Morning Report Friday 17 April 2015

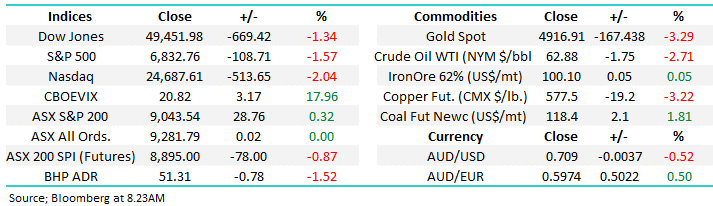

Most people acknowledge that it’s the historically low interest rates, essentially almost free money which has powered the bull market in equities, especially since late 2011. The S&P500 has rallied over 95% since late 2011 as the US Fed cranked up Quantitative easing, the German DAX has rallied over 25% in the last four months as the European Central Bank (ECB) powers up its own enormous Quantitive Easing (QE) / stimulus – see charts 2&3.

• This morning the average yield on German sovereign debt turned negative for the first time in history.

This plummet in German yield has clearly aided a number of international bond markets, starting with the US where the generic 10 year yield remains well under 2% even, as they approach a period of increasing interest rates – see chart 4. Interestingly the good news on rates in Germany did not help equities last night where the DAX fell 1.90% implying that yet more good news is required to continue the recent strong advance.

Show more...