Is Gold bracing for another big move? (COH, REH, TCL, MSFT US, NCM, NST, SAR)

The ASX200 put in a relatively strong performance for the penultimate day of the week drifting less than 1% lower after waking to see US stocks down far more aggressively, after an early spike lower local stocks basically rallied throughout the day in an almost inverted playbook to Wednesday. Considering the heavyweight banks and resources followed their US peers lower it was a fairly robust day that again showed there exists plenty of appetite for a number of stocks into weakness.

We might be a country in extreme lockdown but the statistics are saying were doing an excellent job compared to many countries:

1 – Australia has only seen 63 coronavirus deaths compared to over 144,000 globally – as a comparison the ISG (Influenza Specialist Group) estimates between 1500 and 3000 people die in a typical Australian flu season i.e. lockdown is undoubtedly working with COVID-19.

2 – Australia’s jobless rate has only increased slightly to 5.2% as more holidays were taken in March, while I totally agree with Scott Morrison that this number will soar in April we are holding up ok for a country in lockdown, the US has witnessed 22 million fresh unemployment claims over the last month – being able to work from home (WFH) is helping many local families.

3 – As the pandemic fades Phase 2 as we’ve labelled it is now the most discussed subject i.e. the best path out of COVID-19 until a vaccine becomes readily available. Restrictions in Australia look likely to be slowly lifted from late May assuming secondary infections don’t gather momentum.

**US futures have shot up +3% in their aftermarket following an address by President Trump around phased reopening of America**.

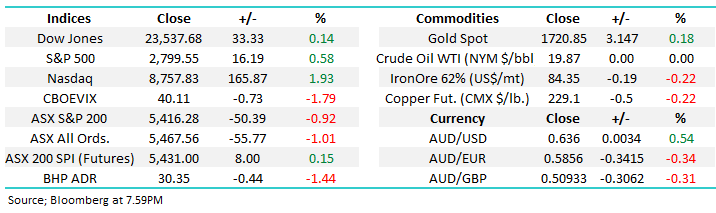

Predicting the economic impact of COVID-19 on Australia and across the globe is akin to attempting a 5000 piece jigsaw with no picture or edges hence were focusing on stocks / sectors we like through 2020 while attempting to circumvent undue risks in the process. March’s influence might have people feeling equities are volatile at present but the second chart below illustrates its gone relatively ‘pretty quiet’ in April which is reflected by the VIX basically halving over the last few weeks.

The VIX (volatility) Index Chart

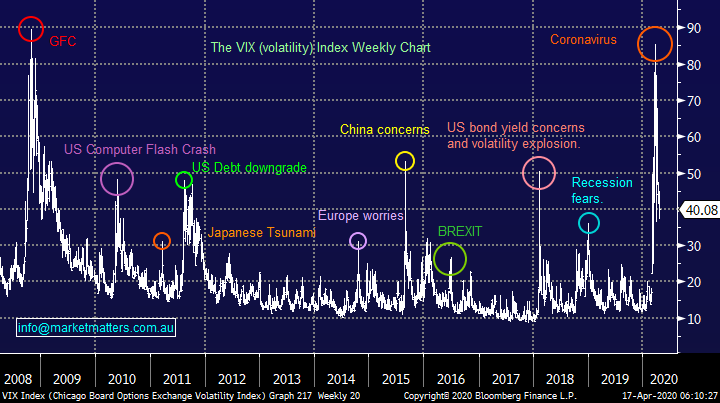

The heavyweight Banking and Resources sectors are creating a headwind for the ASX especially when compared some major global indices. However we remain bullish stocks although further strong gains feel likely to be in selective pockets until a clearer picture of the economic damage from the coronavirus emerges.

MM remains bullish equities but in a selective and cautious manner at current levels.

ASX200 Index Chart

Capital raisings have been coming along more often than trains through Central Station at the moment but each time they leave the platform the strong likelihood is retail investors have been duded. Just consider the below numbers I garnered from an excellent article in in the Financial Review:

1 – Large institutions have enjoyed the majority of the action since the ASX changed the rules, they’ve enjoyed buying stocks at an average discounted price of almost 17% to the last trade conversely retail investors mainly just got diluted.

2 – The average gain by these “clever institutions” is over 30% on the last $6.8bn raised i.e. a $2bn profit!

3 – Just to add to the frustration Australian investment banks have picked up ~$160m in fees in just a few weeks.

However there’s no point crying over spilt milk or the “rules of the game” what’s important is what we can learn from raisings which have already been undertaken. If we look at arguably the cream of the crop Cochlear (COH) and Reece (REH) they rallied 47% and 24% respectively before suffering decent pullbacks – in both cases buying the day after the raise paid off nicely but chasing 2 weeks later as FOMO (Fear of missing out) kicked in has proved costly.

If you like a company that undergoes a capital raise the likelihood is the best time to buy is in the raise itself if possible, or the day it recommences trading.

Cochlear (COH) Chart

Reece Ltd (REH) Chart

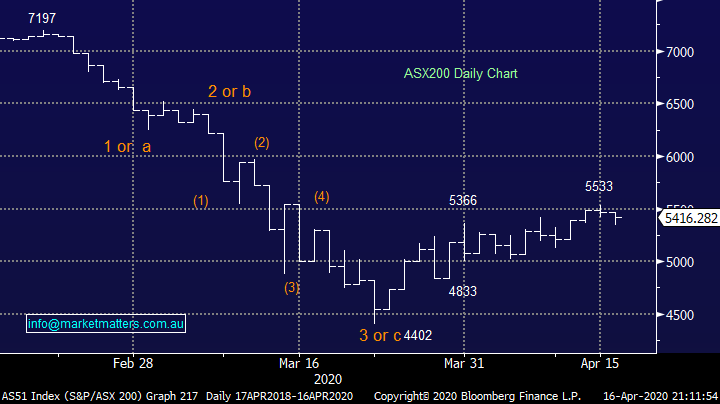

The $A has pulled back 1.5 cents from Mondays high and again the ASX has followed suit by drifting lower, the leading correlation remains intact and at this stage it suggests buyers should remain patient & selective short-term.

MM is bullish both the $A and ASX200 medium-term.

The Australian $A and ASX200 Index Chart

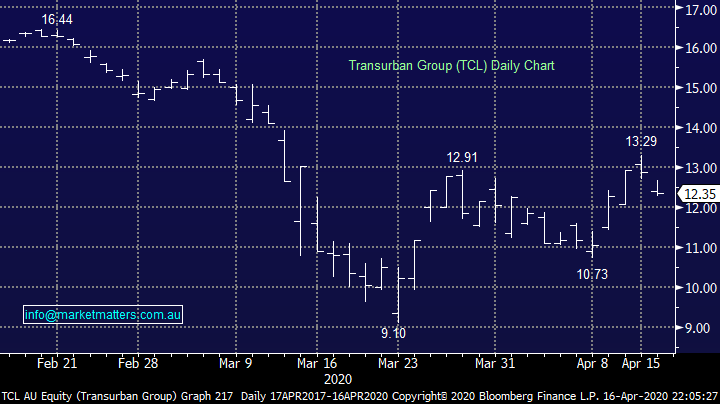

A quick look at toll operator Transurban (TCL) who yesterday reported a drop-off in traffic of 40% and 53% in Sydney and Melbourne respectively – no great surprise there. However it appears to have been a reality check to TCL which had bounced almost 50% from its March low, we will consider the stock for the Growth Portfolio if yesterday’s announcement translates to ongoing weakness back towards $11.

MM is bullish TCL around $11.

Transurban (TCL) Chart

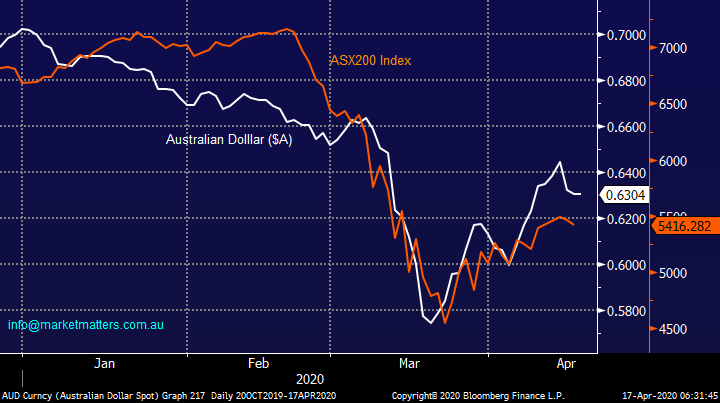

Overseas Market Snapshot

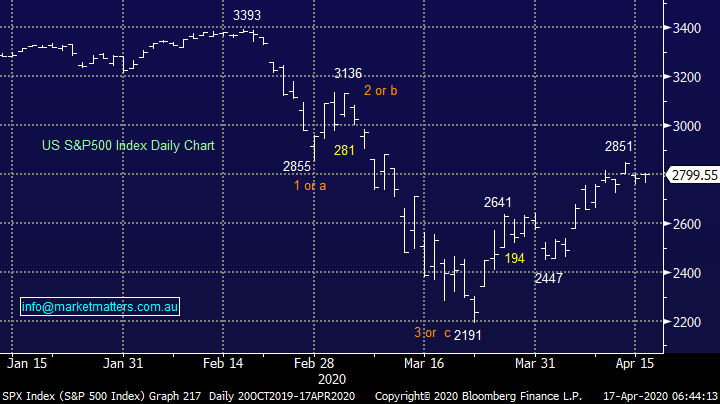

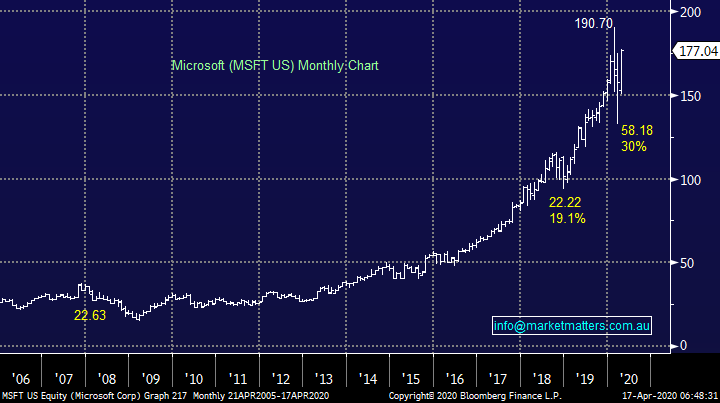

Overnight US stocks were quiet with the tech based NASDAQ standing out as it rallied +1.9% with heavyweight Microsoft (MSFT US) leading the way up 3%. A strong pop in US futures this morning implies the S&P will break to new highs tonight, at this stage anyway.

MM remains buyers of weakness in some US stocks but were still 50-50 at current levels.

US S&P500 Index Chart

When we see major US stocks like Microsoft soaring to within 7% of its all-time high its hard to be bearish in our opinion. At this stage we believe the strength will remain focused on the large cap tech end of town but there will be a time in 2020 where fund managers decide they’re fully priced and eyes will start to be cast over the “second tier” group of stocks which are cheap on paper, picking this change in sentiment can add decent value to a portfolio but there’s no hurry yet.

MM remains long and bullish Microsoft (MSFT US) targeting fresh all-time highs.

Microsoft (MSFT US) Chart

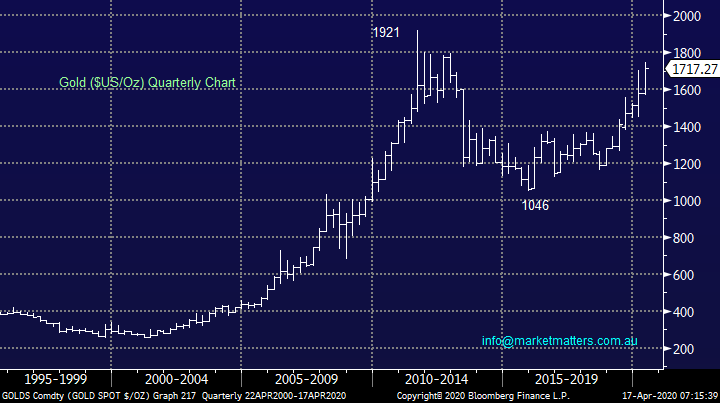

Where to now for Gold?

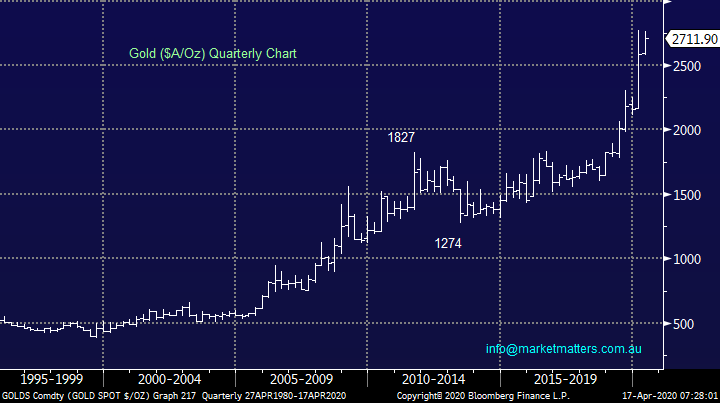

Gold has been rallying nicely now for over 5-years as bond yields have continued their downward spiral, when you stand back and look at the long-term trend a test of $US2000/oz looks highly likely i.e. 15-20% higher. However in $A terms which is what really matters to Australian miners the gold price is already soaring above its 2011 high.

The Fed’s announcement of another $2.3trillion in stimulus to combat the economic impact of COVID-19 has added another significant tailwind for the gold price which supports the bullish technical picture. Also if we are correct and the massive central banks stimuli that’s washing through financial markets does ultimately reignite inflation its bullish both gold and commodities, although the later certainly hasn’t joined the party yet. However all of this is now relatively “old news” and we wouldn’t be surprised to see a ~$US100/0z pullback in gold which may provide some solid buying opportunities in our sector.

Gold continued to rally for 3-years after the GFC QE / stimulus bazooka, we have to think its likely to be similar post COVID-19.

Hence if MM is overall now overall bullish gold we must ask is there any value in the local stocks after their strong gains during the coronavirus panic in March. Today we have looked at 3 major Australian gold producers to see if we can find any attractive risk / reward opportunities in the sector while we remind subscribers that we regard gold stocks as generally “active plays”.

Gold ($US/Oz) Chart

Gold ($A/Oz) Chart

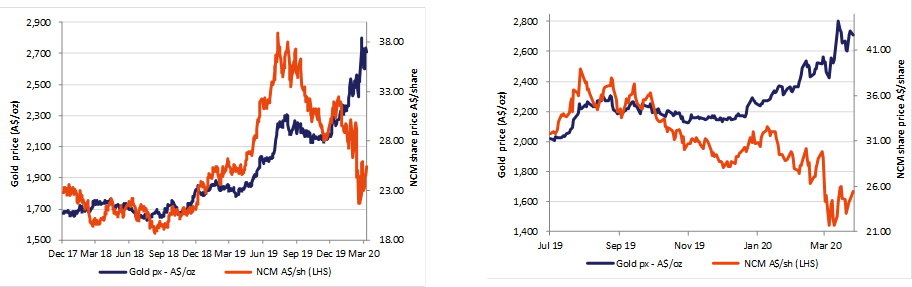

1 Newcrest Mining (NCM) $29.34

Sector heavyweight NCM disconnected with the gold price in the second half of 2019, in a market which is sticking with winners we see no reason to be chasing this underperformer.

NB Evolution Mining (EVN) has trodden a similar uninspiring path to NCM.

Source: Shaw and Partners

MM is neutral NCM at present.

Newcrest Mining (NCM) Chart

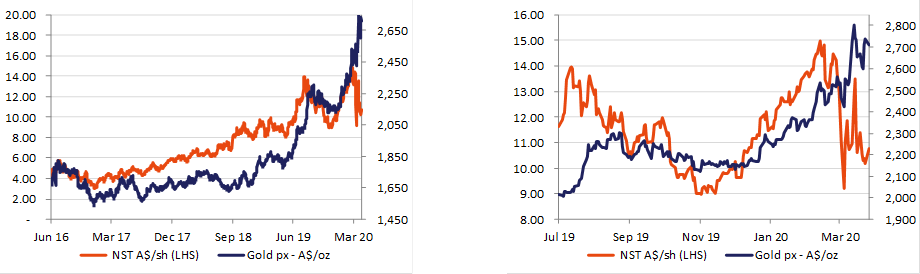

2 Northern Star (NST) $12.91

NST performed significantly better in 2019 following the $A gold price nicely, its also enjoyed tailwinds after Super pit acquisition, we did see some divergence during the March aggressive market decline but things appear to be largely back to business as usual.

Source: Shaw and Partners

MM likes NST with an ideal entry ~$12.

Northern Star (NST) Chart

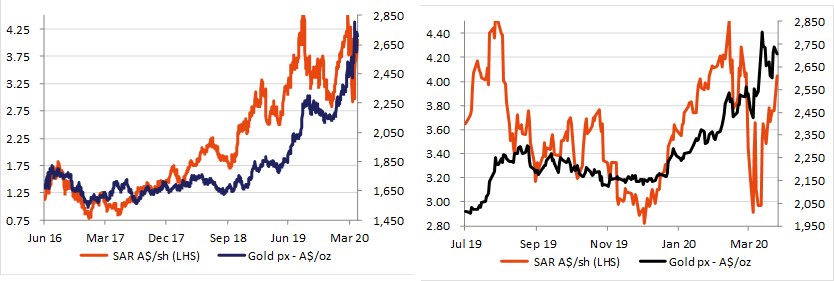

3 Saracen Minerals $4.29

SAR has followed the $A gold price extremely well but if we are correct and the $A is set to rally from here it may dent ongoing strength in SAR even if gold rallies strongly in $US terms. Hence although we are bullish SAR targeting a test of $5 the risk / reward is not particularly exciting into strength, entry levels are arguably more important than ever in an “active / trading play”. We would be happy to accumulate below $4, or over 5% lower.

Source: Shaw and Partners

MM likes SAR under $4.

Saracen Minerals (SAR) Chart

Conclusion :

MM likes SAR and NST as aggressive plays ~5-7% lower, with clearly defined stops.

Overnight Market Matters Wrap

- A weak start in the US overnight on weak unemployment data, only to rally in the final hour following President Trump’s phased plan to reopen its economy. - The US futures is up 3.5% as we write!

- Across to the Euro region, the European Central Bank had thrown a lifeline and temporarily lowered its capital bank requirements due to the coronavirus.

- The June SPI Futures is indicating the ASX 200 to open at least 40 points higher this morning, testing the 5500 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.