Is this the final tourism washout? (QAN, WEB, FLT, CTD, SYD, SGR)

The ASX200 put in a particularly stellar performance on Monday to close unchanged even as Victoria moved into Stage 4 lockdown, the damage to both the state and countries’ economies is huge and growing by the day – yesterday saw some economists suggest the RBA will cut rates today from 0.25% to 0.1%, that’s almost in half although personally I cannot see how that will solve the virus led mounting economic catastrophe. Victoria’s shutdown assuming it only lasts 4-weeks, is set to hit the countries GDP by ~0.3% although considering how the ripple effect is flowing across the country, I feel this may be optimistic.

The missing ingredient is confidence, I believe a rate cut will have zero effect on this problem, people are scarred by the statistics and experience beholding Victoria and until we see a global vaccine its hard to comprehend how businesses will hire & spend with confidence as wave 2 is clearly becoming far worse than March / Aprils initial impact. I felt Scott Morrison dealt with the initial outbreak as well as could be expected, even his biggest detractors haven’t been particularly vocal about what else should have been implemented. However, this time around feels tougher especially for a government that’s attempting to be vaguely fiscally prudent, after all this could be wave 2 of say 5, far from unrealistic without a vaccine.

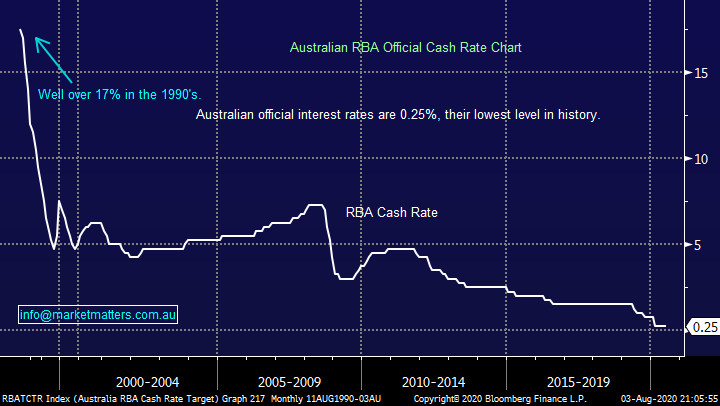

However as investors we must all remain cognisant of the trend and since March its been up with a current sideways bias, remember what we said yesterday - “if the massive monetary & fiscal stimulus can hold financial markets together through the next few weeks then I have to agree with the colloquial phrase “shorts are for the beach””, stocks ignored bad news yesterday and are set to open with a bang today taking the index right back to the 6000 area!

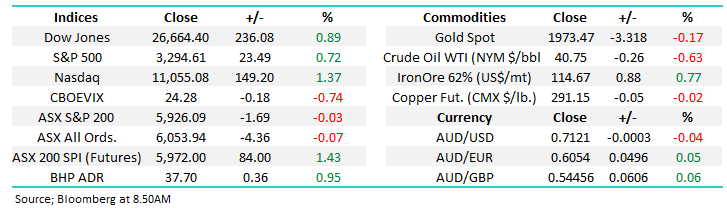

MM still believes interest rates will remain lower for longer.

RBA Official Cash Rate Chart

Yesterday the ASX200 recovered from an extremely shaky start bouncing over 1% to close unchanged, even the banks who endured a tough day closed well off their lows. The buying which commenced shortly after 10am was across the board with over half of the market finally closing up on the day. Stocks who are dependent on a strong and vibrant Australian economy struggled while those facing China and understandably healthcare performed strongly, this could mean revert in the coming weeks but we clearly need to see Victoria recover and NSW / QLD not suffer the same fate, plus of course there’s the potential for further well received stimulus.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

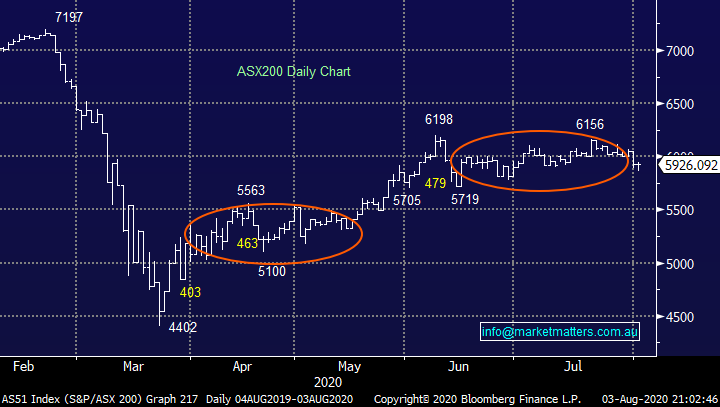

Overnight we saw a strong session for copper which usually bodes well for the global economy, this time around it might be more specifically about China and the anticipated mass global government stimulus on the horizon, either way it bodes well for copper and the resources sector. Technically we see another 4-6% upside before its time for a rest.

MM remains bullish and long the copper sector.

Copper ($US/lb) Chart

Overseas Indices & markets

US stocks continued to follow our anticipated playbook with the tech-based NASDAQ making all-time highs overnight, short-term we are now “less bullish” after Microsoft (MSFT US) and Apple (AAPL US) rallied strongly to lead the market towards our initial target. I’m sorry to sound repetitive but at this stage we see no reason to change our tune – “buy weakness, sell strength with a bullish bias”.

MM remains bullish US stocks medium-term.

US NASDAQ Index Chart

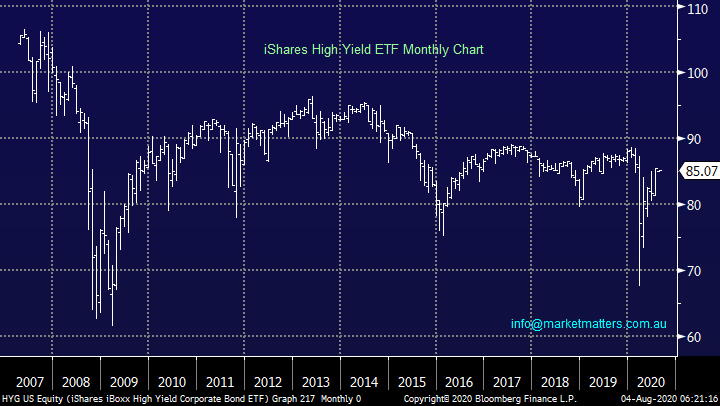

While companies have access to cheap money whether its used to strengthen balance sheets, expansion, acquisition or stock buybacks the net effect is the same, it equals a very strong back drop / tailwind for equities. A quick glance at the picture below illustrates that the cost of money for corporate America is almost at the same level as before the virus pandemic, while central banks keep pumping extremely cheap money into the system stocks look likely to defy their many detractors.

MM remains comfortable with the cost of $$ to US corporates.

iShares High Yield ETF (Junk Bonds) Chart

Are we witnessing the final “Tourism Washout”.

Yesterday we saw ongoing pronounced rotation away from an economic and travel / tourism recovery, very easy to comprehend in today’s environment. Today we’ve asked the simple question – is the sector becoming too pessimistic and bargains are to be had? Australia’s iconic / flagship airline QANTAS (QAN) has now fallen 36% from its post-March recovery high, whereas the index has only slipped ~4% typifying the pronounced underperformance in the travel / tourism sector.

Last night when I watched ABC’s Q&A I was horrified to see that 17 flights are arriving in Sydney today from Melbourne with passengers jumping into taxis, I’m sure this sits extremely uncomfortably with most residents of NSW. Professor Keryn Phelps described the borders as a leaky sieve personally I would call it inevitable death by a thousand cuts, at best. Without joining todays bandwagon in the press, just from the perspective of today’s report I can only see border restrictions and travel being tightened further before we see any light at the end of the tunnel.

As a business I am comfortable that QAN will survive and flourish into the future if at worst case supported by government assistance. However from an investment perspective the stock isn’t cheap enough from a risk / reward perspective - it’s more than $2bn capital raise at $3.65 is already under water and some might be considering bailing ship, we will be interested into panic selling but not here.

MM can see QAN test its March low.

QANTAS (QAN) Chart

Today I have briefly looked at 5 other struggling stocks in the sector to see if any opportunities may be looming on the horizon.

1 Webjet (WEB) $2.63.

On-line offering WEB has endured a truly awful 12-months and short-term it feels like it may get worse before it improves. The company raised capital after much effort back in April, at least It’s arguably over capitalised hopefully enabling it to remain solid through wave 2 of COVID-19. If we see a dip down towards $2 the risk / reward will become interesting to MM.

MM is neutral WEB at current levels.

Webjet (WEB) Chart

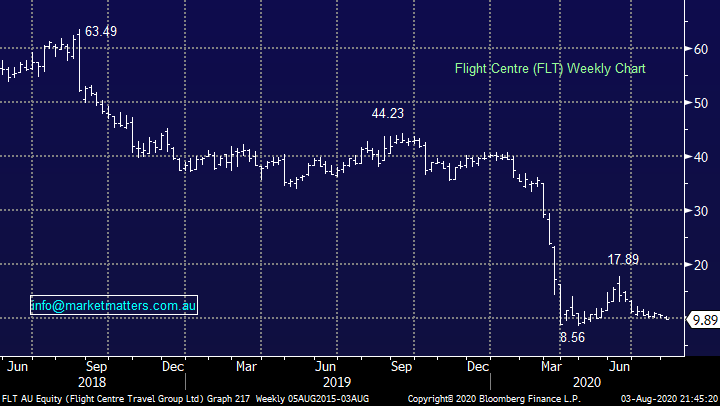

2 Flight Centre (FLT) $9.89

FLT is painting a very similar picture to the previous 2 stocks; it underwent a significant coronavirus necessitated capital raise at $7.20 which still looks good buying at today’s stock price. We like the general direction of the business as it looks to reduce its store footprint and lower operating expenses. The extra cash on hand puts FLT in a solid position well into 2021 but we cannot assume that things will have returned to levels of activity for the business to be turning a profit by then, talk of a return to the market cap in hand by FLT, or anyone else in the sector, might be enough to deliver the panic spike lower we would relish to accumulates a position in the sector.

MM wants to see FLT at least 10% lower before we consider any purchases.

MM is neutral / slightly bearish FLT.

Flight Centre (FLT) Chart

3 Corporate Travel (CTD) $8.18.

CTD was one of the few in the sector who didn’t need to raise capital to assist liquidity. The company benefits from a business model which has a small physical footprint with ~70% of its costs people related which helped with a rapid rebasing of the business. CTD has far greater exposure to the domestic market which will help when things improve but it may take a while, and importantly, we very much doubt the corporate travel market will get back to where it was before the pandemic led ‘Zoom’ movement.

We like the risk / reward into weakness but its hard to pinpoint where is an ideal time to start accumulating, hence its on watch for now.

MM is neutral CTD at current levels.

Corporate Travel (CTD) Chart

4 Sydney Airports (SYD) $5.19.

We have touched on SYD in a few notes recently, with special consideration because it resides in our Income Portfolio. There’s no real change to our thoughts, a retest of 2020 lows would not surprise but we would be buyers as opposed to sellers into such an eventuality. In 2020 the company raised $850m in bank debt as opposed to issuing capital which bodes well when a recovery does unfold because there has been no shareholder dilution (yet!).

MM is neutral SYD short-term.

Sydney Airports (SYD) Chart

5 Star Entertainment (SGR) $2.51.

Wherever you look in the tourism sector the pictures the same – an aggressive sell-off in March, a strong rally fuelled by over optimism followed by a painful reality check as virus uncertainty continues. We like SGR into ongoing weakness, but it feels to 50-50 just here, if Sydney goes into lockdown, we might get an enticing sell-off.

MM is neutral SGR short-term.

Star Entertainment (SGR) Chart

Conclusion

MM is very interested in the Australian Tourism Sector if we see an aggressive decline from current levels but at current prices the risk / reward is not compelling, stocks may stop falling but they could easily tread water for a year, or more. Fundamentally they will be an enticing story into an improved virus outlook but when will this occur is the obvious million-dollar question.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.