Is the competition watchdog providing an opportunity in the Telco’s? (TLS, TPM, VOC, CNU, SPK, SDA)

The ASX200 struggled to close in positive territory yesterday finally managing a gain of just 8-points after being up almost 30-points at lunchtime following optimism that China was about to release stimulatory tax cuts. Overall it was a quiet day with 2 standouts being the continued weakness in the gold sector plus of course the Telcos being smashed which we will discuss later as the bulk of today’s report.

Local stocks are now only down 6-points for December, a pretty good result considering how we started the last month of 2018 – even the RBA have joined in with our short-term bullish Christmas carol as they weighed in with the following at a Sydney conference yesterday:

“Australian equities are not overvalued while they highlighted the outperformance of equities compared to other asset classes over time.” – RBA.

Unfortunately the sceptic in me is forced to question their timing, is it support for stocks or concern around Property. We have shown the below chart a few times in 2018 and it supports the RBA, especially when we include the huge transaction costs with Australia’s favourite form of investment.

In 2014 only 36% of the adult Australian population owned investments listed on the share market, around 20% less than in the US i.e. we do love our property but by definition a correction does become the path of most pain for the domestic economy with a lot of retail investors having all their eggs in one basket.

MM remains bullish the ASX200 short-term targeting a “Christmas rally” towards the 5900 area – still feels a long way off.

Overnight US stocks closed basically unchanged but even with BHP closing up 20c the SPI is calling the ASX200 to open down ~20-points.

MM is in “sell mode” but were still anticipating higher levels.

Today’s report is going to look at the Telcos who were yesterday battered by the competition watchdog e.g. TPG Telecom (TPM) -16.7% and Telstra (ASX: TLS) -3.3% - importantly we will give you a definitive opinion.

ASX200 Chart

The Emerging Markets still look on track for gains of ~5% where we plan to sell our IEM position, more positive rhetoric on US-China trade should help this unfold.

The Emerging markets iShares ETF (EEM) Chart

The Australian Telco’s

In a statement out of the blue on Thursday morning the Australian Competition and Consumer Competition (ACCC) chairman Rod Sims cast serious doubts over the future of the TPG Telecom / Vodafone $15bn merger when he warned of a "substantial lessening of competition". Mr Sims delayed his decision for three months = more uncertainty until March!

Many companies / sectors are finding it a hard “slog” doing business in Australia at present, hopefully we won’t turn away too much foreign interest just when we may need it the most.

The Telco Sector in Australia has been the ugly duckling for a while, and especially since 2017, as the below chart illustrates, but the TPG Telecom / Vodafone merger had added some much needed optimism to the sector hence we question is this announcement just a speed bump that offers opportunity or a reason to again give the sector a wide berth.

Today I have looked at all 6 members of the Telecommunication Services Sector in the ASX200.

ASX200 v The Australian Telco Sector Chart

1 Telstra (ASX: TLS) $2.93

Sector goliath TLS only slipped 3.3% lower yesterday and its now well over 10% below the euphoric levels we saw following the announced TPG Telecom / Vodafone merger. It was presumed that the merger would negate a mobile price war that would lead to lower margins for the sector and TLS. Undoubtedly the merger is positive for the industry hence any uncertainty is not good news short-term – guessing the regulatory outcome is fraught with danger, especially in today’s environment.

We like TLS and the sector moving forward but at what price. Boringly we are neutral TLS around todays $3, our view / plan has not materially changed:

MM is buyer of TLS around $2.50 and sellers ~$3.50 while happy holders collecting the current 7.5% fully franked yield at today’s price.

Telstra (ASX: TLS) Chart

2 TPG Telecom (ASX: TPM) $6.45

TPM was savaged yesterday finally closing down almost 17% as the stock has become a victim of its own tactics / strategy.

TPG Telecom become a potent disruptor and the ACCC clearly wants it to keep on disrupting i.e. aggressively priced mobile plans e.g. an unlimited data plan that was free for the first six months, and just $10 a month after that.

As expected TPM has acknowledged the ACCC’s statement of issues and advised that it “remains confident that the necessary regulatory approvals and other conditions precedent can be completed to enable completion of the merger in the first half of 2019.” – as expected Vodafone has echoed this statement as well. Certainly an example to take profit when its on the table in todays choppy market, the question again is clearly what now?

Looking at the sector performance over the past few years shows how competitive it’s been for the providers – it’s hard to see how the ACCC can suggest a significant lessening in competition through a Vodafone / TPG tie up given the dominance (still) of Telstra . As suggested above however, second guessing a regulator is a dangerous past time.

From a trading risk / reward perspective TPM looks good value but we are neutral the stock, especially considering our TLS holding – we’re unlikely to be a buyer here.

MM is neutral TPM.

TPG Telecom (ASX: TPM) Chart

3 Vocus (ASX: VOC) $3.33

As some of you know Vocus has been our nemesis, however the stock has actually become boring for much of 2018. Technically, it’s actually now slowly becoming one of the better looking chart patterns in the sector.

When Vocus released its latest full year results the company happily met its revenue and earnings guidance. Revenues were $1.9 billion while underlying EBITDA rose 7% to $360 million. However underlying NPAT for the year declined 17% to $127 million, but this actually represented a strong improvement after a poor first half when Vocus had reported NPAT of just $37.3 million i.e. improving momentum into 2019.

While the new management have been quietly beavering away, and kicking (some) goals, questions still remain over the VOC balance sheet i.e. will they or won’t they need to raise equity?

Technically, MM likes VOC as an aggressive play at current levels targeting ~$4.

Vocus (ASX: VOC) Chart

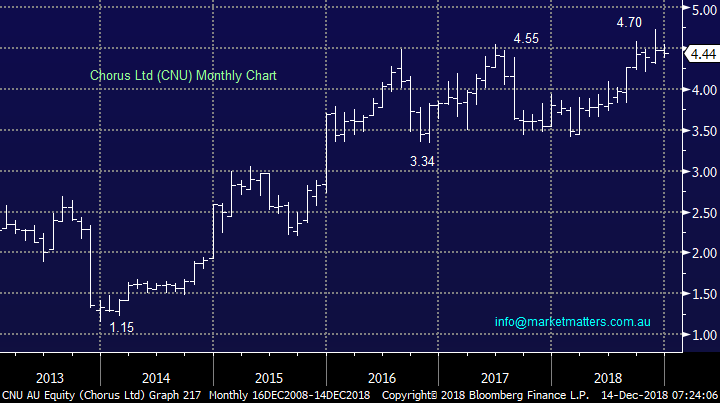

4 Chorus Ltd (ASX: CNU) $4.44

CNU is the monopoly owner of the copper Telco network in NZ, similar to TLS locally and its currently investing $6 billion to build New Zealand’s fibre telecommunications network. For those that hold L1 Capital (LSF), the listed hedge fund that raised a massive ~$1.3bn in April this year at $2.00 and now trades at $1.285, will already hold a position in CNU given L1 is their largest single shareholder with ~15% of the company (seems to be the only investment that’s doing well for them).

The stocks paying a 4.6% dividend yield and many players believe their dividend will grow at a better rate than other infrastructure / utility stocks over the years ahead.

MM likes CNU while it can hold above $4.40.

Chorus Ltd (ASX: CNU) Chart

5 Spark New Zealand (ASX: SPK) $4.07

SPK has also performed strongly along with CNU i.e. New Zealand Telecom has been the place to be over recent years over and above their Australian counterparts.

The stock is now yielding a healthy 5.68% while trading on a reasonable 18.4x Est P/E for 2019.

MM likes SPK will its above $3.80.

Spark New Zealand (ASX: SPK) Chart

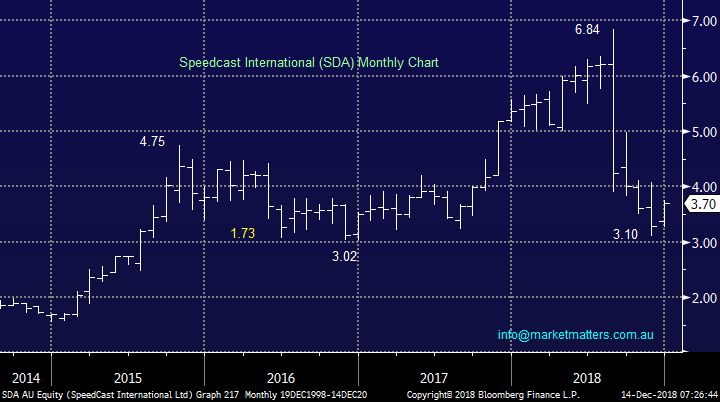

6 Speedcast International (ASX: SDA) $3.70.

Remote data business company SPK has had no fun in 2018 and the traders remain very bearish the company with well over 9% of the stock short sold.

MM still has no interest in SPK.

Speedcast International (ASX: SDA) Chart

Conclusion

MM has a mixed view on today’s Telco Sector:

1 Neutral at today’s levels TLS & TPM.

2 VOC looks good technically however they have some balance sheet risk

3 We like CNU & SPK as yield plays.

4 We have no interest in SDA.

5 We are bullish VOC at today’s levels.

Overseas Markets

Not surprisingly no change from yesterday, MM is short-term bullish targeting the 2800 area / 5-6% higher.

The S&P500 Chart

Overnight Market Matters Wrap

· A quiet session was experienced overnight, with little change seen across the major 3 indices.

· US President Trump said he was prepared to intervene in the Justice Department’s case against the CFO of Chinese telco giant Huawei to help smooth current trade talks, while China was also reported to have bought a large consignment of US soybeans for the first time in six months.

· Across the continent, the European markets eased a little in the wake of UK Prime Minister Theresa May surviving a leadership coup, while the ECB formally concluded its Euro 2.6 trillion “crisis era” bond purchase program. On the commodity markets, oil posted a solid recovery of 3.85% ahead of the pending OPEC supply cuts, iron ore was also stronger, while base metals and gold were steady.

· The December SPI Futures is indicating the ASX 200 to open 26 points lower, towards the 5635 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.