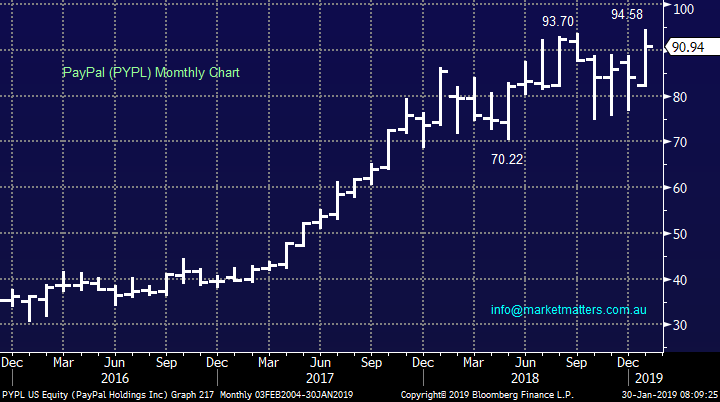

2 PayPal (PYPL) $US90.97

The digital and mobile payments provider is due to report earnings in the next 24 hours so expect some share price movement over the next few days . The company has recovered extremely well from its “split” from eBay announced last year and due for implementation at the end of 2020 when their operating agreement ends.

PYPL is trading up around 10% over the last month making fresh all-time highs – a clear massive market outperformer.

MM is bullish PYPL but a close below $US88 would concern us – not far away.

NB We can see this American goliath potentially becoming a major disruptor to companies in the buy now, pay later space, such as Afterpay (APT) at some point in the future.

PayPal (PYPL US) Chart

3 Boeing Co (BA) $US364.91

The jet manufacturer Boeing is trading up around 15% over the last month performing strongly when so many have been talking about a recession. The business has strong near term earnings momentum and that’s clearly been supportive of the share price while the IATA predicts an increase of 6% for global air passengers in 2019 - obviously good news for ongoing demand for plans

We are bullish Boeing from current levels initially targeting $US400 area.

Boeing Co (BA US) Chart

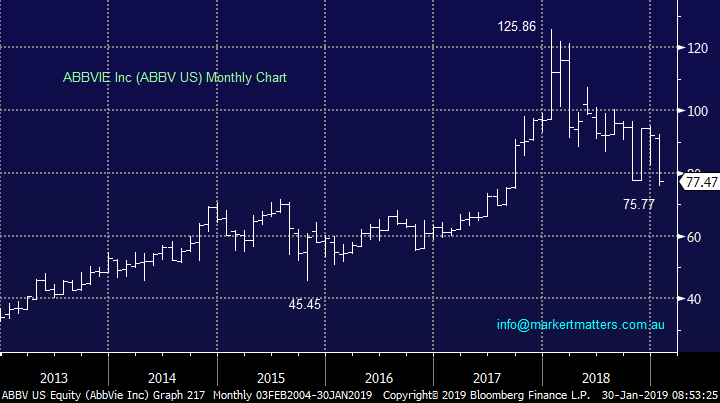

4 AbbVie Inc (ABBV) $US

The research and developer of pharmaceuticals ABBV has fallen around -15% over the last month and technically the picture remains poor.

The issue is around the decline in its Humira sales – a drug that treats autoimmune diseases such as arthritis - and although from a valuation perspective the stock looks cheap as chip (Est. P/E of 8.86x) as we know stocks can be “cheap” for years until the underlying business turns the corner.

MM is bearish ABBV.

AbbVie Inc (ABBV US) Chart

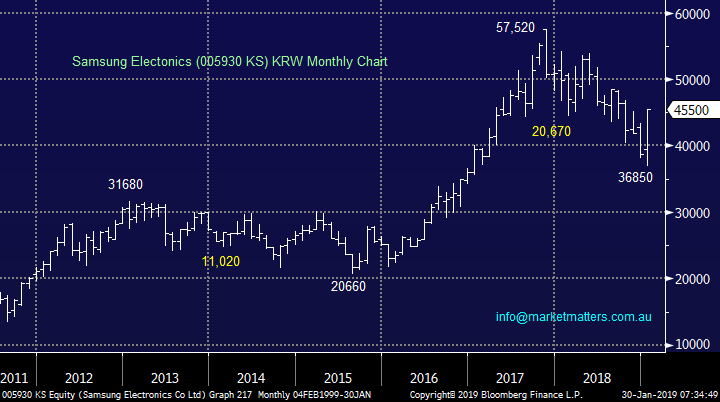

5 Samsung (005930 KS) 45500KRW

The South Korean electronics company has been one of our favourite international stocks over recent months although in hindsight we did press the “accumulate” button a touch early – just like our view on the ASX200 / US indices Decembers pullbacks was more severe than we anticipated. In early January Samsung followed Apple by missing quarterly profit and revenue estimates for Q4 of 2018 with slow sales in China being the issue for both. However the market has clearly seen this as a buying opportunity as opposed to a time to panic.

Yesterday Samsung was up 16.4% for the last month making it a clear standout performer. The rally was undoubtedly helped by the global issues for Huawei who had previously been gaining market share of the global phone market.

We remain long-term bullish Samsung eventually targeting above 60000.

Samsung (005930 KS) Chart

Conclusion

Of the 5 overseas stocks we looked at today our snapshot views are as below:

Bullish – Samsung (005930 KS) and Boeing (BA US).

Neutral – we are neutral positive Netflix (NFLX US) & PayPal (PYPL US).

Bearish – AbbVie (ABBV US).

Overnight Market Matters Wrap

· The US equity markets closed mixed overnight, with the Dow up 0.21% whilst, the tech. heavy Nasdaq 100 underperformed and closed down 0.96% as consumer confidence was reported lower than expected, assisted by the partial shutdown of the US government.

· Over to the European region, the UK Parliament voted in favour of amendment, seeking to remove part of the Brexit deal with the EU delaying, the breakup.

· Following the strength in both Iron Ore and Crude oil overnight, BHP is expected to extend its gains after ending its US session up 1.73% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 28 points higher, testing the 5900 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.