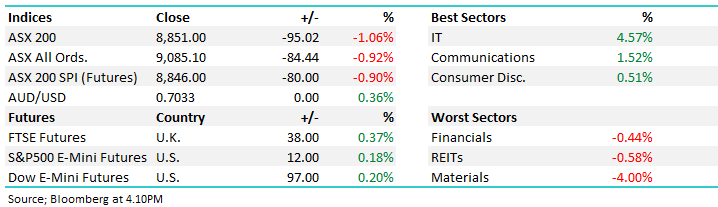

Morning Report Thursday 3 April 2014

Has BHP's mooted $20 billion asset spin-off changed my negative view?

A recent article published in the Australian Financial Review (AFR), suggests that BHP Billiton is considering a US$20 billion spin-off of non-core assets into a separate listed entity. Assets under consideration for the demerger are said to include BHP's aluminium, nickel, manganese and bauxite businesses, the Cannington silver/lead mine (QLD) and energy coal assets in South Africa. When stocks enter a "situation scenario" I generally step aside and let it all unfold unless I have a very clear view as to whether its value positive, or negative. This simple strategy is often implemented by a number of traders and in the case of BHP, I believe has led to a lot of short covering (people buying back positions that were looking for BHP to fall). As I remain negative copper prices, and BHP as a share price prior, to this announcement I would look to sell into current share price strength.

Show more...