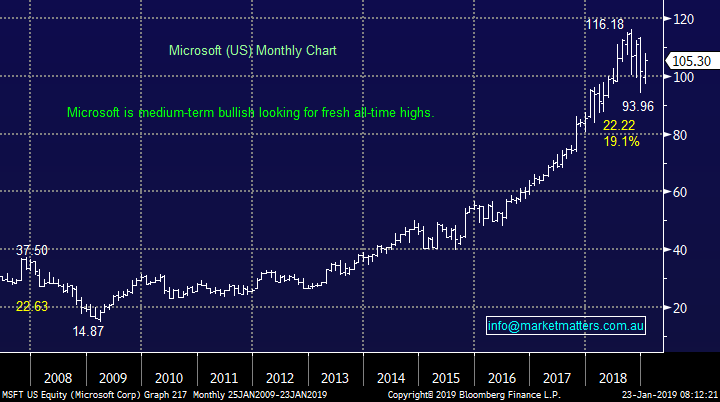

Introducing overseas Wednesday!

The ASX200 again struggled yesterday with selling gaining momentum in some of the larger names e.g. Westpac (WBC) -1.7% and BHP (BHP) -1.3%. While the main damage to the index came from the banks, volumes remained low due to the combination of school holidays and the US being closed on Monday night.

The market’s currently behaving itself rejecting / stalling at the 5900 technical resistance level, our ideal target for a pullback would be around the 5750-5775 area but considering the volatility in December / January a plunge lower would not surprise if the market regains the bearish bit between its teeth.

MM remains just in “sell mode” but with cash levels now sitting at a comfortable 20% we will become more fussy moving forward, but we are definitely not ruling out buying decent weakness for a short-term play.

Overnight US markets were hit hard as US – China concerns again reared their head with the Dow falling over 300-points, the SPI futures are calling the ASX200 to open down around 30-points / 0.6%.

Today we are going to evaluate 8 overseas stocks which currently occupy a position within the largest 100 stocks by market capitalisation on a global basis. We plan to have an overseas focus each Wednesday unless time sensitive moves need coverage, as we work on launching two more internationally focussed portfolios in the next month or so. Broadening our coverage more regularly into international stocks (and ultimately into two more portfolio’s) is something that many subscribers have requested and I think it’s particularly timely at this point in the cycle.

ASX200 Index Chart

US stocks came back to work with a large bang and we now expect an ongoing correction to the last few weeks strong rally for another good buying opportunity.

US S&P500 Index Chart

Scanning 8 of the worlds heavyweight stocks.

We have firstly chosen 4 stocks from the US, interestingly in our opinion no longer as attractive to Australian investors as the $A is showing signs of life after its significant fall.

However we are not FX traders so we are going to look at these stocks in their own currency i.e. $US.

Australian Dollar ($A) Chart

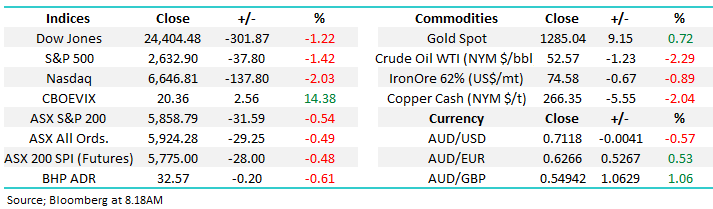

1 Apple (AAPL) $US153.15

The first US company to be valued at a trillion dollars, Apple has tumbled almost 40% from its October high, that’s huge volatility for the (once) largest company on the planet.

The maker of the iPhone, iPad and numerous relations has been falling since late 2018 for a number of reasons including :

1 – Concern over iPhone sales, which was exacerbated when Apple stopped informing the market how many products it had sold each quarter. Reduced disclosure is never a good thing in my view

2 – The high price of its products worries many if we do experience the much touted global recession.

3 - Opinions are mixed around Apples services businesses moving forward e.g. Apple Store and ApplePay.

4 – The US – China trade war threatens Apple more than many with its sales in the region under scrutiny – around 20% of the firms current revenue.

The shares have received downgrades from the likes of UBS who cited the “weakest purchase intent” for an iPhone in 5-years hence production has been slowed. That said, of 46 analysts covering Apple, there is not a single SELL call on the stock!

Earlier this month Apples stock fell almost 10% after Apple cut its revenue forecasts for the first time in 16-years blaming China iPhone sales as the main issue. Clearly AAPL is going through a tough period but this is a company with huge cash piles leading to ongoing stock buybacks and increasing dividends steadily over the last 7-years. Conversely it’s a stock many investors have been caught long at higher prices hence bounces will probably meet selling until China sales improve.

MM likes Apple below $US150 for a 15-20% recovery, the jury is out longer-term.

Apple Inc (AAPL) Chart

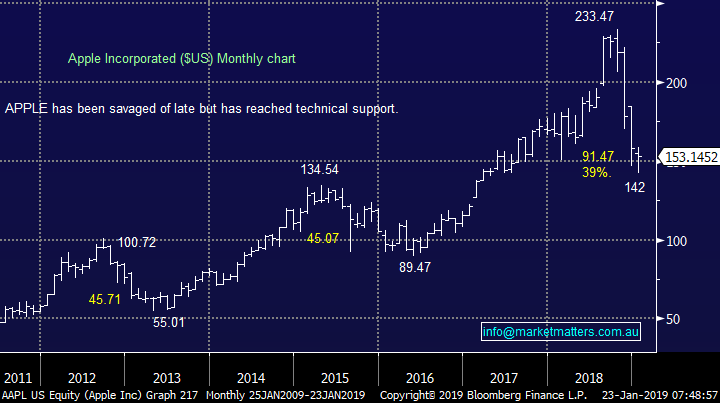

2 Alibaba (BABA) $US151.07

The leading e-commerce goliath in China BABA has also corrected close to 40% from its 2018 high. The stock like many in the space have struggled of late with its shares even falling after recording $30.8bn sales for its November Singles Day online shopping in China, up 27% year on year.

However the main reason the stock has been “on the nose” was its weak earnings report last August given the business is investing for future growth.

From a risk / reward we like BABA below $US150 but would not become married to any holding if we see failure below $US129.

Alibaba (BABA) Chart

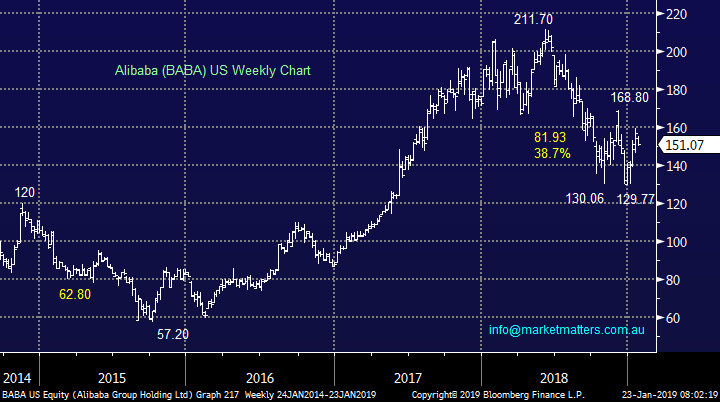

3 Microsoft (MSFT) $US105.30

MSFT performed strongly during the recent market volatility and appears to have only been dragged down by market / sector sentiment. i.e the cream stayed on top.

MSFT actually eclipsed Apple as Americas top public company by the end of 2018. We like that MSFT has de-emphasized Windows in favour of cloud, open-source and cross-platform services.

MM is bullish MSFT targeting fresh all-time highs, ideal buying is a few % lower but not one to be too fussy.

Microsoft (MSFT) Chart

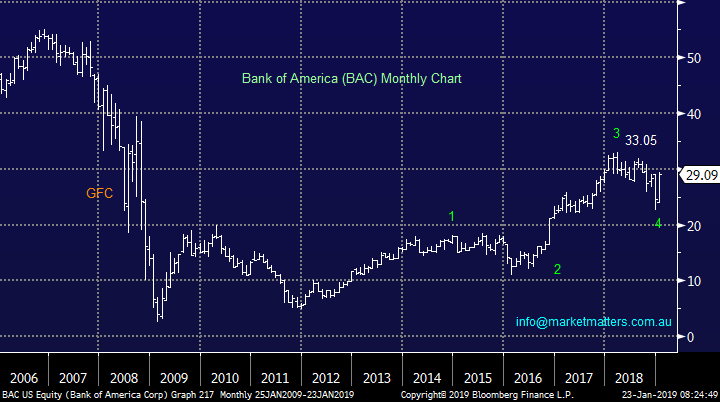

4 Bank of America (BAC) $US29.09

BAC was simply smashed in the GFC but it has been an impressive turnaround story over the last 2-years, hopefully our “Big 4” will follow suit!

Despite mixed fundamental news on the surface, the stock looks a strong technical buy. MM is bullish Bank of America targeting fresh recent highs – the risk / reward is only 50-50 with stops below $US24 but the momentum is excellent.

MM is a comfortable buyer of BAC below $US29 with stops below $US24.

Bank of America (BAC) Chart

5 Nestle (NESN) 84.30 CHF

This well-known Swiss multinational food company has been the epitome of a long-term bull market – people like Kit Kat, Nespresso and smarties it seems - my wife Alice provides strong support for this business

Unfortunately the stocks not cheap trading on a P/E of 21.8 while yielding less than 3%. We like NESN but this is a stock to accumulate in the next bear market in our opinion –history tells us, there will be one!

MM likes Nestle ideally below 70CHF.

Nestle (NESN) Chart

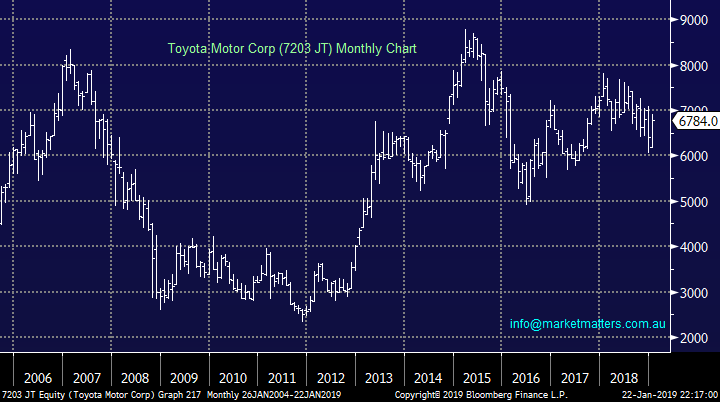

6 Toyota Motor Corp (7203 JP) 6784JPY

Toyota needs no introduction being the world’s largest vehicle manufacturer in 2018. Disappointingly the stocks gone nowhere in the last 3-years when global equities have rallied strongly, not a performance that usually creates interest our end.

The new battery powered car creates obvious uncertainty for Toyota and the industry as a whole and requires significant investment in the year ahead.

MM is neutral Toyota.

Toyota Motor Corp (7203 JT) Chart

7 Tencent (700 HK) HK335.80

The social network / gaming business Tencent was a huge market underperformer in 2018 not helped by the Chinese government blocking its Monster Hunter Game – no stock likes government intervention.

However we are not convinced the growth for this Chinese giant is over with WeChat potential yet to be fully realised and last year’s regulatory issues likely to ease moving forward.

Technically Tencent looks good risk / reward back around the 300HKD level which could easily be achieved on renewed concerns around US – China trade.

MM likes Tencent around 300HKD.

Tencent (700 HK) Chart

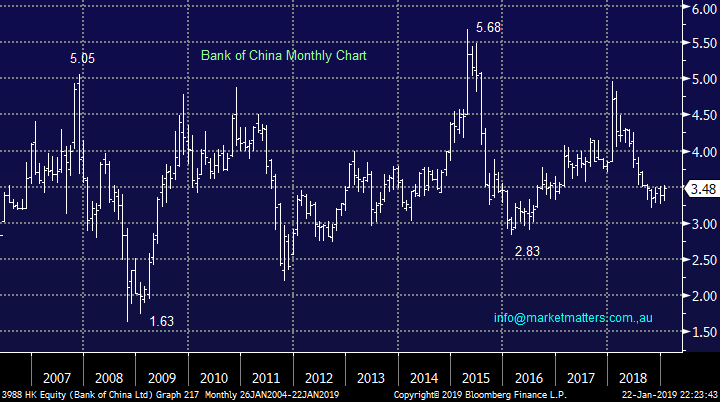

8 Bank of China ltd (3988 HK) HKD

The Bank of China certainly has a presence in Australia depending on the area you are in but this is a company with its roots firmly at home.

The shares have gone nowhere in over a decade leading to our total lack of interest, especially with the Chinese economy slowing albeit from strong levels.

MM is neutral / negative the Bank of China.

Bank of China ltd (3988 HK) Chart

Conclusion

The summary of the 8 international stocks we looked at today are as follows:

Buy – Microsoft & Bank of America plus weakness in Tencent, Alibaba, Apple and Nestle.

Neutral – Toyota.

Sell – Bank of China is neutral / negative.

Overnight Market Matters Wrap

· The US equity markets resumed trading following their long weekend and came back to earth with a thud, as investors digested the slowing Chinese growth data, IMF global growth downgrades amidst reports that US officials had cancelled a planned meeting with Chinese vice-ministers due to frustrations around the lack of progress in their ongoing trade discussions.

· All three key indices, closed weaker led by the tech heavy Nasdaq 100, and export reliant stocks in particular under pressure. The construction sector was also hit after the news that US existing home sales hit 3 year lows in December, according to the latest industry data released overnight.

· Earlier, European markets also retraced from recent highs with the UK market worst affected, dropping 1% led by material stocks.

· Crude oil lost 2.29% overnight amid concerns about China’s economy reignites investors’ fears.

· BHP is expected to underperform the broader market after losing an equivalent of 0.61% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 24 points lower, testing the 5835 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.