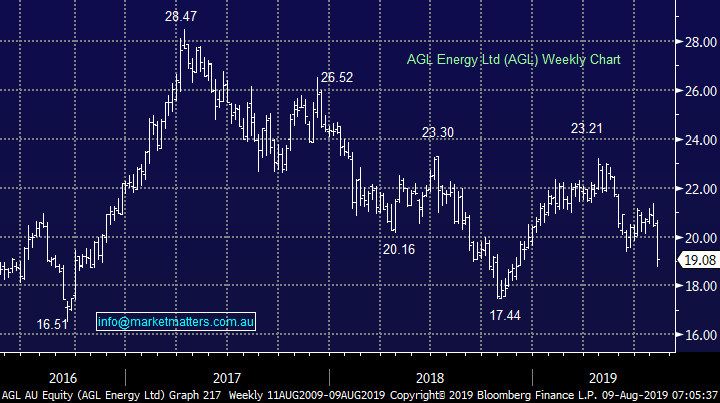

Market Rallies into the Weekend – (AGL, BBOZ, IAG)

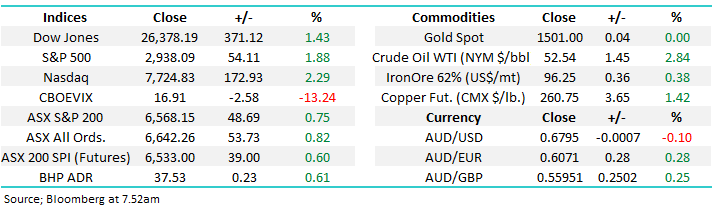

Happy Friday everybody in more ways than one, with US stocks surging overnight to impressively erase all of its weekly losses! US stocks are now only 3% below their all-time high, whereas the ASX200 is 4.5% below its equivalent milestone, perhaps we will see some catch up by the local market. Stock markets remain on a very short leash of sentiment with US-China trade, interest rates and a potential recession taking it in turns to push & pull the market accordingly – at this stage sell strength and buy weakness feels the correct strategy.

Following yesterday’s solid bounce by the ASX200, we question whether much of the 371-point by the Dow is already built into our market, although the SPI’s call of +20-points this morning does feel a touch light. Every sector in the US S&P500 rallied by more than 1% overnight, with most up by over 1.5% implying we will see broad based strength today, BHP closed up an equivalent of 23c in the US from Australia’s previous close - a good effort after yesterday’s strong 1.5% day.

MM remains comfortable adopting a more conservative stance than we did for the first half of 2019.

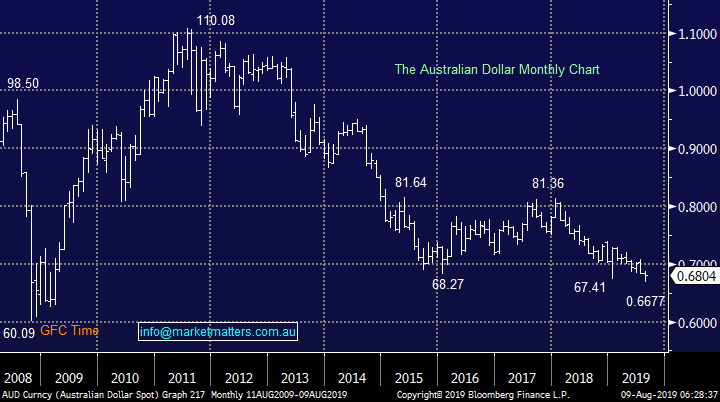

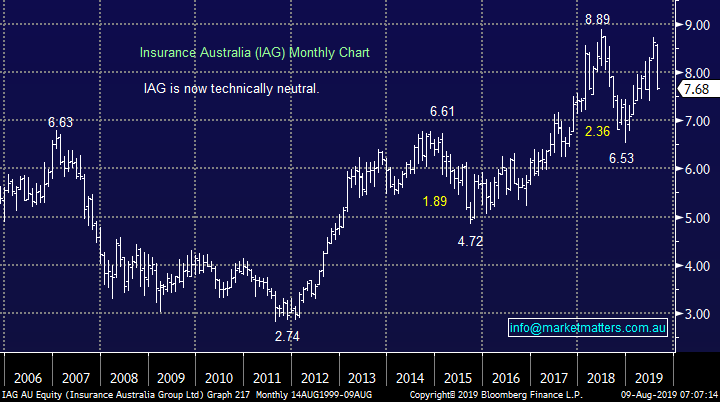

We saw further evidence of the weak internals of the Australian economy yesterday with disappointing reports by AGL Ltd (AGL) and Insurance Australia (IAG), both of whom fell by over -4.5%. That’s before we even mention AMP, our best investment of recent years has been to leave this basket case alone, and our opinion remains unwavered: there is no reason to buy AMP.

Australian Reporting Season: https://www.marketmatters.com.au/reporting-season-2019/

ASX200 Chart

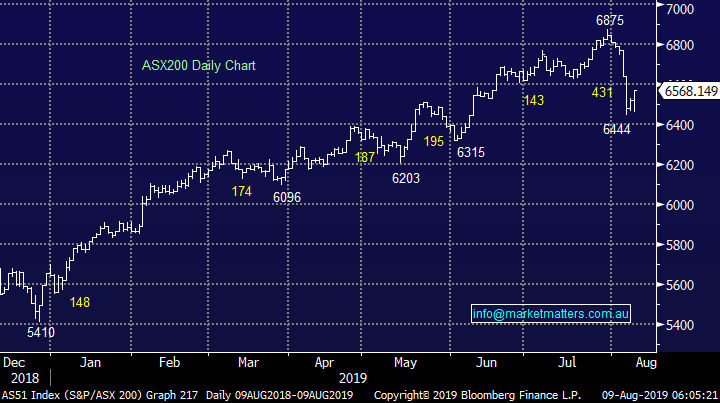

Yesterday, the $A continued its recovery, trading above US68c while I type. We continue to believe it’s “looking to find a low around these levels”.

MM believes the time to average our long $A in our ETF Portfolio is close at hand.

The Australian Dollar ($A) Chart

US 10-year bond yields have started to flirt with their all-time lows, we even read a few articles this week which suggested they may ultimately become negative – amazingly already 25% or $US14Trillion of global bonds are paying a negative yield.

Locally while we think negative yields are a long way off, lower interest rates are not:

MM, like the market, believes the RBA Cash Rate will fall to 0.5% in the next 6-12 months.

US 10-year bond yield Chart

A quick look at the 2 stocks that reported poorly yesterday is not particularly exciting and I know James was not a fan of either before he went for the Apex Charity ride:

Technically both IAG and AGL are uninspiring.

AGL Energy (AGL) Chart

Insurance Australia Group (IAG) Chart

MM remains bearish US stocks, initially targeting the 2750 area for the S&P500 - over 6% lower, hence we are in “sell rallies as opposed to buy dips” mode but caution is warranted as we are still in a bull market.

MM remains bearish US stocks.

US S&P500 Chart

MM’s plan for the days / weeks ahead.

No change:

1 – We are looking to increase our cash position in the MM Growth Portfolio, 16% feels a touch light at present.

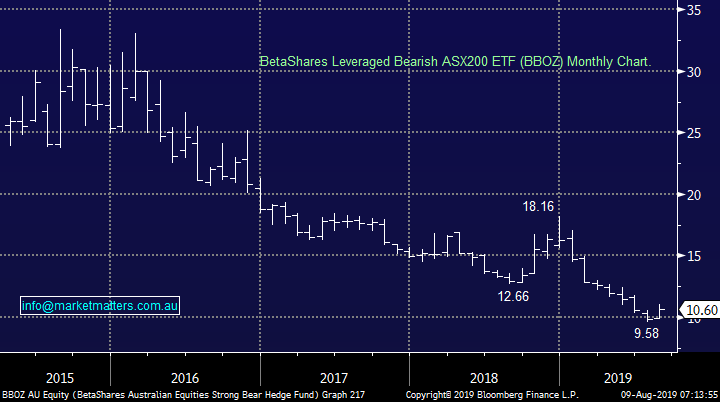

2 – We are looking to buy the Bearish ASX200 ETF (BBOZ) into strength moving forward to hedge a decent part of our portfolio.

BetaShares Leveraged Bearish ASX200 ETF (BBOZ) Chart

Overnight Market Matters Wrap

• The US bounced particularly solid overnight, led by the tech. heavy, Nasdaq 100 as mentioned above. European markets also rallied with the French market in particular 2.3% stronger.

• Commodities rebounded, with crude oil up 2.8% and copper up 1.4%, while the gold price retraced about 0.5% from its 6 year highs. Bonds edged higher, with US ten-years back above 1.7%, having briefly touched 1.79% intra-day.

• The September SPI Futures is indicating the ASX 200 to open 40 points higher, towards the 6605 level this morning.

Have a great day!

Alex & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.