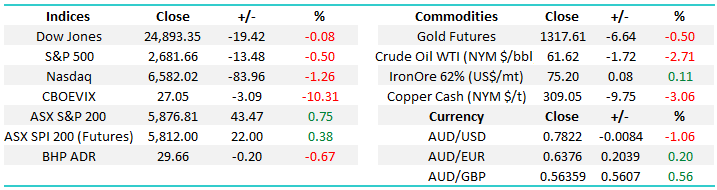

Markets return to relative calm but not in resources land

Relative calm has returned to global equities over the last 24-hours which is best illustrated by the Volatility (VIX / Fear Index) which closed -8% lower overnight, although understandably well above the average level for 2016. The main move overnight that caught our eye was the rally in the $US which assisted the sharp declines in oil, base and precious metals in the US – this will be the focus of todays report following our purchases of OZ Minerals, BHP and RIO Tinto this week.

Moving forward the Fed / RBA certainly will be sweating on their policy decisions as they attempt to the unprecedented QE following the GFC.

- The RBA has held interest rates at the historically low 1.5% since I can remember yet our economy is chugging along nicely however with housing prices already wobbling, it feels to me that the RBA are in a very precarious position.

- The US Fed have been raising interest rates for a while but they still feel a touch behind the curve at present however I feel “the canary in the coalmine” is asset sales by the Fed i.e. The massive unwinding of QE, last week they sold $20bn of assets but there’s another $4trillion to go which is going to potentially create further substantial illiquidity events along the way.

- Europe and Japan don’t even look to have considered how they will unwind their QE as they continue to focus on supporting their respective economies.

We certainly have plenty of ingredients for a significant stock market correction in 2018/9 which is our long-term view at MM, ideally following fresh all-time highs by global equities markets although its unfortunately hard to see the ASX200 getting too far over Januarys 6150 even we see some massive optimism return elsewhere.

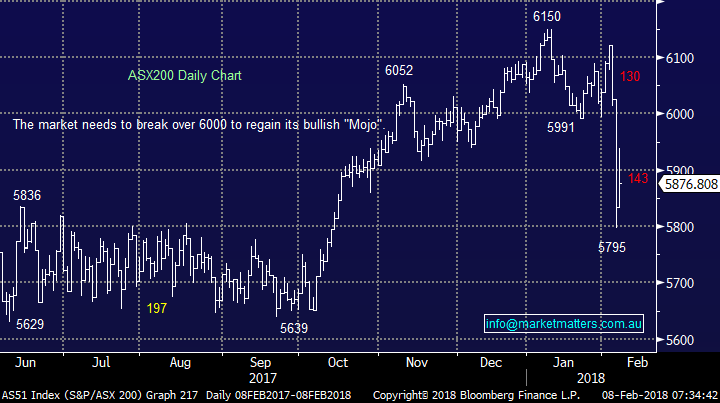

Local Index

Yesterday’s early rally by the ASX200 ran out of steam during the afternoon as traders became wary of the looming session in the US. The average report from CBA weighed on the influential banking sector which basically closed unchanged and remember the quote we often use when discussing the ASX200 “the market cannot go up without the banks”.

At this stage we can see the local market consolidating between 5850-5900 before showing its hand. For us to become bullish technically the ASX200 we need to see a close back above 6000.

ASX200 Daily Chart

US Fear Index (VIX) Weekly Chart

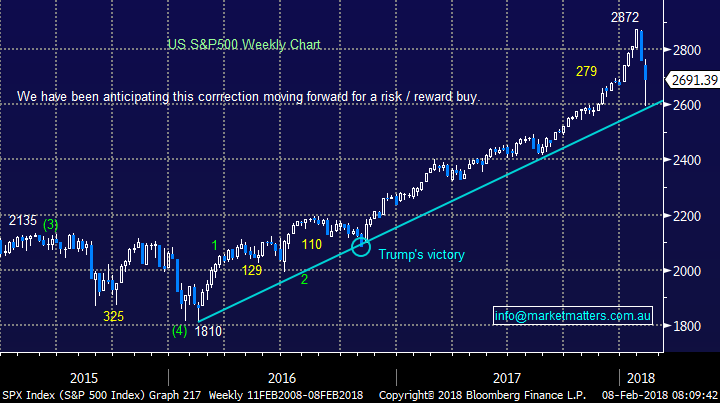

Global Indices

No change from yesterday, following the last few days panic selling.

- The US S&P500 has now corrected -9.7% but has bounced strongly from its long-term trend line support.

- We had wanted the Fear Index above 20 before a potential low was in place, it actually traded over 50 before closing back well under 30 last night.

- We had been targeting a warning for complacent equity investors over recent months and it’s certainly manifested itself with a bang over the last few days.

Overall US stocks are now in the area where we can see a low forming and our opinion is they will be higher in say 1-2 months’ time.

US S&P500 Weekly Chart

Similar to both 2010 and 2014 we believe that US stocks have given the market a relatively friendly warning over recent days – a nudge around what could be on the horizon. At this point in time I expect investors to slowly forget the last few days and refocus on all the bullish fundamental reasons to be in stocks ideally pushing global markets back up to fresh all-time highs before buying the dip will become very dangerous. MM view from here:

- Global markets are likely to regain their bullish euphoric mood through February / March and push prices back to all-time highs.

- Following later in 2018/9 will be a ~20% correction back to the lows of 2016 i.e. hence our recent buying is relatively short-term in nature.

US Dow Jones Weekly Chart

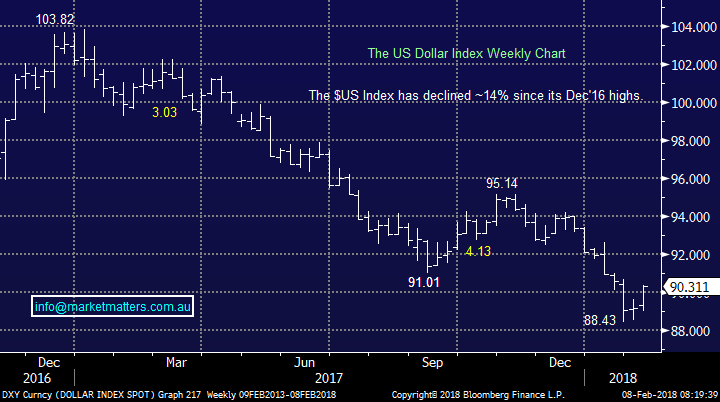

The $US and commodities

Probably our largest contrarian call in our January Outlook Report was the $US would fall into Q1 of 2018 before having a bullish year – this has unfolded to-date.

- If our short-term view is correct the $US should turn lower from around current levels to challenge the 88 area one last time, ideally before a 8-10% rally minimum.

$US Index Weekly Chart

The Emerging Markets have corrected over 9% as anticipated in line with global equity weakness and $US strength. As the below chart illustrates the correlation between our resource stocks e.g. RIO and the Emerging Markets is almost perfect!

Hence as the EEM approaches our buy zone we still have appetite for resource stocks, albeit with our low cash levels. New stocks for the MM Portfolio now on our radar:

- Alumina (AWC) around $2.20

- Iluka (ILU) around $9.

Emerging Markets (EEM) v RIO Weekly Chart

Potential additions to existing holdings:

- RIO -Overnight RIO reported some solid numbers as expected including a 69% rise in full-year profit, a record dividend and another $1bn buyback, their shares traded up 1% in London and we will watch today to see how the local market digest’s the details.

- BHP – We may consider averaging under $29.

- OZL – We would be looking for the $8.50 region before increasing this exposure.

- NCM – No interest in increasing this holding.

- WPL - No interest in increasing this holding.

Conclusion

No major change, at this stage on the macro / index level, MM remains keen to accumulate resource stocks into current weakness albeit cautiously due to reduced cash levels.

Watch for alerts.

Global markets

US Stocks

The US NASDAQ corrected 9.3% before surging almost 5% off this week’s low – we believe there’s a good chance the rally to fresh all-time highs is already underway.

US NASDAQ Weekly Chart

European Stocks

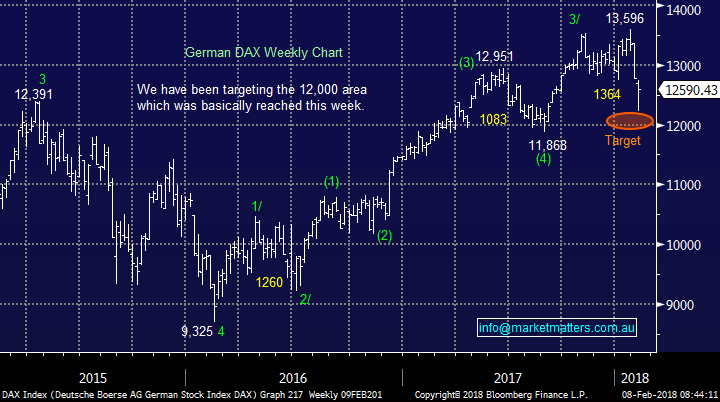

European stocks made fresh recent lows this week as expected, a rally back over 13,000 by the German DAX will look great for fresh all-time highs in 2018.

German DAX Weekly Chart

Moving onto our close neighbours in Asia, the Hang Seng is now in our buy zone around the 30,000 area.

Hang Seng Weekly Chart

Overnight Market Matters Wrap

· Another volatile session witnessed overnight in the US , with the range of the Dow +/- 508 points and the broader S&P 500 +/- 46 points, only to close with little change from the previous session. The Nasdaq 100 however underperformed amongst its peers, ending its session down 1.26%.

· The European markets however, have snapped a 7 day losing streak to close up circa 2%.

· US Fed officials made bullish comments on the economy with one saying the US is “firing on all cylinders” and could justify raising rates 3 or 4 times this year if inflation continues.

· Base metals on the LME continue to sell off with copper and zinc more than 2% lower. Gold continues to fall, oil is nearly 2% lower, while iron ore continues to rally, +1.7%

· The March SPI Futures indicating the ASX 200 to open with little change this morning, still around the 5875 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/02/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here