Opportunities in the stocks that haven’t embraced the markets 9% recovery?

The ASX200 struggled yesterday after trading above the psychological 5900 area in the morning, the market still managed to close up 10-points but it’s been a while since we’ve witnessed a close near the intra-day lows. While volumes were understandably light (US closed overnight) it was still interesting to see some of the recent top performers reverse into the red e.g. AMP Ltd (AMP), Whitehaven Coal (WHC), Cochlear (COH) and Afterpay (APT) – all 4 have rallied over 10% during the Last month.

The gold stocks also had a tough day at the office with the average decline well over 2%, obviously one quiet day hardly creates a trend but we continue to favour gold stocks will come off the boil in Q1. MM are looking to gain exposure to the sector in a meaningful way later this financial year, expect updates in the weeks to come as we “stalk” this potential move.

MM remains just in “sell mode” but with cash levels now sitting at a comfortable 20% we will become far more fussy moving forward and are not ruling out buying decent weakness.

Overnight US markets were closed for Martin Luther King Day but comments from the IMF who now anticipate the weakest global growth in the last 3-years is likely to temper the recent aggressive bounce by stocks, supported by China’s GDP data out yesterday at 6.4% which was the weakest in the past 30 years. The bears still have plenty to chew on!

Today we will look at the 5 worst performing stocks on the ASX200 over the last month – both the strong bounce yesterday in Ardent Leisure (ALG) and plunge by Sims Metal (SGM) spiked our interest in the 5 worst performing stocks over the last month.

**BHP Production Numbers; BHP is out this morning with their December Quarter production numbers and on initial read through they look okay, however there are a few negatives in there that could create some weakness in the share price. Divisionally, Oil production was largely while Iron Ore and Copper production was a tad week. Both Coals were good and overall production numbers were okay. They did talk about costs being higher in the first half due to increased outages / maintenance.

While they reaffirmed full year costs guidance the market may be concerned about the rise of costs in the first half. This also dovetailed into discussion of lower productivity which isn’t a positive trend. This is starting to become more of a trend across the mining stocks in recent times, with increasing costs / lower productivity becoming a bit of a theme. While it’s just one update, BHP has had an exceptional run of late driven by a confluence of capital management and decent commodity prices**

ASX200 Index Chart

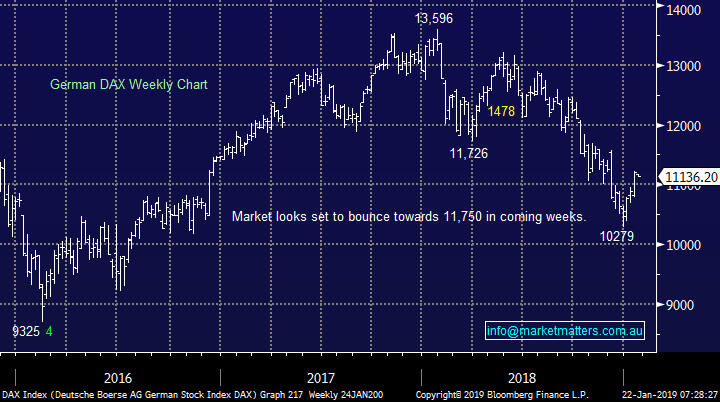

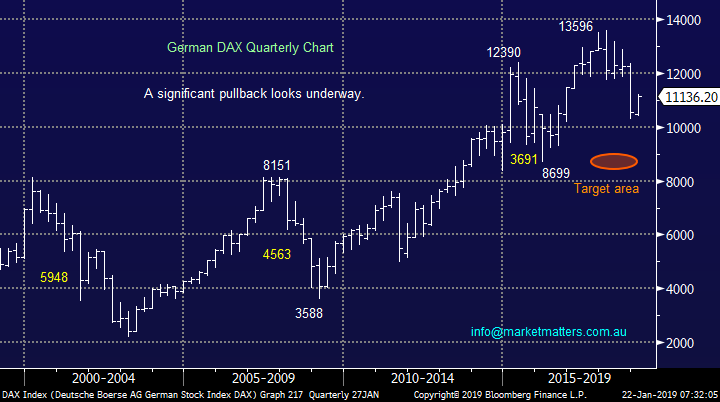

With US stocks closed overnight we’ve taken this opportunity to review European markets. We remain net bearish the German DAX looking for another 10% downside but with the market having already corrected 24% since January 2018 a few decent bounces along the way should be expected i.e. now!

We like the risk / reward selling of the DAX 3-5% higher.

German DAX Index Chart

German DAX Index Chart

The 5 worst performing stocks on the ASX200 over the last month

Today I have singled out the 5 worst performing stocks on the ASX200 over the last month, a period when the ASX200 has rallied strongly led by stocks like Appen (APX) and Afterpay (APT) who both have rallied ~30%.

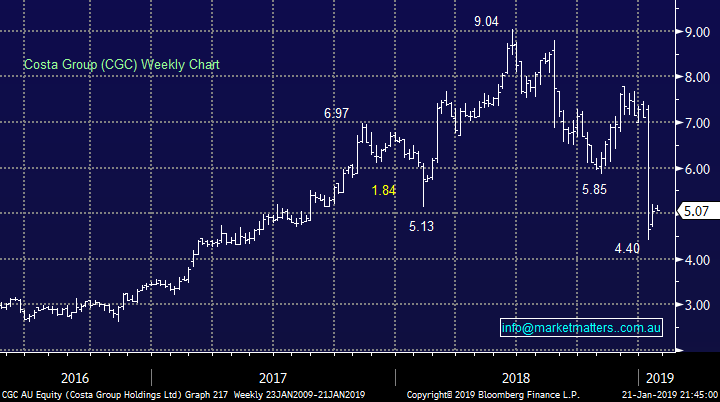

1 Costa Group (CGC) $5.07

CGC has declined -30% over the last month making it one of our favourite stocks for 2019. The company through its subsidiaries grows and markets fruits and vegetables to supermarkets / independent grocers worldwide. Recently they substantially downgraded earnings due to some potentially transient seasonal factors.

Following the stocks significant correction we see value in CGC although it’s not particularly cheap trading on 21.5x estimated 2019 earnings i.e. analysts now bearish factoring in weak earnings in FY19

MM likes CGC below $5 but would want to maintain ammunition to average into another foray towards $4.

Costa Group (ASX: CGC) Chart

2 Sims Metal (SGM) $9.19

Yesterday SGM was hammered 16% following a disappointing earnings update, the stock is now down almost 8% over the last month after an optimistic rally into yesterday’s announcement.

The scrap metal company’s shares are now trading at 1-year lows with the market listening to the CEO’s forecast of challenging conditions ahead.

We feel this is one hot potato that’s not worth catching, its simply not cheap enough to justify the risks attached to a business experiencing earnings contraction.

Sims Metal (ASX: SGM) Chart

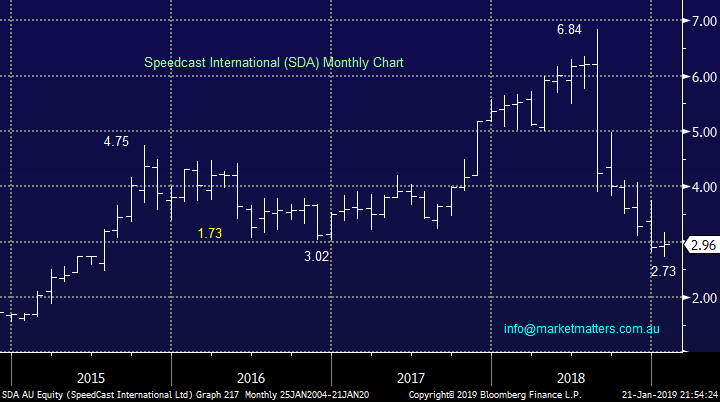

3 Speedcast International (SDA) $2.96

SDA has declined -7.2% over the last month and a painful 52% over the last 6-months, clearly one of the worst performers on the ASX200. The satellite communications company warned investors on Christmas Eve that 2019 was tracking slightly below expectations but the share price was clearly sounding some alarm bells beforehand.

The companies valuation is far more palatable than in 2018 trading on a P/E of 9.8x for 2019 while yielding 2.4% fully franked, however that implies that analysts are still fairly optimistic on the company’s outlook.

While this has been a clear ‘disaster’ in the last 12 months, it seems management is being as transparent as possible announcing the relatively small downgrade in December.

SDA is on our radar as a more speculative trade - a potential turnaround story with good risk / reward from a technical perspective.

Speedcast International (ASX: SDA) Chart

4 Sydney Airports (SYD) $6.43

SYD has declined 7.1% during the last month and just over 10% over the last 6-months suffering most recently from a downgrade by CITI to sell, not a common occurrence for SYD. Last week we also saw a small decline in local traffic at the airport.

Chinese tourism numbers are still strong however recent surveys show Australia has slipped from 2nd to 4th as their preferred travel destination. Indian tourism is gaining momentum however the Chinese are still an incredibly important contributor to the broad spectrum of Australian tourism providers. This is a clear concern for a number of companies who had been enjoying this big tailwind, SYD is certainly one of them.

Without harping on this too much (as it’s been a common theme for us over the past year or so) SYD is also a stock that has become a figurehead for the local yield chasers – while global interest rates have pulled back in recent times, the overall trajectory is up which is a negative for ‘bond like’ equities.

Our view on SYD has not waivered over the last year, we are bearish targeting a break well under $6.

Sydney Airports (ASX: SYD) Chart

5 Ardent Leisure (ALG) $1.45

ALG has declined 6.4% over the last month and 31% over the last 6-months but it was a strong performer yesterday rallying over 3%.

The shares / business have still to recover from the Dreamworld disaster which is no surprise but time can be a good healer. That said, the US business is where future growth resides and numbers there have also been soft.

Unfortunately although the downside feels limited we see no reason to be a buyer at this stage.

Ardent Leisure (ASX: ALG) Chart

Conclusion

Our opinion of the 5 stocks covered today are as follows:

Potential buyers – Speedcast (SDA) and Costa Group (CGC) as more speculative trades.

Neutral – Ardent Leisure (ALG) and Sims Metal (SGM ).

Bearish – Sydney Airports (SYD).

Overnight Market Matters Wrap

Notwithstanding US markets closed overnight for Martin Luther King memorial day, European markets traded slightly lower, following the release of China’s growth numbers which showed GDP as expected for 2018 at 6.6%, the lowest level in nearly 30 years.

The IMF also warned of slowing global growth in its latest update, estimating growth in 2018 at 3.7% and slightly downgrading forecasts to 3.5% and 3.6% for 2019 and 2020, from 3.7% previously, warning the outlook remained clouded with downside risks in particular if the US and China can’t resolve their trade dispute, and a no-deal Brexit. The report also forecast weaker commodity prices ahead, including slashing its oil price forecasts to below US$60/bbl for 2019 and 2020 from US$69/bbl and US$66/bbl previously, and metal prices forecast to decrease 7.4% in 2019 and to remain flat in 2020.

Overnight, the UK PM, Theresa May, also announced her plan B for Brexit to the UK parliament although few details of proposed changes were available: the UK parliament is due to vote again on the new proposal next Tuesday. Commodities were mixed, with copper and aluminium prices about 1% weaker, and oil and gold largely unchanged. The A$ is a little weaker at US71.6c and the futures are pointing to a flat opening on the ASX 200.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.