Is it time to lighten our market exposure? (MQG, RIO, RMD, JHG, ALL)

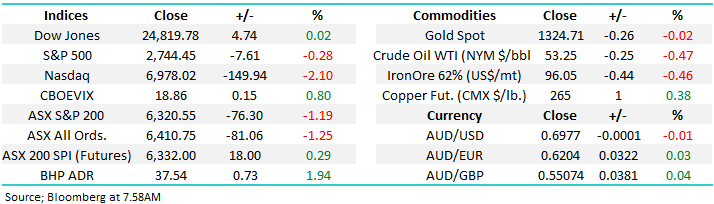

The ASX200 was smacked yesterday with 2 major reasons contributing to the relentless but orderly selling which started when the market opened at 10am and basically continued unabated all day:

1 – The geo-political trade concerns intensified into / over the weekend following President Trumps latest tariff attack on Mexico as we saw China launch an investigation into FedEx in what appeared to be a “tit for tat” slap back at the US following its extremely heavy handed approach to Huawei.

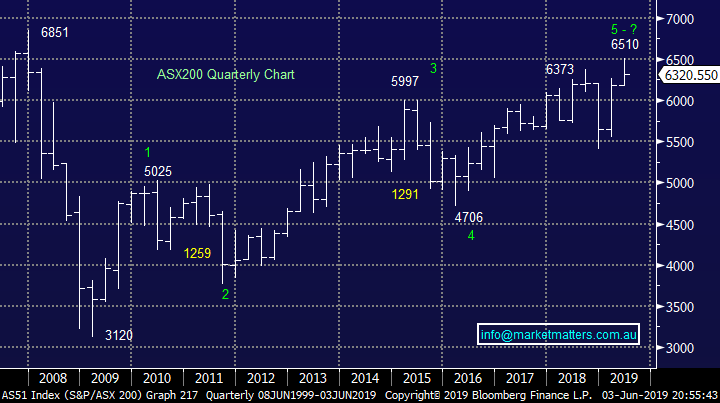

2 – The Australian Financial Review (AFR) ran a story “The 3 reasons the RBA might surprise everyone and not cut today”, not ideal when the market is expecting the first of at least 2 rate cuts at 2.30pm today.

With almost 80% of the ASX200 closing in the red it appeared to be a classic “one, two combination” hitting the market which had run strongly since December and was starting to feel comfortable / optimistic. However even after the recent 2.9% pullback things are not too bad as we remain 16.8% above Decembers panic low. By the days end good news was extremely thin on the ground as June kicked off in earnest, adding to the markets pessimism was US investment bank Morgan Stanley forecasting that if President Trump escalates the trade war any further a global recession will unfold in well under a year – not a particularly big call as most of us know a trade war will be very damaging to both economies and equities alike.

The market had started to “feel wrong” over the last few days and the way we dropped 76-points like a knife through butter was very unattractive price action - the likes of which we hadn’t seen since last year.

MM is now neutral the ASX200 unless we see a close back above 6450.

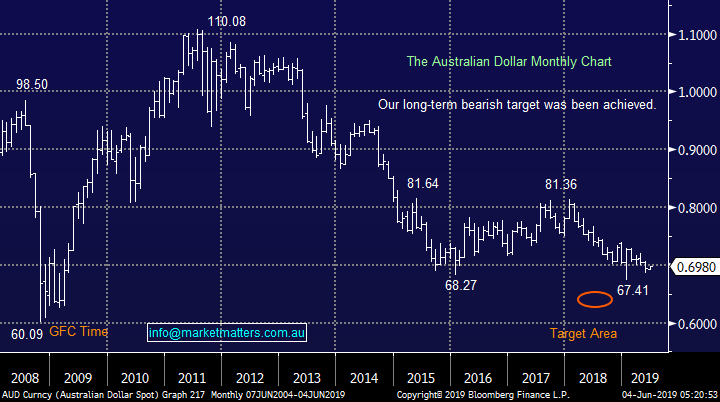

Overnight US stocks were extremely choppy finally closing mixed with the Dow and small cap Russell 2000 closing positive while the tech based NASDAQ fell ~2%. The SPI futures are pointing to a slightly firmer start locally although BHP is pointing to an open +1.7%.

In today’s report we are going to focus on our flagship Market Matters Growth Portfolio that provides an active approach to investing in ASX listed stocks. The ‘absolute return’ approach, can go to high levels of cash if warranted and even benefit from market downturns by investing in ETF’s that inversely track the market hence the obvious question being, is our 12% cash position too low?

ASX200 Chart

One of our biggest concerns yesterday was the apparent selling of Australia and buying of alternative global indices implying our “Scomo and rate cut fever” outperformance is running out of puff e.g. the ASX200 fell -1.2% but Hong Kong and China were basically unchanged.

Fortunately the switching appeared to fade away overnight implying it was just a one day phenomenon probably as traders squared up ahead of today’s RBA decision, however if we don’t see a rate cut this afternoon we may well see The ASX re-align with overseas markets, as shown through the S&P 500 below.

ASX200 v US S&P500 Chart

Many of us may have seen an article in the AFR implying the RBA won’t cut rates but the impact where it really matters (on bond yields) was minimal with the below chart illustrating that investors are still calling official interest well and truly lower in 2019/20.

Australian 3-year bond yields Chart

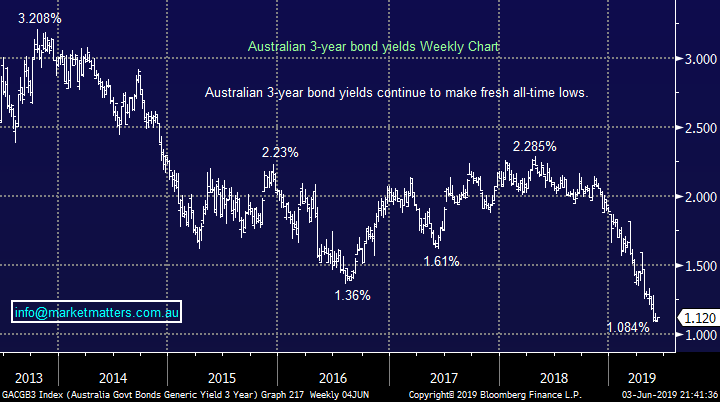

The Australian dollar enjoyed the speculation that the RBA will leave rates unchanged at 2.30pm but the rally to 69.80c was also assisted by a weakening $US.

We expect rates to be cut today, and again over the coming months, however we also think that is largely baked into the cake. If the RBA hold tight for another month, the AUD would clearly spike higher. If they cut, the fate of currency will be dictated by the language in the attached statement.

The Australian Dollar ($A) Chart

Moving onto the stocks and sectors within our Growth Portfolio (click here to view), below we have outlined our current thinking on positions.

With our cash holding at 12% we would consider ourselves net long stocks, a position that certainly felt uncomfortable yesterday.

1 The Banks

MM still holds 8% of our portfolio in each of CBA, NAB and Westpac plus 5% in Bank of Queensland (BOQ) & 3% in Macquarie Group (MQG).

We like our high yielding “Big Four” banking exposure at present plus BOQ while MQG is clearly dancing to the US tune, we are actually considering increasing our MQG position to 5% if the stock falls below $110.

MM remains comfortable with our banking exposure.

Macquarie Bank (MQG) Chart

2 The Resources & Materials stocks.

MM holds a sizable 5% of our portfolio in BHP & Orica (ORI) plus 3% in Iluka (ILU), Orocobre (ORE), Ausdrill (ASL) and lastly 4% in Pact Group (PGH).

Overnight even with the US uncertainty BHP closed up ~65c which theoretically will erode 2/3 of yesterday’s losses. This implies the resources should have a decent day at the office, the question being, is this an opportune time to “tweak” our sector exposure, our thoughts on each of these stocks:

1 BHP Group (BHP) $36.81 – MM remains comfortable with this BHP position, especially as RIO is so close to our optimum buy zone.

2 Orica (ORI) $20.42 – MM remains comfortable with our ORI position.

3 Iluka (ILU) $9.53 - MM remains comfortable with this ILU position but a failure to hold this $9.50 level is likely to see us take profit.

4 Orocobre (ORE) $3.13 – The lithium space has failed to embrace the takeover bid for Kidman Resources (KDL) in early May as we expected. A stock / sector that cannot enjoy good news plus one that is an ideal candidate for tax loss selling is a concern – watch for sell alerts.

5 Ausdrill (ASL) $1.38 – In hindsight we have given this position too much room after it traded within a sniff of our target area. The recent decline leaves us neutral ASL and hence it’s a logical candidate to sell - watch for sell alerts.

6 Pact Group (PGH) $2.24 – PGH keeps making fresh 2019 lows making it very hard to remain comfortable with this turnaround story plus it’s also an ideal candidate for tax loss selling - watch for sell alerts.

However MM remains a keen buyer of RIO only 1-2% lower and similarly with Fortescue (FMG).

Hence we are considering switching from part / all of ORE, PGH and ASL into FMG & / or RIO who have also experienced meaningful corrections. This could satisfy a couple of objectives relatively quickly:

1 – Reduce our exposure to higher risk / beta stocks which tend to fall harder in times of uncertainty i.e. simply buy the quality.

2 – If we sell all 3 it would liquidate 10% of the Growth Portfolio, if we then allocated ~4% into FMG and RIO our net cash position would inch up 2%.

3 – Significantly reduce our exposure to potential tax loss selling.

4 – Increase the yield of our portfolio in these low interest rate times.

RIO Tinto (RIO) Chart

3 Healthcare stocks

MM holds 6% of our portfolio in healthcare stocks equally through Healius (HLS) and ResMed (RMD).

We like both of these positions but were mindful that RMD is close to our target area while Healius is a takeover play which ~5% higher will start to lose its attraction from a risk / reward perspective.

MM remains comfortable with our healthcare exposure.

ResMed (RMD) Chart

4 Finance stocks

MM holds 8% of our portfolio in the financials through Janus Henderson (JHG) – 5% and NIB Holdings (NHF) – 3%.

1 NIB Holdings (NHF) $6.60 – we remain bullish with a target ~10% higher.

2 Janus Henderson (JHG) $28.99 – we have been caught on this one by the BREXIT debacle but we would average into fresh lows hence selling at current levels makes no sense, especially as the stock is cheap on Est P/E of 8.2x while yielding over 7% unfranked.

MM is likely to stay as we are within this sector.

Janus Henderson (JHG) Chart

5 ”The balance”

MM holds 4 other stocks in our Growth Portfolio, plus of course 12% in cash:

1 Emeco Holdings (EHL) 4%, $1.76 – Earthmoving business EHL’s lack of ability to rally is a concern but we feel its cheap enough to see how it reacts to new lows.

2 Bingo (BIN) 4%, $1.80 – BIN has failed to hold above $1.85 we are considering taking profit as discussed in previous reports – watch for sell alerts.

3 Costa Group (CGC) 6%, $3.73 – We averaged this holding last week, it’s on a close watch but obviously we will give it a little longer.

4 Aristocrat (ALL) 5%, $28.28 – ALL is enjoying an excellent 2019 especially after delivering a solid half yearly result last month. We like the business but are mindful that with these success stories the shares can get ahead of themselves.

A mixed bunch of stocks for MM with 2 winners and 2 losers, at this stage BIN is in our sell sights.

MM is considering taking profit on BIN this week.

Aristocrat (ALL) Chart

Conclusion (s)

MM is considering a couple of movements within our Growth Portfolio:

1 - A major tweak of our resources holdings:

Sell ORE, PGH & ASL to buy RIO / FMG while increasing our cash position slightly.

2 - Take profit on Bingo (BIN).

Global Indices

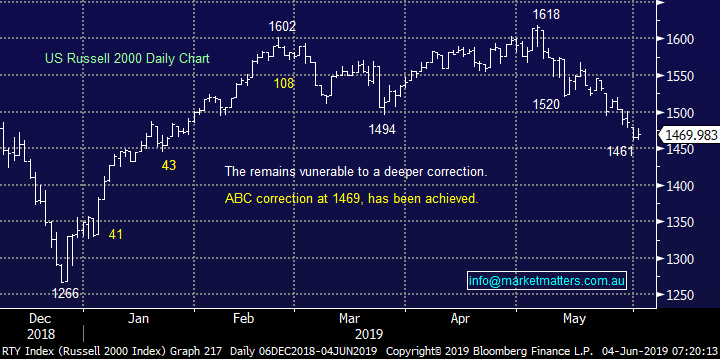

Nothing new with our preferred scenario the current pullback is a buying opportunity although we are only looking for a test of / slight new 2019 highs from US indices.

US Russell 2000 (small cap) Index Chart

No change again with European indices, we remain cautious European stocks but the tone has improved in 2019.

German DAX Chart

Overnight Market Matters Wrap

· The market was whippy overnight, with both the Dow and S&P 500 ending its session with little change, while the Nasdaq lost further ground, off 2.10% as US regulators are looking to investigate Facebook, Apple, Google (Alphabet) and Amazon for anti-competitive behaviour. They were all sold off as a result with Facebook copping the brunt, down 9% at one stage, while Alphabet hit a five month low.

· US treasuries rallied further as investors accumulate it bet on a Fed rate cut this year following St. Louis Fed President James Bullard’s comments that a rate cut may be needed “soon” amid the trade war.

· BHP is expected to outperform the broader market and climb a tad from its recent weakness after ending its US session up and equivalent of 1.94% from Australia’s previous close.

· Local data today – April Retail sales (11.30AM) and RBA interest rate announcement (2.30PM) with most analysts expecting a rate cut of 0.25% to 1.25% this afternoon.

· The June SPI Futures is indicating the ASX 200 to open 8 points higher, testing the 6330 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.