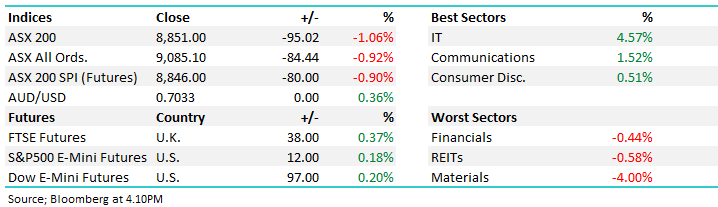

Morning Report Friday 4 April 2014

Everyone’s talking interest Rates, lets stand back and consider implications

Most questions I am receiving at present are around my call to action that selling banks in the next 1-2 months will prove be a wise move. Without starting a boring economics lesson, I am going to outline below, in very simple terms, why I believe "the yield play" is about to enter a period of significant underperformance. I believe the winter is fast approaching, likely after May dividends for the banks, and see a case for a 15-20% correction in the banks. However, historically the US markets peak in mid-April so I am on constant watch.

The US Fed has told us that 4.0% is their appropriate long term Fed Funds Rate - this will overshoot with inflation.

Show more...