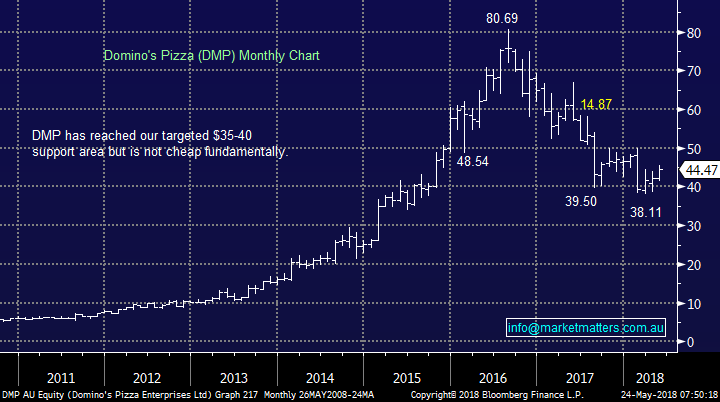

Looking at 5 Potential “Short Squeezes” Into EOFY (DMP, SYR, VOC, APN, JBH)

**We experienced some technical issues yesterday afternoon and some subscribers would have received the afternoon report late yesterday or early this morning. Apologies for the delay**

The ASX200 has now declined for the last 7 trading days and although the correction has been less than 2%, or under a third of the gains from the early April low, the momentum and general market feel has changed noticeably - the negative psychology around the “May effect” appears to be taking hold.

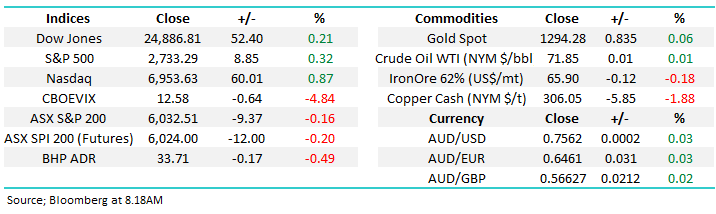

The energy sector suddenly experienced an aggressive fall from grace yesterday as the Santos (STO) board did it again, rejecting another takeover offer, sending the stock down over 8%, but at least they secured their jobs! After rallying 19% over the last 12-months we can see further downside for the sector and remind subscribers of our recent call for Origin Energy (ORG) – MM sees a further 10% downside from yesterdays close for ORG. With crude oil trading at 3 ½ year highs it felt like an opportunistic time to be selling but time will as always tell.

The market’s getting very skittish on the stock level as both the EOFY and May factors are weighing on investors’ minds – this is regularly a very tricky time of year for both retail investors and professionals. To add concerns to the market bulls is May’s range, which is sitting at only 168-points. Statistically if we break below the month’s swing low at 5978, there’s a high probability of follow through to the downside.

Overnight the Dow enjoyed an impressive 220-point turnaround on news that the Fed “sees no reason to rush interest rate hikes,” but the ASX200 still looks set to open down around 10-points as we continue our alignment with Europe who had a bad night, falling over 1% following weak manufacturing data - adding to concerns around the region’s growth.

- Medium term MM remains mildly bullish targeting 6250 but the risk / reward is not exciting for buyers. – We remain in overall “sell mode”.

While we have increased cash levels in our Growth Portfolio over recent weeks, it never feels enough when the markets sentiment turns lower as it has. Today’s report is going to look at some of most “shorted” stocks as we consider potential pops / short squeezes into EOFY as hedge managers evaluate their holdings and potentially crystallise some profits.

ASX200 Chart

Origin Energy (ORG) Chart

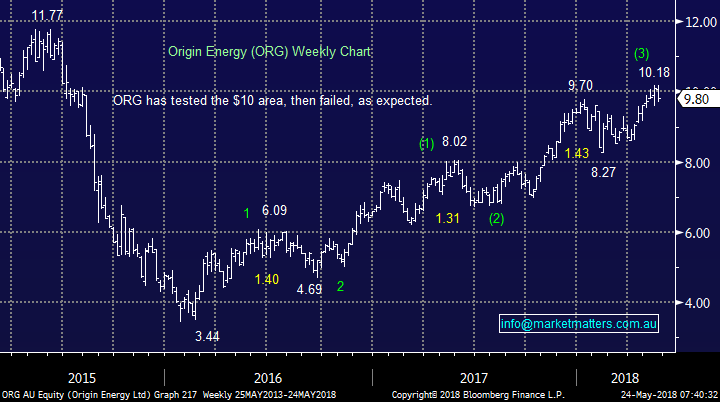

In yesterday’s report I touched on the seasonally weak statistics around May and I thought this should be reiterated today for any readers who may have missed it. The pullbacks the ASX200 has endured at this time of year have been both regular and significant since the GFC:

- The average pullback from top to bottom is just over 10%.

- If we ignore the 5 times the markets corrected over 10% the average is still almost 6% - note the smallest pullback was over 3%.

- So far, we’ve only corrected 2% from the May 6146 high, a 6% correction targets ~5775.

As we often say statistics can be illustrated in lots of different ways but this is undoubtedly a dangerous period to be aggressively long / overweight stocks.

ASX200 Seasonality Chart

Potential “short squeezes” into EOFY

In yesterday’s report we considered the worst 8 companies in the ASX200 over the last 12-months, all of whom are down over 20%, considering the risks / opportunities that the EOFY held for them.

Today it’s a very different group, stocks who are heavily shorted by traders / hedge funds. These may be showing decent paper profits or starting to feel uncomfortable – hedge fund managers often like to lock in $$ before EOFY creating “pops” in the respective companies and / or simply “clean up” their positions.

- Shorting is the strategy adopted by traders where they sell a stock, which they don’t own looking to profit from buying it back cheaper at a later date i.e. covering.

An up to-date list of the top shorted stocks on the ASX can be found at - https://www.shortman.com.au/

There were a number of candidates for today’s 5 companies reviewed and we may add to this list over the coming few weeks, especially as we own 2 stocks who have ~10% of their stock short sold i.e. Orocobre (ORE) and Independence Group (IGO).

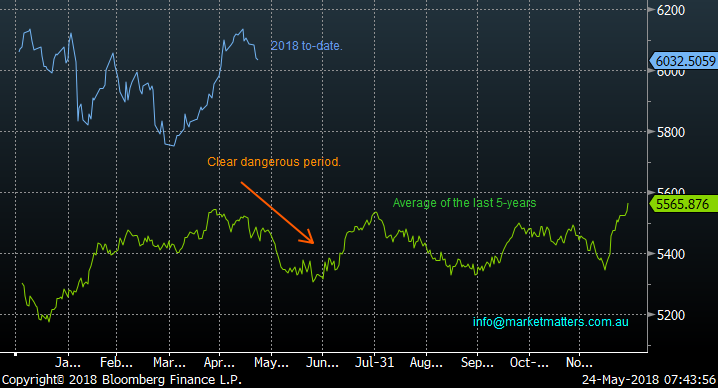

1 Domino’s Pizza (DMP) $44.47

Domino’s (DMP) was also mentioned in yesterdays report as the stock has traded down almost 30% over the last 12-months. DMP has a significant short position of 18.3%, which has been increasing as the stock bounces from its 2018 lows below $40 – makes sense to us.

At MM we don’t like DMP as a business / long-term investment but a short squeeze would not surprise us with our potential target around the $50 area.

- Extremely aggressive traders cold consider buying here with stops below $43, solid risk / reward but not a position for MM due to our overall view.

Domino’s Pizza (DMP) Chart

2 Syrah Resources (SYR) $3.50

Graphite producer Syrah Resources (SYR) is the most shorted stock on the ASX with almost 20% of its stock short-sold although this has decreased 1.5% over the week.

The negativity towards SYR appears to stem from scepticism towards the profitability of its Balama project / prices that can be fetched for its graphite.

SYR is not a stock we are considering for any medium / long-term investment although its degree of short-interest cannot be ignored.

- Aggressive traders could consider buying here with stops below $3.30, again solid risk / reward but not a position for MM due to our ambivalence towards SYR.

Syrah Resources (SYR) Chart

3 Vocus (VOC) $2.39

Vocus (VOC) has been a tough story for many Australian investors over recent years, including us. The short-position in VOC sits at 12.1% but well below the 17.5% of last year – the traders have clearly been rewarded and taken their spoils.

We all know the reasons behind the dislike of the telco sector as its vied with the Hayne royal commission for real estate in the press – especially when the journalists are in a bearish mood.

We can see traders covering some more of their VOC position in the weeks ahead as the stock appears to flat lining after being hit with a deluge of bad news.

- We like VOC as a trade in the $2.30’s targeting a rally to ~$2.90 while running stops below $2.24.

However we note that seasonally the best time to buy the Australian telco sector is mid-June, as it bottoms out before the overall market, hence we would not be in a hurry just yet to press the “buy button”. The other risk for VOC is around capital, and whether or not they’ll tap the market. If the stocks rallies from here, we think that would be a strong possibility.

Vocus (VOC) Chart

4 APN Outdoors (APO) $5.15

APN Outdoors (APO), the outdoor advertising operator currently has 10.3% of its stock short-sold, a figure that’s steadily risen over the last 12-months. APO has new management which in April announced their most recent trading update stating their guidance of single-digit revenue growth was all on track – it appears there are no skeletons in the closet – although outdoor advertising is becoming a more competitive area.

The stock’s actually marginally higher for the year and potentially one the hedge fund managers may not want in their short basket for the second half of 2018. The stock’s not cheap trading on a forward PE of 17.2x for 2018 while paying a 3.7% fully franked dividend.

- We like APO at current levels targeting over $6 but we would run stops below $4.80 – solid risk / reward.

APN Outdoors (APO) Chart

5 JB HIFI (JBH) $23.86

JBH HIFI (JBH) has maintained a short position between 15 and 16% since February. The journey’s been a volatile one for the traders, but a profit guidance downgrade earlier in the month would have settled many of the bears nerves, however the stock remains up almost 5% over the last 12-months.

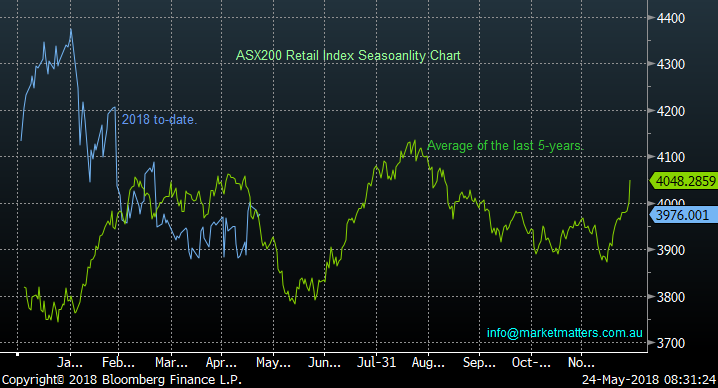

We note that the Australian Retail Index usually recovers very well from around 10-days into June, like the telco’s a touch earlier than the overall index + looking at the trend in the US overnight, consumer discretionary stocks saw some big gains. As we suggested last week, we are watching the retailers closely.

- JBH is messy from a technical level but we would consider a trading position if it experiences weakness below $22 in the next 2-3 weeks.

JB HIFI (JBH) Chart

ASX200 Retail Index Seasonality Chart

Conclusion

Below are our conclusions with regard to these 5 stocks with potential EOFY position juggling on the horizon:

1 MM likes APO and VOC as trading positions around current levels – ideally VOC a touch lower in early June and this risk of a capital raise can’t be ignored

2 MM is neutral DMP and SYR.

3 MM likes JBH into weakness below $22 in the next 2-3 weeks.

Overseas Indices

No change, we remain mildly bullish overseas indices targeting fresh 2018 highs for many but we are mindful that we are in May plus the UK FTSE has already reached MM’s new all-time high target.

US S&P500 Chart

Overnight Market Matters Wrap

· US investors tempered expectations of the pace of rate hikes following the release of the Federal Reserve minutes from its May meeting, which indicated that the Fed was in no hurry to accelerate tightening and would even temporarily tolerate inflation above its target of 2%. Another 25bp rate hike, however, is still expected in June.

· The UK FTSE had its biggest fall in two months, down 1.1% from its record highs, with the energy and commodity related stocks under pressure following the weaker economic data, with copper in particular down 1.5%.

· BHP is expected to underperform the broader market, after ending its US session down an equivalent of -0.49% to $33.71 from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 15 points lower towards the 6015 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/05/2018. 8.31AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here