Oil below zero as volatility & opportunity both return! (WPL, BPT, CSL, APX, REH, COH)

The ASX200 was clobbered 134-points yesterday as the local market put in an awful performance considering the Dow rallied over 700-points on Friday and Asian indices were generally fairly quiet. The market followed MM’s short-term bearish outlook to the tee with 85% of the ASX200 closing in the red headlined by 26 names tumbling by over 5%, for good measure all 11-sectors also declined on a day which had an ominous feel about it. The chart below illustrates perfectly we’ve still hardly dented the aggressive recovery from the March lows.

Our opinion remains that equities have simply run out of enough short-term “good news” to support a market that’s already run 26% in under 4-weeks:

1 – The media and financial markets have become optimistic that we’ve “flattened the curve” with regard to COVID-19, few people are considering the risks of secondary outbreaks as countries slowly return to work.

2 – Markets are currently pricing in a smooth recovery for the global economy fuelled primarily by liquidity as opposed to underlying fundamentals.

3 – We feel the crescendo of capital raisings we’ve witnessed over the last few weeks has satisfied a decent portion of the short-term buying.

Yesterday MM took the flagged short-term profit in Magellan (MFG) increasing our cash position in the Growth Portfolio up to 17% adding some buying flexibility into any future meaningful correction.

MM remains bullish equities medium-term and hence in net “buy mode”.

The ASX’s worst session in April adds weight to our view that the next 5-8% move for stocks is to the downside hence today we’ve again highlighted 5 of our favourite buying opportunities into current weakness as ongoing fascinating news flow greeted investors this morning i.e. crude oil futures traded negative overnight which sounds as crazy with interest rates below zero, history can clearly only help so far with forecasting how markets are set to unfold post the coronavirus.

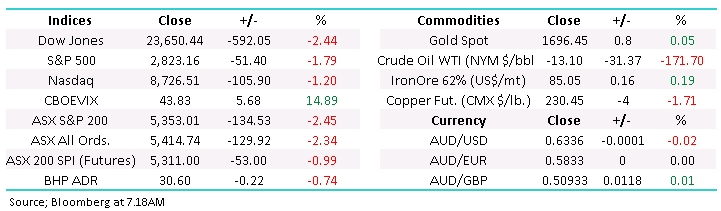

ASX200 Index Chart

Virtually all technical research I’m reading presents a similar picture to the labelled chart below with a break of Februarys 4402 low looming in the coming weeks – I’m very uncomfortable running with the crowd, makes me think of Pamplona when the bulls always seem to catch a few of the herd. My best guess at present is a pullback towards 5000 before the buyers re-emerge – remember US Fund Managers are sitting on very elevated cash levels. However we must remain cognisant of the aggressive downtrend since February and the most common “set up” in history after such rapid declines is at least a retest of the lows i.e. 4402.

MM remains bullish equities but in a selective and cautious manner at current levels.

ASX200 Index Chart

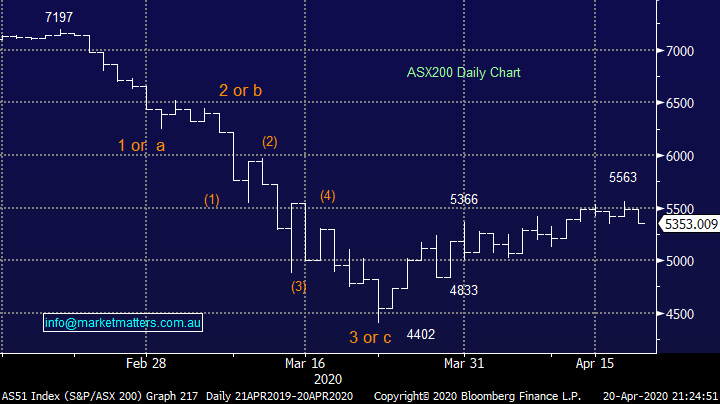

The $A is only sitting ~1c below its recent high which implies FX traders / investors are not losing confidence in risk assets and global growth in the year (s) ahead. The ASX has again followed suit by drifting lower, the correlation of the $A leading Australian equities remains intact and at this stage it suggests to us buyers should remain a little patient & selective short-term although we feel a test of the 62-62.5c looks likely to find some buyers and hence ultimately support for stocks.

MM is bullish both the $A and ASX200 medium-term.

The Australian $A and ASX200 Index Chart

“Dr Copper” is usually a reliable indicator for the global economy, or in today’s environment how / when investors are betting things will return to a degree of pre-COVID-19 normality - as subscribers know we believe things will never be quite the same. Similar to my observation on the ASX earlier all technical research I read on copper is calling for a test of $US/lb200 but a crowded trade (idea) is fraught with danger. We like copper into weakness and would throw the proverbial “kitchen sink” at the view if it were to test 200, a fall that would be implying an extended period of global contraction.

Copper is an industrial metal with growing usage as we evolve down the EV (electric vehicle) path, things are obviously slow today but in a few months’ time copper will be on the menu for a number of industries.

MM is bullish copper into any weakness.

Copper June Futures ($US/lb) Chart

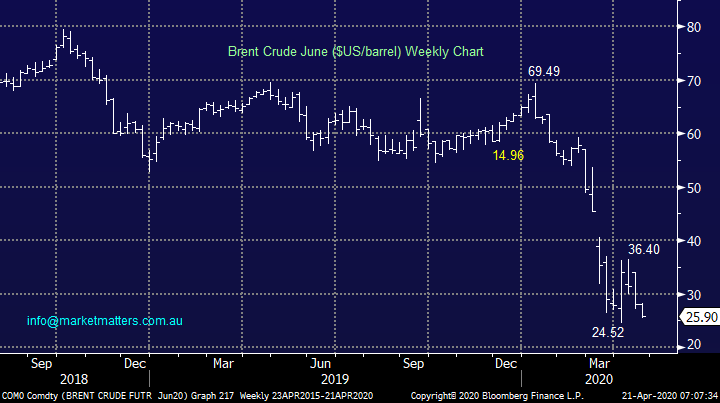

Last night crude oil reminded investors, if they still needed it after March, to “Never say never” (a very James Bond like phrase) as we saw spot crude oil futures trade to NEGATIVE $US40/barrel. The explanation is simple but the likely pain immense:

1 – Last night was the last opportunity to close out long May crude oil futures otherwise holders have to take delivery and there’s basically no storage left as we’ve all stopped driving!

2 – Hence we had mass forced selling sending the spot (May) contract spiralling out of control while more longer dated contracts held up far better i.e. near dated contracts are trading well under longer dated ones, a phenomenon called Contango.

3 – December 2020 crude oil closed at $US32.57/barrel and December 2021 at $US32.75 another example of Contango. NB Interestingly both of these contracts traded and closed well above their March lows.

The distant contracts trading well above their respective March lows tells me players believe the global economy is on a far better footing than a few weeks ago.

Crude Oil May Futures ($US/barrel) Chart

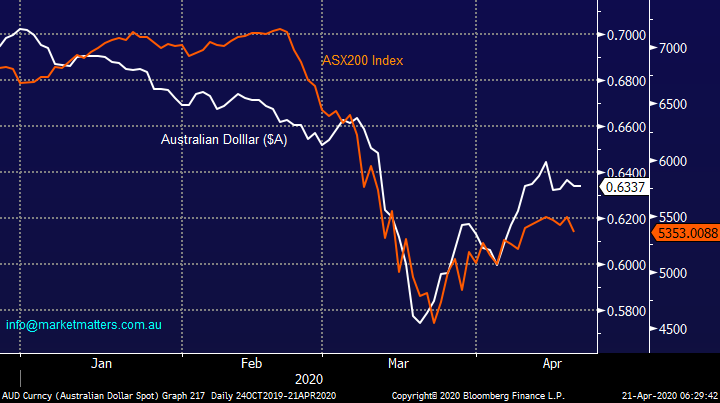

Similar to the longer dated crude oil futures contract Brent Crude closed above its March low but only just for the June contract shown below. After last night’s panic drop in short-term crude prices we expect some stability to arrive sooner rather than later but on balance we still expect new lows for many contracts which is easy to comprehended fundamentally as the worlds still producing too much oil due to the unprecedented massive demand hit courtesy of COVID-19. Ultimately, we will need to see meaningful supply cuts to address this imbalance – which will happen. There is no surer remedy to low prices than low prices themselves.

To put things into numerical perspective global demand has just fallen by 2.2 million barrels per day, the most ever in one week. April is now showing oversupply to the tune of 25 million barrels per day - that’s a lot of oil when storage is full. A supertanker can only hold 2m barrels and it costs a whopping $US350,000 per day, up a massive 100% in just one month – supply and demand effects are in play everywhere. Time to drain the pool perhaps – not sure the kids or the bride would go for it!

MM is looking for a low in Brent Crude.

Brent Crude June Futures ($US/barrel) Chart

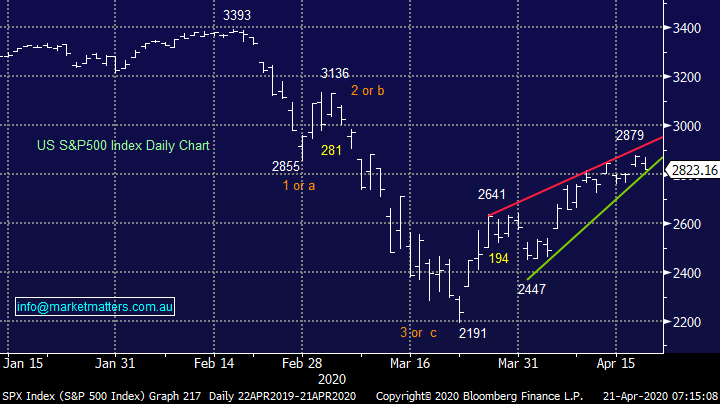

Overnight US stocks gave back most of Fridays’ gains with the S&P500 falling -1.8%, best on ground was again the IT based NASDAQ which only slipped -1.2% lower. The rising wedge we illustrated in the Weekend Report remains in play with a decent spike lower still feeling a strong possibility. Remember the classic investor phrase: “Sell in May and go away” – it’s easy to imagine when we consider Marchs volatility and the major bounce from the lows that any shorter-term bounce investors will be taking some money from table and putting their feet up.

MM remains net buyers of weakness in some US stocks but we’re short-term bearish.

US S&P500 Index Chart

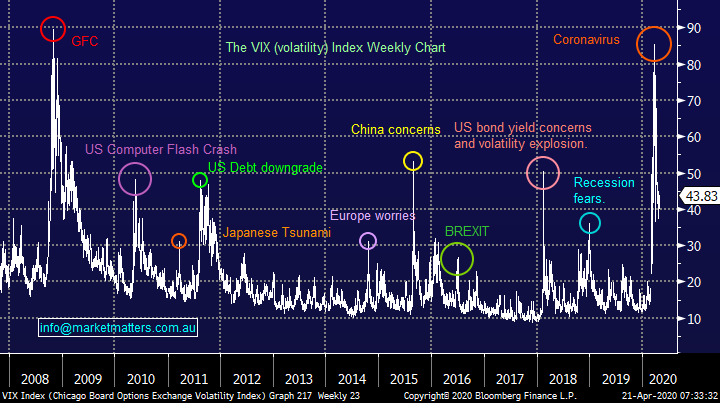

Pandemonium in the oil markets overnight helped the VIX (volatility Index) rally 15% while we can see the market bouncing around between 40 & 50% overall we remain bearish volatility through 2020 anticipating gradual return to normality.

MM remains bearish the VIX.

The “VIX” Volatility Index (Fear Gauge) Chart

At MM we are relatively cashed up and volatility is clearly increasing hence we have simply updated 5 plays we are watching carefully if another correction does unfold in the stocks / sector or overall market – when opportunity comes knocking, we must be prepared.

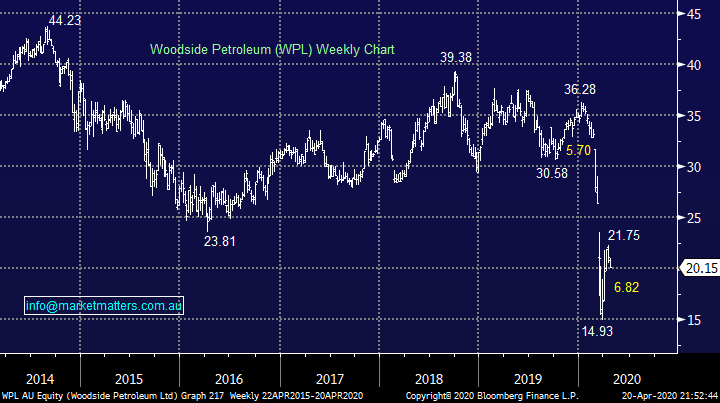

1 Crude Oil related stocks.

Interestingly as crude oils plunge captured all the headlines this morning the S&P500 Energy sector only slipped -3.3%, less than Real Estate which fell -3.7%. Please excuse the repetition here but when markets follow our mapped-out path, we must pay close attention, MM is still considering increasing our position in Beach (BPT) around $1.25 or buying Woodside (WPL) below $20. This stage we are looking for a ‘trigger” like oil stocks ignoring a decline in the underlying commodity – watch this space.

MM is looking for a low in the Energy Sector.

NB We previously switched part of our BPT into Santos (STO) around $1.20 but we like to look forward, not back with respect to investments hence buying back in slightly higher is not a concern to MM.

Woodside Petroleum (WPL) Chart

Beach Petroleum (BPT) Chart

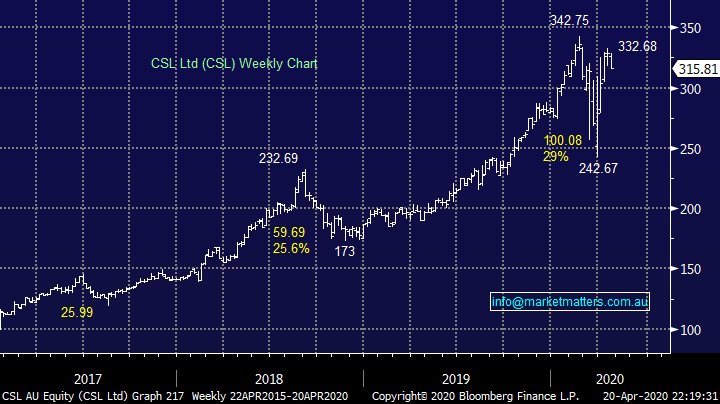

2 CSL Ltd (CSL) $315.81

We feel the markets search for “safe” investments has pushed CSL too hard too fast but while we remain bullish this quality business it’s all about risk / reward. We like CSL back around $300 which is not unrealistic in this volatile market especially as some “weak longs” are probably sitting in CSL, remember how hard it fell in late 2018 for just that reason.

MM likes CSL ~$300.

CSL Ltd (CSL) Chart

3 Appen Ltd (APX) $24.83

Artificial Intelligence (AI) business APX was strong yesterday in a weak market, always an encouraging sign although it should remind investors they may have to “pay up” to buy APX. This is a stock we would like to own and while we aren’t keen to chase while we expect short-term market weakness, we are open-minded.

MM likes APX ideally around $23.

Appen Ltd (APX) Chart

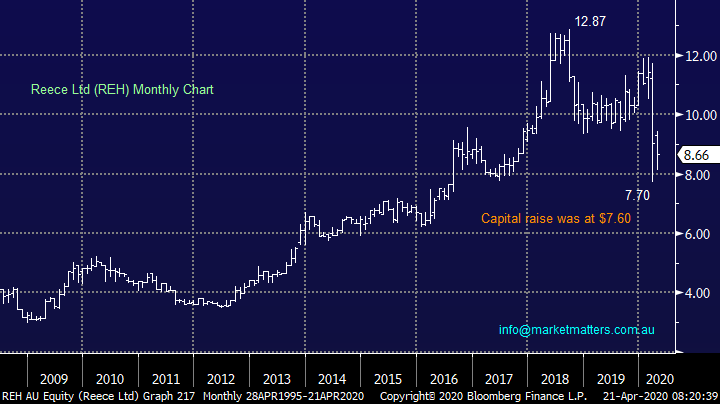

4 Reece Ltd (REH) $8.66

Plumbing business REH raised $600m in April to strengthen their balance sheet and to potentially take advantage of opportunities that may arise, not because they “needed it” – smart in our opinion, management called it a “pre-emptive and decisive step”. Their results delivered at the end of February showed revenue of almost $3bn for the half year, up 9% - a solid performance in a lacklustre market. The business ticks our investment criteria for 2020/21.

MM likes REH at current levels.

Reece Ltd (REH) Chart

5 Cochlear (COH) $185.51

Similar to CSL Cochlear is a quality company that we believe is positioned to eventually make fresh all-time highs. We’ve felt the post capital raising strength has diminished the risk / reward attractiveness of the stock but it’s now fallen over 10% since its initial raise euphoria and I wouldn’t be surprised if some investors area touch complacently long, similar again to CSL.

MM likes COH into weakness.

Cochlear (COH) Chart

Conclusion:

MM likes all 5 stocks / scenarios outlined today.

Overnight Market Matters Wrap

- US equity markets sold off overnight as earnings season gains momentum although very few companies offering any sort of guidance in this

- Focus was seen in the energy sector as front month crude oil futures sold off and for the first time in history traded and ended in negative territory as the trio of low demand, high supply and nowhere to store it saw panic selling (or is that buying!!)

Locally – all eyes will be on airline, Virgin Australia which is expected to be in voluntary administration, being the first major corporate victim to the coronavirus.

- The June SPI Futures is indicating the ASX 200 to open towards the 5335 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.