Is the healthcare sector looking vulnerable? (RHC, CSL,COH, SHL, RMD)

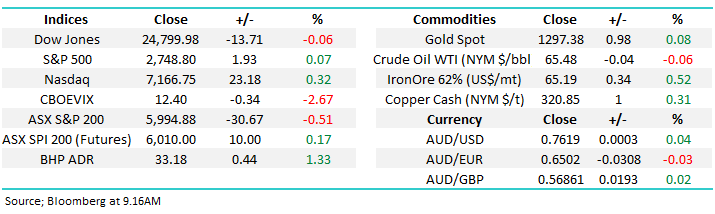

The futures market nailed it on Monday night calling the ASX200 down ~25-points even when the Dow was up 178-points – fund managers often adjust their market weightings through the futures market hence it’s a brave, or silly, person who “bets” against the leveraged financial instrument which effectively trades around the clock.

Within the market the energy, resources, real estate and healthcare sectors were all weak leaving CBA for change to try and support the index – the largest Australian company continued to bounce following its AUSTRAC settlement rallying 1%.

Overnight stocks were mixed with the US tech-based NASDAQ making a new all-time closing high while European indices generally struggled. Today the futures are calling the ASX200 to rally around 10-points with the resources looking to lead early strength – again back above 6000.

· Medium term MM remains mildly bullish targeting 6250 but the risk / reward is no longer compelling for the buyers. – we remain in “sell mode”.

Today’s report is going to focus on the popular healthcare sector as we question whether it’s time to take some money off the table in this high valuation sector which is up 12.2% for the year, compared to the ASX200 which is up 4.2%.

ASX200 Chart

Firstly, we consider the correlation between our healthcare sector and the $A, potentially relevant as the majority of the stocks have strong offshore earnings – our conclusion is simple – the AUD has had very little influence recently with perhaps the exception of some day to day spikes i.e. since 2015 the $A has edged higher which is theoretically negative for our healthcare sector that theme has been shrugged off by the sector’s bullish vibe. While the $A clearly has an impact on earnings of these companies it’s not been a major driver of the respective stock prices.

Australian Healthcare sector v $A Chart

The ageing population in most major countries plus the huge swelling middle class in China is currently the driving force behind the sector - a significant tailwind that as a fundamental driver is unlikely to go away any time soon, the relevant thought here and now is how much is already baked into the cake in terms of share prices.

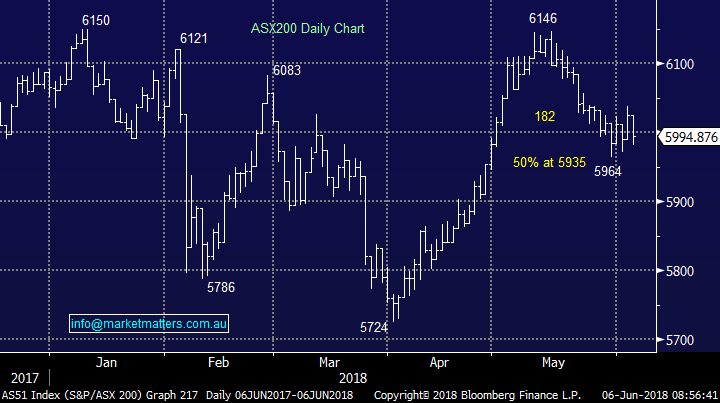

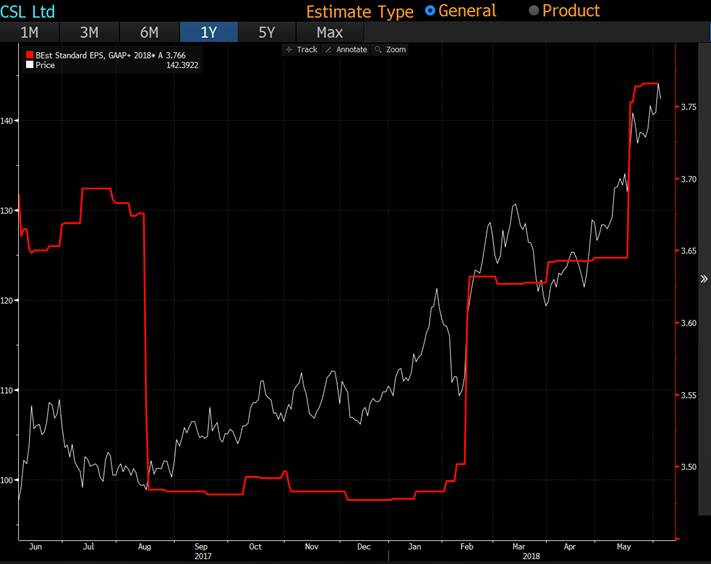

However, looking further afield rising inflation / bond yields is historically bad news for high P/E stocks including the healthcare sector on a relative performance basis and it’s the impact on high valuation stocks that triggered the idea for today’s report – remember the recent sell-offs in A2 Milk (A2M) and Treasury Wines (TWE).

At MM we continue to believe the multi-decade bear market in bond yields / inflation is behind us hence volatility / opportunities may increase in the healthcare sector i.e. don’t chase strength but consider weakness.

US 10-year bond yields Chart

Now let’s look at 5 of the leading healthcare stocks in Australia on an individual level.

1 Ramsay Healthcare (RHC) $58.10

We covered Ramsay Healthcare yesterday but felt it should be included again today following its continued weakness i.e. down another 3%. RHC is on 18.5x forward while yielding 2.4% fully franked – Healthscope which is under a takeover offer is trading on valuation of 23.1x 2019 earnings according to Bloomberg consensus. As suggested yesterday, over the past 5 years RHC has traded on an average PE of 29x.

The tailwinds are clear in the healthcare space – well understood and acknowledged however the stock has failed to find any love for now being down over 30% over the last 2-years. The rising cost of private health insurance is probably the largest single factor with the greatest volume of people ever leaving the private health system last year.

RHC is a prime target for EOFY selling and we still have no interest at this stage in the stock unless it falls another 6-7%.

We should remember rival Healthscope (HSO) is the target of a $4.1bn takeover with Australian Super part of the bidding consortium hence it seems the longer terms drivers for the sector remain attractive to some.

- At MM we have been bearish RHC for well over a year targeting the $54-5 area which is now ~6% away – MM is a buyer of RHC around $55.

Ramsay Healthcare (RHC) Chart

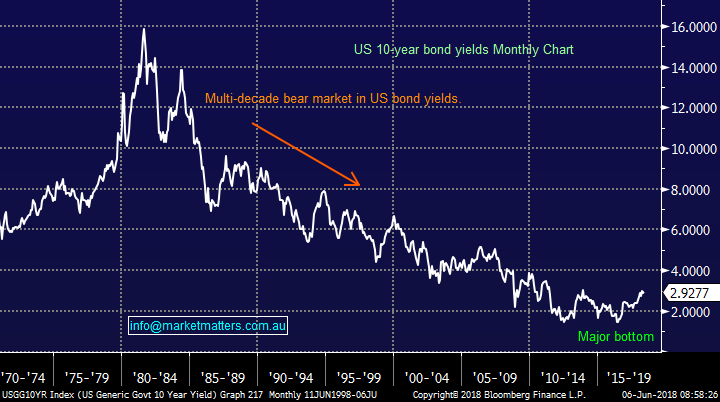

2 CSL Ltd (CSL) $186.94

CSL is one of the best large cap companies on the Australian market and following its recent profit upgrade and subsequent rally by the stock, it is trading on a P/E of 37.7x while yielding 1% unfranked. Looking are expected earnings, clearly momentum has been strong but the share price is now factoring in the known knowns!

CSL – Earnings expectation red & share price white

In May CSL announced an expected net profit after tax for 2018 financial year of around US1.7bn, an upgrade of 8% to previous guidance – what a difference to the likes of QBE! The company has enjoyed a bad flu season in the northern hemisphere, not a constant but certainly a reoccurring problem.

This impressive company is always expensive but it’s all relative when we consider both the management and stocks consistent performance.

· CSL has clearly outperformed our expectations and we will consider buying the next reasonable correction, around $160 looks attractive today.

CSL Ltd (CSL) Chart

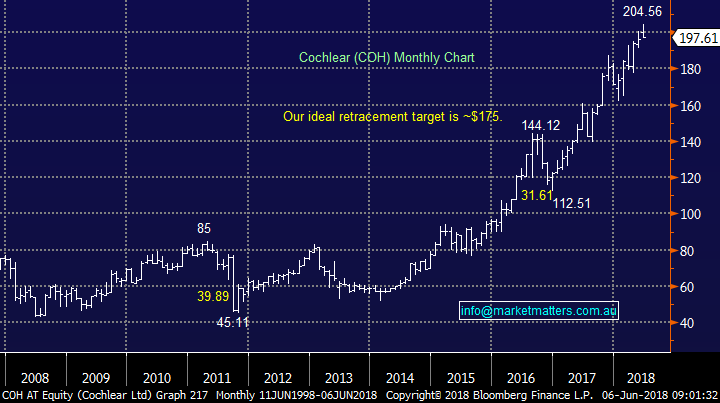

3 Cochlear (COH) $197.61

Cochlear has had an amazing year and is now trading on a forward PE of 45.7x while yielding 1.4% fully franked. The shares are clearly on the expensive side but the premium seems to be justified considering the stocks quality and potential growth.

COH is positioned well for an ageing population whose hearing will undoubtedly be failing and like most of its peers it prefers a weak $A – our view at MM moving forward.

So just like CSL we like COH but they key is where to buy a stock trading on the rich side which brings with it risks

· MM likes COH into weakness around $175, or over 10% lower.

Cochlear (COH) Chart

4 Sonic Healthcare (SHL) $23.59

This medical diagnostic company is trading on a noticeably cheaper valuation to both CSL and COH, with a PE of 21.2x while yielding 3.3% part franked. The company has had a few issues in Ireland but the stock clearly remains comfortable around its all-time highs.

Following its launch in the infamous 1987 SHL has become one of the largest pathology companies in the world generating excellent capital growth for its shareholders while paying a relatively high yield for the sector.

· Technically we feel SHL is looking tired and can easily see a 20% correction hence not for us at present.

Sonic Healthcare (SHL) Chart

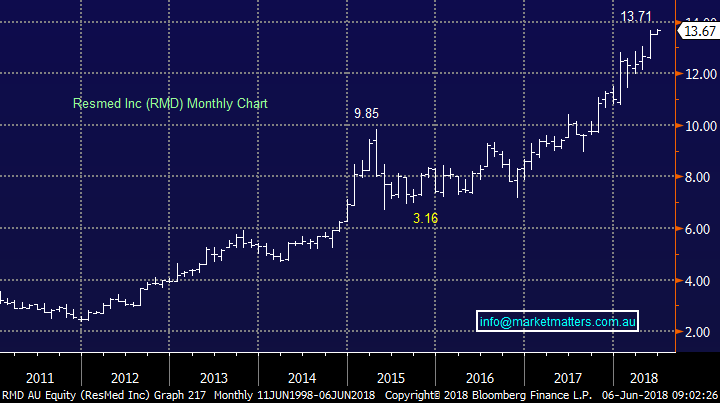

5 ResMed (RMD) $13.67

The sleep disorder company ResMed (RMD) is another Australian healthcare stock with excellent penetration into the US, its trading on a PE 29.82x and yield 1.3% unfranked.

Sales grew last year above 10% with net income on track to increase 25% in 2018 which reflects the relative strength of global economies – RMD’s revenue is over 60% from the Americas and over 25% from Europe.

RMD is another healthcare business we like into a pullback but would not be chasing at current levels.

· MM currently likes RMD below the $12 area.

ResMed (RMD) Chart

Conclusion

We have an interesting outlook for the Australian healthcare sector as rival forces face off against each other, the bullish ageing population plus growing Chinese middle-class v rising bond yields and inflation.

Our view is over the coming years there will be periods when the market focuses on the later causing meaningful pullbacks in the healthcare sector:

1 Our favourite 2 stocks are CSL~$160 and COH ~$175.

2 Our “ok” picks are RHC around $55 and RMD below $12.

3 We are not keen on SHL.

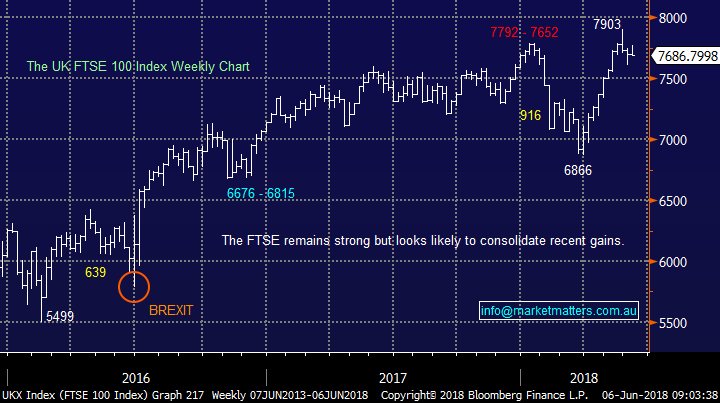

Overseas Indices

The tech-based NASDAQ is trading around its all-time high while the UK FTSE is threatening to fail after achieving its same milestone 2-weeks ago.

Hence, we are on alert for a decent market correction and are still looking to increase our cash position into EOFY.

US NASDAQ Chart

UK FTSE Chart

Overnight Market Matters Wrap

· Another night, another record level on the Nasdaq as the technology sector continued to power higher, taking the tech heavy index 0.4% higher to beat Monday’s record level, closing at 7637, with Apple, Amazon and Netflix leading the charge.

· Outside of technology strength, the broader market was however flat, with the Dow -0.1% and the S&P 500 +0.1%, despite stronger than expected economic numbers, after the non- manufacturing ISM rising to 58.6 in May, vs forecasts of 57.6.

· Commodities were firmer with the US oil benchmark WTI recovering 0.8%, iron ore +1.3% and copper again in demand, rallying 1.8% as supply/demand outlook tightens.

· Locally, investors will be watching for the Q3 GDP data at 11.30am which is expected to show growth for the period of around 1% (+2.9% annualised). The A$ lost some ground overnight , easing back 0.4% to close just above US76.10c, while the futures are pointing to a 0.4% stronger opening, with help from both BHP and RIO up in overnight trading.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/06/2018. 8.24AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here