Is it time to jump back into the banks? (SEK, CBA, NAB, UBS US)

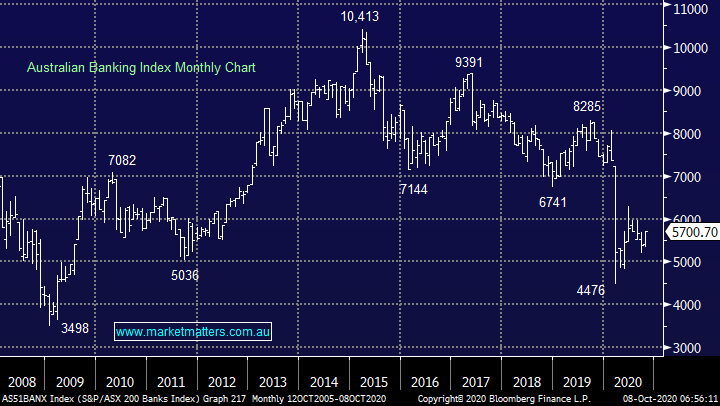

Another strong session for the ASX saw the local index close above 6000 for the first time in a month, a great performance considering the US market had tumbled -1.4% on Tuesday night – again the ASX has been a global index leader as US stocks surged overnight, the Dow rallied 530-points. This week’s already seen the market rally almost 250-points as October starts to live up to its reputation as the strongest month from a seasonal perspective. Less than 80% of the index closed higher yesterday but when the banks catch a bid the ASX200 usually follows suit and on Wednesday it sent the index up 74-points, or +1.25%.

As we discussed in Wednesdays Afternoon Report the budget appears to have been a big hit with investors as the Australian stock market outperformed its global peers – it was nice to type that for a change! Our primary take out being “it’s bullish for many stocks / sectors while there’s is a distinct lack of major losers”.

The government has focused on a private sector led recovery and of course getting people back to work, it’s a tough economic backdrop to stimulate but this feels a strong step in the right direction plus of course the RBA’s expected to step up to the plate next month with some additional monetary policy starting with another rate cut – the tailwinds are building.

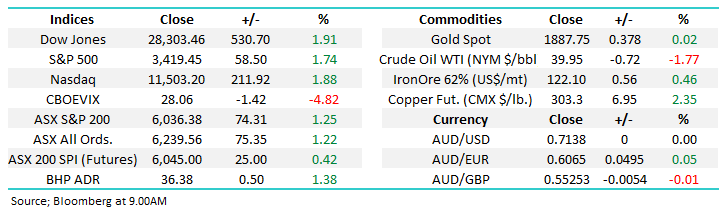

The bond market is telling us in no uncertain terms that Australian interest rates are going lower for longer:

1 – The Australian 3-year bond yield traded at a fresh all-time low of 0.122% yesterday, under half of the current RBA official cash rate of 0.25%.

2 – The local 10-years aren’t close to their panic March low but being able to borrow money for 10-years at 0.84% is attractive, a definite tailwind for asset prices like the vital housing sector to which so many Australians are leveraged. No wonder Infrastructure development was a centre piece of the budget.

3 – The only market which didn’t embrace the falling bond yields was the “Aussie Dollar” but considering the 55c area we tested back in March the current rotation around 71c feels bullish.

MM believes fighting central banks in today’s COVID environment makes zero sense.

Australian 3-year Bond Yield Chart

We’ve been looking for a catalyst to send the ASX200 to fresh post March highs and we feel the recent pick up in the Banking Sector might just be the backbone required to see us clear the psychological 6000 area, our ideal target by Christmas is 6400-6500 – hence the topic of today’s report. Another factor in our favour is the markets not on board the stock market train – recent sessions has seen some of the record shorts closed out in the US tech space but Tuesday’s 43% Investor Sentiment Bearish reading was still way above its mean implying it’s just a question of time until we see a big squeeze in the stock market – perhaps it began last night.

MM remains bullish stocks short-term.

ASX200 Index Chart

Another stock which caught my attention when I reassessed yesterday’s rally was online recruitment business Seek (SEK) which like many businesses has endured a tough 2020, including the board suspending the stocks dividend back in August. However the companies now looking far more attractive as investors look for a global economic recovery in an ever decreasing interest rate world, to us the stock looks poised to scale fresh all-time highs into Christmas – also a great read through for the underlying index in our opinion.

MM is bullish SEK looking for ~15% upside.

Seek Ltd (SEK) Chart

Overseas Indices & markets

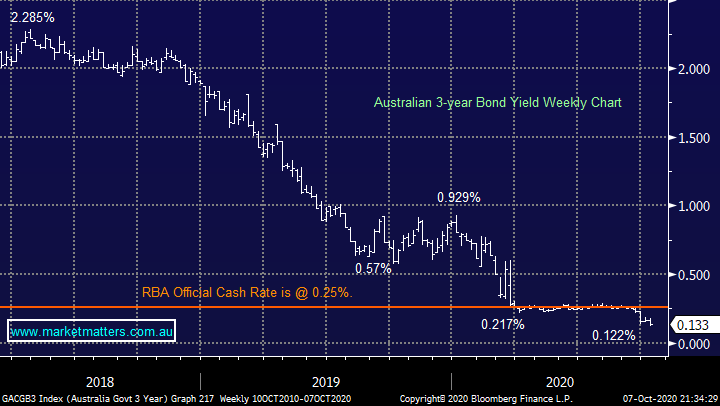

Overnight US stocks continued their recovery led buy the NASDAQ which gained another +1.9% - remember the NASDAQ has been carrying a major short position. The tech stocks continue to look great, especially if they can add to weekly gains through this week, we remain bullish with an initial target ~10% higher but we’re continuing to watch for early signs of rotation into the underperformers such as banks and energy.

MM continues to believe US stocks have found a significant short-term low.

US NASDAQ Index Chart

Interestingly, overnight US bond yields continued to edge higher i.e. moving in the opposite direction to our own. However the $US didn’t embrace the move and this morning the $A is trading at the top of its daily range, close to 71.5c, the only standout loser was gold which fell back under $US1900/oz – gold becomes attractive when investors can enjoy a higher yield from fixed interest i.e. bonds.

MM remains bullish US Bond Yields medium-term.

US 10-year Bond Yield Chart

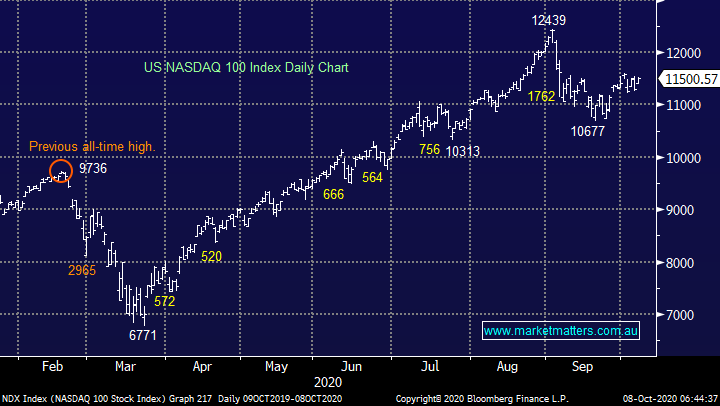

Is it time to buy the Australian banks?

The Australian Banking Index has been on the front foot for the last few days with Commonwealth Bank (CBA) for example bouncing almost 8%, significantly outperforming the ASX in the process. However we all know the sectors endured a really tough 5-years, basically halving while equities rallied, there have been a number of headwinds but 3 spring to mind : margin contraction as bond yields fall, the risk of rising bad debts which has been amplified by COVID and the aggressive domestic regulatory environment. However, we feel there is some real light emerging at the end of this long tunnel:

1 – Domestic bond yields are still falling into the RBA meeting next week, but their US peers are starting to rally, if / when we see a global economic recovery bond yields will follow helping bank margins. NB: banks borrow short and lend long, the difference in that curve or gap plays into their margins.

2 – The government’s latest budget should help stave off the mounting fears of an avalanche of bad debts as we see JobKeeper payments reduced and indeed vanish for many, replaced with incentives for employers to ramp up hiring.

3 – The recent baton change from ASIC to APRA to “police” Australian lending is a definite relaxation in our opinion, a clear step in the right direction for banks. Also, history has shown us that tightening lending criteria pressured housing prices far more than even COVID hence this relaxation should help local house prices taking the pressure from Point 2 above.

The 3 points above, and especially the last 2, are in our opinion providing a better tailwind for the Banking Sector into 2021. Importantly we also believe its shouldn’t be underestimated how complacently underweight the sector investors / fund managers remain, it’s been a great place to avoid for many years but when “the crowd” is underweight ~20% of the index its easy to see an aggressive squeeze higher when optimism returns and we believe that time is approaching fast.

MM expects ongoing outperformance from the banks into 2021.

ASX200 Banking Index Chart

It probably comes as no surprise to subscribers that MM remains comfortable with the local banking sector at present and we hold 21% of our Growth Portfolio in the sector via CBA and NAB i.e. we are market weight the banks at this point in time. However at this stage we still want to see a more definitive increase in bond yields / global economic activity before considering moving overweight but with term deposits plunging below 1% unfranked what’s not to like with say CBA paying around 3% fully franked with the expectation that 5-6% yields will return in the coming years.

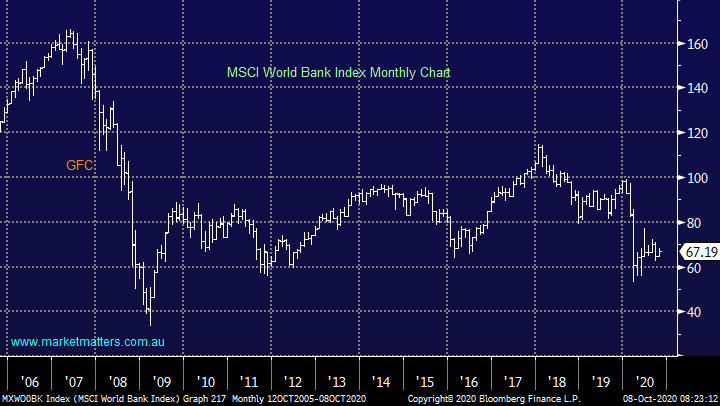

The picture globally is very similar for the banking stocks although ours have been on the wrong end of the performance spectrum due to the previous Australian regulatory environment, exactly what Trump fought and succeeded in removing within the US. Bond yields have a been the standout driver of the share price of banks since the GFC, when bond yields do meaningfully rally expect banks to follow.

MM likes the global banking sector from a risk / reward perspective.

MSCI World Banking Index Chart

MM remains comfortable with our 2 local holdings in our Growth Portfolio plus we particularly like one in the MM International Portfolio.

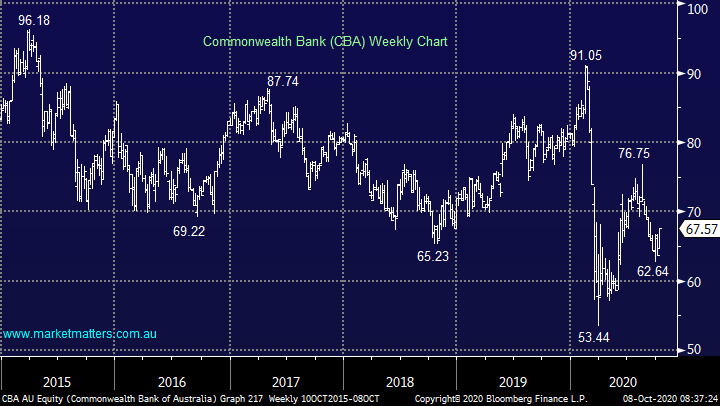

1 Commonwealth Bank (CBA) $67.57

The largest Australian bank continued to pay dividends through COVID, albeit at reduced levels, illustrating the strength of the company’s balance sheet. Technically and fundamentally we can see a rally towards $80 but nervous investors could consider stops below $62. This is a good risk / reward trade.

MM remains bullish CBA.

Commonwealth Bank (CBA) Chart

2 National Australia Bank (NAB) $18.60

Australia’s “business bank” should be warming to all the governments support for small business although COVID has certainly left some major damage in its path. NAB is forecast to pay ~3.5% fully franked in the next 12-months, again very attractive compared to term deposits, before we even consider franking. Technically and fundamentally we can see a rally above $20 but nervous investors could now operate stops below $16.50 – again great risk / reward.

MM remains bullish NAB.

National Australia Bank (NAB) Chart

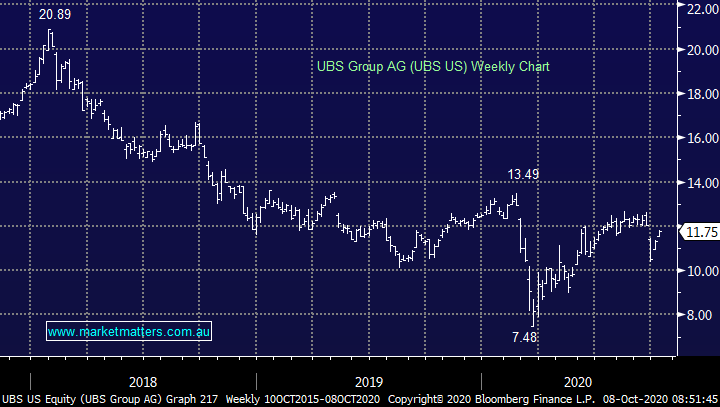

3 UBS Group (UBS US) $US11.75

On the international front we are particularly keen on our holding in UBS which looks poised to at least pop 10% into Christmas.

MM remains bullish UBS.

UBS Group (UBS US) Chart

Conclusion

MM remains bullish banks but wants to see bond yields show signs of a sustainable recovery before going overweight the sector.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.