New Year’s Eve Update

NB MM daily reports will recommence on the 14th January however we will continue to send live alerts if / when we transact in the market, plus the odd ad hoc report if the market warrants it.

What a month, MM has been looking for a Christmas rally for most of December but to no avail only for the last day 4-trading days to produce an explosive 244-point / 4.5% advance with the futures now suggesting the month will actually close positive – certainly doesn’t feel like it!

Todays quick unscheduled report is to ensure subscribers remain across our views as global stock markets experience some of their greatest volatility in recent times plus importantly a snapshot of what are we looking to do from here and why.

The ASX200 has now corrected 15% from its August high and although we still believe the index will look under 5000 in 2019 / 2020 there are likely to be enormous opportunities available in both directions in the months ahead – we believe it’s going to be a time to consider investing outside of the “comfort zone” which is perfect for the active investor who is prepared to buy weakness and sell strength.

Firstly the ASX200 is tricky in the short-term hence we will use the US indices for signs of a roadmap because it has certainly been the “tail that wags the dog” during the recent decline, importantly, we do anticipate a net upside bias over the next 6-months, albeit a choppy one.

ASX200 Index Chart

The US S&P500 has so far corrected 594-points / 20% from its all-time September high. Our preferred scenario from here is in 2 halves:

1 – The S&P500 makes one final low to complete the recent leg lower, ideally down towards 2300 i.e. over 7% lower.

2 – After this final washout (which is easy to comprehend after Decembers sharp decline) I can see a larger recovery playing out.

Hence the important takeout is MM wants to be flexible and in a position to buy weakness if the above unfolds.

US S&P500 Index Chart

The MM Growth Portfolio

Potential selling

The MM Growth Portfolio’s cash level is now 8% following our sale of Suncorp (ASX: SUN) last week. We have been planning to sell into strength for most of December and although the ASX200 is not ~5900 as we hoped we are still getting a late Christmas rally to end the year – a regular phenomenon because it makes fund managers performance look better, they simply stop selling!

As we consider increasing cash levels further in anticipation of buying at lower levels there are 3 groups of stocks we are considering offloading:

1 – Stocks we no longer wish to hold moving forward e.g. Suncorp (ASX: SUN).

2 – Stocks that have hit our targeted sell areas e.g. Xero (ASX: XRO) around $44.

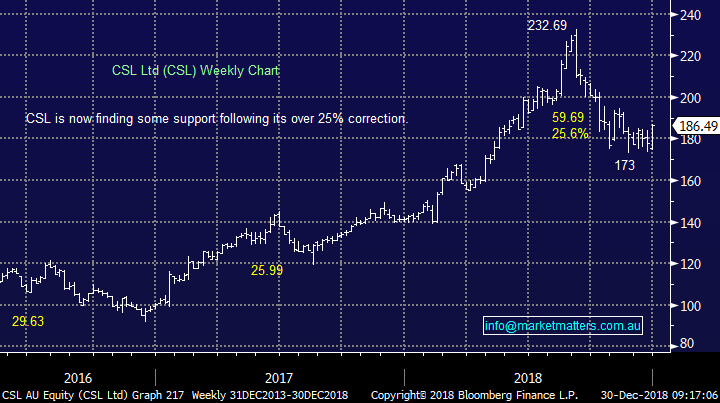

3 – Stocks that may get an exceptionally strong push into the end of 2018 because they are largely held by fund managers e.g. CSL Ltd (ASX: CSL).

By definition the stocks we are looking to buy, ideally into weakness, need to be preferable to the ones above to make the exercise logical i.e. a portfolio “spring clean” to start 2019.

MM’s potential / likely sell list for next week:

1 - Xero (ASX: XRO) close to $44.

2 – CSL Ltd (ASX: CSL) above $190.

3 – iShares Emerging markets ETF (IEM) above $56.

4 – Ramsay Healthcare (ASX: RHC) above $58.

We put a lot of money to work into Octobers panic selling which was essentially around todays level for the ASX200 hence while its felt like a tough month, the damage has been less dramatic than the 15% decline we’ve seen by stocks over the last 3-months.

CSL Ltd (CSL) Chart

Potential buying

We’ve outlined earlier how we see markets evolving into 2019 hence we need a shopping list for one final attempt lower by local stocks as we look to tweak the MM Growth Portfolio over the coming weeks, ideally helped by a final spike lower into January – note it will be very easy for equities to regain their bearish sentiment.

We are looking at 2 groups of stocks to buy:

A – Those that we have been waiting to buy into weakness.

B – Those that have bounced well over the last 5-days implying no selling at these lower levels.

Currently some of our favourite stocks into weakness from Fridays close are:

1 – Cleanaway Waste (ASX: CWY) $1.71.

2 – Macquarie Bank (ASX: MQG) $108.59.

3 – New Hope Corp (ASX: NHC) $3.32.

4 – A2 Milk (ASX: A2M) $10.50.

5 – NIB Holdings (ASX: NHF) $5.20

6 – Altium (ASX: ALU) $20.92 - below $20.

NIB Holdings (ASX: NHF) Chart

Conclusion

MM is looking to rejig our Growth Portfolio as described above i.e. increase cash position into the recent strength to enable us to aggressively buy a test of December lows led by the US markets.

NB Markets are volatile and extremely fluid at the moment so we must / will remain flexible on what comes next.

Happy New Year

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.