North Korea rattles markets, again! (WES, ALL, BEN, IFL)

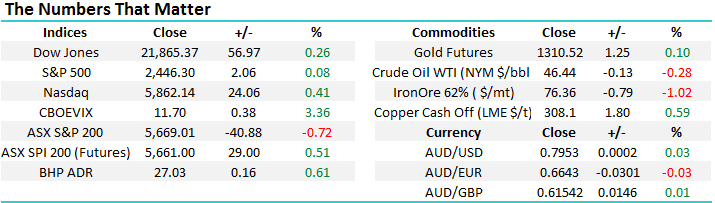

Yesterday, the market was set for a quiet opening until North Korea shocked us all by firing a missile over Japan and into the ocean, rapidly the selling kicked in and the ASX200 reached its lowest level in 11-weeks. Follow through selling over the coming days and the market will break its 14-week holding pattern that we’ve been discussing for a while.

The technical “abc” target for the local market is ~5510 / 2.8% lower, definitely not a big ask considering the current geo-political tensions. Please remember that technical analysis in our opinion is a great investment tool but not a pure science e.g. the ASX200 has just paid out ~25-points in dividends hence should we raise our target closer to 5550? Importantly we believe investors need to be both flexible and prepared during these periods of uncertainty / volatility.

Today we are going to look at 4 potential investment decisions we are considering over the coming days / weeks – 1 sell and 3 buys.

ASX200 Daily Chart

US Stocks

US equities bounced overnight as they discounted the risks of potential escalation from the North Korea situation. As we said in the Weekend Report, US stocks appear to be in the middle of a reasonable correction but there is no sign of a short sharp downside shock – that view felt wrong yesterday but calm again managed to return overnight, for now.

We remain mildly bearish US stocks targeting a correction of ~5% over coming weeks / month as sell signals continue to slowly emerge.

US NASDAQ Weekly Chart

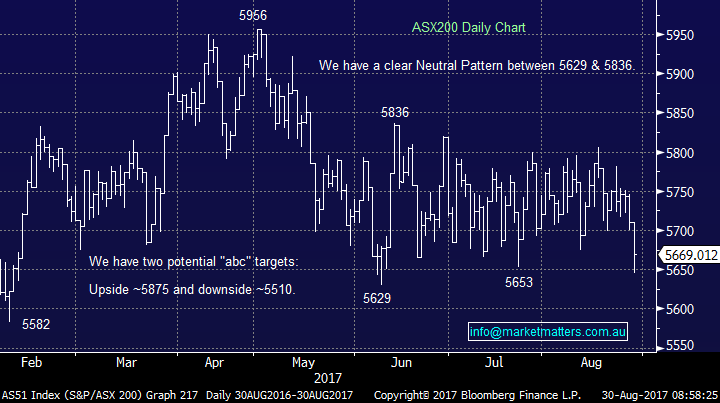

European Indices

European stocks fared far worse than their American equivalent overnight with most indices closing down ~1% after being almost 2% lower during the sessions worst period.

We still see a little further downside for European stocks but they are rapidly approaching the area where we will switch from bearish to neutral / bullish.

German DAX Weekly Chart

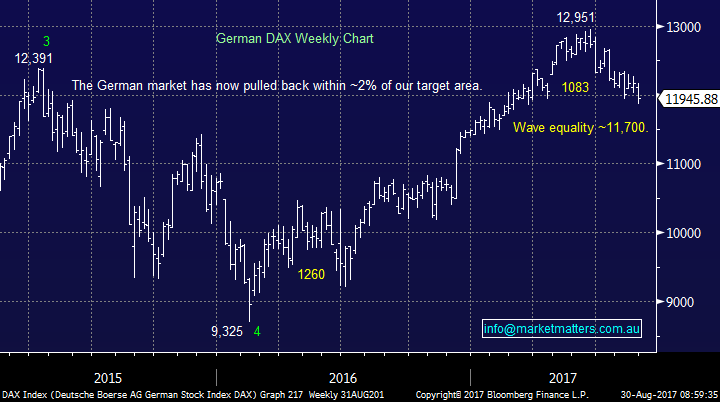

Gold

Gold surged to its highest level in 11-months which is no surprise considering North Korea’s actions however, Gold has been rallying over recent weeks and the move was actually lacklustre considering the news that was hitting our screens. Perhaps traders are sitting tight for this week’s US employment print which could put a bid under the US currency.

We didn’t wait, increasing our holding in Newcrest Mining (NCM) by 2.5% but this action was not due to North Korea. As we outlined in Tuesday’s morning report gold ETF’s have now rallied almost 7% this month and are breaking out from their 8-month holding pattern with excellent risk / reward in place for the bulls.

Market Vectors Gold ETF Monthly Chart

1 Wesfarmers (WES) $41.39

MM is long WES in our Growth Portfolio & Income Portfolio’s and are showing an ok 5% profit including a healthy $1.20 fully franked dividend. As we have mentioned a few times recently we are not “married” to this position and we have been considering taking profit ~$45. However, the stock has rallied a few percent over the last month while the ASX200 has fallen hence we are considering selling early if a better opportunity presents itself i.e. a switch.

Wesfarmers (WES) Weekly Chart

2 Aristocrat (ALL) $20.64

We’ve been keen on ALL for a few weeks and any continuation of the recent weakness towards ~$20 and MM may become buyers.

Aristocrat (ALL) Weekly Chart

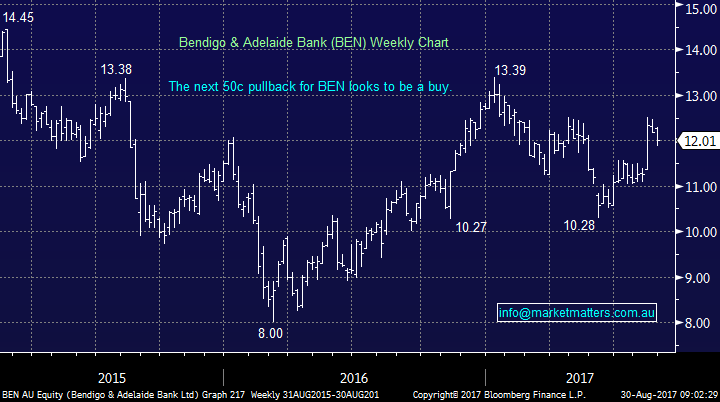

3 Bendigo & Adelaide Ban (BEN) $12.01

BEN popped under $12 yesterday during the North Korea fuelled aggressive selling, we did not add to our large banking position as we still saw a strong possibility of a break under 5600 by the local index, now likely off the table this morning at least. We remain bullish BEN from under $12 however our exposure to banks is high

Bendigo & Adelaide Ban (BEN) Weekly Chart

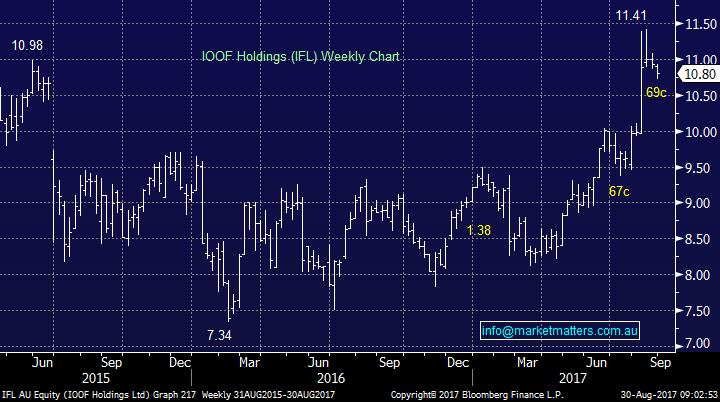

4 IOOF Holdings (IFL) $10.80

Following its excellent result IOOF Holdings has been on our radar over recent weeks, we are bullish IFL around this current $10.80 region targeting at least fresh post GFC highs over $11.50.This is more a shorter term trade

IOOF Holdings (IFL) $10.80

Conclusion (s)

MM is considering switching WES into one IFL, ALL or BEN.

We are conscious of our large banking holding hence the BEN scenario is the most unlikely unless we see strong signals that bond yields are ticking up.

NB We also remain sellers of our BHP and AWC into ongoing strength.

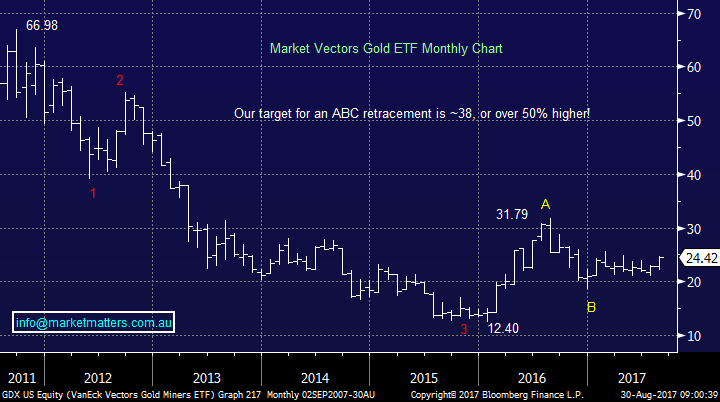

Overnight Market Matters Wrap

· Tensions eased overnight, leading an incline in the US major indices as investors saw little concern from North Korea’s missile launch in Japan’s territory yesterday.

· Corporate earnings today are BLD, CAB, GTY, IGO, RHC, SFR & TOX.

· Despite Iron Ore and Crude Oil off overnight, BHP is expected to outperform the broader market, after rallying an equivalent of 0.61% in the US market from Australia’s previous close

· The September SPI Futures is indicating the ASX 200 to open 19 points higher, testing the 5690 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here