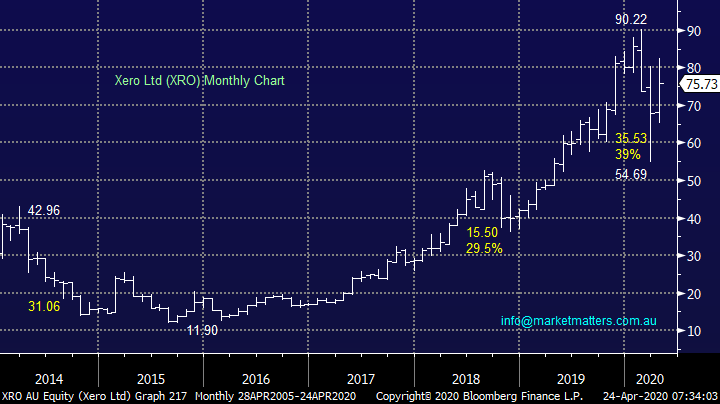

“Keep it simple stupid” (KISS) in today’s uncertain environment (STO, EHL, JNJ US, XRO, TNE, NXT, TTD US, AMZN US)

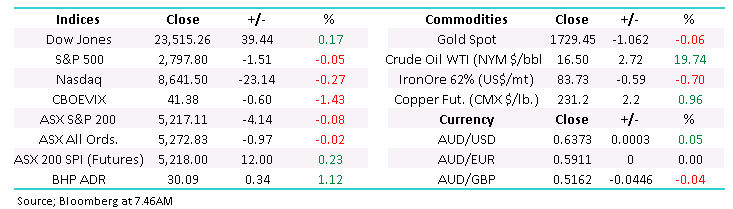

The ASX200 must have read our report yesterday morning as it ignored another big swing on Wall Street, in our opinion we’re not running our own race but more a case of leading global equities which makes sense seeing as we’re the first major index to open each day. Thursday was effectively a reverse of Wednesday as we opened strongly only to drift all day to finally close down just 4-points. On the sector level it was noticeable mean reversion of one of the markets most entrenched trends as Healthcare fell -2% while Oil & Materials rallied +2.2%, of course one day doesn’t make a summer but it does tie in with our reference in MM’s International Report on Wednesday.

“This morning we’ve again seen how well the ASX has “called” overseas stocks as the Dow bounced 2% but don’t assume, we’ll rally strongly today!” – MM Thursday morning report.

Overall, I felt the coronavirus news was mixed yesterday and it probably helped the ASX to an unconvincing conclusion:

1 – Australia now only has 76 reported deaths from COVID-19 not a huge number considering we lost ~160,000 people for various reasons in 2019. What this really illustrates is how successfully we have dealt with the pandemic so far.

2 – The States and Federal government are rolling out plans to cautiously return to work as the balance between containing the virus and financial strain continues.

3 – China, the original virus epicentre, has started to increase quarantine rules primarily because of secondary infections being brought in by citizens from Russia. Hence, we don’t anticipate international travel restrictions to be significantly reduced in 2020.

It feels that overseas holidays may be “on ice” until well into 2021, the only tourism exposure I could consider today could be domestic.

Markets can be fickle at the best of times, let alone through a global pandemic. By the close of Wednesday I was frustrated to see 3 stocks MM is considering CSL Ltd (CSL), Appen (APX) and Cochlear (COH) all reverse up on the day but yesterday the best of the bunch fell by -1.4% illustrating how this current market still appears likely to give both buyers and sellers opportunities as long as they’re prepared i.e. “Plan your trade & trade your plan!”.

MM remains bullish equities medium-term and hence in net “buy mode”.

ASX200 Index Chart

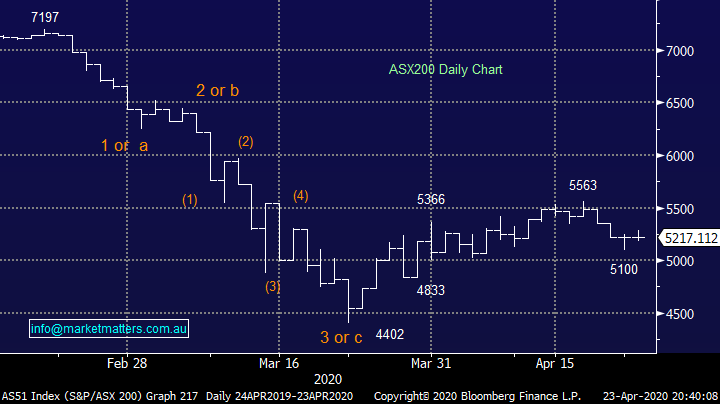

We touched on the Santos quarterly update in our PM Report and “Direct from the Desk” yesterday with a definite conclusion that we were happy, as was the market which sent the stock up almost 7%. The company is striving to reduce its cost of production down from an existing ~$US25/barrel, clearly important if oil were to remain at todays deflated prices into 2021 however at this stage with 70% of their production through 2020 hedged closer to $US40 they look solid to us, especially considering our bullish view on crude from current prices.

MM remains bullish STO with an initial target ~30% higher.

Santos (STO) Chart

Earth moving equipment leasor Emeco Holdings (EHL) was upgraded by Goldman Sachs yesterday to “a buy with a price target of $1.30”, good news for our position in the MM Growth Portfolio as the stock popped +14%. The recovery in EHL since the dark days of March has been dramatic and we will continue to assess it carefully into further strength.

Our initial target for EHL is 10-15% higher.

Emeco Holdings (EHL) Chart

Overnight US stocks were largely unchanged, its feels like a long time since I typed that! Our preference remains for more downside short-term with an ideal target ~3% lower, a touch micro I know but the below pattern from the Weekend Report has worked so far.

Overnight we saw equity markets largely ignore awful economic data showing they are forward looking and are net fairly optimistic:

1 – US Jobless Claims have reached a previously unimaginable 26.5 million while new home sales fell by over 15%.

2 – The European PMI (Purchasing Managers Index) came in at the lowest in history with Europe’s economy now looking set to contract by almost 8% per quarter. The UK is experiencing its worst economic downturn in centuries, BREXIT’s timing may prove interesting.

MM remains bullish the US S&P500 targeting the 2700 as an ideal risk / reward buying area.

US S&P500 Index Chart

5 stocks to let investors sleep.

Arguably there’s never been a better time to own a portfolio of quality companies that have cash on the balance sheet and a business largely insulated from the uncertainties during the COVID-19 pandemic. However, as we showed earlier with EHL the largest gains can be enjoyed from stocks that have been oversold during periods of market panic although these of course require some excellent dexterity of market timing plus a degree of luck. An optimum portfolio weighting comes down to an individual investors risk appetite but we stick with our view that this remains a time to have a smaller number of recovery stocks in a portfolio as the virus looks highly likely to claim further corporate causalities i.e. Virgin will be the first of a number.

In the US overnight the world’s largest healthcare stock Johnson & Johnson (JNJ) made fresh all-time highs, this month its continued an amazing record / tradition of increasing its dividend for a whopping 57 consecutive years. The companies on track to yield 2.6% pa which is a solid number for the US market and obviously when compared to term deposits. The stocks still attractive from a risk / reward perspective with a 10% stop which is not too close in today’s environment.

I feel that JNJ is a perfect illustration that quality stocks that many might say are “too expensive” remain well positioned over the uncertain year ahead, especially when we consider the risk / reward side of the equation. Hence MM can often see ourselves increasing our market exposure through simply increasing existing holdings that have passed our fundamental and technical screens as opposed to moving too far up the risk curve into pastures new, although obviously we remain open-minded to all opportunities.

Today I have outlined 5 stocks that MM likes both locally and in the US which we can see ourselves buying in the next week or so – a relatively common theme over recent reports but we must be prepared if the market follows our anticipated path. Note I haven’t mentioned APX, CSL or COH again but they remain firmly on our radar. The common denominator is were looking for stocks who look poised to make fresh all-time highs like JNJ.

Johnson & Johnson (JNJ US) Chart

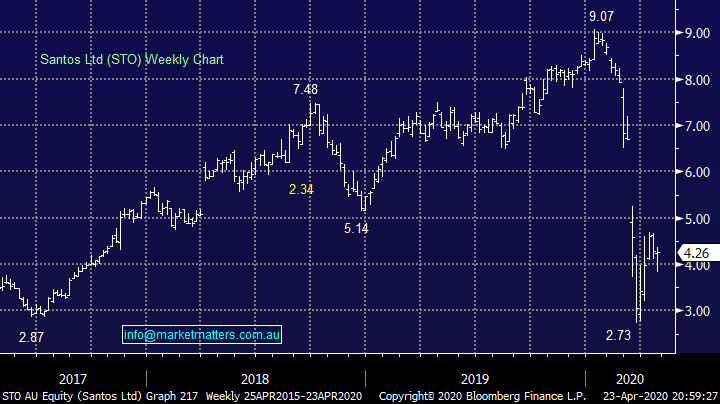

1 Xero (XRO) Ltd $75.73

We remain bullish and long accountancy software business Xero targeting a test of $100 in the foreseeable future, the stock ticks lots of boxes for MM not least its scalability. Xero is not traditionally cheap but its growing strongly with any impact from COVID-19 likely to be on the supportive side of the ledger plus there’s the small matter of over $100m cash buffer sitting on their balance sheet.

MM is considering increasing our XRO position a few % lower.

Xero Ltd (XRO) Chart

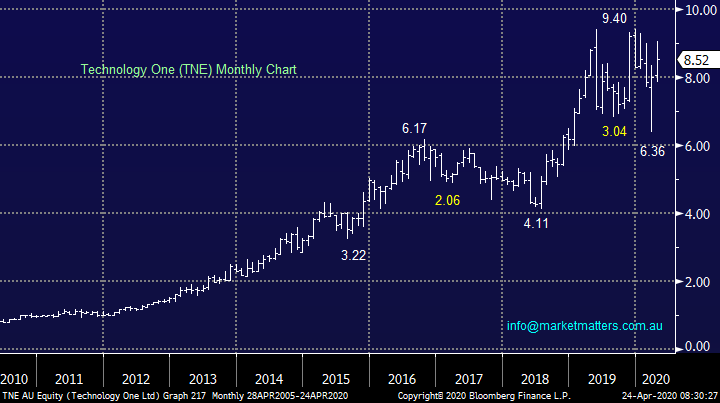

2 Technology One (TNE) $8.52

TNE has been discussed by MM a few times in 2020, the company delivers enterprise software to over 1200 companies and government operations. The Brisbane based company is now Australia’s largest stock in its field, importantly it has a relatively recession proof income stream, no debt plus cash on its balance sheet, what’s not to like in the current environment. MM can see ~20% upside in TNE.

In hindsight we’ve been a little slow accumulating TNE, but our upside target is still ~20% higher hence maintaining the attraction to MM.

MM likes TNE around $8.50.

Technology One (TNE) Chart

3 NEXTDC (NXT) $8.61

NEXTDC is excellently positioned to benefit from the WFH (work from home) trend that COVID-19 has jump started, we believe the workplace landscape will never be the same again. The company has evolved into Asia’s leading data centre business offering connectivity and content hubs which certainly is a boom area at present - also the company is building an infrastructure platform for the ever-expanding digital economy. The cloud boom should be NXT’s friend and they recently enjoyed strong demand for the company’s $672m capital raise to fund its accelerated expansion initiatives.

The capital raising was undertaken at $7.80 which looks to have provided an opportunity to buy this quality growth business at solid levels.

MM likes NXT into current weakness.

NEXTDC (NXT) Chart

4 Trade Desk (TTD US) $US253.97

One specific stock MM discussed in 2019 was advertising technology company Trade Desk (TTD US) its recovering extremely well since the March madness and although buying today might not look optimum timing to many if it’s going to fresh all-time highs who cares, our target is over 30% higher.

MM is bullish Trade Desk (TTD US).

Trade Desk (TTD US) Chart

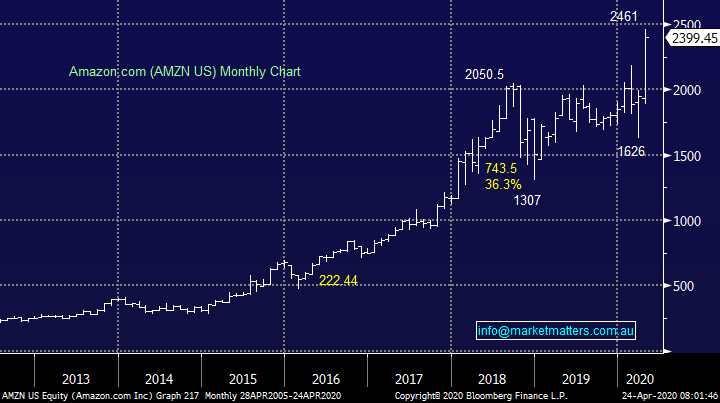

5 Amazon.com (AMZN US) $US2399.45

I deliberately left Amazon until last because it’s the perfect illustration of the strong getting stronger in today’s market, as stated were looking for stocks which appear well positioned to make fresh all-time highs.

Last week AMZN the largest global cloud & e-commerce company surged to fresh all-time highs, MM still believes this phenomenal story is a buy and we’re happy to chase strength here, especially on a relative basis.

MM is bullish AMZN.

Amazon.com (AMZN US) Chart

Conclusion :

MM likes all the 5 stocks looked at today as we crave holdings that remain well positioned to make fresh all-time highs, as opposed to loading up on too many recovery stories.

Overnight Market Matters Wrap

- The US equity markets closes with little change overnight with the Coronavirus and crude oil being the centre of attention.

- As the quest to find the vaccine asap remains across the globe, it was being reported overnight that a leading experimental drug was not successful

- On the energy front, crude oil rallied managing to settle above the US$16/bbl. handle

- The June SPI Futures is indicating the ASX 200 to open 26 points higher, towards the 5245 level this morning.

For our fallen, in remembrance of your service and sacrifice, Lest We Forget.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.