Looking at 5 stocks where their option volumes leapt yesterday (AWC, AMC, CTX, S32, CCL)

**I’ll be presenting a Webinar at midday today; Registration is not required, simply click on the IMAGE below at midday and I’ll be live on YouTube – covering market views leading into Christmas**

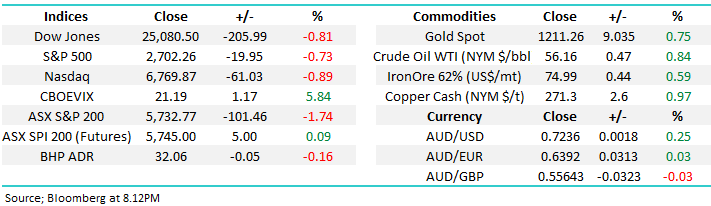

The ASX200 got whacked again yesterday taking the losses from the last 2-days over 200-points / 3.5%, far weaker than we expected following ok sessions in the US and Europe plus the S&P futures were positive during our time zone. The $30bn market unwind was led by a “tsunami like wave of selling which hit the SPI futures and didn’t take a back step all-day – selling in SPI futures rolls into arbitrage selling across the whole market with the larger names in the market garnering the most attention i.e. banks / resources and healthcare.

What surprised us was the US and Asian markets were also pointing to an ok day in equities land but one or more major players had a very different idea – yesterday was all about selling Australia, not global equities.

When fund managers & / or hedge fund managers sell the SPI with such gusto it’s often due to one of 3 reasons:

1 – They are no longer bullish the overall market and want to reduce their net exposure quickly before deciding what specific stocks or sectors to sell / exit

2 – They are initiating a large spread position e.g. sell Australia and buy the battered Emerging Markets - would potentially make sense if you felt that Australian property market was going to continue its recent decline significantly damaging our economy in the process.

3 – Aggressive players are simply “going short” our market looking to profit from a decline in the ASX200.

Bad news is dominating the financial press - journalists are having a field day in the negative corner, it’s easy to see how one or more people may have pressed the “sell button” – the press can often be self-fulfilling in the short-term. The volume that hit our market over the last 48-hous will need some meaningful news to make a 360 degree about turn any time soon.

MM is now more cautious short term targeting an eventual retest of the psychological 5600 area.

Overnight Europe drifted lower while US stocks were sold off hard into the close with the Dow finishing down 205-points making it 5 consecutive days in the red. The SPI’s pointing to an unchanged open by the ASX200 and BHP closed down only 6c, perhaps we pre-empted the declines yesterday.

NB The US has closed at 2701, smack on our targeted support area in our Weekend Report – click here to view the note

Today’s report is going to look at 5 stocks that saw a noticeable increase in their respective options turnover yesterday, as we look for clues that traders are getting set ahead of potential moves / activity.

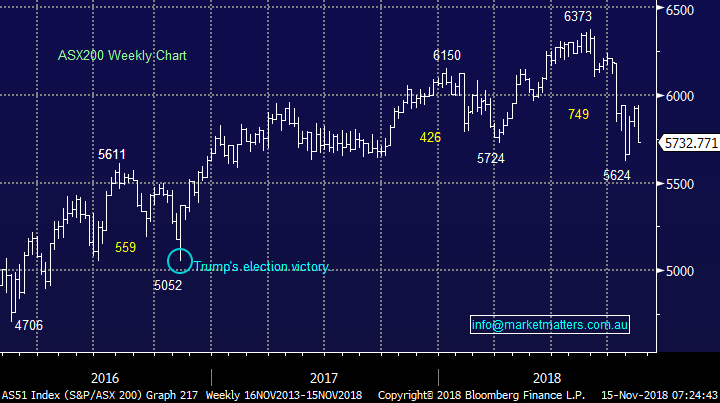

ASX200 Chart

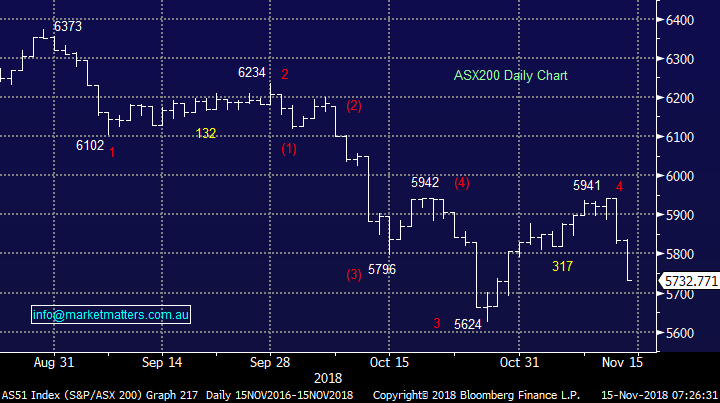

Yesterday we were explaining why our preference was for our path A for the ASX200 - that opinion was clearly given the major thumbs down by the market yesterday.

A – The market experiences a corrective pullback towards 5800 prior to an assault well above the psychological 6000 area.

B – The October weakness returns with a vengeance and stocks retest, and probably break, the 5600 area.

However remember how we see scenario B unfolding:

1 – By definition we will see a test of 5600 but MM does not expect a major break of this area in 2018.

2 – If we reach 5600 in the coming days / weeks MM will be bullish for a Christmas rally back towards 5950-6000, not exciting compared to Mondays close but ok if you have some cash up the sleeves.

3 – Our preference for “scenario A” may in hindsight led to us missing the opportunity to significantly increase cash levels around 5900 but we believe a second bite at the cherry will present itself in the next 6-weeks.

ASX200 Chart

5 stocks that saw a noticeable pick up in option volatility

Options are often traded by professional investors for a number of different reasons including portfolio protection, trying to increase portfolio yield or pure speculation - Kerry Packer was very comfortable buying huge quantities of call options when he was considering a tilt at a business e.g. Westpac Bank (ASX: WBC) back in 1992. Interestingly, the stock was trading around $3.00 at the time.

When we see a noticeable increase in the option turnover of a stock we usually run our numbers over the company in case an opportunity, or alarm bells should be ringing – similar to how we look at insider buying / selling.

Any subscribers who want further explanation on option strategies that can be used around a portfolio just drop me an email – James.

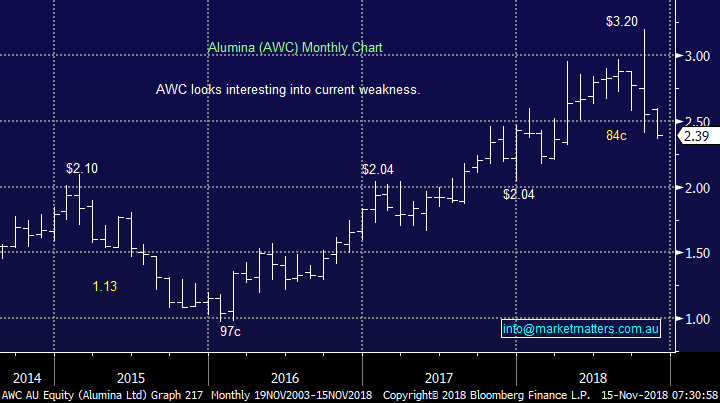

1 Alumina (ASX: AWC) $2.39

Alumina’s option volume was 8.3x above the 20-day average with 99% of the activity in the calls implying some decent buying interest at current levels.

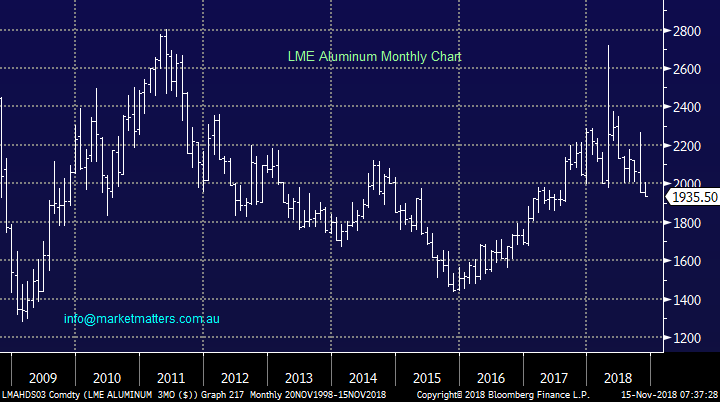

AWC has now corrected over 25% from its “blow-off” style October top which was caused by severe short-term Aluminium demand concerns in Brazil, similarly the stocks correction has been in line with that of the metal.

We like AWC from both a valuation and yield perspective but investors must remain aware that the stocks direction will be dictated by the Aluminium price just like our recent purchase of nickel miner Western Areas (WSA).

MM likes AWC at current levels and could consider buying on the backfoot i.e. accumulating.

NB We are considering adding to our holding in the MM Income Portfolio into further weakness..

Alumina (AWC) Chart

LME Aluminium Chart

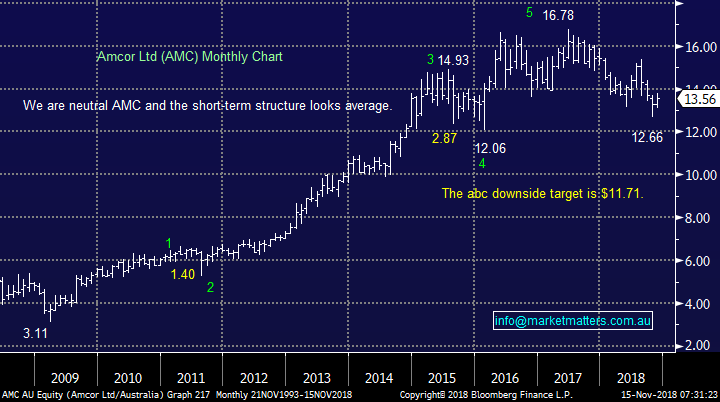

2 Amcor (ASX: AMC) $13.56

Amcor’s option volume was 7.5x above the 20-day average with 99% of the activity in the calls, again implying some positive interest in the stock at current levels.

Over the last 18-months we’ve been bearish AMC targeting the $12 region which has almost been satisfied – we are now neutral. Interestingly yesterday’s profit warning by rival Pact Group’s (ASX: PGH) was ignored by AMC, a positive sign in our opinion – PGH’s almost 10% plunge felt about right following the news.

Technically we could now buy AMC with stops below $13.10.

There’s no obvious play here but I definitely would no longer be short AMC.

Amcor (AMC) Chart

3 Caltex (ASX: CTX) $26.92

Caltex’s option volume was 5.5x above the 20-day average with 99% of the activity in the calls, a third time the activity was on the positive side of the ledger.

CTX is another stock MM has been bearish for the last 18-months targeting the $26 area, now only ~3% away.

Investor’s didn’t like the recent company update although the profit numbers were fine but the dividend was cut. It’s hard to get excited about CTX’s longer term prospects given the likelihood that in my lifetime, petrol cars may become a thing of the past. There will be trading opportunities in this stock but that’s as exciting as it gets.

MM will remain patient CTX but may have interest ~$26.

Caltex (CTX) Chart

4 South32 (ASX: S32) $3.35

Diversified miner South32’s option volume was 3.5x above the 20-day average with 45% of the activity in the calls.

I’ve typed this a few times recently but S32 is another stock MM has been bearish, this time for a few weeks targeting current levels i.e. a 22% correction.

We are now neutral S32 but would have interest into weakness ~5% lower.

South32 (S32) Chart

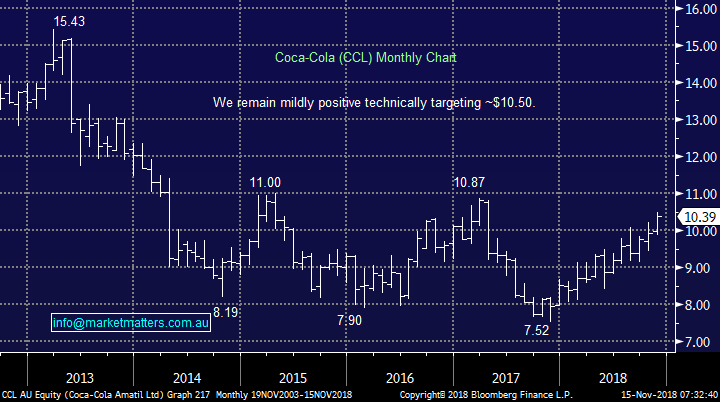

5 Coca Cola Amatil (ASX: CCL) $10.39

Coca Cola’s option volume was 1.9x above the 20-day average with 14% of the activity in the calls implying investors believe that CCL’s bounce is coming to an end.

MM has been mildly positive CCL in 2018 from a technical perspective targeting ~$10.50 which has now been achieved.

CCL’s grind higher may continue a few more % but we feel the risk / reward is not exciting.

Coca Cola Amatil (CCL) Chart

Conclusion

Unfortunately no exciting triggers from the stocks we looked at today but into current / further weakness a few are becoming interesting.

We are looking to tweak the Growth Portfolio today – watch for alerts this morning.

Overseas Indices

The US S&P500 has now satisfied our downside bearish target from the weekend switching us to neutral / bullish.

US S&P500 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January.

German DAX Chart

Overnight Market Matters Wrap

· The US majors remained in the sea of red with the broader S&P 500 experiencing its fifth consecutive day in negative territory.

· Crude oil bounced for the first time in 12 days after a record losing streak as OPEC appears to be considering production cuts that may be greater than anticipated. The OPEC President said supply will be restricted enough to balance the market.

· The December SPI Futures is indicating the ASX 200 to open marginally higher towards the 5735 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.