New 2017 highs for the ASX200, now what? (FMG, OZL, QBE)

**Today’s reports will be the last for 2017 with the full service returning on the 8th January. Throughout that period, we will send alerts as usual should we make any amendments to our portfolios. 2017 has been a big year for Market Matters, we hope you’ve enjoyed and more importantly benefitted from the service. At times delivering a morning, afternoon and income report +email and text message alerts can be draining, but we thoroughly enjoy the markets and are very passionate about presenting our views to the MM community. Thank you to our subscribers, particularly those that have been with us over the long term, and we welcome all our new subscribers in 2017. We will continue to enhance and improve our offering in 2018 and look forward to writing to you again in early 2018. Merry Christmas from our family to yours and here’s to a prosperous 2018 – James & the Market Matters Team**

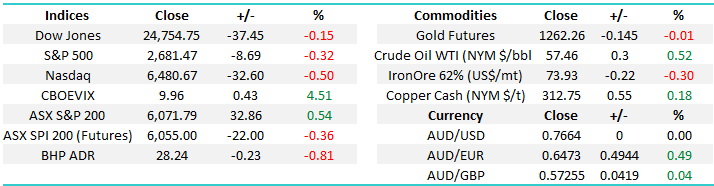

The ASX200 enjoyed another classic December rally yesterday closing at a fresh highs for 2017 of 6072. This morning may prove interesting with a lack of positive leads from Wall Street, will we be able to maintain this Santa Claus rally? Historically buying any early intra-day weakness in the last 2 weeks of December has usually paid dividends for aggressive traders.

So far this December the ASX200 has traded in a 142-point range from 5938 to 6080 and yesterday closed up 102-points / 1.7% for the month, let’s compare this to relevant statistics:

- Since the GFC the average range for December is 335-points with the lowest coming in at 254-points.

- The average monthly range in what’s been a very low volatility 2017 is 201-points with the smallest of 138-points.

- The average performance for the ASX200 in December since the GFC is 2.5% which targets 6120.

Overall there is no change to the view of MM with a 6125-6150 target area to say goodbye to 2017, now only around 1% above yesterdays close which would produce a healthy +8.1% return for the year excluding dividends. However if the market follows its rhythm since the GFC as opposed to just 2017 we could be surprised on the upside.

On the flipside, failure back under 6035 will be a strong technical signal that the best is behind us and we may increase cash levels at lower areas than targeted / hoped.

Today we are going to focus on 3 other stocks in the Growth Portfolio we are considering selling / reducing. We’ll detail our thoughts in terms of the Income Portfolio in that report later today.

ASX200 Daily Chart

Three further stocks we are considering selling

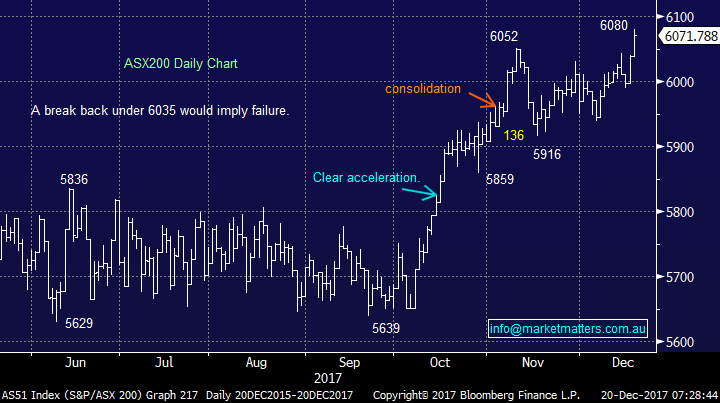

1 Fortescue Metals (FMG) $4.90

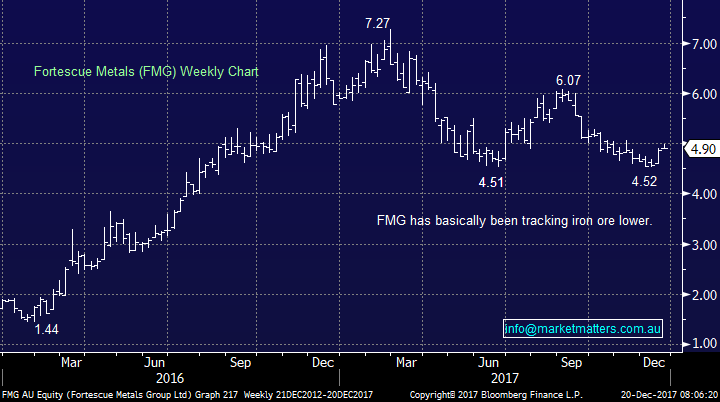

We are long FMG as high risk / short-term investment from $4.60 initiated about 3-weeks ago. FMG has been one of our most profitable vehicles at MM since our inception as it provides excellent risk / reward opportunities for the patient. FMG corrected 38% from its high in February magnifying the 27% fall in iron ore. Unfortunately the 38c / 8.4% bounce in FMG has been pretty muted compared to the 26% rally in iron ore.

We’re staying long for now targeting a clear break back over $5 but we are watching carefully primarily because the stock is underperforming the underlying bulk commodity when it should be outperforming in a rising market given the discount FMG receives often contracts in a bullish mkt (and expands in a bearish mkt as we’ve seen at times this year)

Fortescue Metals (FMG) Weekly Chart

Iron Ore Daily Chart

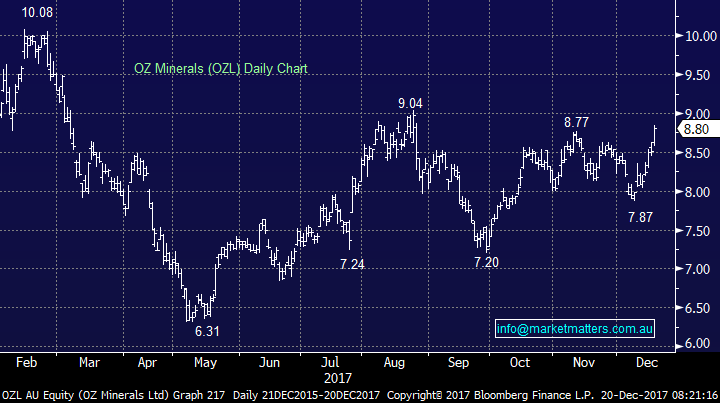

2 OZ Minerals (OZL) $8.80

Major copper miner OZL is following the recovery in copper nicely already showing us a paper profit of over 10% in just 2-weeks.

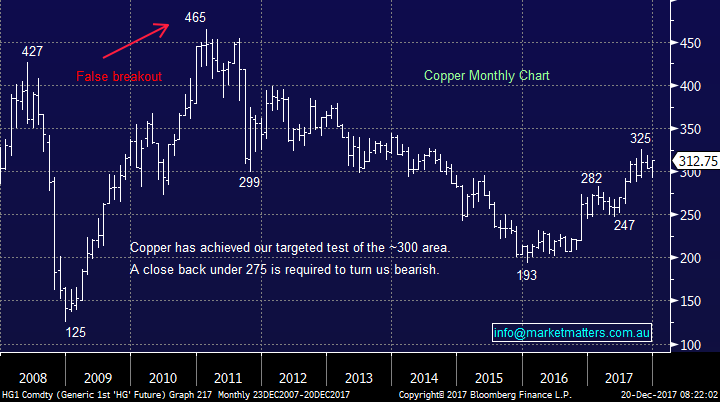

We remain bullish copper short-term targeting fresh 2017 highs over US$325/lb, or ~5% higher.

MM currently intends to take profit on our OZL position basis copper which currently targets well over $9 for OZL.

OZ Minerals (OZL) Daily Chart

Copper Monthly Chart

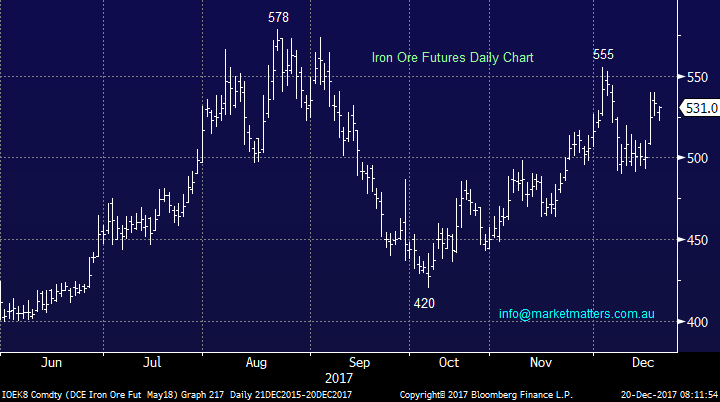

3 QBE Insurance (QBE) $10.66

QBE has been one of our disappointments of 2017 where we correctly picked macro tailwinds of rising US interest rates / a weak $A has been countered by further poor corporate performance.

Back in the middle of the year we were sitting on a paper profit of almost 30%, targeting $15 for the stock, before the company again let investors down plus they had extra claims around a number of global disasters. Australia’s largest global insurer QBE remains down 70% over the last 10-years as the company continues to fail to get its mix right, the obvious question being does it make sense for MM to hold our position?

QBE has been a shocking performer on both an index and sector basis e.g. over the last 5-years QBE is down well over 10% whereas the ASX200 is up well over 30%, IAG up ~50% and SUN up over 40%.

We still believe QBE can rally back towards the $15 mark that has contained the stock for the last 4-years, and we will retain a holding on the expectation that will play out, however we’re assessing whether or not a 7.5% weighting is too high, especially considering our large (12%) weighting in Suncorp (SUN).

QBE Insurance (QBE) Monthly Chart

Global markets

US Stocks

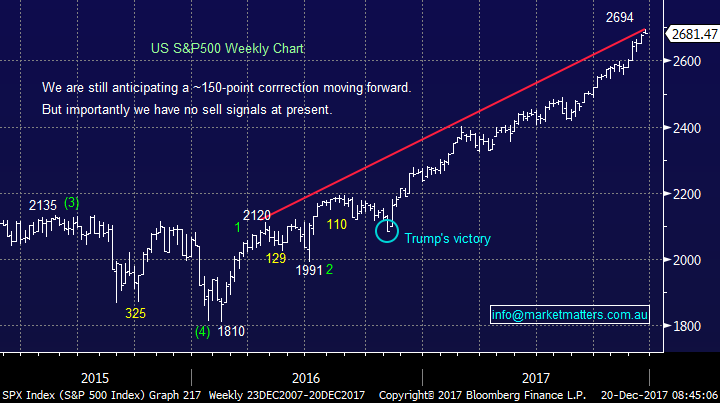

US stocks continue to remain strong on optimism around the Republican tax bill which now heads to the senate. Just Imagine the magnitude of corporate activity – takeovers, buy backs, increasing dividends etc if we get the ~$US3 trillion sitting offshore returning to the US.

No change in our view, we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date.

The feeling is traders are going short and then getting caught as the market fails to correct. The current strong rally since Donald Trump’s election adds to our confidence with buying the first decent ~5% pullback.

US S&P500 Weekly Chart

European Stocks

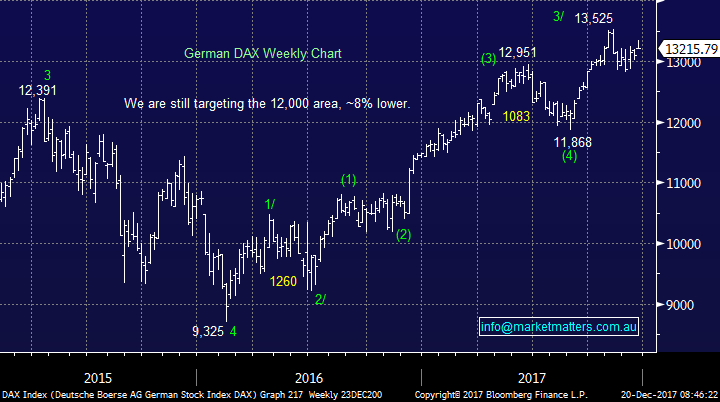

European stocks look to be failing after their recent break out to fresh 2017 highs, we remain neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

We remain short-term bullish the ASX200 and hence are continuing to refine our plans to increase cash levels into any unfolding market strength. FMG, OZL and QBE are all in our cross hairs to sell if they experience strength into the New Year.

Overnight Market Matters Wrap

· US investors took risk off the table overnight as the House passed the tax bill following the indices hitting an all-time high from the previous session.

· Commodities were mixed, with crude oil edging higher, while iron ore had a breather.

· The December SPI Futures is indicating the ASX 200 to open 20 points lower, testing the 6050 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/12/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here