Is it time to accumulate some aged care exposure? (HLS, SUN, IAG, 1913 HK, EHE, REG, JHC)

The ASX200 had a very choppy start to the week with the big miners dragging the index higher i.e. Fortescue (FMG) +5.4%, RIO Tinto (RIO) +1.7% and BHP Billiton (BHP) +1.4%. However I would remind subscribers that in the last Weekend Report, in our “Trade of the Week” section we called Fortescue (FMG) as a sell around $7, now only ~3% away, time will obviously tell but we remain comfortable with the call.

Weekend Report Sunday 17th of March – click here

Overnight we saw more “messy” news around BREXIT with the speaker of the house John Bercow pointing out to the UK parliament that they cannot have a 3rd vote on a BREXIT deal unless its significantly different to the previous two, not just renamed – oops! However the reaction illustrates perfectly the markets current “glass half full mood” with the Pound dipping just 0.25% and the UK FTSE rallying almost 1%, clearly investors are comfortable things will be alright in the end. Note MM is not suggesting we fight this current wave of optimism but simply keep an eye on it as history tells us it won’t last forever.

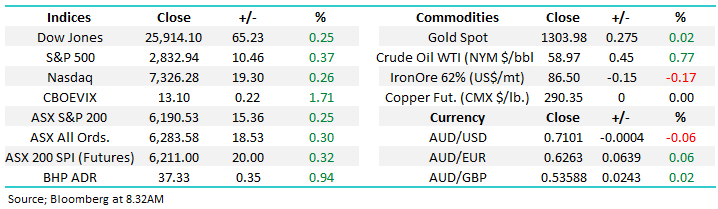

This week sees major derivatives expiry on Thursday morning and considering the market has rallied into this March date, including the futures illustrated below, a classic “squeeze” over the next few days would not surprise assuming external influences remain fairly benign.

MM remains neutral the ASX200 after its strong rally from late December lows but we are not afraid to buy selective stocks.

Overnight US markets remained firm with the S&P500 rallying +0.37% reaching its highest level since October last year, SPI futures are calling the ASX200 to open up ~20-points with BHP again likely to lead from the front closing up almost 1% in the US.

Today we are going to look at the Aged Care sector which is currently in the midst of a Royal Commission, are investment opportunities around as the bad news starts filtering through.

ASX200 March SPI Futures Chart

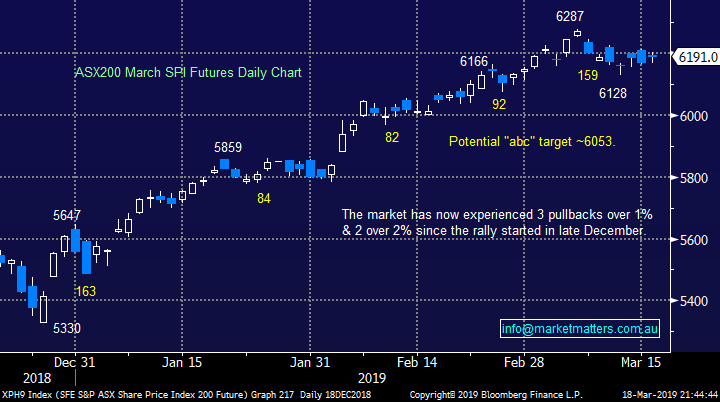

Yesterday MM was busy for the Growth Portfolio allocating 2% into Emeco (EHL) at a higher level than first hoped, 3% into Healius (HLS) and reducing our banking exposure by selling 4% of our holding in National Australia Bank (NAB) still leaving us with a pretty hefty 26.5% cash position.

We have finally purchased Healius (HLS) after much discussion, following it’s ~12% short-term pullback, on the premise that the bid from Chinese suitor Jangho at A$3.25 has more credibility than the market is pricing in. Jangho currently owns ~16% of HLS and they made a bid for the company in January – which was subsequently rejected, HLS describing it as opportunistic, significantly undervaluing the business. While HLS has been under some pressure in recent times, they are turning the ship around. We would suspect any potential deal from here would need to be well above the $3.25 level.

MM is bullish HLS from a risk / reward perspective with a $3.25 takeover bid on the table.

Healius (HLS) Chart

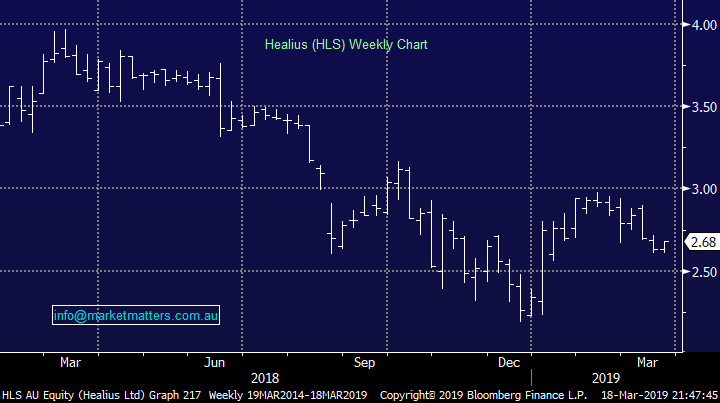

Both Suncorp (SUN) and IAG Insurance (IAG) fell over 1.5% yesterday, no doubt fuelled by worried investors seeing the continued extreme weather patterns batter our shores. We’re happy to be out of the domestic players for now (SUN & IAG) and only hold a 4% position in QBE which is more of a turnaround play although we still plan to take our $$ around $13, under 4% away.

We had previously been considering switching from QBE into IAG but the large 2 players in the local sector “feel wrong” at the moment, when we do sell QBE it now feels unlikely the funds will be channelled into IAG, or even SUN for that matter.

Suncorp (SUN) v IAG Australia Chart

Lastly a quick look at the current risk of a fleeing Chinese consumer, a group that many global & Australian businesses have almost assumed is paved with gold.

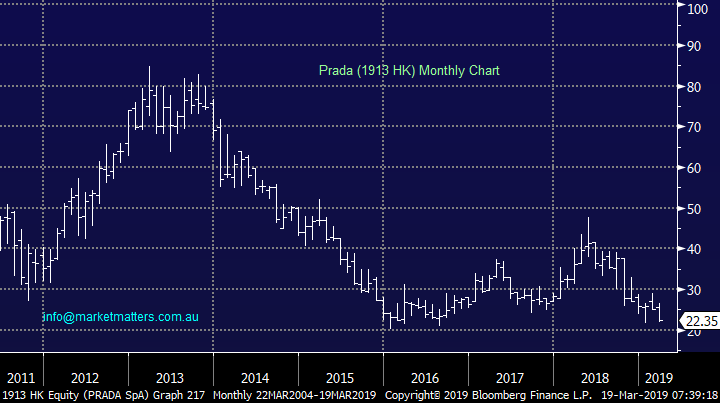

This week Prada’s shares plunged over 10% to reach almost fresh decade lows as Chinese growth slows. The Milan-based luxury goods group reported a slowdown in the second half of last year but we interpret this as doing business in China has simply becoming tougher but far from impossible, companies need the correct strategy but get it wrong, and it will be painful financially i.e. the “easy money” has gone.

MM can see Prada trading below 20HK in 2019.

Prada (1913 HK) Chart

The Australian Aged Care Sector

The Royal Commission into Aged Care Quality and Safety commenced last Monday in Adelaide and already some headlines are filling the press but bad news often creates lows in sectors / stocks as we saw with the banking equivalent. Two headlines that caught our eye are below but perhaps the most concerning is the fact that nursing homes are claimed to be turning residents into “zombies”, not an exciting prospect for anyone’s future.

1 – There were a staggering ~3700 assaults in Australian nursing homes in the past financial year.

2 – Its been claimed that 80% of applicants seeking to provide aged care are “bottom feeders” simply looking at the process as a business opportunity.

Clearly emotive headlines.

Let’s take a quick look at 3 of the country’s largest aged care operators which as a sector had a collective $500m wiped off their value last September when the Royal Commission was announced. Effectively they have moved as one big unit due to the regulatory risks facing the sector hence we won’t dwell too long on each.

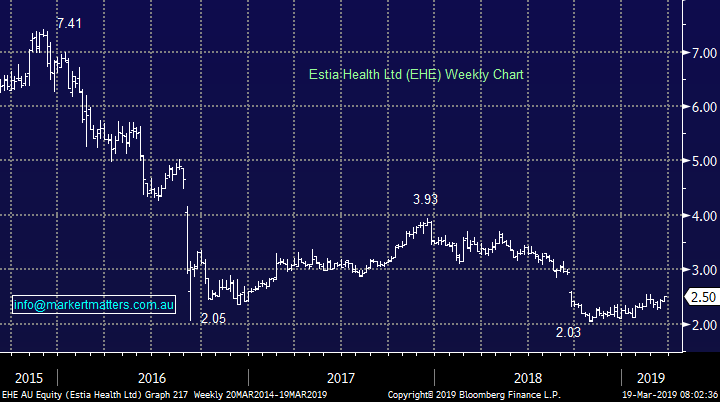

1 Estia Health (EHE) $2.50

EHE shares rallied last month following an announcement by the Federal Government that they will provide over $650m in additional funding for aged care / seniors – not an unusual move in an election year. The company’s half year results showed an increase of revenue to almost $290m but occupancy was lower than expected plus EBITDA was downgraded a touch - however the stock has shrugged off the result and looks firm.

The shares currently trade on an Est. P/E for 2019 of 15.3x while yielding an appealing 6.4% fully franked. In terms of valuations, it’s traded between a peak of 21x when optimism was high about our aging demographic, and a low of 11.8x when the RC was announced with an average P/E of 16.9x, making is marginally cheap.

MM likes EHE at current levels but if we did pull the trigger here, we would want to maintain enough $$ in reserve to average below $2.

Estia Health (EHE) Chart

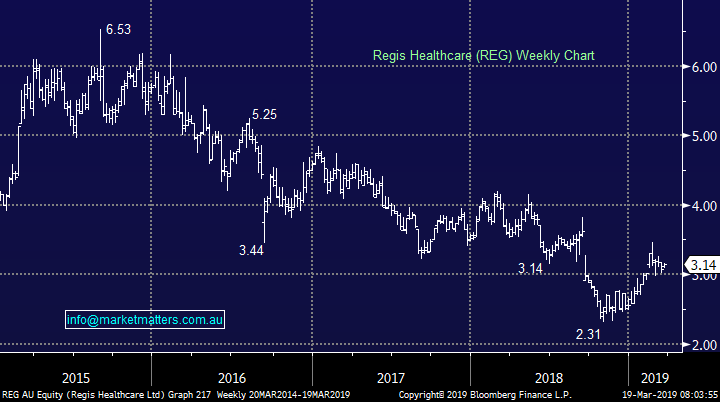

2 Regis Healthcare (REG) $3.14

Similarly REG has bounced well in 2019, along with the whole market, but it fell badly following its half yearly results in late February. The company produced an 8% increase in revenue but an almost 20% fall in profit after tax plus they announced the imminent departure of the MD / CEO after over 11-years at the helm – which was enough to dampen investors appetite for the stock.

This is a higher quality operator which comes at a higher cost – it currently trades on an Est. P/E for 2019 of 19.6x while yielding an appealing 5.3% fully franked.

MM is neutral REG seeing better value elsewhere in the sector.

Regis Healthcare (REG) Chart

3 Japara Health (JHC) $1.42

JHC looks similar to the previous 2 stocks and just like its sector compatriots fell on the days they released their half year results which showed revenue of over $193m but NPAT down 18.3% - occupancy remains a key challenge for JHC given it has a more ‘mature’ portfolio of facilities

The shares are noticeably more expensive currently trading on an Est. P/E for 2019 of 21.6x while yielding an appealing 5.4% fully franked which makes sense considering the company’s position.

The real value in JHC and the other operators in this sector is not so much from an earnings point of view in the short term given the headwinds, but it looks to be an asset play for value orientated longer term investors that can look through shorter term earnings issues.

Technically, MM is bullish JHC with an initial target ~30% higher.

Japara Health (JHC) Chart

Conclusion

MM believes the aged care sector should prove to be a great long term investment due to Australia’s ageing population and subsequent expected increase in demand for their services, the question is do we hold off from investment until the Royal Commission concludes. Also of course they have already enjoyed a decent bounce but remember one of our favourite investment quotes:

“I will tell you my secret if you wish. It is this: I never buy at the bottom and I always sell too soon.” – Baron Rothschild

MM is considering a small investment in either / both EHE or JHC, hiowever this would be targeted towards the Income Portfolio

We are confident the sector will be higher in the years to come it’s just short-term that’s testing investors nerves.

Global Indices

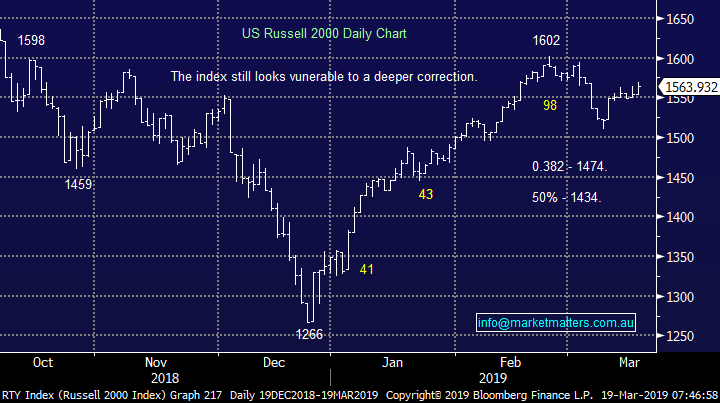

No major change but US stocks, like our own are proving very resilient to any meaningful pullback. We cannot be vaguely negative the US Russell 2000 Index short-term while it holds above 1550, only 1% lower.

However we will continue to avoid stocks that are highly correlated to the US at this point in time e.g. Macquarie Bank (MQG) & the broad based growth sector.

US Russell 2000 Chart

Also no change, European indices are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage.

Any significant Increase in our equities exposure moving forward may be accompanied by purchasing a negative facing ETF.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets started its week higher overnight, as investors’ position themselves ahead of the US Fed Reserve interest rate meeting where no change is expected.

· Over to the European region, reports that the UK will now have to rely on European leaders approving an extension to the Brexit deadline following a 415 year old rule appears to block PM Theresa May presenting her Brexit proposal to Parliament for a vote for a third time.

· On the commodities front, crude oil rose which helped BHP in the US to close up an equivalent of 0.94% from Australia’s previous close to $37.33.

· The March SPI Futures is indicating the ASX 200 to open 21 points higher, above the 6210 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.