Is reporting season providing any bargains? – (BPT, RMD, QAN, CIM, DOW, NHF, APE)

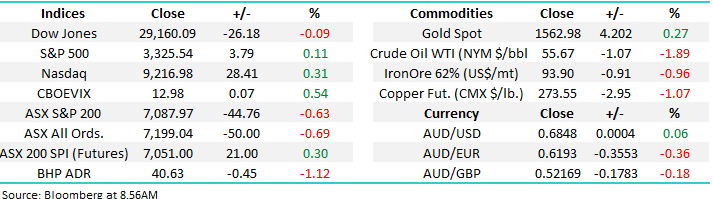

The ASX200 gave back a little ground yesterday experiencing its worst day in 2020, only the IT Sector managed to close positive while the Energy & Industrials bore the brunt of the selling, more on them later. It took a trilogy of bad news to drag the market lower but were still up 6% for the month, far from a shabby start to the new year and decade :

1 – Asian indices were again smacked as the footprint of the coronavirus increases, the Chinese government has now quarantined Wuhan, a city on the Yangtze river that many readers may not of heard of before the current outbreak, but it has a population of 11 million people, almost half of Australia! The reported death toll sits at 17 and around 600 people infected with Singapore and Vietnam joining the list of countries with confirmed cases - on Thursday China fell -2.75%, Hong Kong -1.5% and Japan -1%.

2 – A better than expected Australian Employment Report reduced some participants confidence for interest rate cuts through 2020 but although the index dropped swiftly after the data I feel many players are missing the point – the market is still pricing in at least 2 rate cuts by the RBA this year to move from 0.75% to 0.25%, however a firming $A appears to be the main / only dampener our market has experienced this year and yesterday it rallied strongly back towards 69c, we felt that was a large negative influence yesterday.

3 – Two ASX200 companies CIMIC (CIM) and Downer (DOW) received hefty downgrades sending both stocks spiralling almost 20% lower - remember we’ve previously warned subscribers to expect a few nasty surprises this reporting season because “interest rates are plunging towards zero as things are tough out there on the domestic front”.

However even though we can see similar news flow over the weeks ahead our best guess for the ASX200 moving forward has been tweaked to a consolidation pattern evolving between 7050 and 7250, similar to that experienced by the market from its mid-December high.

MM remains bullish the ASX200 while it holds above 6930.

Overnight US stocks were recovered from early losses to close around unchanged, the SPI is calling the ASX200 to open up around 20-points regaining half of yesterday losses.

Today we’ve looked at 5 stocks who’ve been unceremoniously thrown into the “naughty corner” over the last month, they’re all down ~10% or more since late December while the index has soared.

Due to Australia Day this Weekends Report will be delivered on Monday as opposed to Sunday, it might even assist on clarity with the coronavirus situation.

ASX200 Chart

The reaction to yesterday’s Employment Data made a few headlines but it hardly registered with the bond markets as can be seen by the closely followed local 3-years below. However Commonwealth Bank have now backed away from their call for a rate cut next month, in true Donald Trump fashion via a Tweet! The futures market has reduced the probability of a cut next month from 60% to 25% but confidence remains for cuts later in the year with the bush fires being cited as a driving factor by many economists.

MM remains bullish Australian 3’s i.e. bond yields lower.

Australian 3-years Bonds Chart

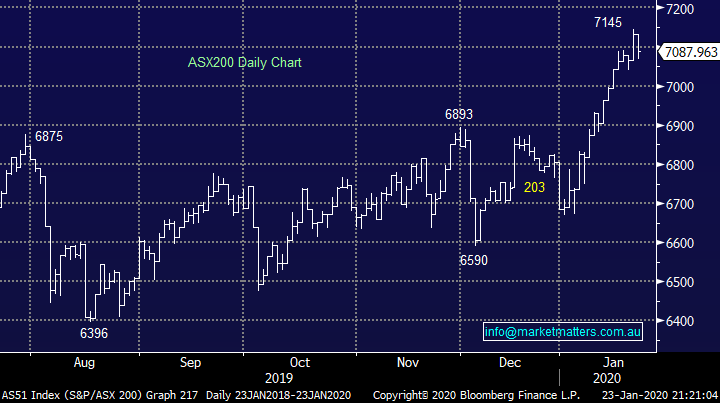

A quick glance at the $A shows it remains in the same tight range since May of last year, we are bullish the local currency which implies some eventual underperformance by the ASX200 this year but it’s a coin toss to identify when it may commence. Overnight it relinquished some of yesterday’s gains implying today we should perform better than many expect – let’s wait and see.

MM remains bullish the $A ultimately targeting the 80c region.

Australian Dollar (AUDUSD) Chart

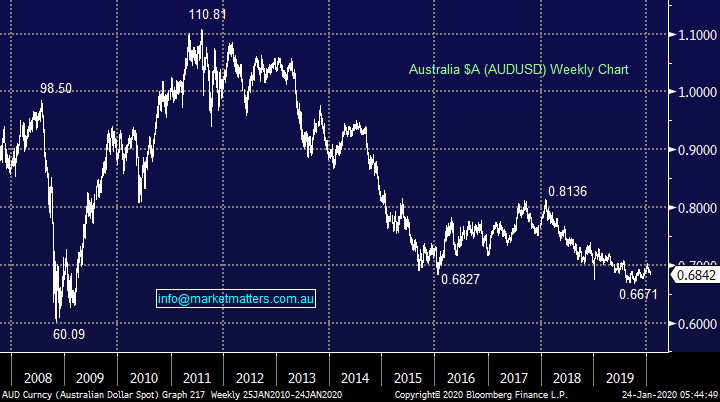

Unfortunately a stock we own in the MM Growth Portfolio was the 3rd worst performing stock yesterday , beach Petroleum (BPT) which fell -6% on the combination of a declining oil price and a broker downgrade. At MM we remain mildly bullish crude oil but not with the same degree of conviction as say the base metals hence our BPT position is being watched carefully – the coronavirus is currently weighing on the oil price in a major fashion, it fell another 2% overnight.

MM remains cautiously bullish BPT.

Beach Petroleum (BPT) Chart

Evaluating the 5 worse ASX200 stocks over the last month.

The ASX200 has rallied 6% so far in January but 10 stocks have fallen by over 5% with 6 of these tumbling closer to 10-18%, clearly a bad result during such a strong market. However this is nothing unusual over reporting season but it can throw up the occasional gem of an opportunity e.g. this time last year ResMed (RMD) plunged almost 24% before subsequently doubling over the next 12-months, this was one gem that MM managed to nail, at least on the buy side, we did take our $$ a bit too early in hindsight.

Overall stocks remain bullish in our opinion although the rally is maturing fairly quickly hence buying a stock that’s oversold after its report can be one way some value (alpha) can be added to a portfolio. Importantly I would estimate only 1 in 5 at best provide exciting returns a few months later, not quite a needle in a haystack but certainly caution is warranted as the odds are in favour of the sellers.

Today we have looked at 5 of the last months “dogs” to see if anything excites MM.

ResMed (RMD) Chart

1 QANTAS (QAN) $6.66

Australia’s flagship airline QANTAS (QAN) has fallen almost -10% over the last month with the coronavirus breakout certainly not helping matters – in 2003 when SARS broke out in Southern China / Hong Kong airline Cathay Pacific tumbled almost 30%, not an ideal precedent. Also for good measure the bushfires have started hindering the numbers of international travellers arriving on our shores – down 0.4% in December.

With the press reporting that holiday makers have been cancelling trips to Oz following the scary global coverage of our bushfires the picture for 2020 is not particularly rosy, especially after stocks soared over the last 5-years, the risk / reward is unappealing to MM at this stage.

Technically QAN is negative with ~15% downside feeling likely.

MM is bearish QAN

QANTAS (QAN) Chart

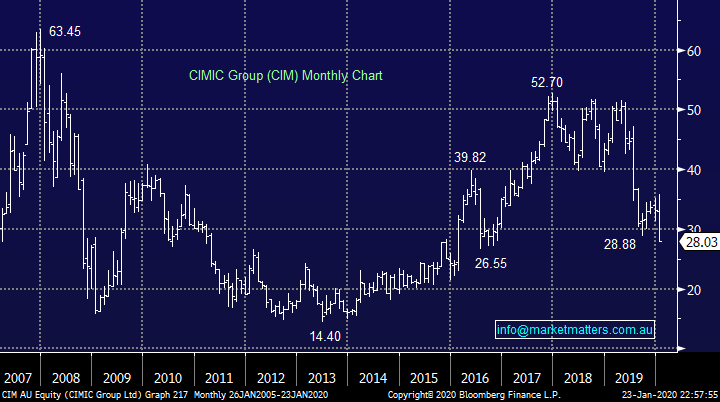

2 CIMIC (CIM) $28.03

CIM has now fallen -19% over the last month with yesterday’s disappointing news sending the stock to fresh multi-year lows. CIM’s $1.8bn write down on its BIC contracting business, as it extracts itself from the Middle East, caught many investors napping and removed the company’s dividend for 2020. This is one stock MM has called well, last September we answered a subscribers question in a Monday report as below:

"With CIM:ASX on Friday commencing the buyback of 10% on limited float, I wonder now Market Matters view on CIM:ASX?" Thanks Rodney

Hi Rodney,

CIMIC (CIM) continues to struggle, significantly underperforming the market. As we said last week ”some other industry insight we have garnered in recent times also paints a negative picture for CIM’s current position” hence we are leaving alone for now. The buy-back is positive however to me, the share price is telling us we should remain sceptical. I reiterate what we said in last week’s Monday Am Report: MM has no interest in CIM.

However, as we wrote yesterday “in terms of their underlying business, excluding write-offs, CIMIC sees NPAT for 2019 of around A$800m in line with 2019 guidance. While we have often written about the complexity of the CIM business, and this move is massively painful, once the stock settles it will be worth revisiting (at some point)”.

One for the watch list but probably from lower levels although technically the risk / reward is becoming interesting.

MM is currently neutral CIM.

CIMIC (CIM) Chart

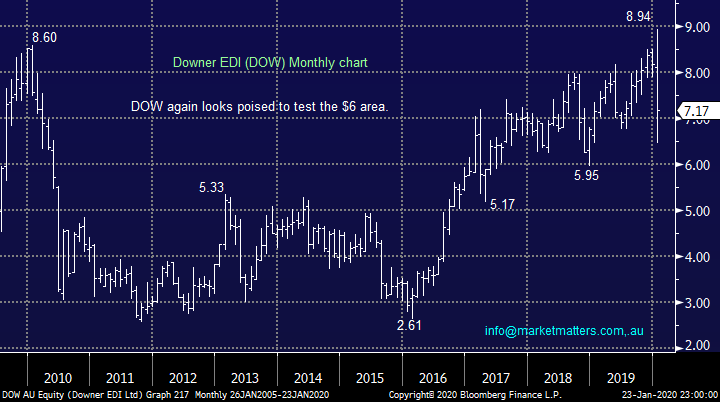

3 Downer (DOW) $7.17

Yesterday major Engineering and infrastructure contractor, Downer EDI plunged 18% after cutting its full year profit guidance by $65m to $300m, or a painful 17.8% - The stocks has now fallen -13.3% over the last month, not too bad considering the stocks advance over the last few years. However we didn’t like the way the company seemed to take haircuts all over the business as opposed to a classic “one-off mistake” , this is a stock we currently find easy to sit back and watch.

Technically DOW looks in danger of again testing the $6 region.

MM is neutral DOW.

Downer (DOW) Chart

4 NIB Holdings (NHF) $5.46

Health insurer NIB Holdings (NHF) is down almost 18% over the last month triggering us to write about the insurance sector on Tuesday, our view hasn’t changed much but the ongoing weakness has vindicated our thoughts at least in the short-term. Its recent major downgrade of close to 20% made our selling above $8 feel simply great. An uptick in claims was blamed but our concern is this is likely to be an ongoing issue with our ageing population.

Another of my concerns for NHF is many of my friends / colleagues who have private health insurance only do so due to the tax implications, not because they see particular value in the product / offering and I know of a number who are still considering saying goodbye to what was an automatic family cost a few years ago i.e. a potentially a tough environment for margins.

Technically the stock has probably seen the worst of its correction to the multi-year rally but at least a challenge of $5 would not surprise.

MM remains neutral / bearish NHF.

NIB Holdings (NHF) Chart

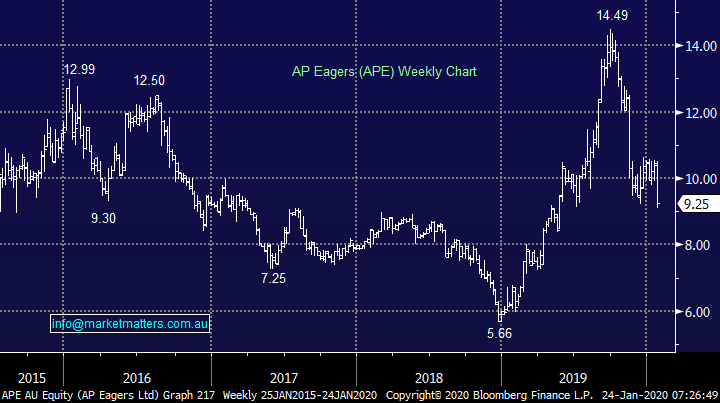

5 AP Eagers (APE) $9.25

Australia’s largest car yard, auto retailer APE has now fallen -10.7% over the last month with another broker downgrade weighing on the stock as car sales remain weak. I don’t know many people considering buying new cars at present and this cyclical business is reflecting the fickle nature of the Australian consumer. However the stock shirked off huge negativity around the indebted Australian consumer in 2019 to rally strongly, though in hindsight the optimism was ill-founded.

We find this a tricky stock to forecast / value and hence one easiest left alone.

MM is neutral APE.

AP Eagers (APE) Chart

Conclusion

Unfortunately of the 5 stocks looked at today non appeal to MM but remember it’s the stocks we leave alone as much as what we buy that adds alpha to our portfolios.

Overnight Market Matters Wrap

• The US equity markets closed with little change overnight as the Coronavirus continues to make headlines with new cases across the Asian region ahead of the Lunar New Year festivities.

• On commodities front, all metals fell on the LME, while the safe haven, gold rallied. BHP is expected to underperform the broader market after ending its US session off an equivalent of -1.12% from Australia’s previous close.

• The March SPI Futures is indicating the ASX 200 to open 32 points higher, testing the 7120 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.