NAB raises mortgage rates, are they now worth chasing for yield? (NAB, CBA, BEN)

The ASX200 bounced nicely yesterday afternoon enabling the market to finally close up 22-points with the Banking Sector supporting a generally firmer bourse. The banks appeared to respond positively to NAB’s mortgage hike although I fear that it may unnerve a number of other sectors in the weeks ahead. Volumes remain noticeably low with school holidays not finishing up until mid-next week – the roads into Sydney this morning were again extremely quiet implying a quiet day ahead of the Australia Day long weekend.

In an overall lacklustre market the news theme that has caught my eye over recent weeks has been the constant aggressive banging of the “sell the $A” drum and stocks appear to be responding with gusto, over the last month Cochlear (COH) +17.8%, Ansell (ANN) +10.8%, CSL +11.9% and Aristocrat (ALL) +15.6% - go the $US earners! As subscribers know we are not convinced by this crowded belief of $A weakness medium-term but we are happy to ride the current tide of optimism with our COH and ALL holdings, for now at least.

Interestingly yesterday’s solid Australian jobs numbers, with unemployment falling to 5%, was not believed by the $A which initially spiked above 71.6c on the news before quickly reversing gains to trade down below 71c with it sitting around 70.9c this morning. Generally we believe that a market that reacts poorly to bad news is a weak market, another test of the large psychological 70c area would not surprise us in Q1 however we continue to believe the bulk of the downside move has played out during 2018.

The markets strong bounce from its panic December sell-off appears to be at least stalling and from an index perspective we would be sellers of break / test of the 5911 monthly high while buyers down towards 5750 i.e. we are looking for more choppy action in the weeks ahead.

MM remains mildly in “sell mode” with our positions in Challenger (ASX: CGF) and the Emerging Markets ETF (ASX: IEM) most likely on our proverbial chopping block.

Overnight US markets were mixed but quiet with the Dow closing marginally lower while the NASDAQ rallied 0.7%. The ASX200 is set to open up 20-points as we continue our trend of following European indices e.g. German DAX +0.5%.

Today we are going to look at many Australians largest exposure to local equities, the banks who have endured a very tough few years e.g. CBA is trading ~25% below its 2015 high with the sector as unpopular today as it was loved backed then.

ASX200 Index Chart

The gold stocks have drifted lower over the last 5-days as we’ve been expecting with Northern Star Resources (ASX: NST) the worst of the bunch plunging over 12% in just the last 5-days, while heavyweight Newcrest Mining (NCM) is down close to 4%.

We remain keen buyers of gold stocks into weakness over the next few months.

Northern Star Resources (ASX: NST) Chart

The US markets have now recovered around half of their losses from the second half of 2018.

We continue to expect an ongoing choppy rally of over 5% over the coming months.

US NASDAQ Chart

How MM is considering “playing” the banks in Q1 of 2019

Following the news that NAB had raised their mortgage rates a subtle bid tone came into the banking sector which helped send the overall ASX200 up into its highs on the close, this leads us to ask 2 questions:

1 – Should we increase our already overweight exposure to the largely unpopular sector as CBA and Bendigo look to trade ex-dividend next month? – MM has 30% of its Growth Portfolio in the “Big Four” banks compared to the index weighting of 21.4%.

2 - Alternatively, would a push higher provide an ideal opportunity to lighten our position ahead of further housing uncertainty and the results of the Banking Royal Commission report which is handed to the Federal government of February 1st i.e. only a week away.

Our view is it’s all down to housing with the damning Royal Banking Commission about to travel into its last chapters, hence the big question being where will the current correction to property prices bottom out, especially in the influential cities of Sydney and Melbourne. While investors perceive housing prices will fall, and potentially hard, banks are unlikely to rally in a meaningful manner.

High prices and high debt levels clearly left the Australian housing market vulnerable to falls and if mortgage rates continue to climb these issues will only become exacerbated. We all know the headwinds the market is now facing as banks are forced to restrict lending by regulators, a drop off in Chinese buying, interest only loans being pushed into interest & principle and a looming federal election where Labour are likely to put further pressure on an already weak market - the problem as is often the case, is the uncertainty as everyone guesses where the bottom will be.

Our best “guess” is the housing correction is probably about half way through but this feels baked into many share prices from banks to retail,arguably the surprises could now soon be on the upside. The main risk to banks is default’s and subsequent foreclosure / forced selling but while interest rates are low and as we saw yesterday employment strong we shouldn’t see a sharp increase in this horrible phenomenon – remember the markets now sniffing interest rate cuts into 2020 to support property. We feel the main issue for banks will be slower bank lending and that will restrain bank profits, however this theme in our view, is priced in.

Technically the banking sector has enjoyed an 8% recovery from its panic low in December, pretty much in line with the ASX200. Overall the downside feels limited but like with the index we feel it’s going to need some good news to push significantly higher through current resistance.

Lets move onto 3 individual banks before coming to our conclusion (s) – no need to consider UK based CYB in this report.

Australian Banking sector Chart

1 Commonwealth Bank (CBA) $72.51

CBA is set to trade ex-dividend in around 3-weeks, the banks currently paying just under 6% fully franked.

Investors who buy CBA today will receive 3 dividends over the next 13-months producing an excellent yield but obviously capital gains / losses are also an important part of the scorecard with investing.

MM remains comfortable with our CBA holding but we may be tempted to take part profits 3-4% higher.

Commonwealth Bank (ASX: CBA) Chart

2 National Australia Bank (NAB) $24.58

NAB traded ex-dividend in November paying 99c fully franked, even following its recent $2 bounce the bank is yielding over 8% fully franked, the market clearly feels there are risks the dividend may be cut moving forward – perhaps the rate rise is an effort to avoid this stigma.

MM remains comfortable with our NAB holding but we may again be tempted to take part profits 3-4% higher.

National Australia Bank (ASX: NAB) Chart

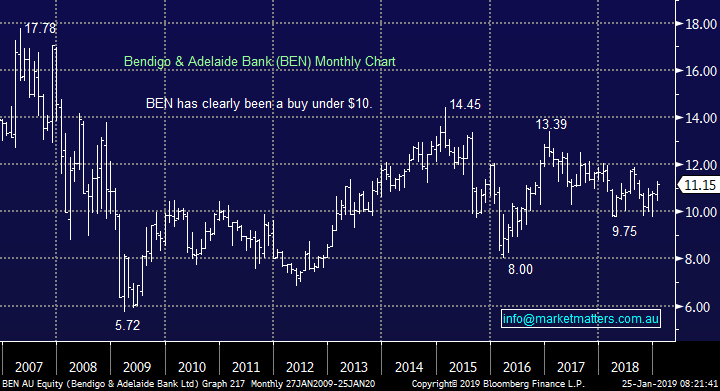

3 Bendigo Bank (BEN) $11.15

BEN is set to trade ex-dividend in late February, the regional bank is currently estimated to be yielding 6.28% fully franked.

Similar to CBA, investors who buy BEN today will receive 3 dividends over the next 13-months producing an excellent yield with capital gains / losses remaining an important part of the scorecard with investing.

MM thinks BEN looks solid at present but are unlikely to increase our sector exposure further at this stage.

Bendigo Bank (ASX: BEN) Chart

Conclusion

We have 2 underlying thoughts on the banks moving into 2019 /2020:

1 – We believe the banks will prove good investments over the coming years hence we are likely to be regularly overweight the sector, like today.

2 – We still believe the market will have a tough and volatile 2019, probably more so in the second half. Hence we will consider trimming our positions into strength i.e. CBA over $75, NAB around $25.50 and Westpac above $26.50.

Overnight Market Matters Wrap

· The US equity majors closed mixed overnight, with the China-US trade wars being the pinnacle of unknown to investors’ eyes at present.

· Safe haven buying has been the highlight at present, with US treasuries leading the charge as U.S. jobless claims fell 13,000 to 199,000 last week, the lowest level since 1969. January flash manufacturing PMI came in above expectations, rising to 54.9 from 53.8.

· On the positive side the quarterly reporting season continues to deliver strong numbers, with the likes of Texas Instruments and American Airlines beating expectations. Despite the strong results from USA airlines companies, their CEOs are warning that the partial government shutdown will have a significant impact the longer it goes on.

· BHP is expected to outperform the broader market, following the strength in crude oil and ending its US session up an equivalent of 0.75% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 22 points higher this morning, towards the 5890 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.