More reporting season curve balls to evaluate – Part 3! (CWN, SGR, WSA, CTD, SVW, A2M, PGH, MMS, WTC)

The ASX200 struggled for the first time in a while actually falling almost 50-points from the mornings high before bouncing to close mid-range on the day, but still down just over 10-points. The banks gave back some recent gains with regional Bank of Queensland (BOQ) actually making 5-year lows – we’ve looked at this stock for a few days but it hasn’t felt “quite right”. The large cap resources continued their fine form with BHP and RIO both up over +2.5% but there were simply too many stocks closing down on the day for the index to gain traction I.e. over 50% more companies closed in the red.

On the day we saw a few market sectors thrown in the sin bin with noticeable losses in banks, insurance, real estate, retail and the Telcos. It’s starting to feel that after the market calms down from this hectic but exciting reporting season the underlying ASX200 maybe ready to drift lower. However it’s all about the action under the hood this week with 5 stocks in the ASX200 rallying by over 10% and 3 falling by the same degree while a total of over 10% of the index ended the day up / down over 4%, who says stock selection does not rule!

MM’s ideal scenario remains a pullback of around 150-points from yesterdays close but we will be looking to buy this move at least short-term.

MM remains in a patient “buy mode” with relatively elevated cash levels.

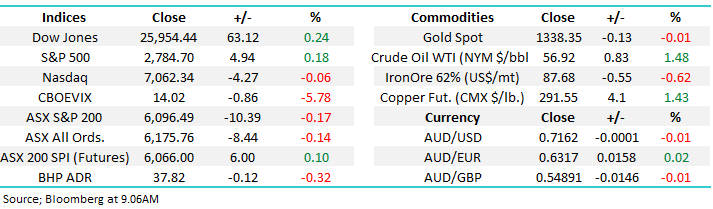

Overnight US markets were mildly firmer with the ASX200 SPI futures pointing to an open up less than 10-points.

Today we are again going to evaluate 3 of the best and worst stocks from yesterday.

ASX200 March SPI Futures Chart

Australian Casinos

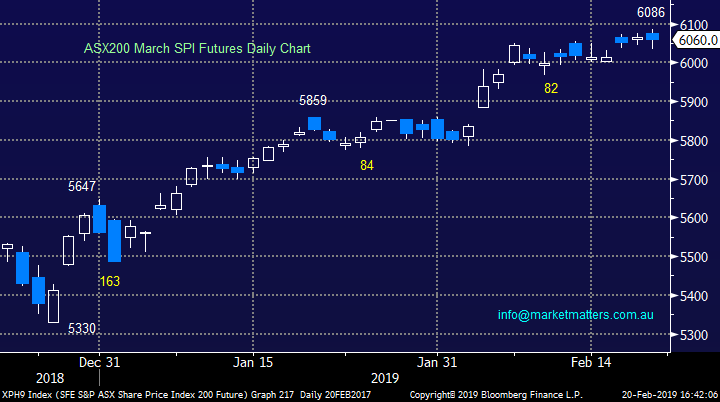

Yesterday Crown Resorts fell over 5% following the release of its half year results ending December 2018, their net profit was down almost 10% before significant items on revenue down 7.3%. Basically none of its result was particularly encouraging which the company blamed on weaker economic conditions – that’s a clear worry for the increasing number of investors / economists who foresee a recession, or at least tougher times, looming on the horizon for Australia.

China’s tightening of financial controls is also likely to be putting pressure on the volume of high rollers visiting Australia, we already know that our fair shores have slipped down the desirability rankings for the average Chinese tourist, just when everyone was assuming the growing Chinese middle class would become a cash cow for Australian tourism.

MM remains bearish CWN with an initial target ~$10.

Crown Resorts (ASX: CWN) Chart

Conversely we have been “stalking” Star Entertainment for months with an ideal entry closer to $4, which in today’s environment is not far away. They’re just out with results and initial read through suggests a slight miss for the half while guidance was fairly opaque. We’ll dig into more now…

If the stock sells off we may buy SGR on weakness to fresh 2019 lows.

Star Entertainment (ASX: SGR) Chart

Western Areas (WSA) $2.37

Yesterday one of our holdings WSA reported on the soft side leading to a -2.5% drop in the shares, almost a win in today’s environment! The issues were around slight cost creep which had been previously flagged and overall earnings trend but both guidance and all operational / financial metrics were maintained.

We will be watching WSA carefully in case our target of $2.70 starts to feel too optimistic. Benefit of the doubt provided for now!

Western Areas (ASX: WSA) Chart

Overseas indices

No change with European and US markets, we still believe they have a strong risk to the downside with our target ~5-6% lower. The upside momentum is clearly wanning and a lot of good news has been baked into the recent index appreciation.

US Russell 2000 Chart

3 of the best performing stocks.

Yesterday while we saw the market drift 10-points 5 stocks in the ASX200 were very impressive surging by over 10%, two of these bounced after falling way too far on Tuesday but the other 3 reacted to their profit reports.

Importantly to MM the fact the Bingo Industries (BIN), which we bought on Tuesday, was able to bounce over 12% illustrates the value in identifying stocks which are sold off too hard following their reports – shame we weren’t as aggressive with Emeco Holdings (EHL) which bounced almost 14%.

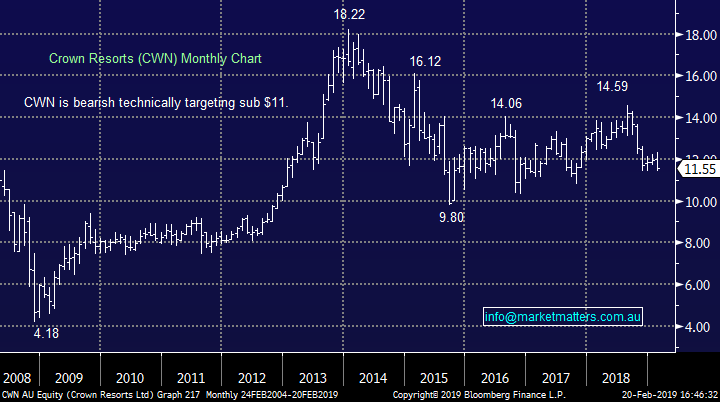

1 Corporate Travel Management (CTD) $28.81

Yesterday CTD rallied almost 15% following a strong report card led by revenue up 23% and adjusted net profit up 20% which helped the board raise the dividend 20% to 18c.

This is a clear success story and shows the value in having a business led by people with skin in the game, in this case the founder. The company was “attacked” by Sydney hedge fund VGI in 2018 who cited a number of issues including revenue recognition which the company has fought with accountancy heavyweight Ernst and Young, the last few rounds appear to have gone to CTD which will be hurting VGI’s P & L.

MM is neutral CTD at current levels.

Corporate Travel Management (ASX: CTD) Chart

2 Seven Group Holdings (SVW) $19.02

Yesterday SVW rallied well over 12% and the chart below has an uncanny resemblance to CTD’s above. The rally was following a better than expected half-year earnings report with Net Profit after Tax (NPAT) coming in up 61%, close to $260m. There was a lot to like in this report from balance sheet strength to cash flow profile.

SVW is a diversified operating and investments company with interests from Beach Petroleum (BPT) to the Seven Network and Caterpillar dealerships. There’s a lot of moving parts in this business but management is clearly enjoying the asset markets recent recovery.

MM is neutral to bullish at current levels.

Seven Group Holdings (ASX: SVW) Chart

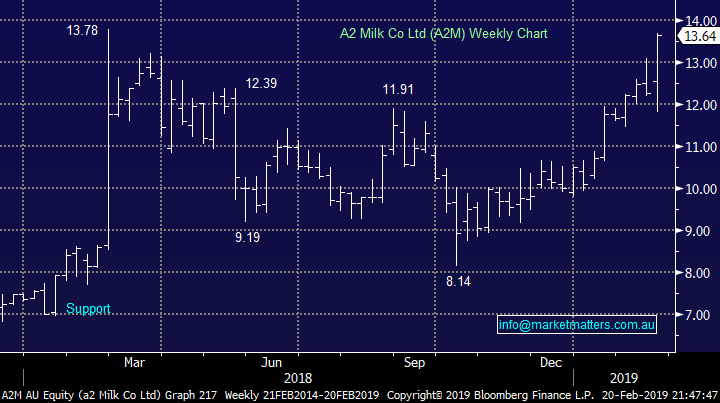

3 A2 Milk (A2M) $13.64

Yesterday A2M rallied over 10% tracking back around its all-time high, reached around this time in 2018, although it’s been a rollercoaster ride in between. The business is now remarkably a large cap company being the 41st largest company within the ASX200, a huge rise to fame.

The business beat expectations at the earnings line and in terms of guidance plus unlike Blackmores yesterday, they’re executing on their Asian growth ambitions. Hard to fault the result today – a likely decline in 2H EBITDA margins the only area to watch.

MM is neutral / bullish A2M at current levels.

A2 Milk (ASX: A2M) Chart

3 of the worst performing stocks.

Yesterday the losers dominated on the company specific level with 11 stocks falling by ~5%, or more. Today we have signalled out 3 stocks that caught our eye.

1 Pact Group (PGH) $2.58

Top of the pile yesterday was PGH which plummeted over -17% as the Australian packaging manufacturer admitted they had “not done a great job” reporting a $320 loss – note this included a non-cash impairment charge of $327m. The company’s underlying profit fell 29% to only $36m as they cited cost pressures and weaker demand.

However we have been watching PGH carefully over the last 6-months and following this month’s ~40% plunge we believe value is returning to the business.

MM have considered allocating 2% into PGH for our second addition to the “dogs” group when selling momentum shows signs of exhaustion

Pact Group (ASX: PGH) Chart

2 McMillan Shakespeare (MMS) $12.70

Yesterday salary packaging / leasing business MMS was clobbered almost 13% following its half year result which showed a very small increase in revenue but an almost 4% decline in EBITA (earnings before interest, taxes, depreciation and amortization). Even after the profit decline the company announced a small increase in the dividend – perhaps an attempt to appease investors.

The result was significantly worse than expected but it’s not a stock I would be buying yet as other companies in and around the space are also struggling.

MM is neutral MMS at current levels.

McMillan Shakespeare (ASX: MMS) Chart

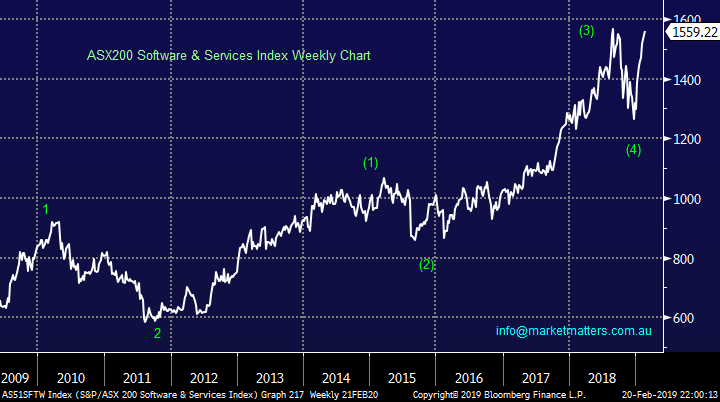

3 Wisetech Global Ltd (WTC) $21.03

Yesterday Wistech (WTC) fell by just over -10% an unusual occurrence to the high growth sector this reporting season. Shares in the logistic software company tumbled on a soft half year report. The stock briefly traded back below $20, a fall of more than 15% before staging a minor recovery. As a reminder, WTC’s main product is a logistics platform that allows management of complex logistics transactions across a number of clients and countries. We covered it in more depth yesterday afternoon – click here

We have no interest in WTC at this stage especially following our recent comments around the AX200 Software & Services sector.

Wisetech Global Ltd (ASX: WTC) Chart

AX200 Software & Services Index Chart

Conclusion

We’re considering PGH is for a 2% allocation in the Growth Portfolio, if selling momentum starts to fade

BOQ is in the same boat for the Income Portfolio

SGR results may deliver an opportunity there today

Overnight Market Matters Wrap

· The US closed marginally mixed overnight as investors sift through the latest US Fed minutes.

· Crude oil lifted 1.48% higher overnight, while iron ore lost some ground, leaving BHP in the US to close an equivalent of -0.32% from Australia’s previous close.

· Locally, corporate earnings will dominate the market, with the likes of the following to report today - Sydney Airport, Qube, Audrill, Webjet, Santos, Origin, Wesfarmers, Coca-Cola Amatil, Nine, MYOB, Flight Centre and more.

· The March SPI Futures is indicating the ASX 200 to open 14 points higher, testing the 6110 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.