North Korea and the banks dominate market “chat”.

Considering North Korea tested a nuclear bomb on the weekend the performance from the ASX200 yesterday was pretty solid with the index only declining 22-points / 0.4%. The continued strength from our miners, who managed to close marginally in the black, allowed us to outperform most of the Asian region which closed ~0.9% lower. Overnight US stocks again shrugged off Kim Jong-un’s latest provocative actions and managed to close up ~0.2%. Our large cap resource companies look set to rally higher today with BHP closing up over 30c in the US to around $27.80, less than 20c below their highs for 2017.

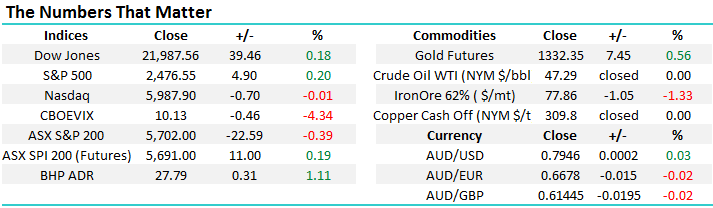

The ASX200 remains tightly bound between 5629 and 5836 for its 16th week, managing to ignore some huge geo-political influences. With reporting season behind us and equity markets ignoring waves of “Trump – Kim” news it’s hard to imagine what’s going to be the catalyst to break the gridlock. Donald Trump threatened fresh sanctions against North Korea following their latest nuclear test, it currently feels like the North Korean dictator is winning this scary game of bluff as Trump’s rhetoric softens while their actions escalate. China needs to be the circuit breaker here, but to date they are MIA.

ASX200 Weekly Chart

With BHP set to test its 2017 high today we remind subscribers that we will be looking to realise some excellent profits on the “Big Australian” over $28.

BHP Billiton (BHP) Weekly Chart

US Stocks

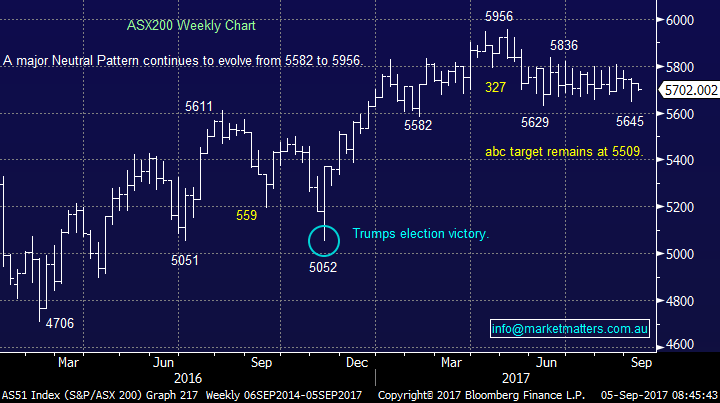

US equities continued with their recent strength overnight gaining ~0.2% with resource stocks dominating the gains. The US market continues to feel like it wants to retest the 2500 area before it contemplates a pull back to our targeted 2350 area.

We remain mildly bearish US stocks targeting a correction of ~5% over the coming weeks / month as sell signals slowly emerge.

US S&P500 Weekly Chart

Apart from the general interest that bitcoin has generated with many subscribers this is potentially another example that investors should keep a very open mind as the global asset bull market since the GFC continues to mature. The volatility in many asset classes is likely to increase following their significant gains assisted by historically low interest rates across the globe i.e. many investors are looking for the next thing to buy as they receive almost no return from the bank, very often not the correct reason to buy.

Bitcoin has corrected almost 10% in the last 2-days although this remains a small dent in its gains since mid-2017. The fall has been triggered by China’s central bank saying all initial coin offerings -- which are sold by companies to raise money -- should be stopped. “The ban on financing of initial coin offerings will take effect immediately as they are illegal and disrupt financial markets” - according to a statement on the People’s Bank of China website. It’s hard not to see bitcoin falling further following this news.

Bitcoin Currency Weekly Chart

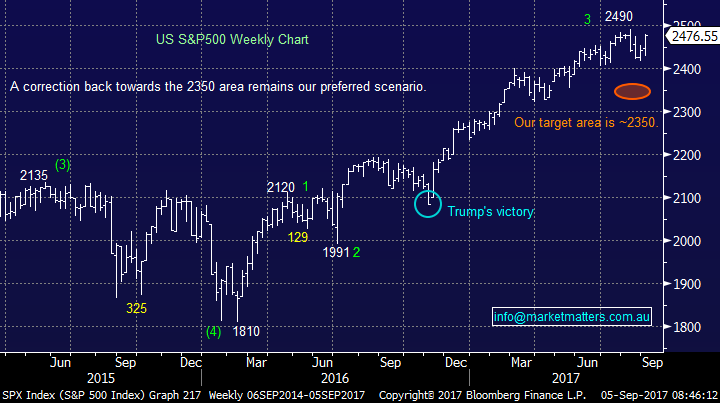

Please excuse us if we sound repetitive but the Bitcoin moves reminded us of our mantra for 2017 - we passionately believe remaining open-minded will enable investors to enjoy far greater returns in the coming years. Just consider the outperforming US stock market since the year 2000.

1. We have seen two corrections of over 50%, it wasn’t just the GFC that was very painful.

2. The market has corrected ~15% and 20% respectively in the last 6-7 years alone.

Hence when we stand back and look at the big picture our anticipated 20-25% correction is far from outlandish in the context of recent history.

US S&P500 Quarterly Chart

Australian Banks

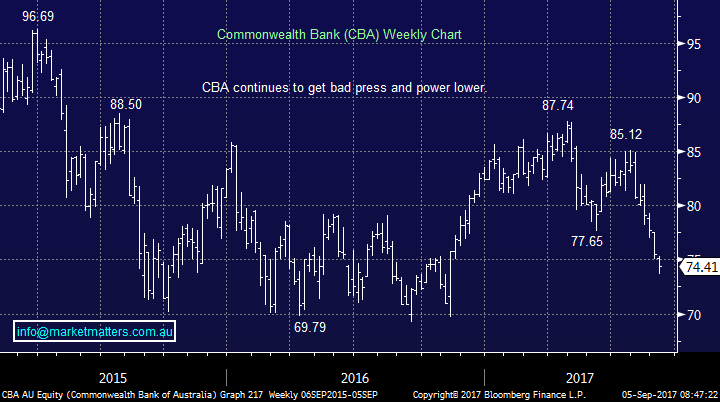

Commonwealth Bank (CBA) has been in the news a lot recently for all the wrong reasons and last night the Australian Financial Review ran a story that ASIC was intensifying its battle with another bank – Westpac - around improper lending. Simply the banks are not popular at the moment although regulators seem to forget how they smack the average Australians super if / when they wage war on our banking sector – seems a little unfair considering how well they faired during the GFC compared to most of their global equivalents.

As we outlined last week the statistical data around our banks is pretty solid this time of year:

1. The banks have rallied well over 4% over the last 7-years from the 3rd week of September until the end of October i.e. investors get long before the big dividends.

2. This implies that if the banks fall for the next 2-3 weeks it’s time to expect a bounce at the very least.

It’s not surprising that CBA has been under the cosh recently as historically it’s been priced as the bank that can do no wrong, especially on a relative basis, but that premium position has certainly been rattled by recent events – CBA has fallen ~5% in the last month, if we take into account its dividend, compared to say NAB +1.1% and ANZ -0.3%. After its correction CBA is now trading on similar footing to the other “big four” from a valuation perspective:

1. CBA est. P/e 12.84x and yields 5.77% fully franked.

2. NAB est. P/e valuation of 12.46x and yields 6.54% fully franked.

There remains a strong possibility that we’ll increase our banking exposure in ~2 weeks in the Growth Portfolio, as we did yesterday for the Income Portfolio (+2.5% into CBA around $74 mirroring our 7.5% in the Growth Portfolio).

Commonwealth Bank Weekly Chart

Conclusion (s)

September is still likely to be a volatile month for the ASX00 with from a seasonal perspective a strong potential buying opportunity in the banks in around 2-weeks’ time, we may consider increasing our exposure to the sector at this time if current weakness continues.

Overnight Market Matters Wrap

· A quiet session is expected today, as the US was closed overnight for Labor Day. The European markets however, were weaker, but not as bad as our market yesterday despite geopolitical tensions still in the upper band of the threshold.

· The RBA meets today with most expecting rates unchanged at 1.5%.

· Nickel and copper rallied on the LME, gold was slightly better as investors sought safe havens. Iron ore and oil were weaker.

· The September SPI Futures is indicating the ASX 200 to open 9 points higher, towards the 5710 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here