Morning Report Monday 11 August 2014

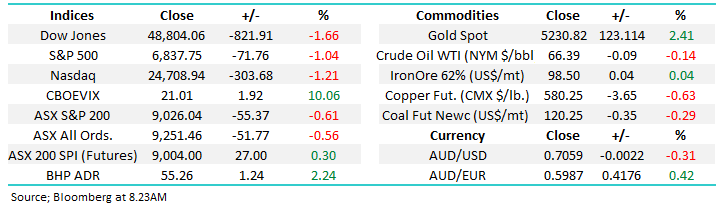

Last week, we witnessed volatility jump and the ASX200 retrace 128 points as geopolitical risks dominated the newswires. Although I still believe the ASX200 will retrace back towards the 5,350 level, it is currently a “stock pickers” market and as I had discussed recently, buying the current pullback should typically be very profitable on a cyclical basis. However, investors must recognise the changing circumstances and simply chasing traditional yield sources will likely lead to underperformance.

Bank of Queensland (BOQ) [last close at $11.85] is currently yielding over 5.2% fully franked, and is only on an ~18.2x PE compared to Westpac on ~14.3x. The ideal technical buy zone is around $11.30, but I would start accumulating around these levels.

Show more...