Looking for opportunities from 7 movers following results / AGM’s this month (WBC, CSL, ALQ, TNE, ALL, A2M, WTC, WEB, APX)

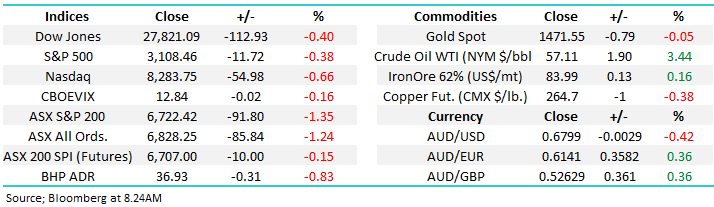

How often have I heard “shares go up by the stairs and down by the elevator” well I certainly got some déjà vu yesterday as the ASX200 tumbled almost 100-points as sellers didn’t take a meaningful backward step all day. Less than 15% of the ASX200 managed to close up on Wednesday (often referred to as drive day) with the Financials, Energy and Utilities Sectors leading the declines, a pretty mixed bag with no clear underlying theme except the fairly aggressive sell-off in bank stocks following the news that Westpac may have breached anti-money laundering laws. More on this below.

Donald Trump threw a spanner in the works during the day when said he would actually raise tariffs on Chinese goods if the two economic super powers could not agree a trade deal – hardly conciliatory rhetoric. I get concerned by the Presidents logic at times, where’s the upside in spouting off comments like “China’s is going to have to make a deal that I like. If they don’t that’s it”, sounds almost personal to me. Unlike President Trump Chinas Xi Jinping has no election to worry about next year, he can play the long game which as we know the Chinese historically like to do.

However although the US futures fell over -0.3% while our market was still trading it wasn’t the sort of decline that would usually induce panic selling. Interestingly markets heavily correlated to US – China trade talks, like the $A and our resources stocks, significantly outperformed on the day implying the smart money was ignoring the latest outbursts from the ‘colourful’ US President. Throughout the day it simply felt like a slight increase in the selling volume from the psychological 6800 area cut through the buyers but I am cognisant that over the years the ASX has often led pullbacks by US stocks – watch this space but technically a 2-3% pullback does feel overdue for the S&P500.

Short-term MM remains neutral the ASX200 with an upside bias.

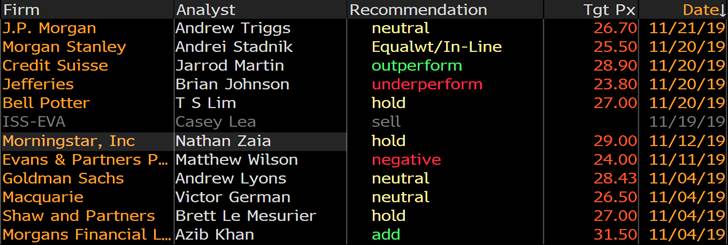

Overnight global stocks did indeed follow through on the downside with the Dow down around 200-points at 6am before rallying into the close, the SPI is only pointing to the ASX200 falling 10-points this morning illustrating we did indeed build in a negative performance from US stocks in yesterday’s tumble. Also the $A slipping back below 68c overnight has probably been supportive of local stocks considering the recent relative performance as the $A has been gyrating between 68 and 69c.

This morning MM has briefly looked at 7 stocks which have both enjoyed and endured AGM’s / results this week looking for solid risk / reward opportunities either now, or moving forward

ASX200 Chart

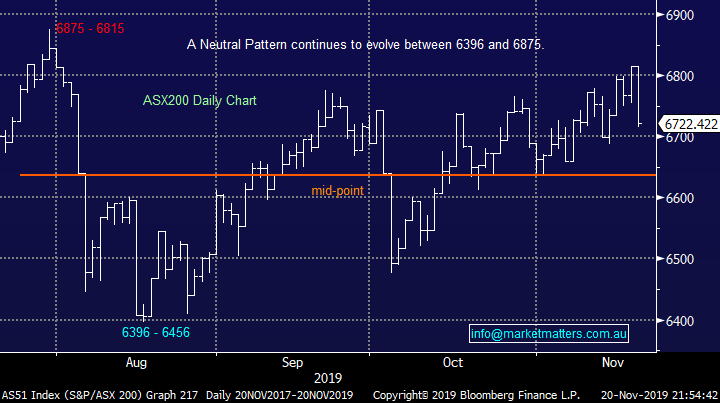

We are keeping our fingers very much on the pulse of the stock markets internals as the “Value or Growth” argument rages on for 2020, the information we received overnight was similar to that from the ASX yesterday – nothing clear, it’s still a relatively choppy mess!

As the Dow fell more than 100 points on renewed concerns around US - China trade we saw Energy and Utilities rally while IT and Communications were the worst performers, a slightly defensive night as would be expected but the Energy Sector rallying and Resources trading ok doesn’t really follow the expected path for increased risks for a breakdown in trade talks.

MM prefers value over Growth into 2020 but no confirmation is yet in place.

US S&P500 Value v Growth Indices Chart

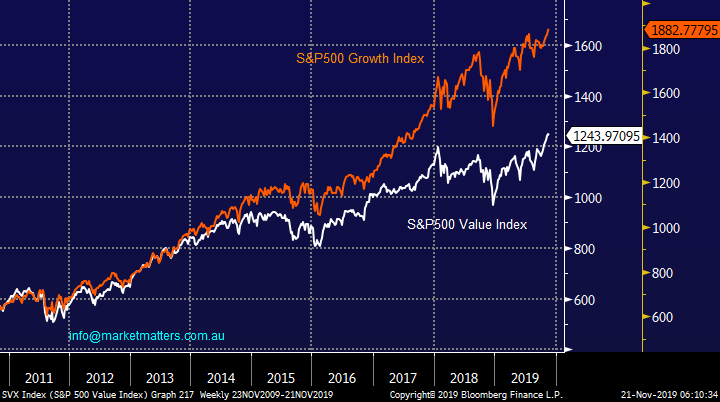

Westpac (WBC) $25.67: The claim put forward in the Federal Court yesterday from AUSTRAC is significant and could lead to a big fine for Westpac - the quantum of any fine is the unknown. There are 23 million breaches and my understanding is that one interpretation of the act implies that each breach can attract a $210 fine. That number is too big to comprehend and it would ultimately bring down the bank. The other interpretation is a fine per category of breach. There are 14 categories of breach identified with each attracting a ~$20m fine implying a ~$280m liability. More likely is a negotiated settlement and after talking with our analyst this morning, his view is something in the range of $1-$1.5bn. To put this into context, CBA was fined $700m with the CEO Ian Narev losing his job – Brian Hartzer at Westpac seems likely to lose his.

Below are current broker calls on Westpac – Bells this morning cut their price target to $27, down 8.5%.

Westpac (WBC) – Broker Calls

We own Westpac in both the Platinum & Income portfolio’s and plan to hold for now, although acknowledge this claim put a large uncertainty over the stock. Worth also thinking about NAB & ANZ. If both CBA and WBC have had issues in this area, it would be surprising if ANZ and NAB were immune.

Westpac (WBC) Chart

Searching this week’s AGM’s / reports for opportunities

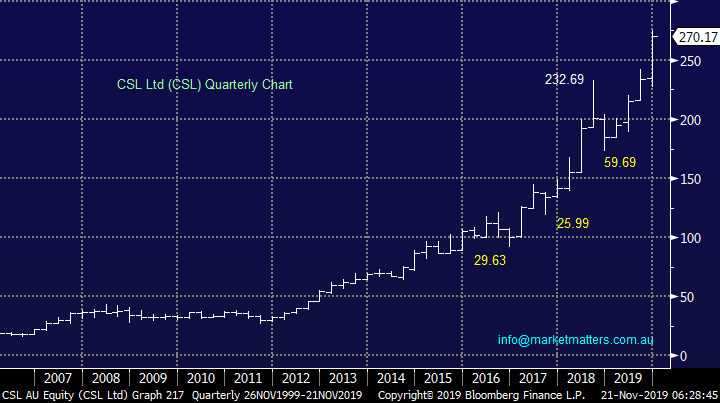

The ASX200 is basically at the same level as it was in mid-September but there’s been a huge amount of action under the hood as investors have embraced solid company performance while punishing those that disappoint in almost merciless fashion. As we have discussed over recent weeks fund managers appear to be very concerned for the global / local economy into 2020 hence they are more comfortable driving up the valuation of perceived “safe” stocks like CSL Ltd (CSL) while they remain reticent to commit any $$ to business with any apparent earnings risk.

With volatility often comes opportunity and today I have briefly looked at 7 stocks who have faced the music this month as we look for a good home for some of MM’s $$ into Christmas and beyond.

CSL Ltd (CSL) Chart

1 ALS Ltd (ALQ) $9.06

The top performer in the ASX200 yesterday was testing services company ALS Ltd (ALQ) following better than expected half year results – revenue was almost $920m while net profit after tax came in at just over $98m, around 5% above prior guidance. The life services business guided well, expecting FY20 profit of $185-$195m.

Technically, MM is bullish ALQ targeting around $10 and stops can now be operated below $8.30, unfortunately not particularly exciting risk / reward.

MM is net bullish ALQ with stops below $8.30.

ALS Ltd (ALQ) Chart

2 Technology One Limited (TNE) $8.72

The second best performer was enterprise software company Technology One Limited (TNE) which rallied over 11% following their report which delivered a net profit of $76.4m.

A large part of yesterday’s rally was making up for Tuesdays losses after the stock slumped on concerns around the same result – demand remains strong for its services. MM is bullish TNE with stops below $8.10, ok risk reward especially as the company’s performing nicely.

MM is bullish TNE targeting ~$10.

Technology One Limited (TNE) Chart

3 Aristocrat (ALL) $33.71

Gaming technology business ALL rallied to fresh all-time highs yesterday after reporting strong underlying growth, revenue for the year was up an impressive 22.7% which flowed into increased profits and an elevated dividend.

MM has enjoyed ALL’s rally over the recent years but at current levels we feel more comfortable sitting on the fence.

MM is neutral ALL.

Aristocrat (ALL) Chart

4 a2 Milk (A2M) $13.84

A2M delivered a strong trading update this week allowing the stock to regain much of its 2019 losses the question is it now cheap? The business is expecting to enjoy revenue close to NZ$800m for the first half of its financial year, growth around 30% at the upper end of its forecast.

China remains its growth engine and assuming Trump et al finally calm down this should continue. However what really caught our eye were the strong margins, which came in ahead of expectations plus of course this stock is heavily shorted, around 58m shares of 8% of the register short this stock.

Considering its current growth profile a P/E for 2020 of under 32x doesn’t feel too challenging.

MM now likes A2M but stops need to be ~10% lower.

a2 Milk (A2M) Chart

5 Wisetech Global Ltd (WTC) $26.19

MM has been bearish WTC for a while and its continued fall is giving our view the thumbs up. The stock fell again this week following its AGM plus ongoing reports by aggressive short seller J Capital who is vocally bearish the business. The logistics company delivered revenue just under $350m and a NPAT of $54.1m and they reconfirmed their 2020 guidance approaching 30% growth for revenue – tweets by J Capital on the day felt almost Trump like and didn’t add any weight to their negative thesis in my opinion, however another leg lower in the share price feels likely.

MM will reconsider WTC in the $22-23 region.

Wisetech Global Ltd (WTC) Chart

6 Webjet (WEB) $12.88

On-line travel agent WEB soared this week following its AGM which delivered a strong trading update and forecast for the year - the Thomas Cooke debacle now feels like it’s in the rear view mirror. The company maintained its performance targets moving right out until 2022 with the block chain solution helping to drive improved efficiencies - the business is expecting EBITDA growth of ~30% over FY19.

In hindsight MM was too fussy around $10 when we considered the stock a few weeks ago but following this recent update entry around current levels is more appealing.

MM likes WEB with stops under $11.70.

Webjet (WEB) Chart

7 Appen Ltd (APX) $24.98.

APX delivered an excellent trading update on Monday with the artificial intelligence (AI) business raising its FY19 guidance now taking year on year growth to almost 39% at the top end of guidance – the improvements included increases in margins.

This is clearly a volatile stock but we like the quality of its earnings as it evolves as a company. Technically we could go long with stops under $23.

MM is bullish APX at present but risk / reward is tricky.

Appen Ltd (APX) Chart

Conclusion (s)

Of the 7 stocks looked at today we like ALQ, TNE, A2M, APX and WEB but only Webjet (WEB) is offering interesting risk / reward at current levels.

Global Indices

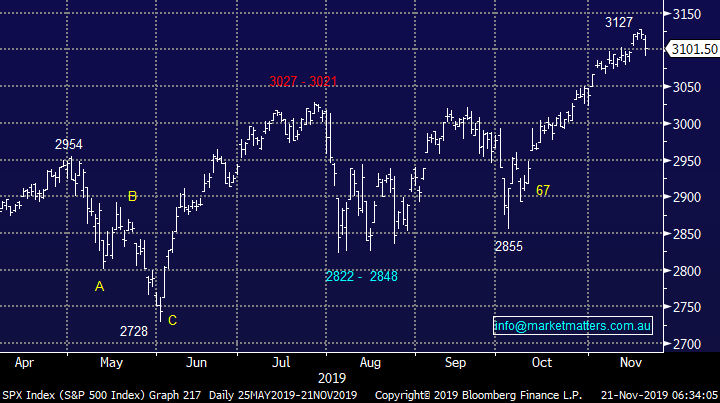

No major change, we had given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated, a close well under 3020 for the S&P500 is required to switch us to a bearish short-term stance.

Short-term a pullback towards 3050 looks underway which should present a short-term buying opportunity for the very active subscribers.

MM is now neutral / positive US stocks.

US S&P500 Index Chart

European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias with a target ~8% higher looking realistic.

German DAX Chart

Overnight Market Matters Wrap

- The US equities markets sold off overnight as Trade talks once again dominated headlines with a Reuters report saying a phase one US-China deal may be pushed into next year. China is pushing for a more comprehensive rollback of the tariffs while the US wants the intellectual property and technology transfer issues dealt with.

- On the commodities front, crude oil surged 3.44% higher following lower than expected stockpile reported.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of 0.83% from Australia’s previous close.

- The December SPI Futures is indicating the ASX 200 to open to test the 6700 level this morning on November Index Options expiry.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.