Is it now time to switch from iron ore? (WSA, PAN, MCR, RIO, SFR, S32, WHC, ILU)

Before we get onto the AM Note today, just a quick heads up that I’m running a Webinar tomorrow afternoon at 4pm, talking about our views on the market, our positioning etc. While the Webinar is designed more towards enticing new subscribers to take up our end of Financial year offers – so it may have some shameless propaganda scattered throughout, existing subscribers are more than welcome to attend. There will be a specific email going out today on this, however in the meantime, if you’d like to register CLICK HERE

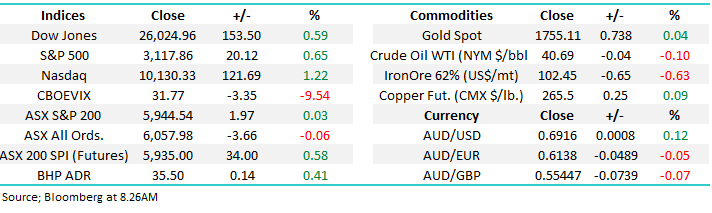

On Monday the ASX200 illustrated yet again that if the news isn’t too bad that the path of least resistance remains up, that’s what tends to happen when too many people are sitting on large cash levels saying the markets expensive – even if they are correct the market initially usually squeezes higher than most expect. Yesterday the market had plenty of reasons to fall, some of which we touched on in our morning report, but after initially dropping over 1% on the open the market regained lost ground to finally close marginally in positive territory, although only 40% of the ASX200 closed up the influential banks and large cap resources were enough to keep the bulls happy.

Travel stocks had a very bad day as secondary breakout fears moved to front and centre with Corporate Travel (CTD) -8%, Webjet (WEB) -5% and QANTAS (QAN) -4.1%. While we feel a major secondary breakout is unlikely the trouble is it feels way too early for any major changes to international travel hence in our opinion it’s also simply too early to consider travel and tourism stocks.

One thing that caught my eye over the day was downgrades to a couple of previous high flyers, Transurban (TCL) and Altium (ALU), although they declined -4.1% & -7.6% respectively on the day we wouldn’t be accumulating either just yet:

1 – Transurban (TCL) $14.54 – the toll operator is suffering from the virus created very pleasant reduction of traffic levels on our roads, we own TCL in our Income Report from much lower levels, another 10% lower and we might consider increasing our exposure.

2 – Altium (ALU) $33.60 – there’s nothing like a high valuation stock missing analysts estimates to produce a little blood on the streets, the company announced that revenue is set to miss expectations as a potential second wave of coronavirus curbs expected sales, MM is neutral at current levels.

The market undoubtedly is showing some impressive backbone to rally in the face of bad news on both the macro and stock level, plus for good measure we had Challenger (CGF) tapping the market for a $300m capital raise. MM is never keen to sell markets that exhibit strength into bad news but we remain cognisant that it can only absorb so much negativity hence we are considering reducing our market exposure if we see a pop above 6200 - perhaps the straw that breaks the proverbial camels back is looming in the months ahead and a 10% pullback can unfold. However short-term with Scott Morrison urging Australia to push ahead with openings despite outbreaks things still look ok for local risk assets.

MM still remains bullish equities short & medium-term.

ASX200 Index Chart

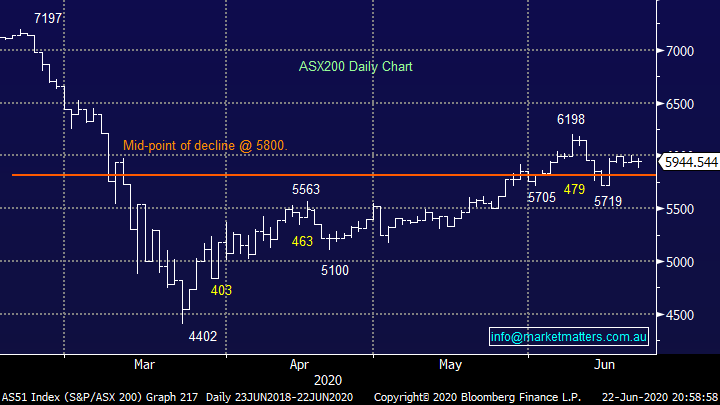

I know a lot of subscribers wonder why equities keep rallying in the face of adversity and MM often points the finger at huge liquidity injections by central banks like the US Fed, the chart below tells the tale. M2 Money Supply illustrates perfectly the almost exponential amount of liquidity the Fed has pumped into financial markets, which filters down to the likes of you and I, since the coronavirus pandemic. Compared to the GFC its amazingly how this year stands out as one where the printing presses have been working around the clock.

On Bloomberg this morning an opinion piece popped up that sourced commentary from Stephen Schwarzman , the Chairman, CEO & Co- Founder of Blackstone, one of the worlds biggest asset managers with +$600b under management. I recently read his book ‘What It Takes’, a really good read on his path to create a huge asset management company from scratch. Anyway, Blackstone are at the pointy end of large scale investment and he sighted the huge support coming from central bank liquidity, which is shown in the chart below. The outcome he believes is support for asset prices even though the economy will take time to recover from COVID-19.

MM is sticking with the anecdote “don’t fight the Fed” for a while longer.

NB: Money supply is the total value of money available in an economy at a point in time.

M2 Money Supply ($US Billion) Chart

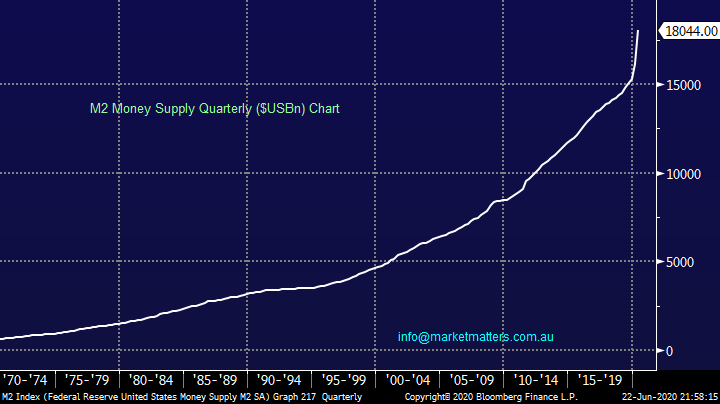

Recently we’ve seen the market “Big Boys” turn their attention towards nickel with OZ Minerals (OZL) buying Cassini Resources (CZI), while BHP Group (BHP) has bought Norilsk’s Honeymoon Well Nickel Project and Western Areas (WSA) bought a cornerstone stake in Panoramic Resources. When we simply glance at the price decline in nickel over the last year its easy to envisage why its catching some people’s attention, especially if they’ve just ridden the huge iron ore bull market.

MM feels the risk / reward for nickel is now switching very much towards the bullish stance.

Nickel Spot ($US/MT) Chart

Panoramic Resources now has a market cap of under $150m and considering its decoupling from Western Areas (WSA) this year it’s interesting to see the $630m nickel producers interest – WSA recently took a 19.9% stake through a capital raise by PAN. We feel PAN is a good “cheeky punt” around current levels for the adventurous.

Western Areas (WSA) v Panoramic Resources (PAN) Chart

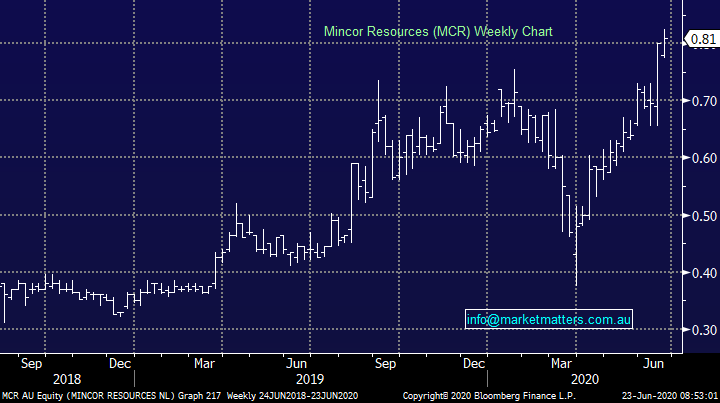

The other smaller Nickel company that we’ve been reviewing is Mincor (MCR) which is capped around $300m, a company with a checkered history although less so than Panoramic. MCR is a sort of ‘middle ground’ between the large cap WSA and the small cap / super high risk PAN. Andrew Forrest owns 14% of MCR while BHP also has reasons to see MCR’s Kambalda Project in WA get off the ground. Importantly, Mincor will produce a nickel sulphide concentrate, and so is exposed to the battery metal thematic.

MM is bullish Nickel, pondering the best way to play it.

Mincor (MCR) Chart

Global Markets.

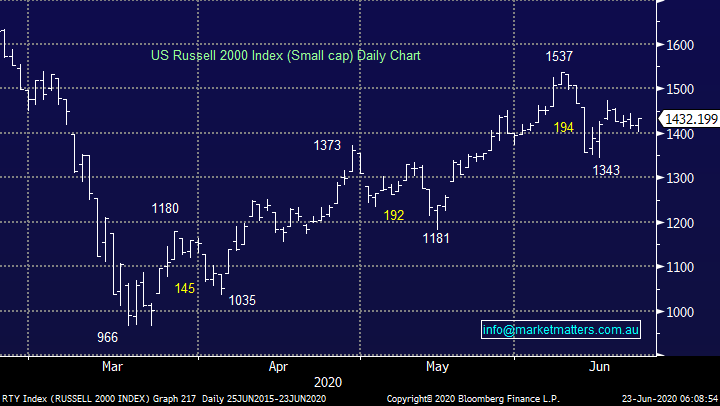

Whether it’s Trump’s potential demise in Novembers election or U.S. Home-Mortgage delinquencies reaching their highest Level Since 2011 stocks remain extremely firm and we still expect another break to the upside led by the tech based NASDAQ which almost scaled fresh all-time highs overnight – investors still aren’t embracing this rally fully implying to me the path of most pain remains up. The small cap Russell 2000, which the ASX200 follows very closely, still looks capable of an assault on 1550, or 8% higher.

MM remains bullish US stocks short-term.

US Russell 2000 Index (small cap) Index Chart

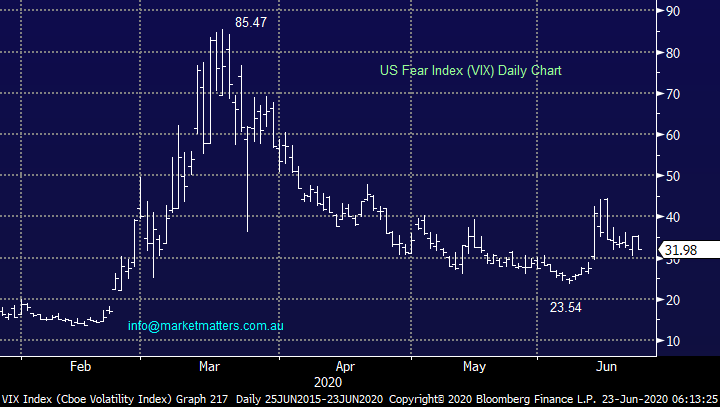

The US volatility index has continued to become increasingly comfortable with equities, overnight it closed down almost 10% with its 5-week low now in sight, we can see further downside as stocks grind higher but under the 30 area we feel macro traders should consider accumulation into weakness. However at this stage our key takeout is the VIX supports MM’s short-term bullish stance towards equities.

MM remains bullish volatility but from lower levels.

US Fear Index (VIX) Index Chart

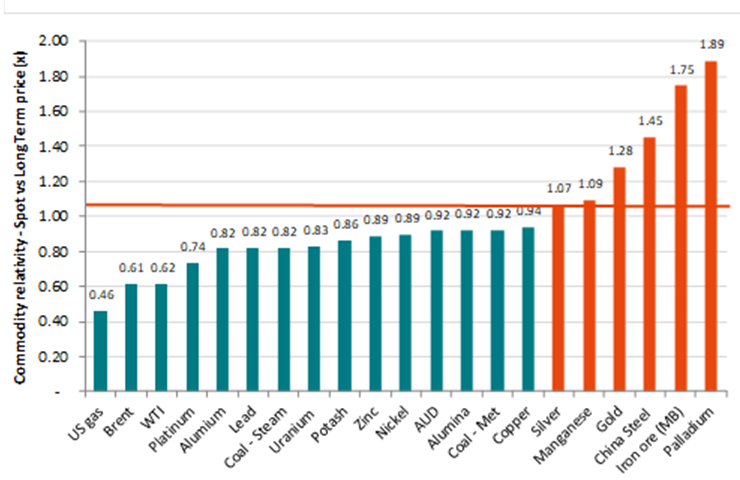

Is it time to switch iron ore exposure?

One of our core views at MM is inflation will gather momentum over the next 12-18 months sending the price of commodities higher, today we have considered if it’s time to take some $$ off the table from the high flying iron ore sector and switch to a sector laggards like nickel which we touched on earlier. The bulk commodity has more than doubled since its sell-off in Q1 whereas economic bellwether copper has bounced only ~20% leading to major differences across the resources performance, although the dial does already appear to be turning slowly.

Importantly we are not considering reducing our exposure to resources at this stage but the optimal mix is always under consideration, today I have considered 3 stocks in the sector who aren’t discussed as regularly as heavyweights BHP and FMG. MM recently went outside the box slightly through a purchase of Alumina (AWC), a position that’s already up close to 20% in just over 1-month illustrating Australian resources aren’t just about BHP et al.

Iron ore v copper Chart

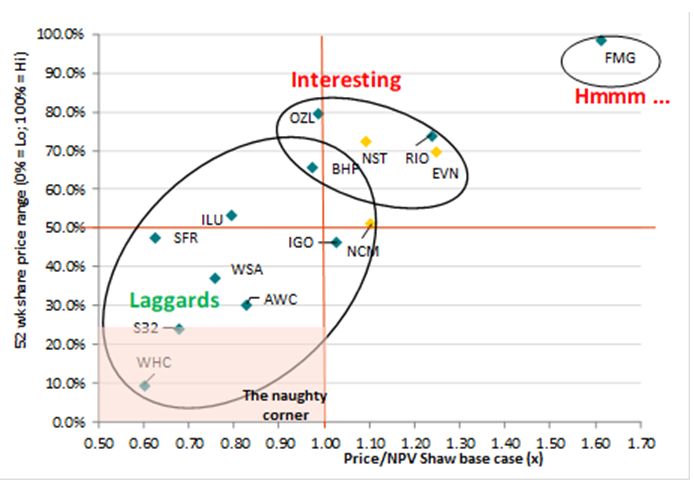

A couple of great charts from my mate “Rocky” at Shaws shows why today’s report took shape:

1 – iron ore’s performance is off the proverbial chart.

Source: Shaw and Partners

2 – Fortescue Metals (FMG) is looking clearly vulnerable to a decent correction.

Equity valuation vs performance … The laggards have lifted off recent lows but more catch up

Source: Shaw and Partners

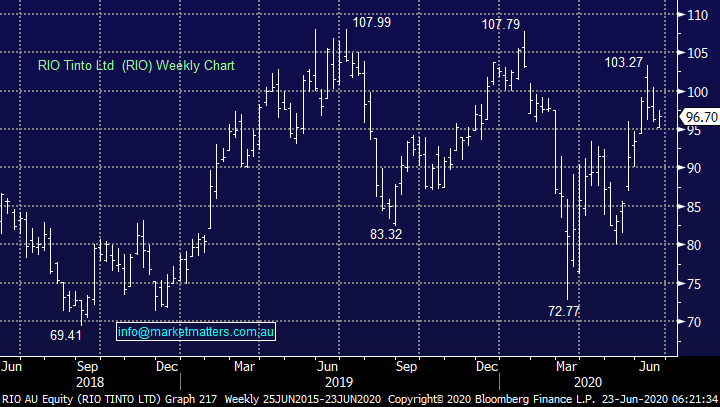

Firstly I have taken a quick look at Rio Tinto Ltd (RIO) the purest iron ore position currently residing in both the MM Growth & Income portfolios, considering the iron ore price and its diversification a slightly rich price feels justified.

RIO is also forecast to yield ~4.5% fully franked which feels achievable and attractive in today’s interest rate environment. We remain comfortable with our RIO positions but any assault back on $110 may see us consider taking some profit, a nice consideration to be required!

Rio Tinto (RIO) Chart

Now moving onto 3 laggards, we already own Alumina (AWC) in this category and we covered WSA above hence I have cast the net further afield and looked at 3 other alternatives.

1 Sandfire Resources (SFR) $4.85.

Coper & gold miner SFR has endured a trough few years on both the absolute and relative front. Interestingly Vinva investments have recently acquired a 5% stake in the business implying they believe it’s time to accumulate this particular laggard. Back in February the company reported solid revenue and profitability growth for H1, and they seem to be starting to improve operationally plus of course they are taking steps to improve mine life, something the market has been concerned about.

MM likes SFR around $4.50.

Sandfire Resources (SFR) Chart

2 South32 (S32) $2.06.

Diversified miner S32 may look an unlikely target for Fortescue (FMG) in our opinion as we discussed in yesterday’s PM report but never say never and it would give Twiggy Forest the path to diversify away from iron ore, pretty much the thematic of today’s report. We believe S32 is a well-run financially sound leveraged play on some key commodities like alumina, coal and manganese, when these start to turn the stocks likely to shoot back towards $3 with, or without FMG.

“If I were to wrap a percentage around the idea of FMG for S32 I would say … the probability of a deal is Not zero, but likely sits between 0% and 50%, but most probably closer to zero than 50%” – Peter O’Connor, Shaw & Partners.

MM likes into current weakness.

South32 (S32) Chart

3 Whitehaven Coal (WHC) $1.59.

WHC has continued to grind lower over the last fortnight which is really a continuation of the last 2-years bear trend, albeit with some decent bounces along the painful journey. We have expressed ongoing caution towards the coal sector and have refrained from “bottom picking” during the stocks demise but most businesses have a value and we like WHC into fresh 2020 lows. We know there remains a keen seller of WHC with a block of ~50m shares to sell that came out of escrow about 5 months ago, and this could be the catalyst that sends WHC into a fresh panic low.

MM likes WHC ~$1.30.

Whitehaven Coal (WHC) Chart

4 Iluka (ILU) $8.40.

Mineral sands operator Iluka (ILU) reported a $300m full year loss in February while announcing plans to spin-off its royalty asset as a means to cushion the blow to investors, not an ideal backdrop for bottom picking in the new COVID-19 world. However we like the stock at current levels believing the decline in the share price has largely taken into account the disappointing trend in earnings, the risk / reward looks attractive down towards the $8 area with stops below $7.50.

MM likes ILU around $8.

Iluka (ILU) Chart

Conclusion

MM believes it is time to look away from just iron ore for local resources investing although were not sellers of our exposure through RIO Tinto (RIO) and BHP Group (BHP).

However with regard to other Australian resource stocks mentioned today we like WSA, MCR and AWC, the last of which we already own plus the 4 discussed above at prices / levels discussed – our order of preference at such levels is S32, WHC, SFR and ILU.

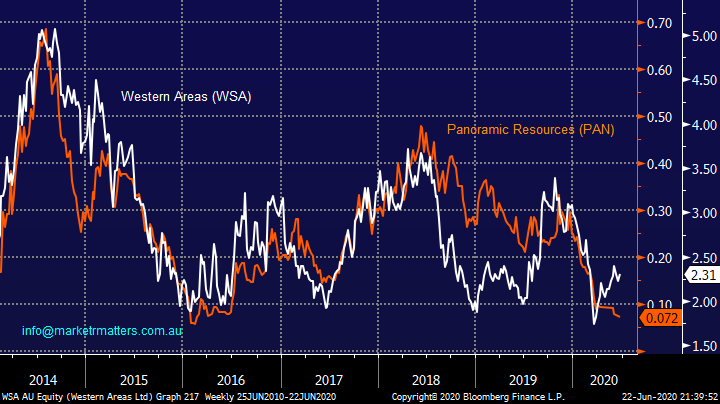

Overnight Market Matters Wrap

- The US equity markets started the week on a positive note, with assistance from the tech. heavy, Nasdaq 100 as investors attempt to shrug off the potential second wave of covid-19.

- Geopolitical risk between US and China is slowly creeping back into the market, as China halted poultry imports from a Tyson plant that was exposed to covid-19.

- On the energy front, crude oil rose currently sitting at US$40.69/bbl. while gold continues to hover on the trough of its current trading range, currently sitting at US$1,755.11/oz.

- The September SPI Futures is indicating the ASX 200 to open 58 points higher, testing the 6000 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.