Keeping our finger on the pulse of current volatility (CIM, CWY, JHG)

The action was pretty mixed yesterday on the local share market and while the ASX200 finally closed up almost +0.3%, it would have been easy for an investor to be either euphoric, or dejected, depending on their holdings. The banks were again the most influential group of stocks on a day where the activity was mainly on a stock, not sector level as reporting season kicks off.

At MM we have been close to pulling the “buy trigger” on both Evolution Mining (EVN) and OZ Minerals (OZL) over recent days but decided that considering our view of the current market position it was not the time to run the gauntlet of reporting season, potentially a good decision with EVN -4.4% but OZL +2.6% on the day – it would have been a tough day in the office if we’d bought the wrong one!

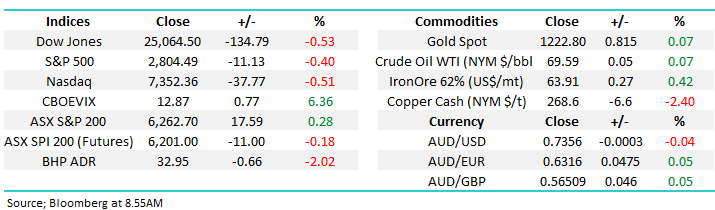

- MM is overall neutral the ASX200 with a close below 6140 required to seriously concern us but importantly we remain in “patient sell mode”.

Equity markets continue to ignore looming risks primarily from Donald Trump’s unpredictability and the Fed raising interest rates. Today we read an excellent piece in Livewire by Hamish Douglass of Magellan (MFG), in our opinion a very smart guy! Our summary of the article would be - he believes there’s a 50-50 chance of a 20-30% correction in stocks before next Christmas due to US bond yields rallying too fast, potentially caused by a blowout in wage pressures.

NB At MM we believe its nearer an 80% chance that a large correction will unfold hence we are very reticent to increase our equity exposure unless the risk / reward is irresistible.

US Stocks closed down around -0.5% overnight following further controversial comments by President Trump, this time challenging the Fed’s logic for raising interest – shame its 101 economics!

Today’s report is going to look at some areas of the market where volatility is increasing, an overall theme we believe will continue considering markets are in a late cycle bull market for many assets while interest rates are starting to rise.

ASX200 Chart

1 Updating the $US and its repercussions.

Following on from yesterday’s report at around midnight we saw the $US make fresh highs for 2018, sending the $A tumbling close to 73.2c.

- On balance, we now believe it’s time for a rest in the $US’s advance and MM is strongly considering taking a profit in our $US ETF position.

NB This is not a huge profit but adding a few % return to a, effective cash holding definitely helps the P&L at years end i.e. adding value / alpha.

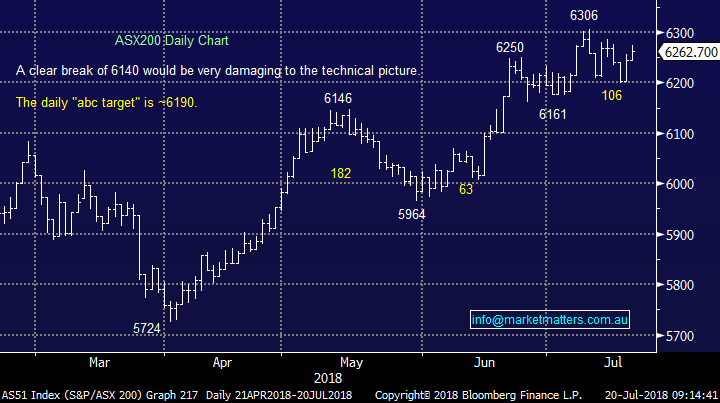

While the $US surged last night “doctor copper” followed its inverse relationship and fell well over 3% at one stage, making fresh lows for 2018 down almost 20% in just 6-weeks.

- MM is still considering buying OZ Minerals today but from a risk / reward perspective we would want the stock nearer ~$9 – this is clearly an “active” play.

NB You see below we are not fans of OZL’s 20% revenue stream from gold at this point in time which may keep us on the sidelines.

Interestingly the correlation between the $A and copper is almost perfect and its only since 2017 that the based metal has started outperforming the $A. When the $A was here in 2017 copper was well over 10% lower.

- Hence the correlation suggests that either copper falls, or the $A rallies moving forward with the combination of the two of course a possibility.

NB this correlation explains why any buying of copper related stocks will be extremely fussy on entry.

Copper v $A Chart

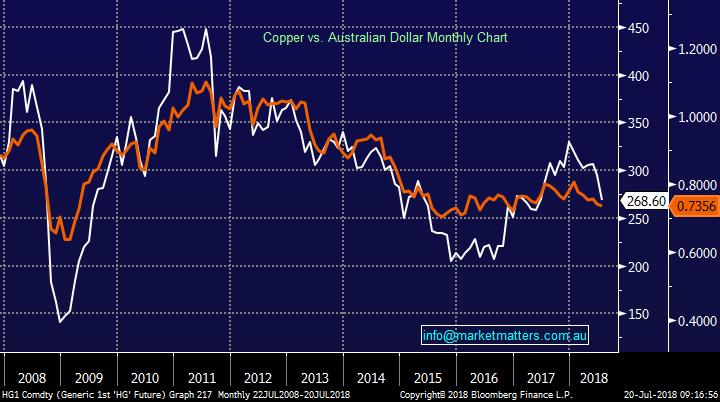

Yesterday most of our gold sector was whacked pretty hard e.g. Newcrest Mining (NCM) -1.2%, Northern Star (NST) -2.9% and Evolution Mining (EVN) -4.4% following an average report.

At MM we are concerned over the health of this sector with gold in $A terms threatening to end its over decade long bull market in which time the local gold stocks have soared while their global counterparts have tracked sideways.

- MM is now likely to avoid gold stocks for at least the short-term.

Gold in $A Chart

2 The US yield curve.

The potential for an inverted US yield curve has many market players on high alert i.e. when US 2-year bond yields surpass their 10-year equivalents its usually the precursor for a recession – they are now less than 0.25% apart.

- This looming inversion ties in with Hamish Douglass’s concerns and we believe it’s actually likely to be self-fulfilling.

We believe if the yield curve continues its contraction it will eventually become the straw that breaks the camel’s back of this 9-year equity bull market.

US 2-year & 10-year bond yields Chart

3 Should we chase any of the recent high flyers?

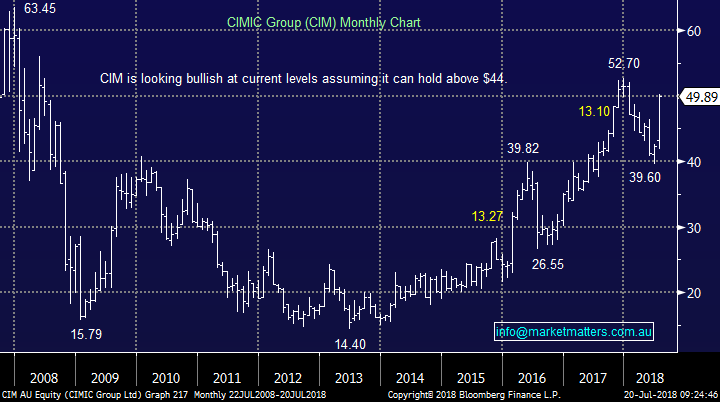

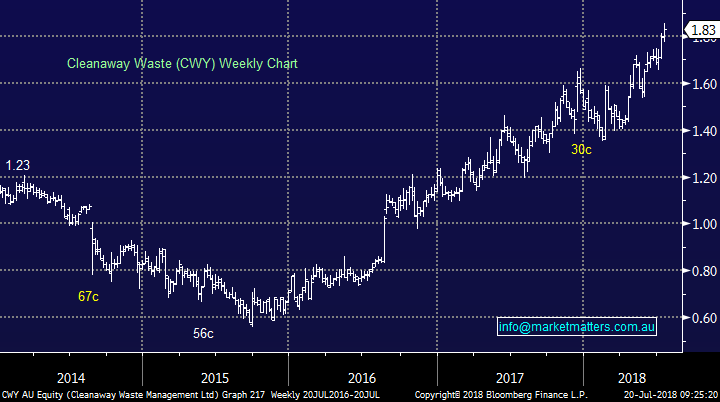

The best performing stocks in the ASX200 over the last 5-days are Cimic Group (CIM) +17.7% and Cleanaway Waste (CWY) +4.3% - a big difference in moves!

Our current thoughts on these 2 inform stocks:

- Cimic Group (CIM) $49.89 – We are bullish while it can hold above $44 targeting around $55, unfortunately after yesterday’s surge not exciting risk / reward.

- Cleanaway Waste (CWY) $1.83 – We like the stock technically and fundamentally but its current valuation of 34x feels too rich hence worth watching into a pullback. There is a lot going on in the waster management space at present from a regulatory which makes it a harder place to invest in the short term.

Neither of CIM or CWY are exciting at current levels but worth watching in case they have a short-term pullback.

Cimic Group (CIM) Chart

Cleanaway Waste (CWY) Chart

4 Are any MM stocks close to our sell levels?

The one stock that currently stands out to us is Janus Henderson (JHG) which has been causing us some angst for most of 2018 but the stock has recovered over 5% during the last week.

- MM is currently looking to sell our JHG around the $44.50-45 level.

Janus Henderson (JHG) Chart

Conclusion (s)

We remain nervous around stocks but the pieces of the puzzle to become fully bearish are not yet in place hence our caution to initiate fresh long positions.

- MM is likely to take profit on its BetaShares $US ETF during trade today

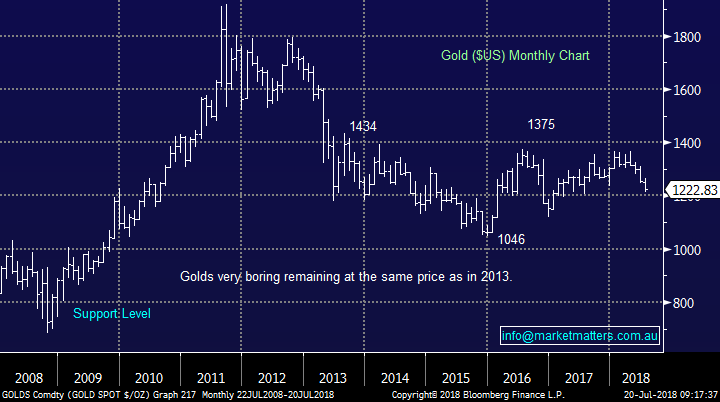

Global markets

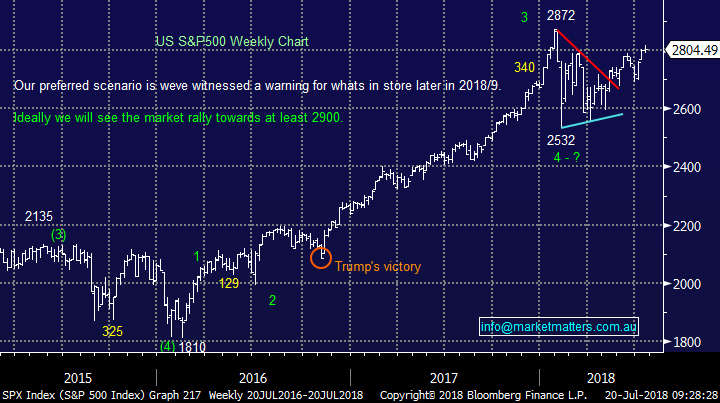

The US market continues to feel like it’s on a Trump inspired rollercoaster, last night the S&P500 slipped -0.4% after his comments around the Fed raising interest rates – feels like he wants control of everything!

US S&P500 Chart

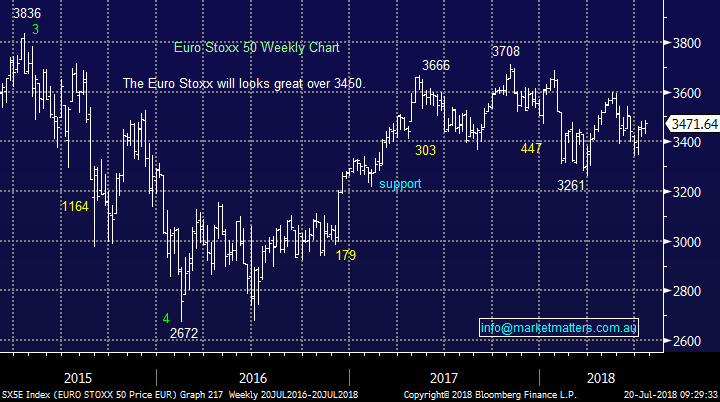

European stocks also slipped lower overnight in sympathy with the US and in the short-term another 1-2% lower would not surprise.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· Concerns over global growth and some mixed US quarterly earnings weighed on both equity and commodity markets overnight with the Dow 134 points weaker (-0.5%) as financials notably gave back some of their recent gains.

· The copper price in particular - a barometer for global growth - hit a 12 month low as base metals retreated once again on fears of growing trade tensions impacting growth. The EU trade commissioner said the EU is preparing a list of US goods they could target in response to US import taxes on European cars. On Wednesday, the EU also slapped a 4.3bn euro fine for anti-trust behaviour on Google - a move which prompted President Trump to tweet “they truly have taken advantage of the US but not for long!”

· BHP is expected to underperform the broader market this morning after ending its US session down 2.02% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open with little change this morning above the 6260 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here