Is Myer creating some opportunity in retail? (MYR, NCK, JBH)

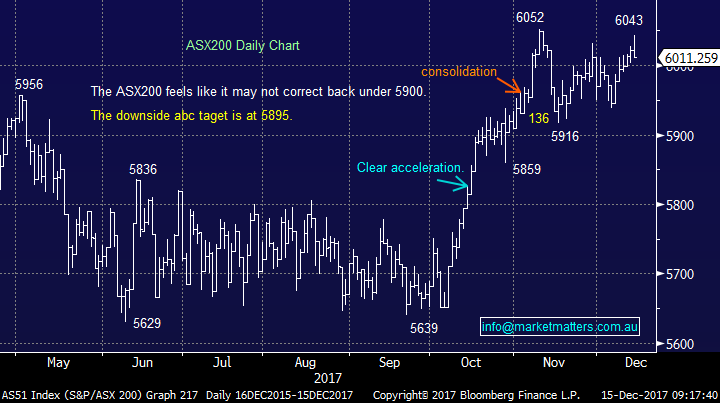

The ASX200 failed to provide any Christmas cheer yesterday, closing down 10-points after rallying nicely early in the morning. While we still remain above the psychological 6000 area, the high for 2017 of 6052 feels like a step too far at present.

The market itself feels fairly quiet but the volatility of the individual stocks is slowly increasing as is common with volumes slowly decreasing into the Christmas period. We’ve been talking about the typical seasonal strength in December… well the “Christmas rally” usually starts right about now!

We have no change to our market view that the local market is heading towards 6125 this month, but we are planning to increase our cash holding if this strength does materialise.

ASX200 Daily Chart

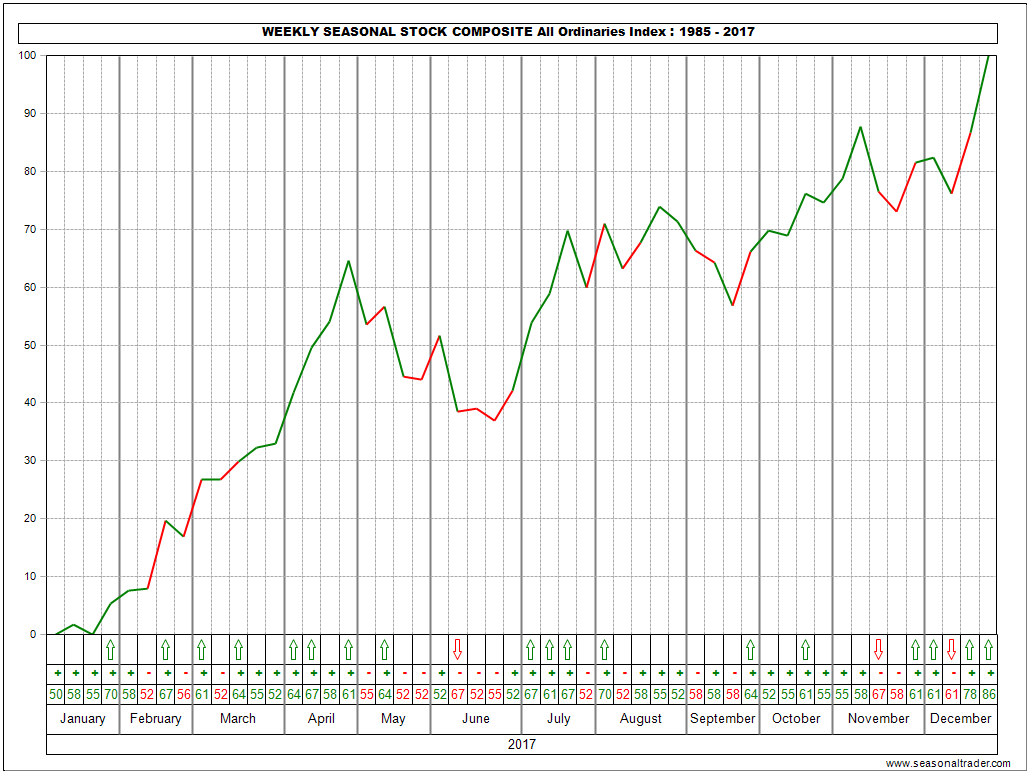

The below seasonality chart illustrates perfectly how the Australian stock market rallies strongly from mid-December over the last 20-years – if we were traders, it would be a classic case of “long or out”.

ASX200 December Seasonality Chart

Ongoing retail concerns

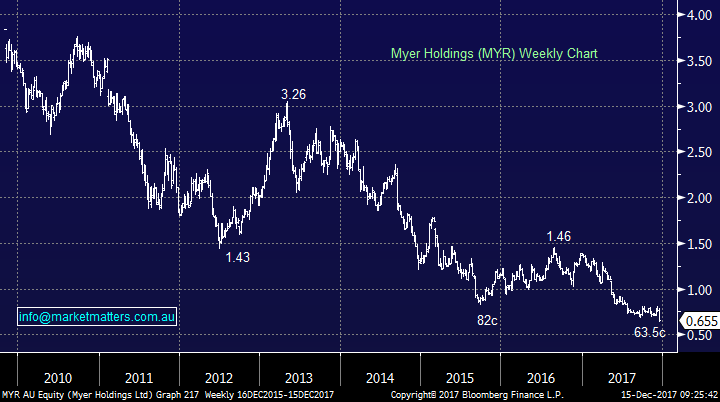

Myer (MYR) - 65.5c

Yesterday, Myer (MYR) released yet another downgrade leading to an 8% fall in the shares. MYR made all-time lows in the morning on almost panic early selling, an extremely painful ~80% below its now dizzy levels of 2010.

One of the reasons for MM’s strong 2017 has been our view that retail is simply too hard and a sector to avoid. I thought yesterday was an ideal time to go and experience a MYR store first hand, plus get some Christmas shopping ticked off. My 3-initial takeout’s were:

1. The MYR store I went to was certainly one of the quietest in the particular Westfield centre.

2. The service in MYR was awful as I repeatedly had to wait for young assistants to finish their personal conversations before acknowledging my presence.

3. The store does too many things on an average level at best- with the exception of an excellent Christmas set-up.

I can see why Solomon Lew is furious, even if MYR does eventually lose the battle to the internet, it’s currently almost trying to accelerate its own demise. As an occasional shopper it took me about 15-minutes to come up with some ideas on how to improve the store, it feels like the MYR board / management did not listen at school to the most famous scientist of all-time:

· “Insanity Is Doing the Same Thing Over and Over Again and Expecting Different Results.” - Albert Einstein.

We can certainly envisage some quick improvements at MYR as they come off a very low base, especially with regard to service. Reminds me of Telstra (TLS), which has rallied 12% in the last 3 weeks.

Unfortunately, with MYR it still feels like any decent share price appreciation will come down to corporate activity, do you feel lucky Mr Lew?

Hence to us at MM, embattled retailer MYR is an aggressive trade with stops under 60c and one we will not be taking.

Myer (MYR) Weekly Chart

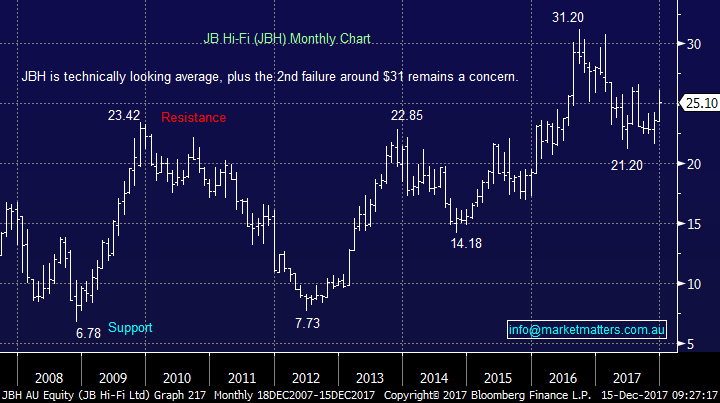

JB HI-FI (JBH) - $25.10

Last night the music and electronic goods retailer, JBH was certainly much busier than MYR which unfortunately does not say a lot. However my simple concern with JBH when I walked around the very busy store was that everything they sell lends itself to being posted, hence a perfect target for Amazon. Even if JBH wins the on-line battle, it will probably be with much reduced margins.

We have no interest in JBH at present.

JB HIFI (JBH) Monthly Chart

Nick Scali (NCK) - $6.85

We’ve enjoyed mentioning NCK today, because we hold it in our Income Portfolio and its showing us a healthy paper return. What NCK shows us is if you stick to what you know and implement it well, then retail is fine especially in sectors that sell goods which do not post / courier easily.

Technically and fundamentally NCK looks solid with a target up towards $8.

Nick Scali (NCK) Weekly Chart

Global Indices

US Stocks

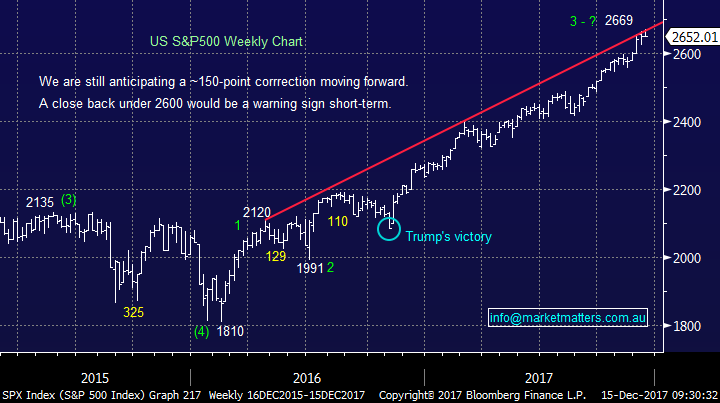

US equities are following our recent thoughts where the selling of any new all-time highs, if / when they occur has paid dividends at least for 24-48 hours as the market slowly looks for a top.

Overall there is no change to our short-term outlook for the US market, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US S&P500 Weekly Chart

European Stocks

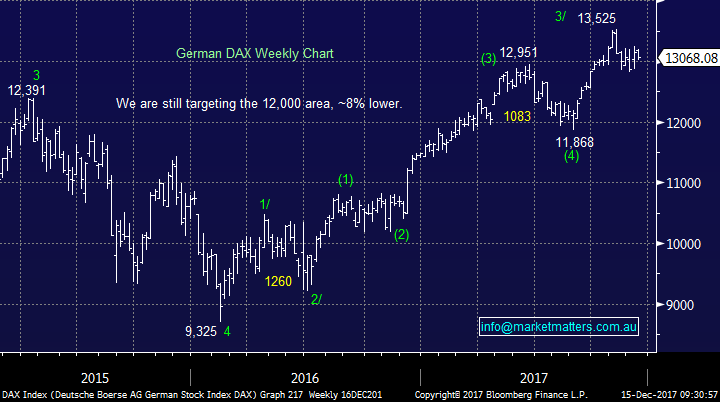

No major change with our preferred scenario for the German DAX, a 7% correction back towards the 12,000 region.

German DAX Weekly Chart

Conclusion (s)

There’s still no hurry to buy retail but the likelihood of some sharp countertrend rallies is increasing.

*Watch for alerts.

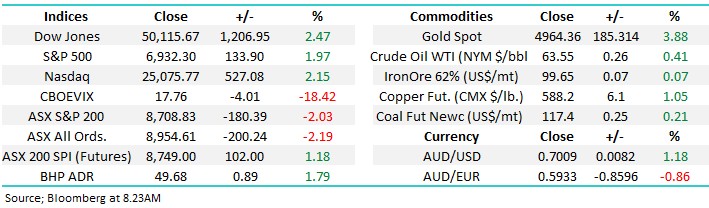

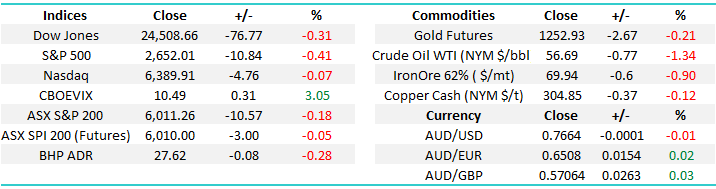

Overnight Market Matters Wrap

· The US equity markets had a breather from hitting new highs this week, ending their session in negative territory.

· US retail sales beat analyst’s expectations in November, while the number of Americans on unemployment benefits has fallen to multi-decade lows.

· Inflation will remain benign in Europe according to Mario Draghi, meaning monetary stimulus will be unchanged for the foreseeable future.

· Metals on the LME were better across the board, oil has bounced into positive territory while iron ore is down 0.9%.

· The December SPI Futures is indicating the ASX 200 to open with little change this morning around the 6010 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/12/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here