Looking for a diamond in the rough of the tourism / travel sector (WEB, FLT, SGR, CWN, ALL)

An unrelenting wave of bad news continues to wash over our market, over the weekend it felt like the local State & Federal governments were bickering while failing to comprehend or care what Australians want i.e. to be led by on unified front with simple clear direction conveying logical & comprehendible steps to beat the coronavirus on both the humane and economic front. Yesterday the US senate tossed yet another grenade at equity markets, the Democrats blocked Donald Trumps $1.8 trillion stimulus relief package. The Democrats wanted more cash for the individual and less support for big business with the Republicans pushing in the opposite direction, same old story just a different day.

There’s a lot of selfish and huge ego’s currently ignoring a very scarred global population, whether it’s the US senate, Australian State & Federal governments or that “old news” stoush between Saudi Arabia and Russia we’re seeing very little pulling together as one – I ponder if we will see a true leader emerge in these times of need, there’s no obvious Abraham Lincoln, Winston Churchill or Bob Hawke currently emerging for me.

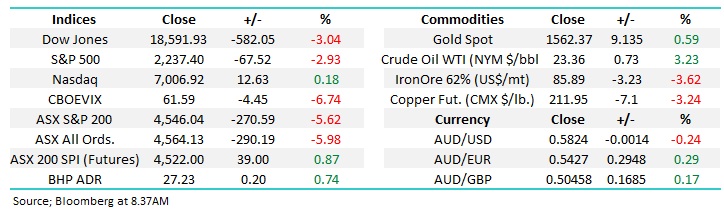

The number of confirmed cases of COVID-19 has rocketed in Italy to around 60,000 I hope and pray the remainder of the western world does a better job of convincing its people that this is a major issue, perhaps that is the only solace in what both Italy and Spain are now enduring. I believe with the strict actions rapidly being implemented across Italy and Europe that we may start to see a reduction in the number of new cases sooner rather than later - my largest concern is the US, especially under Donald Trump’s leadership, a President who described COVID-19 as fake news just a fortnight ago and still wants to get the lockdown over asap.

Importantly Italy has finally seen a slowdown in infections just 2-weeks after going into national lockdown demonstrating it’s the way to beat this invisible adversary.

Confirmed cases of Coronavirus in Italy Chart

The Australian market was massacred yesterday morning simply because it was open after US futures locked “limit down” following the senate’s failure to agree on how to roll out the massive stimulus to the US economy – I can only assume that every day the Democrats and Republicans argue will result in more pain in the US hence I expect things to be sorted sooner rather than later, once of course both parties feel they have adequately puffed out their chests and let off some steam. Overnight the Fed went “all in” with its QE basically committing to buying everything except equities, with importantly US corporate paper (junk bonds) on the menu, this should ultimately be very market supportive in our opinion.

There has certainly been no safe haven in corporate bonds, ultimately I think the carnage in the corporate bond market has a major negative influence on equities. The below chart looks at the spread of high yield bonds over US Treasuries which has hit 10%, up from the low 3’s. It’s no wonder that companies with higher debt burdens are being sold aggressively. Funding costs have essentially tripled.

Premium for high yield bonds v US Treasuries

Looking further at the price movements in the bond market provides a telling story.

While non-investment grade bonds have fallen sharply, so too have investment grade bonds highlighting the rush to cash irrespective of asset class / perceived safety. This is relevant for local hybrids and goes to explain why such price movements have played out, more on this tomorrow in the Income Note.

Non-Investment Grade High Yield bonds

Investment Grade Bonds – bounced overnight on new Fed measures

Yesterday’s -5.6% decline was again largely targeted towards companies with debt and hence a very uncertain future in the short-term, investors clearly fear that many of them might not survive the current COVID-19 turmoil. On the positive front the resource stocks performed strongly with heavyweight BHP leading the way actually managing to close positive on the day and today looking likely to open up 1%.

Most of us are aware that the tourism and travel stocks have been at the forefront of the selling pressure as Australia and the world goes into lockdown, no great surprises when we consider their business models but a number of them will be thriving in a few years’ time making the huge declines over the last month potentially an opportunity, although the following list of causalities does not make pleasant reading for today’s shareholders: Star Entertainment (SGR) -66% (already in suspense), Crown Resorts (CWN) -50% (already in suspense), Flight Centre (FLT) -77.6% (already in suspense), Aristocrat (ALL) -55.6% and Webjet (WEB) -75% (in suspense before its attempted capital raising).

Hence today we have looked at some major beaten up tourism & travel stocks pondering which if any could double over the next 12-18 months, that might sound optimistic but with one eye firmly on risk / reward some significant potential upside is warranted to take the plunge in todays uncertain market.

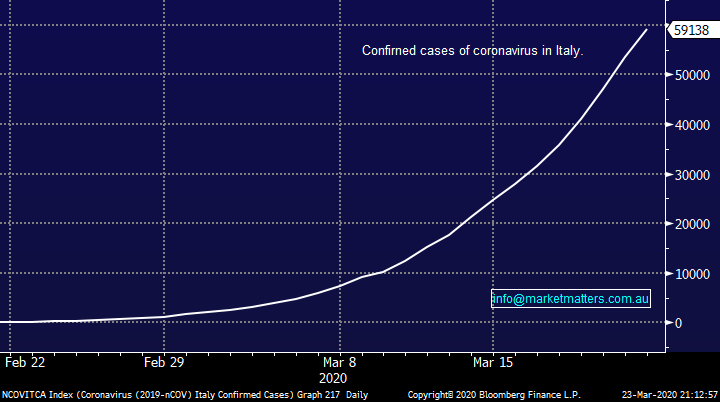

ASX200 Chart

Is it too early for tourism & travel stocks?

The main characteristics we are looking for are businesses that were trading solidly pre-COVID-19, have good assets, are likely to be strong businesses in the future and of course can / will survive this enormous economic downturn – definitely not as easy as it sounds with the “if in doubt stay out” mantra ringing loudly in my ears. However banks are undoubtedly keen to redeem themselves post the royal commission and the government has already announced measures to support tourism definitely making it worth a look. Traditional style capital raising from the market may prove the toughest path for these local companies bringing with it steep share price discounts, importantly during the GFC this often proved to be ideal buying opportunities.

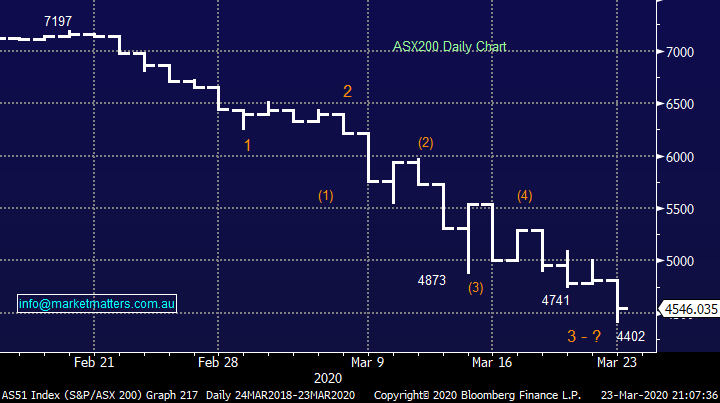

Hence the logical and safest path may be to simply wait for successful capital raisings in a stock (s) we like as opposed to “bottom picking” in today’s extremely uncertain market. The devastation in this group of stocks has not been isolated to Australia, the chart below shows the US equivalent is already down by around 50%, not as bad as many of our own but still very painful - with 3 of the 5 stocks we’ve looked at today already in suspense the current pain / risks appears more pronounced in Australia.

MM can see the logic in now picking up some quality exposure to this embattled sector.

US Travel & Tourism Index Chart

1 Webjet (WEB) $3.76 – in suspense.

Online travel agent Webjet (WEB) has been crucified and it remains in suspense as it searches for $250m to shore up its balance sheet as revenue spirals towards zero – the price and terms will make interesting reading assuming they are successful. We like their online business model assuming they can get adequate funding at the right price, WEB will be worth watching in the coming days.

The ”word” is the capital raise didn’t get supported at any price hence the company is now in discussion with private equity group KKR. The issue with private Equity is they too have reasonably high debt and are under pressure.

MM will evaluative WEB after its capital raise / funding issues are resolved.

Webjet (WEB) $3.76 Chart

2 Flight Centre (FLT) $9.91– in suspense.

FLT was looking solid on paper when its revenue stream was not broken with net cash on their balance sheet, a conservative measure they have applied since the GFC which nearly crucified them, however this current pandemic is clearly a bigger challenge for the travel industry than the GFC.

The stock is trading on a more than 70% discount to its 10-year book valuation but when some investors question your future that’s no surprise – the stocks in suspense pending a company announcement, we expect they need at least $200m

Similar to WEB we feel FLT will be interesting into a deep discounted capital raise.

Flight Centre (FLT) $9.91 Chart

3 Star Entertainment (SGR) $1.615 – in suspense.

SGR was carrying some debt prior to COVID-19 hence the significant pressure on the stock as casinos shut their doors, for how long we do not know - the stock’s in suspense pending a company announcement.

The stock is trading on a more than 60% discount to its 10-year book valuation which is no surprise under the circumstances and we question when the world moves on from the coronavirus whether its Star Casino in Sydney will become a destination of choice when Crowns’ Barangaroo eventually opens its doors.

MM is not particularly enamoured by SGR at present.

Star Entertainment (SGR) $1.615 Chart

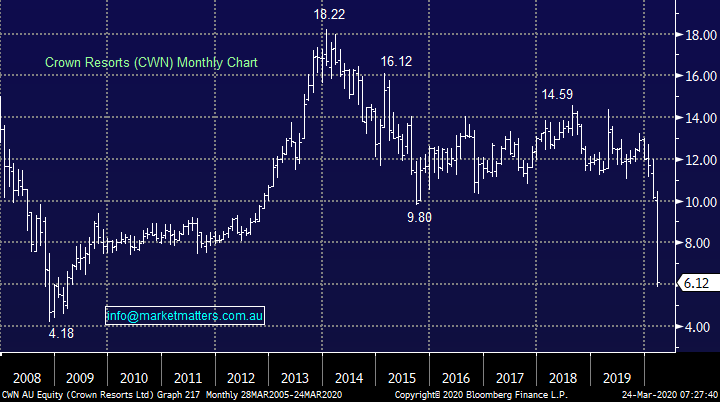

4 Crown Resorts (CWN) $6.12 – in suspense.

MM prefers CWN over SGR as it moves to a net cash position assuming the settlement of apartments at Crown Sydney. Simply, they have higher quality assets in our opinion, once all the dust settles with the virus I can see a global player taking out Jamie Packer and restoring CWN to its former glory - the stock is in suspense pending a company announcement.

MM would be very interested in CWN around $5

Crown Resorts (CWN) $6.12 Chart

5 Aristocrat (ALL) $15.44

ALL is one of the world’s largest manufacturers of gaming machines and as the share price illustrates below they were flying before COVID-19. The company has also invested heavily in the growing light mobile phone games market which we believe is smart diversification both in todays market and moving forward, in the years ahead.

ALL have been reducing their debt levels but if income is perceived to be under significant pressure throughout 2020 a capital raise is always a possibility.

MM likes ALL into today’s panic selling.

Aristocrat (ALL) Chart

Conclusion

MM is interested in the tourism and travel sector as we look 1-2 years ahead, the valuation of these businesses is arguably too low for a loss of 6-months revenue BUT if capital raisings are required opportunities to enter the sector at optimum levels may be close at hand.

Our preferred 2 options into weakness are Aristocrat (ALL) and Crown Resorts (CWN) but it’s all a function of activity on the corporate level at present.

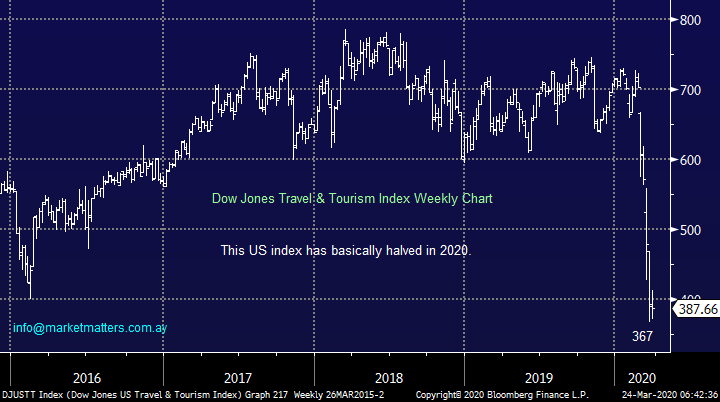

An updated snapshot of Global Markets

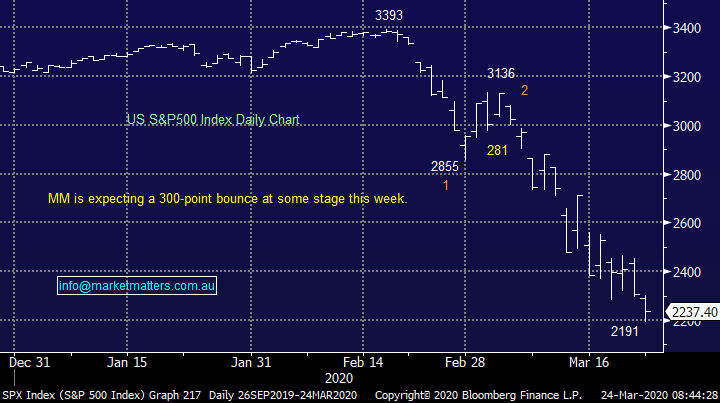

US stocks were again sold off last night but we stick with our view: we like US stocks for a good bounce from last night’s low.

At MM we have refrained from aggressively pushing the buy button for our International Portfolio, it just “felt wrong” previously but we are getting close.

US S&P500 Index Chart

Overnight Market Matters Wrap

- The US equity market fell overnight despite the Fed Reserve reporting a further stimulus

- It was much the same across the Euro region with its major indices closing lower, but off from its intraday lows as global investors seek the 'safe haven' assets of gold and bonds.

- The June SPI Futures is indicating the ASX 200 to open marginally higher this morning, testing the 4580 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.