Is the tech correction complete? (VUK, APX, MP1, V US, AMZN US, QQQ US, ETPMAG)

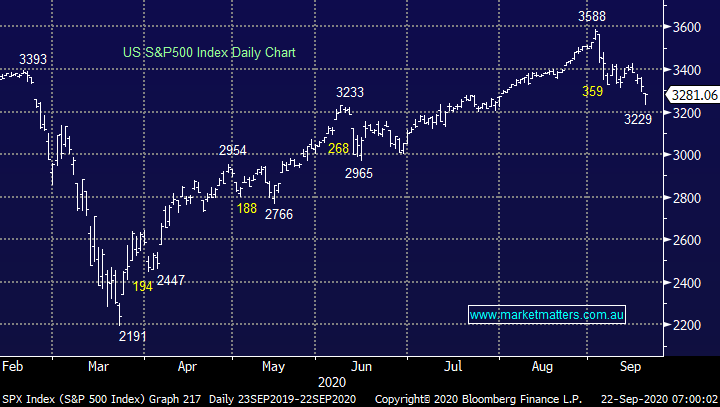

The ASX200 sold off on Monday from around midday as the US futures started heading lower in tandem with global equities who VUbegan embracing the deteriorating COVID numbers with a vengeance. The regressing infection rates being witnessed overseas have sent the local market down towards its 3-month low, just as everybody including ourselves was thinking about the best stocks for an economic recovery – so much for our improving numbers in Victoria and NSW.

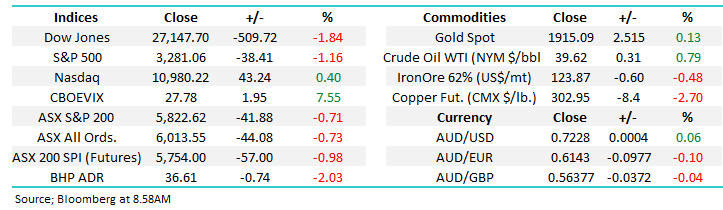

The US has seen ~200,000 deaths from COVID-19 and almost 7-months into the pandemic they are still seeing almost 35,000 new cases every day. In Europe as they head into Autumn things are worsening at a scary rate, France has now reached an almost daily record of 13,000 cases and the UK is starting to go back into low level lockdown with almost 4,000 new cases recorded yesterday, the graph below illustrates a clear second wave is unfolding putting pressure on Boris Johnson and his government.

We’ve said before on a number of occasions that Australia and the rest of the world would be continually going in and out of lockdown without a vaccine, I hate being right on this one. However, what has surprised me is the market’s reaction, it obviously had become far too optimistic on the virus during the Northern hemispheres summer i.e. out of sight out of mind. Compounding the negativity around the virus is the US election, the polls are saying a worsening pandemic is bad news for President Trump, and Biden is definitely not good for stocks in theory.

We’re no scientists at MM hence rather than 2nd guess the pandemic were going to focus on where we want to be invested in order to sleep at night!

Confirmed Cases of COVID-19 in the UK Chart

When a degree of panic surfaces in stocks we like to at least consult the statistics and technical picture as we weigh up if it’s time to fade parts of the selling. One stock which caught my eye yesterday for all the wrong reasons was Virgin Money (VUK) which plunged over -9% on the day as investors become increasingly concerned around earnings for the UK bank as the country looks destined for a second lockdown. Our preferred roadmap is the increasing downward momentum in the stock will lead to another test of $1 before the stock might become interesting i.e. we have no interest catching this falling knife and it suggests the concerns around the world’s economy grinding to second halt isn’t going to vanish overnight.

In this case VUK is not a quality business we are happy to accumulate into weakness, only herd like panic selling will spike our interest.

MM remains bearish VUK.

Virgin Money (VUK) Chart

The local index looks destined to test major support this morning following declines overseas but all the action is evolving under the hood on the stock / sector level. While we remain bullish resources through 2021 after enjoying a period of outperformance we feel some reversion is now likely after the NASDAQ’s aggressive pullback i.e. we think tech might be the place to be through October as investors remember how well it performed on a relative basis through March & April. To clarify a few quick thoughts moving forward:

1 – MM expects stocks to recover strongly into October but fresh 2020 highs might be too much to hope for.

2 – Q4 will be choppy and probably a tough time for stocks hence “buy weakness and sell strength” remains our mantra until further notice.

3 – After major outperformance in recent weeks we feel tech is poised to play catch up, remember monthly trends are unfolding almost in days at the moment.

MM remains bullish the ASX200 over the next month.

ASX200 Index Chart

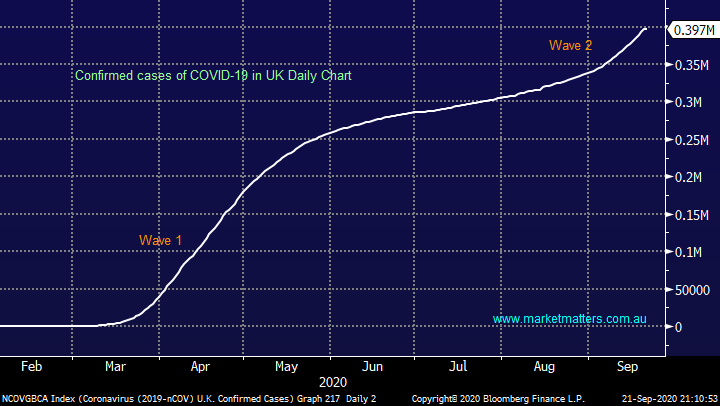

Artificial intelligence (AI) business APX has been on MM’s radar as a buy into weakness. The stock has now corrected ~30% after delivering weaker than expected guidance at their recent full year results. We feel APX can rally strongly now its only trading back on ~29x estimated earnings for 2022.

MM likes APX at current levels.

Appen Ltd (APX) Chart

Megaport is a provider of elasticity connectivity and network services to over 300 centres globally. In other words, it enhances its customers’ ability to better connect to networks and cloud-based systems on a global scale – a business built for current times! In August the company produced another great result, the “network as a service” provider delivered a 66% increase in revenue to $58m while recurring revenue increased ~10%.

We believe the company is well positioned for ongoing strong growth as demand for its services increases in-line with the cloud computing boom.

MM likes MP1 at today’s levels.

Megaport Ltd (MP1) Chart

Given the fairly aggressive moves overseas last night, firstly on the downside before a strong recovery played out from the lows, we have brought forward our internationally focussed report to Tuesday, instead of Wednesday this week.

Overseas markets

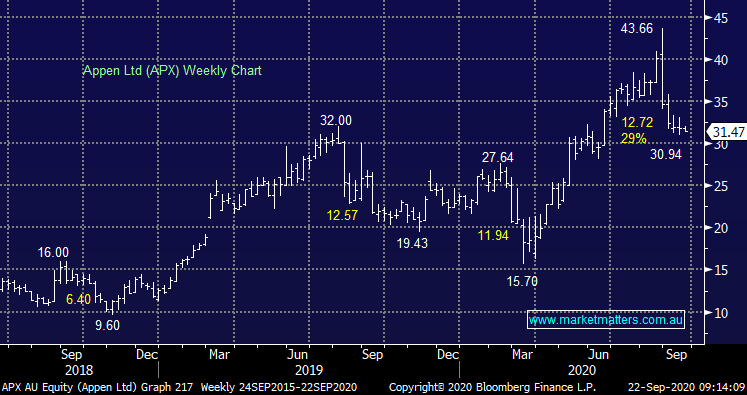

Overnight the S&P500 rallied +1.6% from its lows regaining more than half of its losses in the process, its total correction this month is now exactly 10%, we are now bullish. The NASDAQ which led the whole decline has underperformed correcting -14.2% but last night it reversed to actually close up led by Apple (AAPL US) which finished up 3%. This is a great trigger in our opinion to go long US stocks, and tech in particular.

MM is bullish US stocks at current levels.

US S&P500 Index Chart

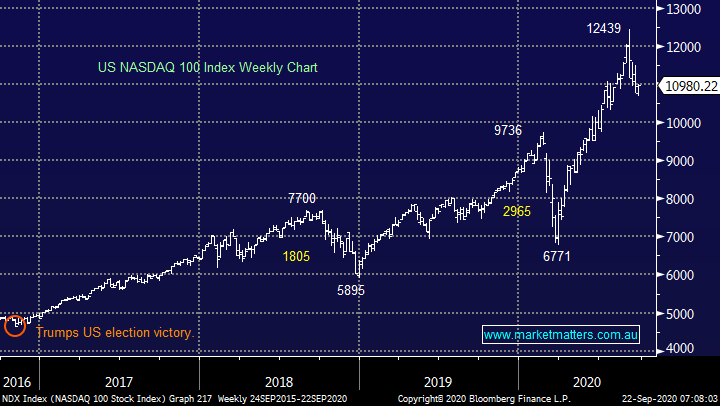

It might not feel like it but US tech closed on its weekly highs this morning, this is now a market we would like to be long both fundamentally and technically.

MM is now bullish US tech stocks short-term.

US NASDAQ Index Chart

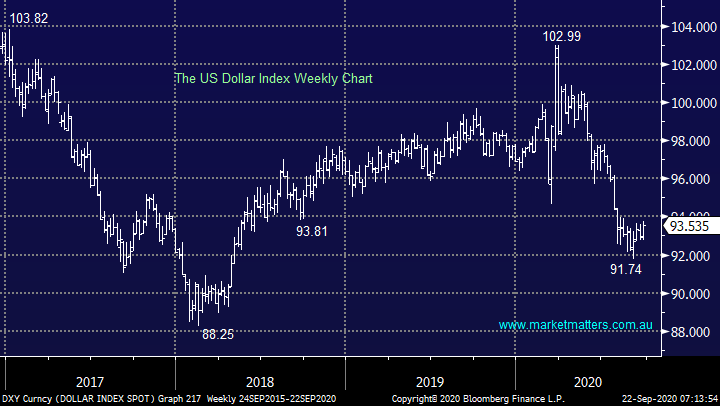

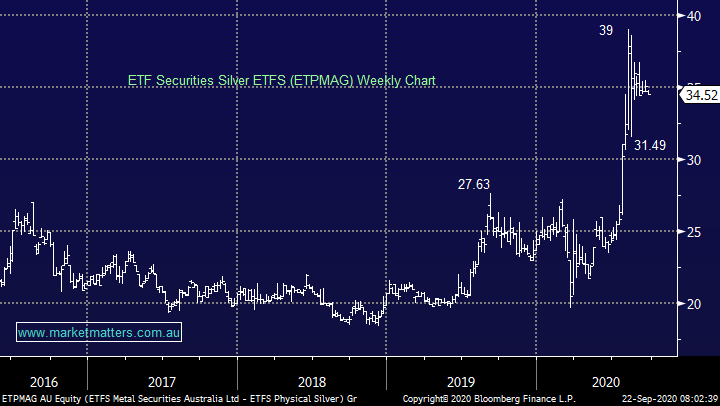

As risk assets have panicked over the last few sessions the $US has bounced back towards our targeted 94 regions sell zone. The subsequent sell-off in precious metals in particular is slowly approaching our buy zones but as we did with the NASDAQ, we still feel its worth being fussy in these volatile times.

MM remains bullish resources into weakness.

$US Index Chart

Silver ($US/oz) Chart

MM International Portfolio

MM continues to hold 6% of our International Portfolio in cash - MM International Portfolio: Click here

Today we have one switch that’s looking very appealing fitting our current view on both the buy and sell side – these are both alerts for the opening of markets tonight.

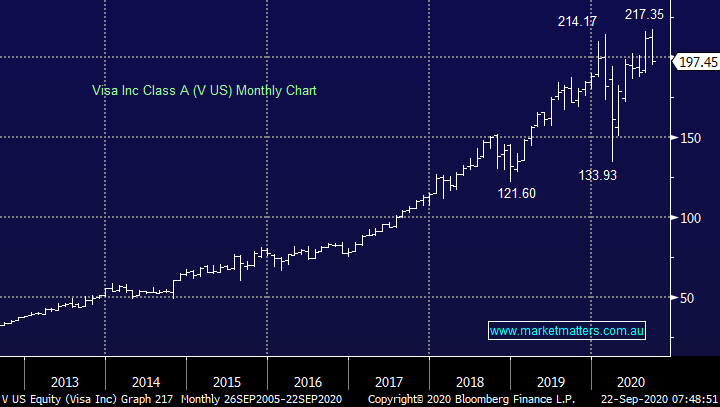

1 Visa Inc (V US) $UA197.45

The financials are obviously a concern as they struggle to embrace any good news. After failing from fresh highs this month were more comfortable being on the sidelines with regard to Visa (V US)

MM is considering taking a small loss on Visa under $US200.

Visa Inc (V US) Chart

2 Amazon (AMZN US) $US2960.47

After correcting over 19% AMZN looks great from a risk / reward perspective around last nights close - this is a business that MM has been looking for optimum levels to enter for a while.

MM is a buyer of AMZN at current levels.

Amazon (AMZN US) Chart

MM Global Macro ETF Portfolio

MM’s Global Macro Portfolios cash position remains at 19%: Click here

After watching markets evolve over the last week, we have the same 2 ideas on our radar but were looking to press at least one button tonight:

1 Invesco QQQ Trust (QQQ US) $US267.51

Following on from early comments around US tech we are looking to buy the QQQ ETF which tracks the NASDAQ on the opening tonight with a 10% allocation.

MM intends to buy the QQQ tonight.

Locally listed Nasdaq (long) ETFs include: NDQ (unleveraged) from Betashares & LMAZ (leveraged) from ETF Securities.

Invesco QQQ Trust (QQQ US) Chart

2 Silver ETFS (ETPMAG) $35.41

Again in line with previous comments we are sellers of precious metals into fresh 2020 highs and buyers back below $32.

MM is looking to take profit on our ETPMAG position above around $40 and buy below $32.

Silver ETFS (ETPMAG) Chart

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.