Is it time to take $$ on our “dog” investments, or switch to the new breed? (DMP, BHP, NHF, CBA, ASL, WEB)

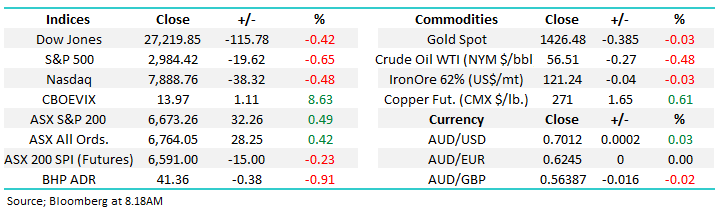

The ASX200 rebounded nicely yesterday gaining 32-points / 0.5% as our potential “rounding top” continues to take shape. Interestingly only 54% of the market closed positive but when the Banks, BHP, Telstra and CSL all have solid days the index will usually respond in kind. Volatility “under the hood” is slowly increasing ahead of next month’s reporting season, the combination of low volumes courtesy of school holidays, some broker up / downgrade plus a sprinkle of stock specific news was enough to push a few stocks around significantly on the day. Undoubtedly some of these pre-reporting broker changes will look a touch “silly” in the weeks to come, we generally prefer cash and flexibility into reporting season as opposed to brave “calls”.

It was a particularly frustrating Wednesday for MM because although we owned 5 of the top 16 stocks on the day the painful 5.1% drop by Domino’s Pizza (DMP) undid so much of the hard work for our Growth Portfolio – more on DMP later. Also, to increase the frustration further 2 of the best performing stocks Elders (ELD) and Western Areas (WSA) were on our buy radar just a few percent lower – it’s a good job I love this game!

Market concerns that economic growth is continuing to struggle is still being reflected by bond yields, our own 3-years are still trading at 0.948%, below the RBA cash rate while US 10-years still look destined to make fresh 2019 lows below 1.9%. However high yielding bonds (junk bonds) continue to drift lower, a potentially bad mix for equities if fund managers lose confidence that the central banks current attitude of economic support at any cost will work because in the past its equalled asset support.

MM remains comfortable to adopt a more conservative stance over the next 6-months.

Overnight US stocks were weaker with the S&P500 sliding -0.7% for its worst fall in 3-weeks while the Dow Jones Transport Average fell the most since May. Fears of a slowing economic growth, partly due to the impact from the US trade war with China, also sent bond yields lower dancing the same tune. US reporting season is kicking into gear with Bank of America (BAC) delivering its largest profit ever a standout helping the stock gain +0.7% - Netflix (NFLX) which we hold in our International stocks Portfolio reports after the US close this morning.

The SPI futures are calling the ASX200 down only around 15-points this morning in-line with yesterdays improved market sentiment.

Today we are going to look at whether we should take our money and run on a few speculative positions we bought for the Growth Portfolio back in Q1 of this year, while at the same time considering a couple of new major underperformers. Also, we’ve touched on 3 stocks who are looking relatively clear short-term which may give us an insight to the path of local stocks for the second half of 2019.

ASX200 Chart

However lets first start with our recent poor performer, Domino’s (DMP ) which closed below the $38.50 level we mentioned in the original alert. We still hold the position and given the fall we’ve experienced in the last two days with the stock closing yesterday at $36.60, around $2 below our trigger point and now only 30c from the lows, we’ve elected to give the stock some more room for now – today at least.

As we mentioned yesterday afternoon, the selling stemmed from their US namesake missing growth numbers for the 2nd quarter which gave some substance to the bearish calls that have been circling DMP locally for some time. These concerns had led to its ~36% share price decline this year. While August reporting is coming up and we concede that “surprises usually happen with the trend”, DMP now seems to be pricing in a weak report, and the market has downgraded expectations already. Overnight, DPZ in the US closed 2.6% higher in a soft market.

Technically, DMP now offers good risk reward into fresh lows however if it fails there, we’ll likely cut and move on.

MM is DMP on a short leash and we may cut and run

Domino’s Pizza (DMP) Chart

When a I started writing this report last night 3 stocks that I follow closely all looked particularly clear from a technical perspective, I have briefly shown them below but they all point to a higher ASX200 before any material weakness which is counter to our current thinking – remaining open minded the clear takeaway here.

1 BHP Group (BHP) $41.74

Yesterday BHP met guidance across the board for their 4th quarter, and as a result the full year from a production standpoint - FY20 guidance was also pretty much as anticipated. Hence the often referred to “Big Australian” is poised to report a stellar profit given the tailwind of significantly higher iron ore prices in the back half of the year. We like BHP, and other iron ore names, into pullbacks – we are initially targeting $38 as a re-entry point for BHP.

However short-term BHP now looks poised to make fresh highs towards $42.50, fortunately BlueScope which we switched into is also rallying strongly.

MM still likes BHP but at lower levels.

BHP Group (BHP) Chart

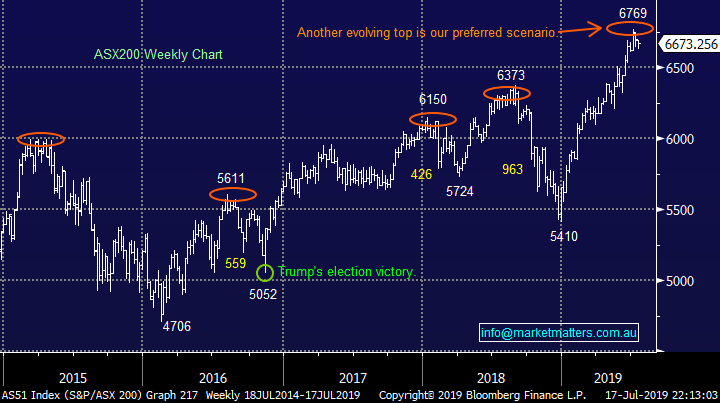

2 NIB Holdings (NHF) $7.81

Yesterday NHF closed over 9% above its panic low on Tuesday, the perfect result for our positive short-term outlook. Importantly MM still intends to take profit if this strength continues as we anticipate.

NHF looks destined to test the $8.25-$8.50 area.

NIB Holdings (NHF) Chart

3 Commonwealth Bank (CBA) $81.32

We switched our CBA position to ANZ yesterday on value grounds but this doesn’t mean we believe CBA cannot rally from current levels – we simply believe ANZ will outperform it. Our technical picture for CBA remains intact:

1 – Our preference is CBA pushes higher towards the $85 area where we will consider lightening our banking exposure overall

2 – Alternatively we can see a pullback towards the $78.50 region where we would again be buyers of CBA as we look to add value / alpha to our portfolios.

MM still anticipates a $78.50 - $85 trading range for CBA in the months ahead.

Commonwealth Bank (CBA) Chart

Is it time to tweak some dogs in the MM Growth Portfolio?

Today’s exercise requires splitting into 2 simple halves i.e. initially where / when do we sell and secondly do we like the new “dogs” of the last 3 months.

We are definitely not looking to switch for the sake of it, plus excuse the repetition but with next month’s reporting season only days away bargains are likely to surface soon as markets over react to the news flow in both directions.

1 An update on 3 of MM’s more speculative positions:

1 – Ausdrill (ASL) $1.92 – This mining services stock remains on track to test our $2 area which is now only 4-5% away. Although we are showing a 25% profit on our position we see no reason to sell just yet.

2 – Pact Group (PGH) $2.70 – Packaging company PGH may only be a few % above our entry level but its still over 20% above its June low. We remain bullish PGH initially targeting 15% higher, hence the stocks a hold + they recently reconfirmed earnings guidance so the stock has less risk heading into earnings.

3 – Emeco Holdings (EHL) $2.20 – This leaser of equipment to the mining sector remains on track to test our $2.50 target, almost 15% higher hence were also holding this one.

The current theme amongst these 3 positions is we are looking for further upside but only ASL feeling like it has the momentum to reach our sell area in July.

Ausdrill (ASL) Chart

2 How do the new dogs look?

We are holding 25% of the Growth Portfolio in cash which may increase to 28% if we exit DMP so there’s certainly ammunition for buying any battered up stocks if we feel the elastic band is too stretched and risk / reward is presenting itself.

However the market has run hard over the last 6-months and we no longer feel that fund managers are scrambling for stocks after they failed to board the bull market train back in December. Hence with a very different landscape than back in February / March when we first considered the “dogs” of the market we will be far more ”fussy” catching any falling knives today.

MM is going to be extremely selective with any buying after local stocks have surged 25% in 6-months.

ASX200 Index Chart

Over the last 3-months, in a rising market, we’ve still seen 12 members of the ASX200 fall by over 20% - that’s a huge confirmation to MM that both stock and sector selection is critical to market outperformance, hence our active management approach.

If we take out the financials and lithium stocks where our relatively small exposure through Janus Henderson (JHG) and Orocobre (ORE) feels more than adequate it leaves 6 names – Reliance (RWC), Mayne Pharma (MYX), Webjet (WEB), Link Admin. (LNK), Speedcast (SDA) and Vocus (VOC). On-line travel business WEB which has corrected ~23% is probably best of a bad bunch but a test under $11 would still not surprise.

Interestingly not one of these names had an attractive technical or fundamental picture with any vaguely compelling risk / reward.

Hence MM will not be chasing any major market underperformers prior to reporting season.

Webjet (WEB) Chart

Conclusion (s)

MM is looking to continue with our plans for ASL, EHL and PGH while none of the dogs from the last 3-months are appealing from a risk / reward perspective.

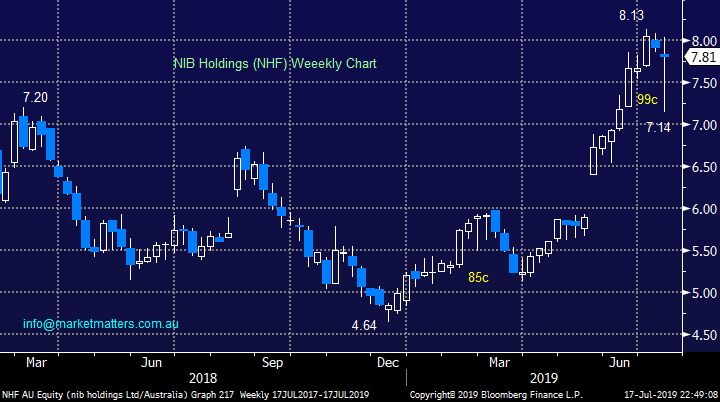

Global Indices

US stocks extremely vulnerable to us at this stage although we need to see a break back below 2950 by the S&P500 to become seriously concerned with the markets health i.e. just around 1% lower.

We reiterate that while US stocks have reached our target area but they have not yet generated any technical sell signals.

US S&P500 Index Chart

No change again with European indices, we remain cautious European stocks and their tone has become more bearish over the last few weeks.

German DAX Chart

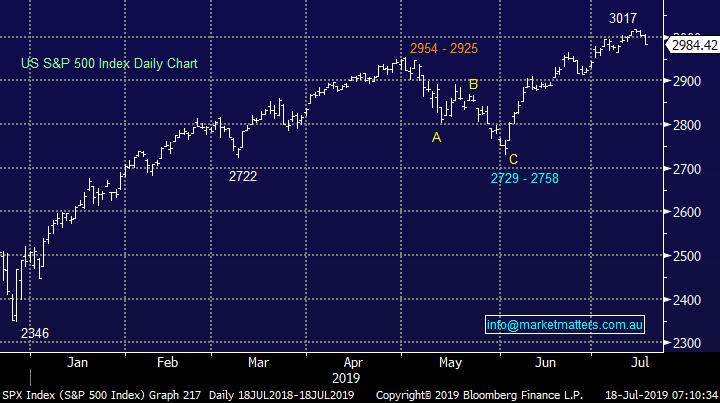

Overnight Market Matters Wrap

· The US-China trade tension was brought back to life, being the major catalyst in last night’s decline, following President Trump mentioning he could impose further tariffs on China.

· Alcoa’s quarterly earnings were released and sold off as much as 4.8% after-hours following mixed Q2 results and reducing its industry outlook for 2019 aluminium demand growth.

· BHP is expected to underperform the broader market after ending its US session off an equivalent of -0.91% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to test the 6660 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.