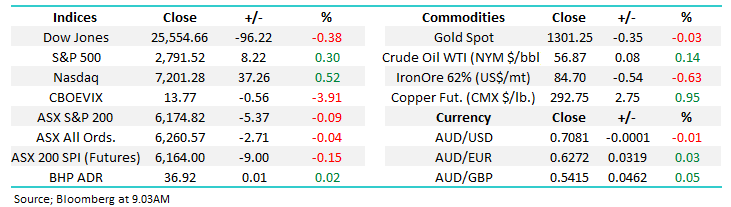

MM “alerts” might start hitting inboxes sooner rather than later! (BAL, IFL, SGR, ALL, AMP, APX, EHL, LLC, JHG, QBE)

The ASX200 failed to embrace an extremely positive lead from overseas indices closing marginally down on the day even after opening up +0.7% following the S&P500’s +1.5% gain in the US. Conversely the rest of Asia continued with its strong week rallying on average of ~1.5%, in just a few days the Australian market appears to have been unceremoniously shoved from its position of a favoured index into the “naughty corner”. Under the hood the financials remained firm while insurance, gold and retail had a tough day at the office but nothing particularly dramatic.

Its impossible to know what has been the catalyst for our markets last few days soft underbelly but perhaps the recent two capital raisings mentioned yesterday was enough to satisfy the last remnants of the panic buying since December. Street Talk reporting this morning that Z1P Co (Z1P) is the next to tap shareholders today.

Local economic data has also been poor recently and Mays federal election gets ever closer creating doubt in many investors’ minds – “if in doubt do nought!”. However the $A remains close to 71c, basically unchanged since late 2018, implying to me it’s not an economic issue at this stage.

The local futures (taking dividends into account) have corrected less than 2% over the last 4 trading days, hardly a dent in the 17.8% advance from late December. Lets stand back and consider some typical statistics as the upside momentum slowly wanes:

1 – If the markets correcting the whole advance from its December low the typical targets would be 5916 and 5804 i.e. implying a lot further to go.

2 – If the market at least matches the early January pullback of 163-points we have another ~1% to go.

3 – A break of March’s 6150 low implies strongly that 6278 is a decent point of inflection and we are likely to fall for a few more weeks into April.

Hence overall we feel comfortable (a dangerous word when investing) with our large 29% cash position in our flagship Growth Portfolio looking for select buying opportunities into weakness.

MM remains neutral the ASX200 after its strong rally from late December lows but we are not afraid to buy selective stocks.

Overnight US markets closed mixed with the Dow down -0.4% dragged lower by Boeing whereas the hot tech based NASDAQ rallied over +0.5%. The SPI futures are calling our market to open marginally lower with BHP unchanged in the US.

Today we are going to look at a few buys and sells MM is watching closely as the market, but not all stocks, drifts lower.

ASX200 March SPI Futures Chart

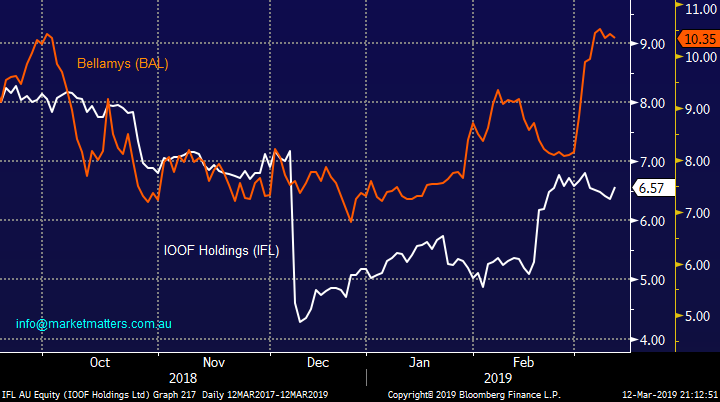

I was just looking over the best performing stocks for the last 3-months and 2 jumped out at me – IOOF Holdings (IFL) +51% and Bellamy’s (BAL) +37%.

The point is when significantly out of favour stocks (“dogs” as we have often referred to them) snap back there is a dearth of sellers and upside momentum can be stunning.

MM continues to evaluate a few “dogs” which are approaching our “buy zone”.

Bellamy’s & IOOF Holdings IFL) Chart

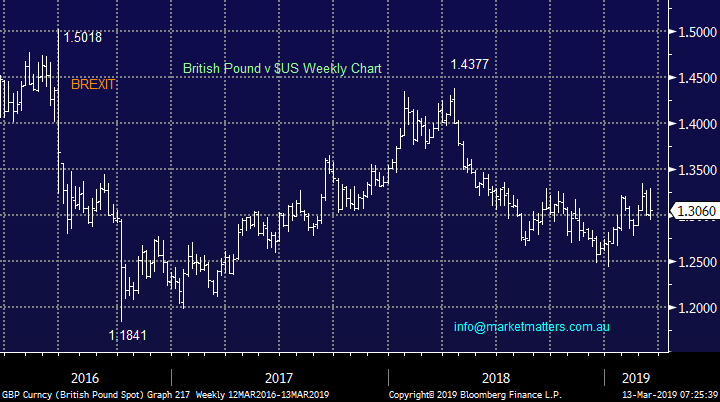

This morning AEST the BREXIT saga continued with optimism for a positive vote yesterday during our daytime turning to reality when Parliament again gave the thumbs down to Theresa May’s proposal – I really feel sorry for her, she was anti-BREXIT in the first place and now she’s trying to put the pieces together after the leave campaigners like Messer’s, Farage and Johnson are nowhere to be seen.

The British Pound gave back its early gains leading to the FTSE being the best of a bad bunch closing up +0.3% - many UK stocks benefit from a weaker domestic currency.

The longer this story takes to unfold the more chance of a second referendum where a remain vote is a strong possibility which would clearly be short-term beneficial to UK exposed businesses. However there are many moving parts in this tale none of which are certain with politicians primarily steering the ship.

British Pound v $US (GBPUSD) Chart

Global Indices

The tech based NASDAQ rallied another +0.5% last night in the process making fresh highs for 2019 but I would not be chasing this strength as the overall momentum slowly wanes, we believe the next ~4% is down.

We would continue to avoid stocks that are highly correlated to the US at this point in time e.g. Macquarie Bank (MQG) & the growth sector.

US NASDAQ Chart

No change, European indices are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage.

Increasing our equities exposure moving forward may be accompanied by purchasing a negative facing ETF.

UK FTSE Chart

Stocks MM are considering both buying & selling

Yesterday we saw the ASX200 fall even after the Dow rallied 200-points implying that at least some degree of weakness was upon us – our preferred scenario is a few percent lower into early April for a buying opportunity.

Hence MM is keeping our finger firmly on the pulse as we hold almost 1/3 of the MM Growth Portfolio in cash.

1 Star Entertainment (SGR) $4.37

We have been targeting a test close to $4 for SGR ever since we took profit on our previous holding in 2017 – as it turned out, a really good exit point.

A few of my colleagues are actually going to SGR for lunch today, it will be interesting to hear back on how the place feels, I cannot remember the last time I was there, probably pre-kids.

MM continues to like SGR into fresh 2019 lows i.e. only 3-4% away.

Star Entertainment (SGR) Chart

2 Aristocrat Leisure (ALL) $23.14

This previous hot stock has endured a tough year falling close to 40% from its 2018 high primarily on P/E contraction i.e. investors are not prepared to pay as much for its growth, similar to what we saw with CSL Ltd (CSL) and Cochlear (COH).

The gaming technology business is now trading on a relatively conservative Est. P/E of 17.2x for 2019 following a disappointing result from a US competitor but ALL is expected to grow earnings by 17% this year i.e. solid growth on an undemanding multiple , assuming of course that they deliver. The last trading update from the business last month at its AGM stated the company is on track to deliver its targets for growth in 2019 with digital a key driver.

There is another wild card in the pack with a few regulatory concerns around gambling since the U.S. Justice Department said internet gambling was illegal – not a specific area of concern for ALL.

MM is considering averaging our holding into weakness below $23.

NB We are wary of ALL”s $US exposure hence this might be a relatively short-term foray.

Aristocrat Leisure (ALL) Chart

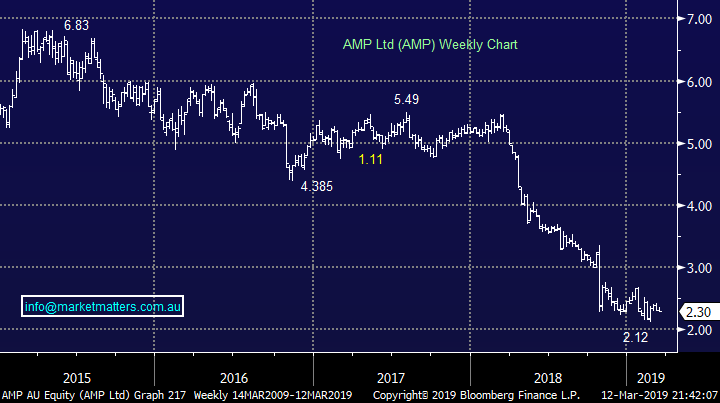

3 AMP Ltd (AMP) $2.30

I certainly feel like I’m on an island looking at AMP but I showed the turnaround by IFL earlier i.e. never say never.

The stock carries a relatively large short position above 7% but the valuation based on its Est P/E for 2019 of 11.5x is not too exciting although the ~6% fully franked yield would be if they can maintain it. I can see AMP trading above $3 in 2019 /20 which would be a huge bounce but not its first over recent years.

MM is considering a small 2% “dog” investment in AMP.

AMP Ltd (AMP) Chart

4 Appen Ltd (APX)

Following its well-timed capital raising APX has corrected over 14% potentially giving us the opportunity we have been waiting for to buy back into the Artificial Intelligence business (AI).

MM is considering starting to accumulate APX under $22 and we would average below $20.

Appen (APX) Chart

5 Emeco Holdings (EHL) $1.995

We have been watching the leaser of earthmoving equipment to the mining industry for most of 2019 and our buy area is approaching in this relatively volatile stock. Its cheap (Est P/E for 2019 of 9.3x) and around our $1.80 target area it will on paper represent solid value.

MM still likes EHL around the $1.80 area.

Emeco Holdings (EHL) Chart

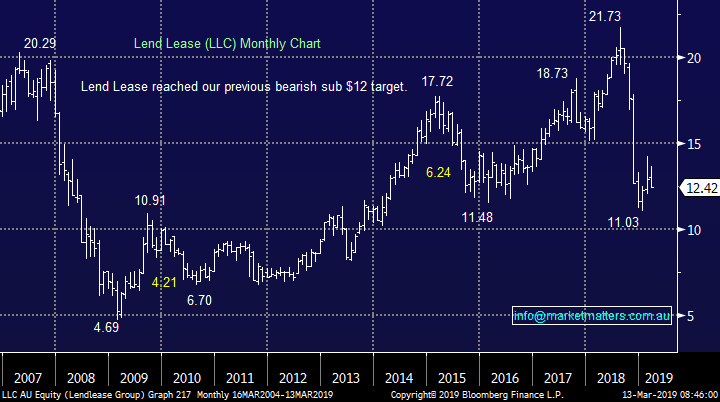

6 Lend Lease (LLC) $12.42

Lend Lease (LLC) has enjoyed a decent bounce including a strong push above $14 following an upgrade by influential broker UBS but we felt they may have fired a touch early. While the company appears to have cleared its decks of “bad news” we question if that’s enough to send the stock higher when property continues to struggle, however if they were successful in getting rid of their engineering division I believe the market would love it.

MM is interested in LLC on another leg down below $11, which is not far with this volatile beast!

Lend Lease (LLC) Chart

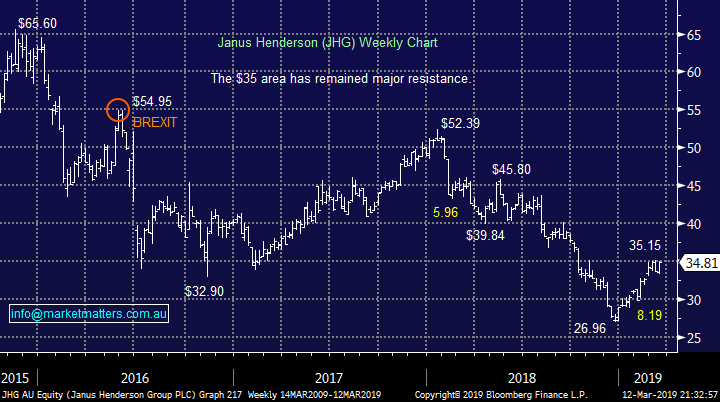

7 Janus Henderson (JHG) $34.81

Janus Henderson (JHG) has been on the BREXIT rollercoaster as well as having to deal with a retiring CEO and struggling funds under management (FUM). However the recent 30% recovery illustrates the stock had become simply too negative. Today’s Est P/E of 9.8x and yield above 5% unfranked is still attractive and this stock could (theoretically) enjoy a value bid.

We are still bullish JHG targeting fresh 2019 highs but once these have been achieved we can raise our stops to just under $35 and we can then see how the stocks plays out from there.

We remain bullish JHG but stops may be raised this month.

Janus Henderson (JHG) Chart

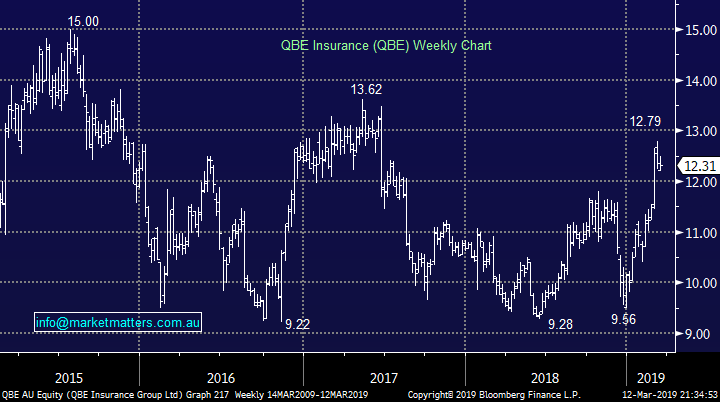

8 QBE Insurance (QBE) $12.31

QBE Insurance (QBE) has been a serial underperformer as most of us know but like JHG is it has rallied ~30% in 2019. MM is concerned with QBE moving forward because of our bullish outlook for the $US which will represent a headwind for earnings when they are translated back to $A.

We are looking to exit QBE around the $13 region.

QBE Insurance (QBE) Chart

Conclusion

MM has a number of stocks on our “buy radar” including a few more not mentioned above that we have covered recently i.e. Elders (ELD), Healius (HLS), IAG Insurance (IAG) and Nufarm (NUF).

Buy Bucket

Star Entertainment (SGR) ~$4.10, Aristocrat (ALL) under $23, AMP into weakness towards $2, Appen (APX) under $22 -$20, Lend Lease (LLC) below $11 and Emeco Holdings (EHL) around $1.80.

Sell Bucket

Janus Henderson (JHG) stops up to $34.90 if / when we make fresh highs above $35.20 and QBE Insurance (QBE) around $13.

Overnight Market Matters Wrap

· The SPI is down 9 points as Boeing once again dragged on the Dow, which closed down 0.4%. The S&P 500 and NASDAQ closed 0.3% and 0.4% in the black.

· Crude oil jumped 1.25% to US $56.77/bbl. as Saudi Arabia extended its bigger than agreed production cuts into its second month. All metals on the LME were higher, with aluminium and nickel up more than 1.5%

· British PM May tweaked her Brexit proposal but once again was heavily defeated in a parliamentary vote. Next up is a vote to rule out leaving Europe with no deal in place.

· Back to the US and data showed that inflation remains in check, giving market participants confidence that the Fed can hold off on rate rises for now. Meanwhile US-China trade negotiations continued with contact between lead negotiators.

· The March SPI Futures is indicating the ASX 200 to ease on the open, futures showing a 10 point slide towards the 6164 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.