It feels like the Market is Finally Listening to Us

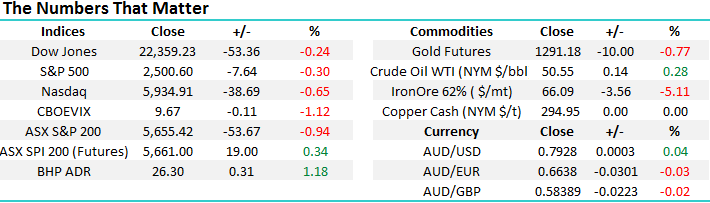

The Australian market came under significant pressure yesterday, falling almost 1% with the selling volume in the futures market around 30% above the daily average – usually a negative indicator. The ASX200 is actually now negative for 2017 before dividends, clearly illustrating investors need to be a little more active than over past years /decades. Those people that simply look at the Dow for an idea of how our market is likely to perform would have been shocked by the continuous selling / 54-point slump by local stocks, but it can be it can be easily explained when we consider the global picture:

1. The ASX200 is a very high yielding market in global terms. Hence over the last 8-10 years, our market has been a home for local and offshore investors chasing yield as global interest rates have been effectively zero and often negative!

2. When bond yields / interest rates start to increase like now, Australian equities feel the weight of money withdrawing, leading to declining stock prices.

3. The “yield play” is the most vulnerable to this unwind e.g. Transurban (TCL), Sydney Airports (SYD), AGL Energy (AGL) and the Real Estate Sector, all of whom underperformed yesterday.

Interest rates go up in a reflationary environment, an investment theme we currently like although the noticeable lack of inflation is certainly disappointing central banks at present. Importantly, where should we be invested in a rising interest rate / inflation environment:

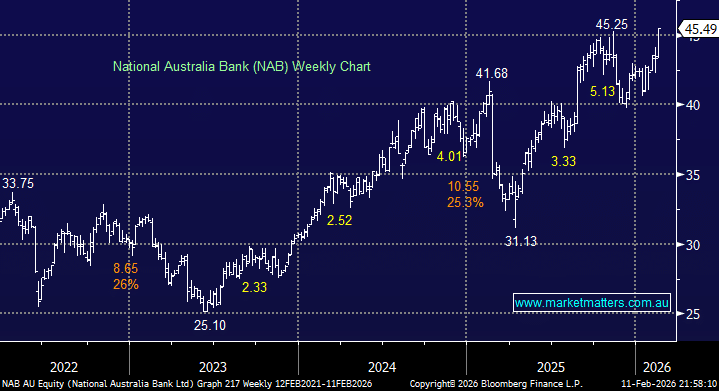

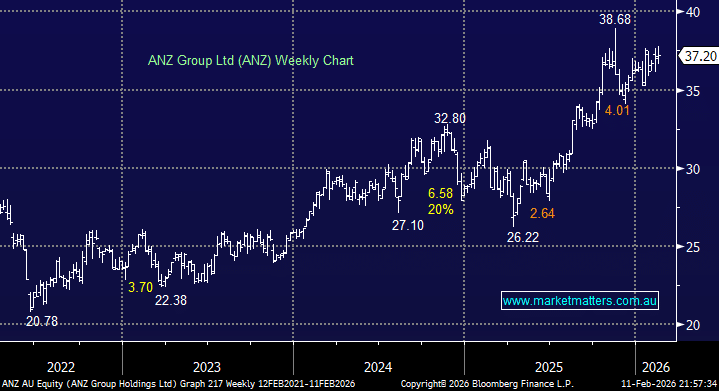

1. Banks should improve if interest rates rally in a controlled manner – we already have 40% of the MM Growth Portfolio allocated accordingly, probably enough, although we may increase slightly with an additional 2.5% into NAB the current standout.

2. Resources should benefit from this theme and we arelikely to be buyers of any further decent weakness.

3. The greatest “value add” is probably to simply avoid stocks that will be in the firing line of rising interest rates i.e. the bond proxies / “yield play” stocks.

We believe overseas investors have been / are pulling money from our shores, which ties in with the aggressive selling in the futures market. Considering how long interest rates have been low, it’s likely this will not be over in just a few days, but considering we are sitting on over 20% cash, this is music to our ears at MM. We still see the ASX200 falling towards 5500 over the coming weeks i.e. only ~2.5% lower.

Today we are going to update subscribers on parts of our “Shopping List” following the recent weakness in local stocks.

ASX200 Weekly Chart

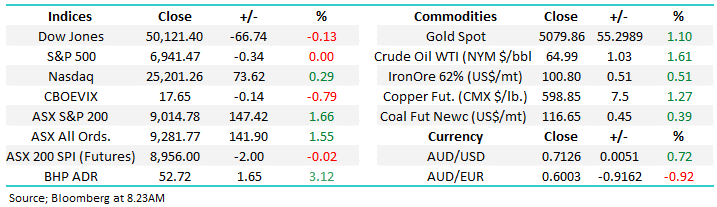

Global Indices

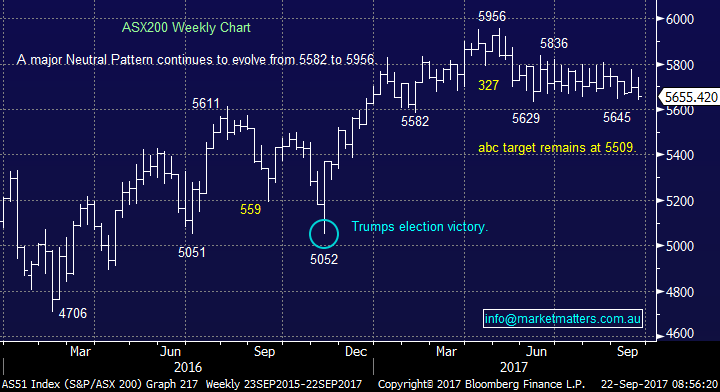

US Stocks

US equities slipped last night, generating excellent risk / reward sell signals primarily in the tech. NASDAQ. It feels to us like a sharp 200-point down day for the Dow is approaching fast.

Overall there is no change to our short-term outlook for US stocks where we are still targeting a ~6-7% correction for the NASDAQ.

US NASDAQ Weekly Chart

Emerging Markets

The Emerging Markets Index has been on a stellar run since 2016, very similar to our highly correlated resources sector. However, a 5% correction now feels overdue, we will be watching this index as a potential indicator for the direction of stocks like BHP and RIO.

Emerging Markets (EEM.US) Monthly Chart

Shopping List

Resources

Iron Ore has corrected 17.5% in just a few weeks and suddenly the press is talking about a bear market, Fortescue not surprisingly has plummeted almost 15%. We liquidated our exposure to the resources sectors into the strength earlier this month. The levels where we currently see value emerging and are likely to commence accumulating are:

BHP under $25.50, RIO under $64 and OZL under $7.50. We also still like AWC as a business but no weakness has yet unfolded.

BHP Billiton (BHP) Weekly Chart

RIO Tinto (RIO) Weekly Chart

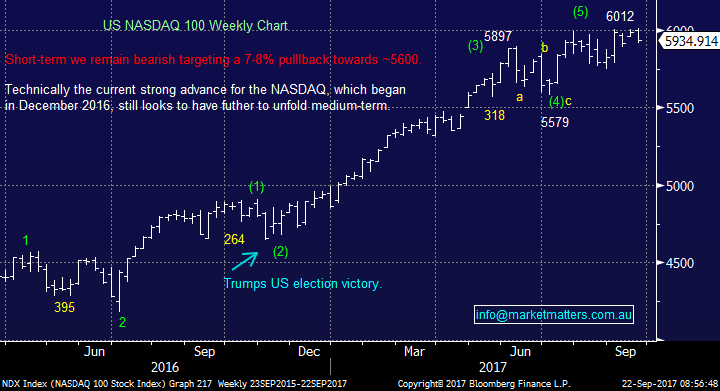

Golds

We remain keen to buy gold stocks into a pullback but the seasonality for gold shows very pronounced weakness usually unfolds into December, hence there is no hurry.

Gold ETF (GDX) Seasonality Chart

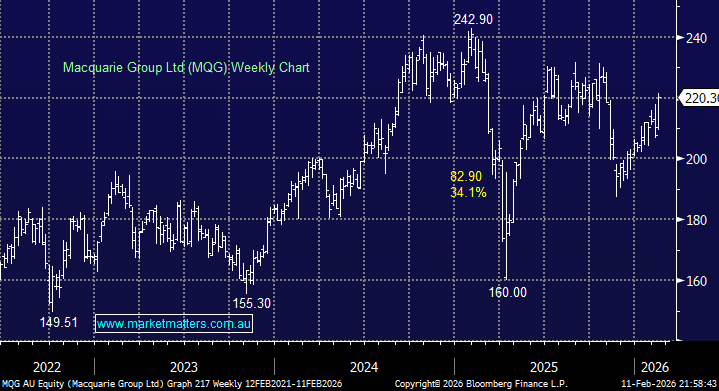

Banks

We are happy with our exposure, but may consider adding 2.5% to our NAB holding ~$30.70.

Financials

No change, we are still to start accumulating Challenger (CGF) under $12.

Challenger (CGF) Monthly Chart

Telco’s

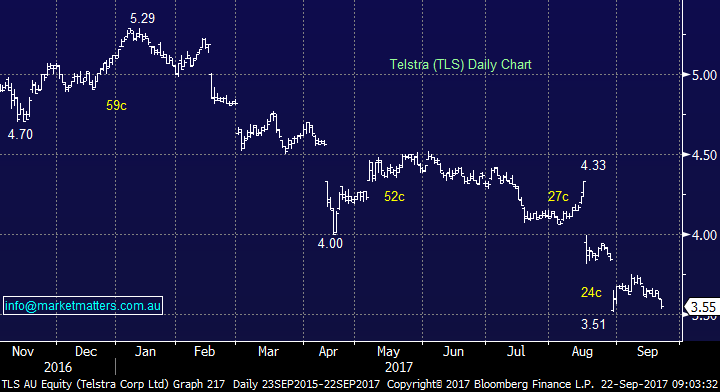

While Telstra (TLS) has clearly been a “yield play” in the past today we see it more as a recovery story hence we will still follow our plan to buy arguably the markets most unpopular stock into weakness between $3.45 and $3.50.

Telstra (TLS) Daily Chart

Consumer Services

We remain keen on Aristocrat (ALL) under $20 where it touched for just a few seconds yesterday.

Aristocrat Leisure (ALL) Weekly Chart

Conclusion (s)

We are in “Buy Mode” having moved to ~20% cash within both the MM Growth Portfolio / Income Portfolio into recent market / sector strength. Obviously, the above target levels maybe tweaked depending on market conditions but they a great guide for now, also we may accumulate / scale into weakness if we believe it may have further to unfold.

*Watch for alerts*

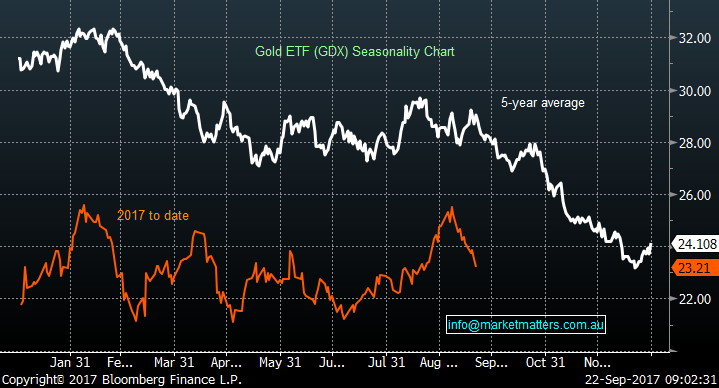

Overnight Market Matters Wrap

· The US equity indices sold off overnight as investors reduce their risk exposure after digesting further on comments from the US Fed overnight with its anticipation of a rampant tapering program underway.

· Iron Ore lost 5.11% overnight (-17% in the 4 weeks), attributed to potential tightening in US monetary policy and Chinese efforts to reduce pollution. However, BHP is expected to outperform the broader market after rallying an equivalent of 1.18% in the US from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 14 points higher, towards the 5675 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here