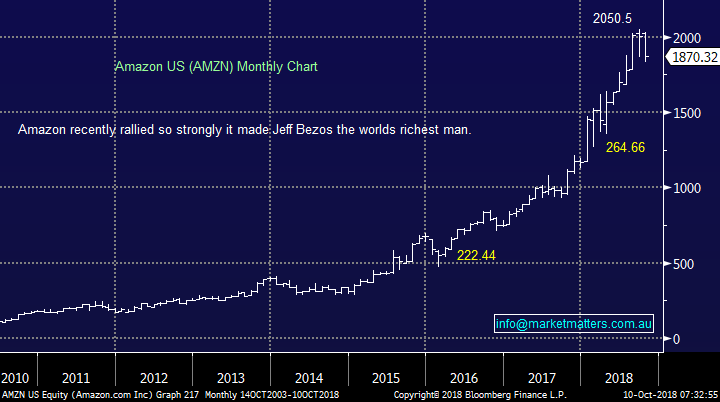

Looking at 5 major global stocks for clues moving forward (COH, CSL, APPL, AMZN, MSFT)

Local stocks were again sold off hard on Tuesday falling another 1%, making fresh 4-month lows, as the growth sector was well and truly in the sellers cross hairs e.g. Wisetech (WTC) -5.4%, Appen (APX) -5.3%, Xero (XRO) -4.9% and Afterpay Touch (APT) -4.5%. The healthcare sector, itself a relatively “crowded trade” and high valuation sector also struggled falling over -2.5% while only the interest rate sensitive utilities managed to close in the black.

One of our main views / positioning over the last few months has been to avoid the high growth / valuation sector which we believed had become an accident waiting to happen i.e. GAAP “growth at any price” is simply not the way to invest.

However, yesterday we actually stood up and bought 2 quality names in the growth space, CSL Ltd (CSL) and Cochlear Ltd (COH) who have now corrected -19.5% and -15.2% respectively. We will touch on these two planned / flagged purchases a touch later but put simply we like quality GARP “growth at a realistic price”.

At MM we’ve been targeting a short-term inflection point around now and it may already be in for some markets i.e. a pullback in bond yields and the $US, a low for emerging markets and an end to underperformance of interest rate sectors like the utilities and real estate. Hence we have commenced rejigging holdings in the Growth Portfolio – note we are looking for a shorter-term not long-term inversion of trends.

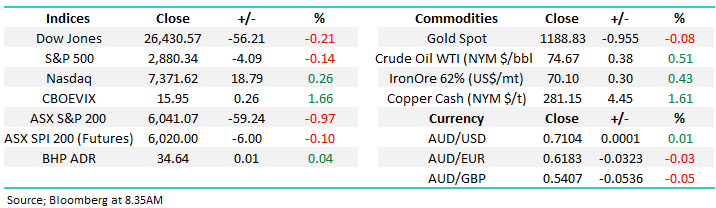

MM remains mildly negative the ASX200 short-term with an initial target ~5975, now only around -1% lower.

Overnight stocks were fairly volatile even though they closed basically unchanged with the Dow falling 56-points while the SPI futures are calling the ASX200 top open down around 10-points. During current volatile times we must remain aware that the ASX200 has a fairly low correlation to US stocks, with the general exception being how we open in the morning – since the end of August the ASX200 has fallen -5.2% while the Dow has risen +1.8%. Another demonstration of why we like positioning around relative strength in different sectors / markets.

Today’s report is going to be split in 2 halves, a touch longer than usual due to the current market volatility:

Firstly, we are going to look at 5 major global stocks who led the global bull market since the 2015/6 lows, we’re looking for clues to put the current markets position into perspective.

Secondly, we are again going to focus on how we may deploy our remaining 7% cash, 5% BetaShares ASX200 Bear ETF and 3% position in the BetaShares US dollar – the equivalent to 15% cash after we spent 6% yesterday

Watch out for alerts.

ASX200 Chart

We often stand back and look at statistics when we’re considering catching the proverbial falling knife i.e. so this October the ASX200 has already fallen 174-points from its high. Where does this fit into things?

1 – So far in 2018 the largest monthly move is 335-points in February before the index basically closed unchanged – a huge month of volatility on global indices.

2 – The average monthly range for 2018 is 222-points with September’s 231-point aggressive decline almost exactly the mean of the calendar year.

Hence, if we press the buy button in earnest around the 5975 level it will be 232-points below the monthly high, from a statistical perspective an ideal time to stand up and buy a market that will undoubtedly be looking awful at the time.

MM intends to take profit on its 5% holding in the BetaShares Bear ETF into current weakness in the ASX200 – we may go slightly earlier so we can concentrate on opportunities within individual stocks – remember the Baron Rothschild quote yesterday.

NB In my years of investing in the local market I’ve noticed the ASX200 very often reaches a meaningful low the day after the US has a particularly bad day, which has not really occurred yet.

ASX200 Chart

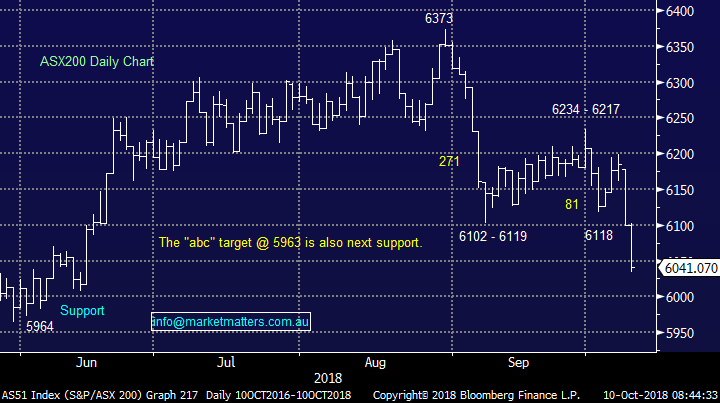

CSL (Ltd) $188.21 and Cochlear Ltd (COH) $191.88

There is method in our madness as we stepped up and bought both CSL and COH below $190 yesterday, just as flagged / planned over recent weeks. These are stocks that are very hard to buy / chase into strength as ~3% daily swings are common due to low liquidity, it’s much easier to be brave and buy volume into weakness when sellers climb over each other to find the exits i.e. buy the panic selling.

While the valuations of these 2 high performers is not cheap being in the range of 30x Est P/E for 2019 , they’re clearly far more palatable than just a few weeks ago.

We are looking at the 2 purchases of 3% as almost being one purchase of 6% hence we are unlikely to average unless we see substantial weakness in either of the two without any deterioration in the businesses themselves.

CSL Ltd (CSL) Chart

Cochlear (COH) Chart

Five goliath International / global players.

Today we have selected 5 global goliath stocks that led world markets higher over recent years to briefly search for any clues as to how the land lies for equities in general moving into 2019 and beyond.

1 Apple Inc (AAPL) $US226.87

Apple remains bullish and a stock that we like into weakness.

A period of consolidation feels due but the surprises are still likely to be with the trend i.e. up.

MM is currently a buyer of Apple around the $US205 area.

Apple Inc (AAPL) US Chart

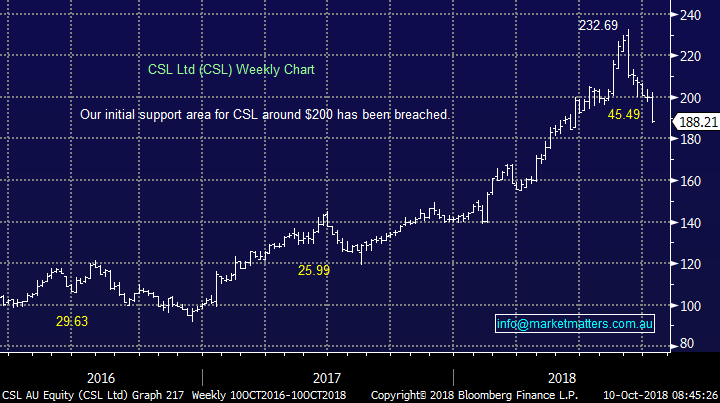

2 Amazon.com Inc (AMZN) $US1870

Amazon has enjoyed a fantastic run since 2016 and its bullish trend remains firmly intact longer term.

A period of consolidation feels underway but the online retailer has already fulfilled ~70% of the pullback we had been expecting.

MM likes AMZN around the $US1800 area, now less than 4% away.

Amazon.com Inc (AMZN) Chart

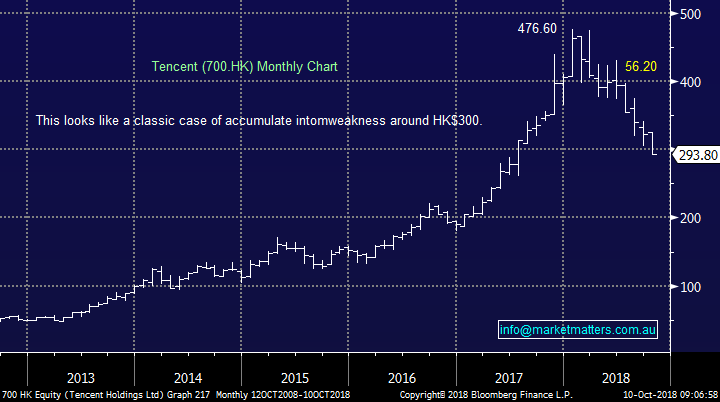

3 Tencent HK (700 HK) $293.80HKD

Tencent has already fallen further than we anticipated as everything emerging markets /China facing has been thrown into the “sin bin”.

We are happy accumulators around 300HKD but now initially only targeting a 15-20% bounce.

Tencent HK (700 HK) Chart

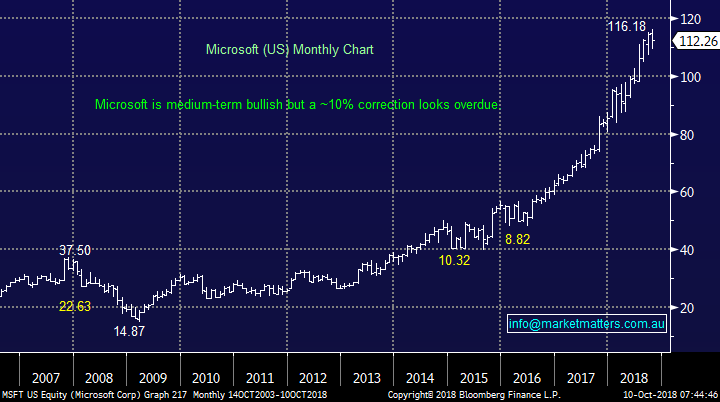

4 Microsoft Corp (MSFT) $US112.26

MSFT is another US stock which has enjoyed an amazing rally and while a 10% correction would not surprise / feels overdue it will hardly register on the chart below.

MM currently likes MSFT into weakness around the $US100 area.

Microsoft Corp (MSFT) Chart

5 Samsung Electronics (005930 KS) 44950KRW

South Koreas Samsung looks excellent value at current levels and adds weight to our current liking for the emerging markets indices.

MM likes Samsung after its 24% correction.

Samsung Electronics (005930 KS) Chart

Overall the main theme remains buy into weakness, not panic. This coincides with our thoughts around fund managers sitting on record levels of cash, most of it recently pulled from emerging markets.

The US primarily tech based stocks look good buying into weakness but not into strength – the huge overweight exposure by fund managers can easily lead to a sharp correction, just as we’ve witnessed locally by the likes of CSL and COH.

MM Growth Portfolio

Secondly a quick update on our thoughts around our Growth Portfolio as volatility within the Australian market increases with the psychological 6000 area looming fast.

1 Its basically time to take profit on our $US BetaShares ETF and Betashares ASX200 Bear positions taking our overall cash position up to 15%.

2 IEM iShares ETF – we are now looking to increase our exposure from 3 to 5% i.e. spend 2%.

3 Westpac (WBC) – we are looking to increase our exposure from 5 to 7% below $27, ideally close to $26.50 i.e. spend another 2%.

4. Buy CIMIC (CIM) around $48, another 2-3% lower, likely 5% purchase.

5. Janus Henderson add to position under $35 or new sector buy of Perpetual (PPT) under $38 (we do already own in the Income Portfolio)

6. Buy ASX Ltd (ASX) under $60 – likely 3%.

There are a number of other stocks on our radar as discussed over recent days / weeks but the above feel most likely to be accumulated over the next 24-48 hours.

Conclusion

While we continue to believe the current longest bull market in history is very mature we don’t believe its time to throw in the towel, more a case of buy weakness & sell strength – sounds easy!

MM still likes some of the main US players into further weakness implying to us the market will again make fresh all-time highs into 2019.

We anticipate further rejigging of the MM Growth Portfolio over coming days, see the latest brief outline above.

Overseas Indices

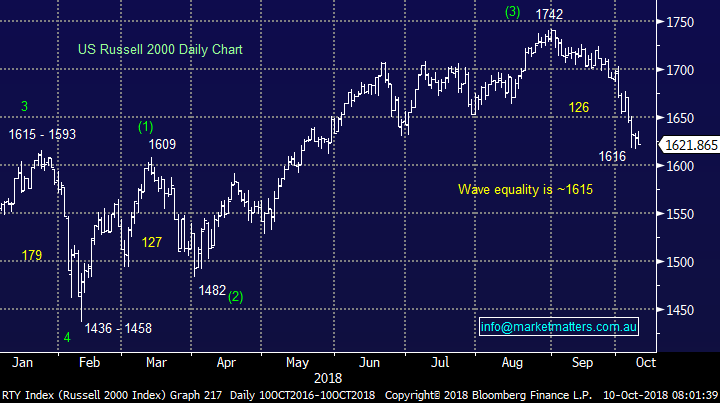

No change, the US Russell 2000 small cap index has hit our ~7% correction target and while the decline does not feel totally finished a close below 1590 is required to turn us bearish.

US Russell 2000 Chart

Again no major change with our ideal retracement targets still around 5% lower.

German DAX Chart

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.