Now it’s Italy & not Trump for a change! (GXY, CBA)

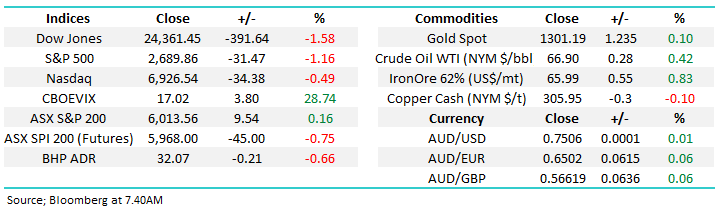

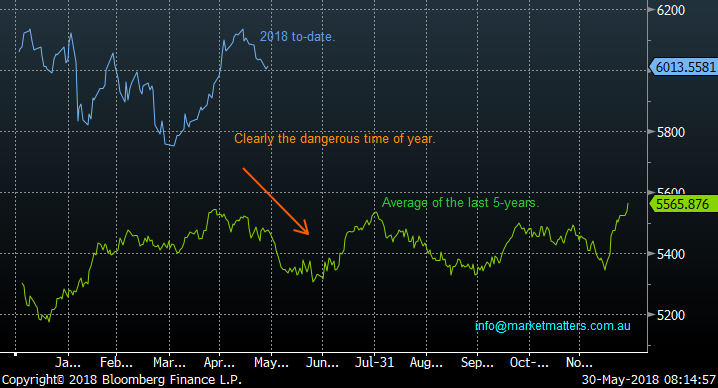

Yesterday the banks finally showed some backbone with the sector closing up +0.66%, also managing to drag the ASX200 into the black while holding above the psychological 6000-area. At MM we remain short-term bearish the oil & resources space hence, assuming we are correct, if the ASX200 is going to hold onto its gains from early April this banking strength must not become a one-day flash in the pan! Only 2 more days of May left and the negative influence of the MSCI rebalancing should be behind us, that just leaves the market to resist Junes usually negative seasonal influence.

Yesterday afternoon I was thinking today’s report, which was going to focus on the continued weakness in Emerging Markets, when Italy’s government meltdown sent risk assets plunging. While US stocks have tumbled by the most in over a month it was the bond market where the fireworks were focused – US 10-year yields fell the most since BREXIT back in 2016 while the Euro fell to its lowest level since mid-2017. However it was the specific antics in Italy that started the contagion effect as they threatened the very existence of the EU – feels like the baby’s thrown the dummy out of the cot as they realise the Football World Cup is about to commence without them!

- Medium-term MM remains bullish targeting 6250 but the risk / reward remains no longer compelling for the buyers. – we remain in net “sell mode” but are not afraid of short-term buying opportunities.

However, we definitely are prepared to consider short-term opportunities if they present themselves – today may be one such occasion.

Today’s report is going to focus on whether we believe this could be the catalyst for the demise of the post GFC bull market for stocks – a comparatively short but pointed report.

ASX200 Chart

As we mentioned in yesterday’s Afternoon Report Galaxy Resources (GXY) soared +14% after an asset sale. The South Korean group will pay US$280 million for the deal, with the proceeds being used to progress the development of Galaxy’s remaining Sal de Vida operation. This sounds like a great deal and the surging share price agreed.

The shorts are having a tough time into EOFY, GXY is the 4th most shorted stock on the ASX100, with almost 15% of the stock short sold, ouch! Orocobre (ORE) currently our preferred lithium play (we are holding it in our Growth Portfolio) is 9th on the list with over 11% of the stock short sold – personally I would not be comfortable shorting a sector which is enjoying so much positive corporate activity.

Galaxy Resources (GXY) Chart

Will Italy herald the end of the 2nd longest bull market in history?

The overnight market turmoil was caused by the failed Italian coalition increasing the prospects of fresh elections in their Autumn, plus a potentially scary EU referendum. Investors are concerned that Italy may ultimately vote to leave the EU, which following the UK would be a major nail in the coffin of the Eurozone – MM said last year we felt the European Union was on borrowed time and this view remains firm. Also, just to add weight to the markets nerves Spain’s government faces a no confidence vote this Friday.

- Billionaire investor George Soros has said the EU “faces an imminent existential threat” and it feels he’s on point for now

From Italians I’ve spoken to it seems they’ve always hated their country joining the EU blaming it for an almost instant plunge in living standards, my uninformed feeling from a desk in Sydney is the Italian people would indeed vote to follow the UK out of the EU.

As touched on earlier Italian bonds endured their worst day in over 25 -years with 2-year bond yields surging over 1.8%, an incredible 200% increase – remember MM’s catchphrase for 2018, remain open-minded, volatility is set to rise. The usual flow on effects are looming like Italy’s credit rating being questioned as it sits on a huge pile of debt, we are now likely to see a deluge of negative “what ifs” around Italy as they work frantically to get their house back in order.

Italian 2-year bond yield Chart

With uncertainty looming on Friday, Spanish 10-year bond yields rose almost +0.1% while the major panic in Europe sent investors back to the relative safety of US bonds sending their 10-year bond yields down over -0.15% - remember bond prices up = bond yields down.

- US bond yields falling smacked their financial stocks over -3%, as they fundamentally enjoy a rising rate environment.

We do not believe it’s time to panic on our view that US rates are going to continue to rise, especially as in our last few reports we stated that US rates had got ahead of themselves and a pullback was likely – Italy just accelerated the move!

Spanish v US 10-year bond yield Chart

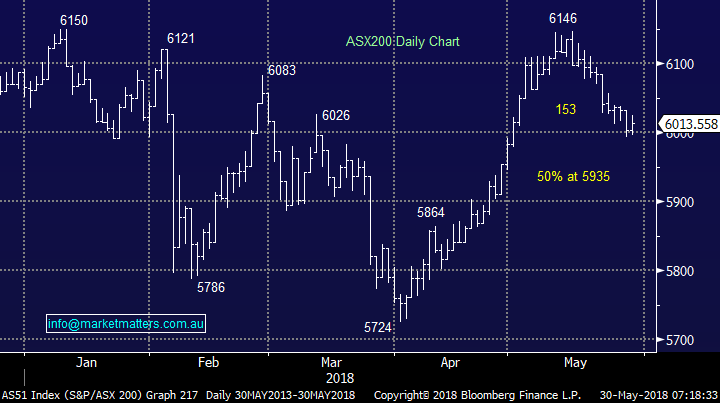

Moving onto currencies, before we importantly conclude with stocks themselves. Not surprisingly the euro plunged overnight while fund managers sought refuge in the relatively safety of the $US.

- The $US Index has now hit our initial target area and we are evaluating taking profit on our ETF position in our Growth Portfolio.

This is a nice 2-edged sword because if the $US continues rallying after we’ve taken profit the likelihood is resource stocks will fall further, hopefully into our buy zones – we have our thinking caps on.

$US Index Chart

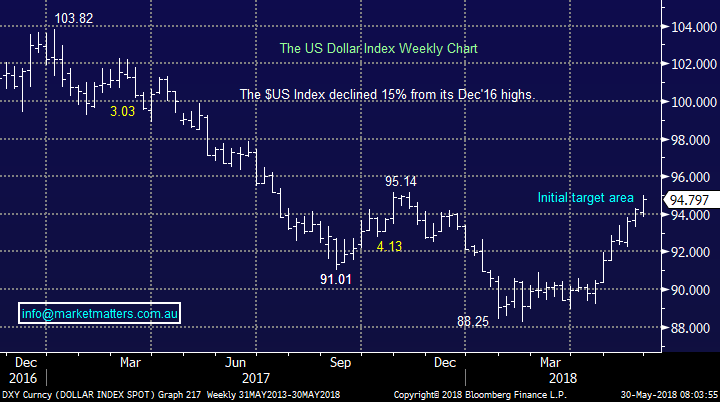

We’ve pointed out the “ugly” seasonal statistics around May / June a number of times over recent weeks but European uncertainties could easily make 2018 another year that fits the uncanny statistics since the GFC:

- The average pullback from top to bottom is just over 10%.

- If we take out the 5 times the markets corrected over 10% the average is still almost 6%.

- So far, we’ve only corrected 2.2% from the May 6146 high, with a 6% pullback targeting ~5775.

ASX200 seasonality Chart

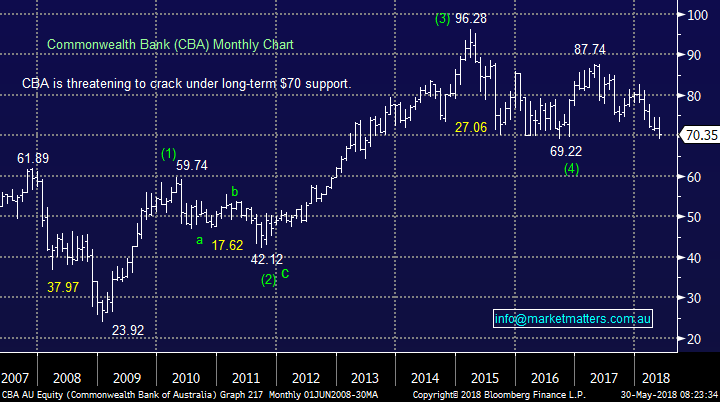

However one thing that is a very different this year, is the performance of our influential banking sector in 2018, primarily due to the Hayne Royal Commission, it’s been awful with Commonwealth Bank (CBA) down -3.7% since January 1st - in our opinion CBA is starting to show some decent value whenever it pokes its head below $70.

- At yesterdays $70.35 close CBA is trading on a forward P/E of 12.86x while yielding 6.23% fully franked.

Hence if the AX200 is going to retest the years lows below 5800 the likelihood is the stocks that have performed strongly will be its undoing – obviously one counter to this argument is EOFY tax loss selling, either way is its going to be a fascinating few weeks.

Commonwealth Bank (CBA) Chart

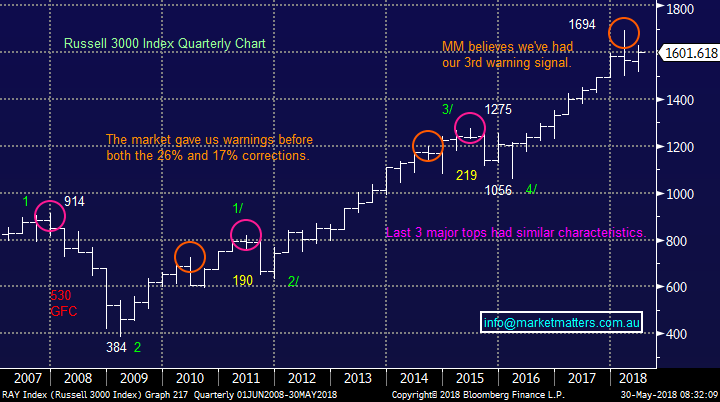

Global indices were weak last night but a drop of -1.1% by the broad US Russell 3000 and -1.5% by the German DAX is nothing like the outright panic that unfolded in bond markets.

- The Russell 3000 remains at the top end of this quarters range and we still believe the market will see fresh all-time highs before a major correction unfolds.

However stocks markets resilience is certainly being tested by current macro events like the oil price slump, Trump-China trade uncertainty, North Korea when were bored and now the potential demise of the EU.

Russell 3000 Chart

European indices received the brunt of the selling last night but even the Italian market only fell -2.6% with the UK FTSE the strongest only falling -1.3% - makes sense as they’ve already had BREXIT.

We remain bullish European stocks but would want to see a recovery over the coming few days, no doubt Angela Merkel is busy but Italians can be unpredictable.

German DAX Chart

Conclusion

While we are looking for a major top in 2018/9 our view is this has not yet occurred hence any aggressive selling between now and the end of June remains a buying opportunity.

Overnight Market Matters Wrap

· European stocks fell sharply led by a 2.7% fall in the Italian bourse as they look likely to head to new elections after the President blocked the formation of a Eurosceptic government. The stability of the Eurozone and the potential for it to collapse is seen as a possibility as Italian 10 year debt yields surged. Greek bond yields also rose and this saw a flight to safety, where the US 10 year notes yields fell to 2.77%.

· All metals on the LME rose apart from copper, while oil and iron ore fell a touch.

· The SPI is down 45 points as the DJIA fell 1.6%, the S&P 500 was -1.2% and the NASDAQ closed 0.5% in the red. The ASX is seen as opening below the key 6000 support level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/05/2018. 7.46AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here