James Gerrish & Peter O’Connor discuss opportunities in the resource space (BHP, RIO, AWC, IGO, OZL)

Yesterday the ASX200 enjoyed another impressive rally with some large individual stock moves, mainly on the upside and most were from the beaten down ‘dogs’ as fund managers search for value in a market that has punched through 5900 and put on a quick 200 points to close at 6098. We suggested yesterday that the market may be due for some consolidation / a cooling off period and given the parabolic nature of the last few days we still hold that view. Interestingly the market now sits just 2.5% below it’s 10 year high, a level which we think will be broken, the only variable is when.

- Market Matters remains bullish the ASX200, initially targeting the 6250 area, or ~2.5% higher

ASX 200 Chart

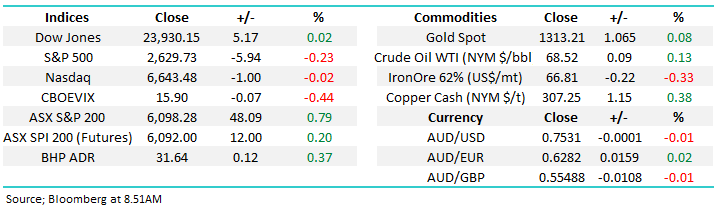

Overnight US stocks were mixed although resource companies were largely higher, our Futures market indicating a rise of 16 points on open this morning.

S&P 500 Chart

Yesterday I sat down with Peter O’Connor, our Resource Analyst at Shaw and Partners. According to Bloomberg rankings, Peter is the No 1 rated analyst for BHP, RIO, Alumina (AWC) and Independence (IGO) – so his views clearly hold weight. I speak with Peter almost daily on the rumblings in the resource space and I do draw from his depth of knowledge. At Market Matters we remain bullish the resources sector, however we remain active in that area of the market, but with an overall positive bias. We recently look profits in some of our holdings on the expectation that a rising US currency may apply some short term pressure on the sector, however when opportunities present themselves we’ll certainly take them, just as we did with Independence Group (IGO) earlier in the week.

Click on the Video below to view – about a 10minute video

Overnight Market Matters Wrap

· The DOW fell close to 400 points intraday before recovering off key technical levels with all major US indices ending its session with little change. The first day of US-China trade talks were positive, however there are no real expectations of any breakthrough agreements.

· The RBA statement of monetary policy will be released today, while US nonfarm payrolls and unemployment data will be closely watched tonight.

· Most metals on the LME were slightly lower, as was iron ore, while Brent crude oil rose 0.5%.

· The June SPI Futures is indicating the ASX 200 to open 16 points higher towards the 6115 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/05/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here